Market Briefing For Wednesday, June 19

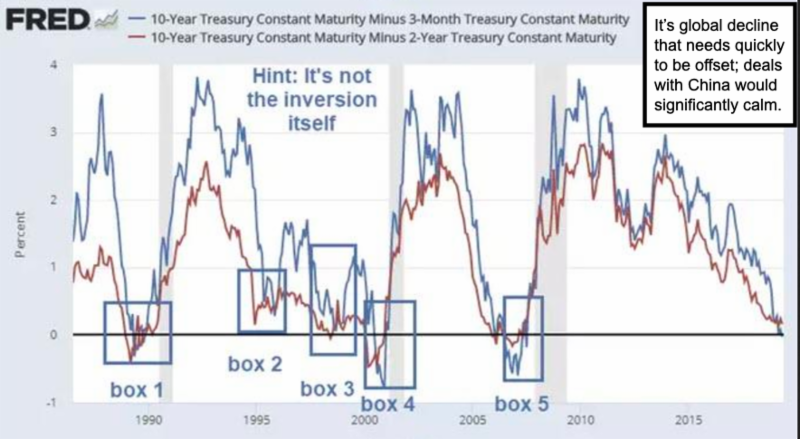

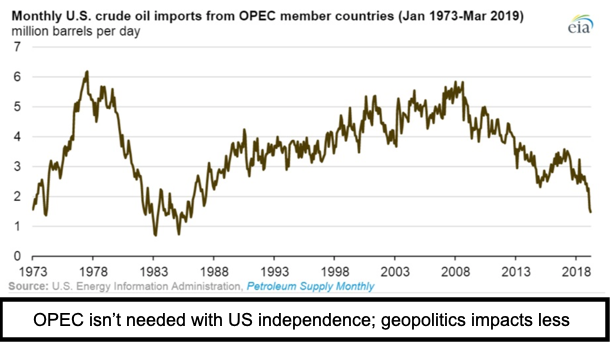

Exporting 'deflation' - from Europe, not just China, may be the single most influential impact on markets; and what allows the Fed maneuvering room, at the moment, to either retrieve (cut) their last nudge higher; or simply wait another month to watch data, and perhaps the outcome of G20.

The President's thinly-veiled (not even) attacks on Powell and even ECB head Draghi (or at least pressing for parity with Europe which is not how this should be played) 'if anything' should embolden Chairman Powell to resist a further intrusion by the Executive branch on the Fed's independence.

Sure, I realize the Fed sees the political inference; and Trump was correct months ago about the Fed's prior hike being unjustified (almost slipped by saying not justified, which would acknowledge economic slippage vs. growth surge they were claiming). However, today's pressure (along with progress in having talks with China, and a strong stock market) argues for the Fed to do nothing, but perhaps lip-service to keeping their eyes focused on 'data', and acknowledging certain sluggish aspects to the economy, while blaming 'trade' uncertainties if they'd like as well.

In sum: as the players' 'deck was shuffled' Tuesday morning (varied hands being played at what evolves into a global poker game), it becomes apparent that the Fed can easily recognize economic slippage at the same time they have 'cover' to not move ahead of a G20 outcome, now that President Trump says he'll have an 'extended meeting' with China's Xi.

Prior to today, I thought the most we can expect from Osaka is some sort of 'outline' of areas to be addressed; or simply a commitment for negotiators to resume talks (especially if both sides embrace what was originally outlined, or as Trump says, 'a deal we had they walked-back from on several points') .. well the markets will be sufficiently comforted and the Fed can stall.

Well late today, the President not only referred to 'extended conversations' at G20; but as he left to fly to Orlando (for his re-election announcement this evening).... he said: 'the teams will start talking tomorrow morning'.

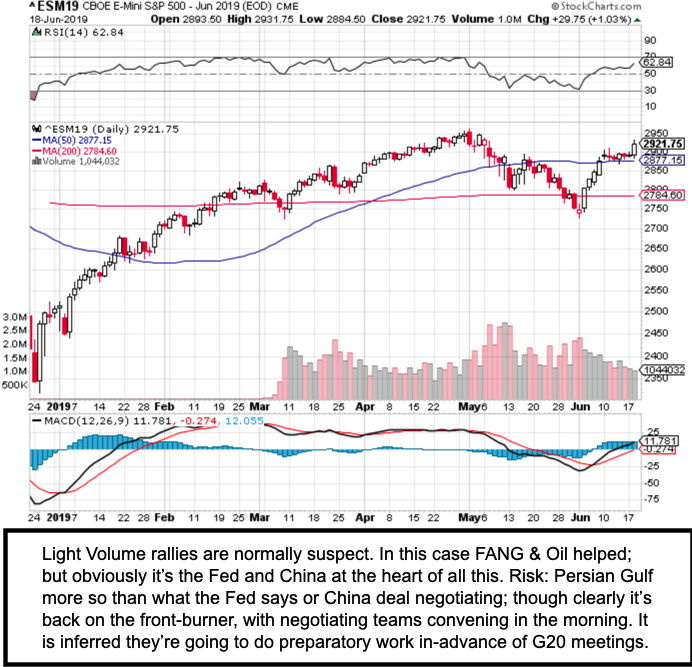

That suggests several things: that the retrenchments we've had were within context of what I called 'likely corrections' (and we will have more especially if or as the Persian Gulf heats up more), but not catastrophes. We certainly may not see much from G20 in 'specifics'; but the late comment today (sure if it's accurate) suggests the 'negotiating teams' will go to work preparing an agenda for the Meeting at G20; hence we might get something positive.

Now that doesn't mean the S&P doesn't get slammed after G20; even if the market gets a brief 'relief' rally thereafter. Why? Because now many will be expecting the moon and they'll get less. But should the next round of tariffs be postponed, for instance, that will be taken well. None of this changes the shift of 'supply-chain' sourcing changes; but many businesses will relax at least a bit if we come to an area of understanding with China.

Bottom line: the worst-case would be a hawkish Fed and no G20 progress; and neither is likely going to be the case. We'd certainly not chase stocks in the wake of the run just had; but we're suggesting we have had this pattern right (corrections and then lateral absorbing tensions and preparing for the next thrust of some type) and we are not looking for catastrophe...all-time highs for the S&P; even if sold into with an ensuing correction; tend to be a more likely prospect.

Nicely done.