Market Briefing For Wednesday, July 7

An 'undertone' of inflation is being described as a causal factor for today's decline, or the Chinese contemplating not allowing listings on US exchanges.

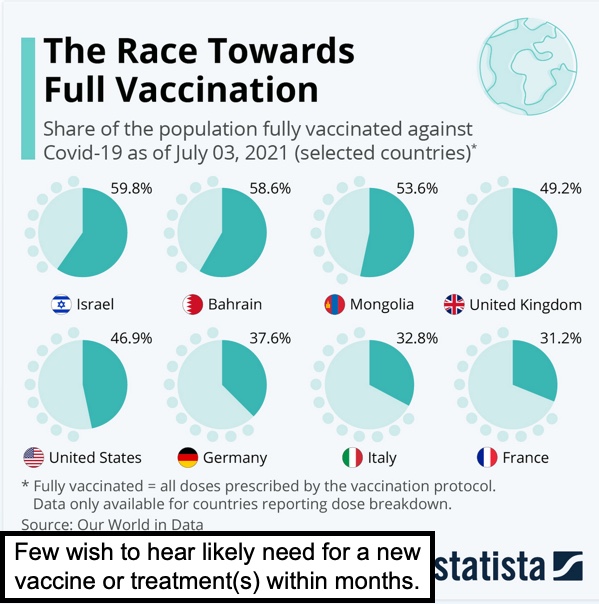

I would contend neither relates to today, and not even the Oil up-down shuffle early in the session. Inflation will endure in most areas (that's been engraved in the future due to wage increases), COVID's not adequately contemplated as a disruptive prospect for the economic recovery, removing Chinese shares is unlikely, but even if it happened that's more money available for US stocks so it doesn't matter much, and earnings comparisons are going to be tough.

But even if it happened - and end of the Commie-Capitalist experiment - that's more capital available for domestic investment or speculation, in fact shutting them off from global capital markets would be a great mistake, putting them behind a financial 'great wall' whether they (or we) implemented the move.

When the rubber hits the road China should be smarter than that. It's also just a bit notable that mainstream financial networks equate what amounts just to antitrust threats or actions, as being 'anti-capitalist'. I would argue it might just be the opposite, since goods and services are going to be essential and mere breaking-up (China or here) won't destroy value, but might harm symbiosis or an ability to move forward with lots of minds or computers humming together.

I think what triggered Beijing's ire was Alibaba (BABA) wanting to go into banking. It's possibly the CCP saying there are certain directions you cannot go, financial moves that relate to consumers directly (or banking) must be regulated and in this case supervised by the PBC. They might argue that allows more capitalist or entrepreneurial types to have opportunities that are squashed when single companies dominate a sector. And that the U.S. is too lax with bankers.

Definitely not a fan of the CCP (quite the opposite, as if anything I contemplated how to retaliate for them attacking me...I took COVID's attack personally...hah). But let's face it, how many American ideas were also usurped by Amazon (AMZN) or Facebook (FB) or more, or vibrant small enterprises snapped-up before they could potentially flourish on their own. So start-up founders made money, but often had their initiative and energy and vision drained from them.. just for wealth.

Also earnings comparisons are going to be tough and that's a factor. Thrusts or peak earnings 'momentum' is likely behind even if calm progress remains.

That last item will be a factor, but mostly this is a technically-warranted move.

The concentration in a handful of stocks historically is actually a warning sign.

We know that some leaders, like Banks, have had share price drift lower, and some think that means they have a set-up to rally on good earnings. Maybe is my view, because if you look behind the scene (such as reverse repo's) you'll see that many banks are very dependent on the Fed's stoking liquidity.

In-sum:

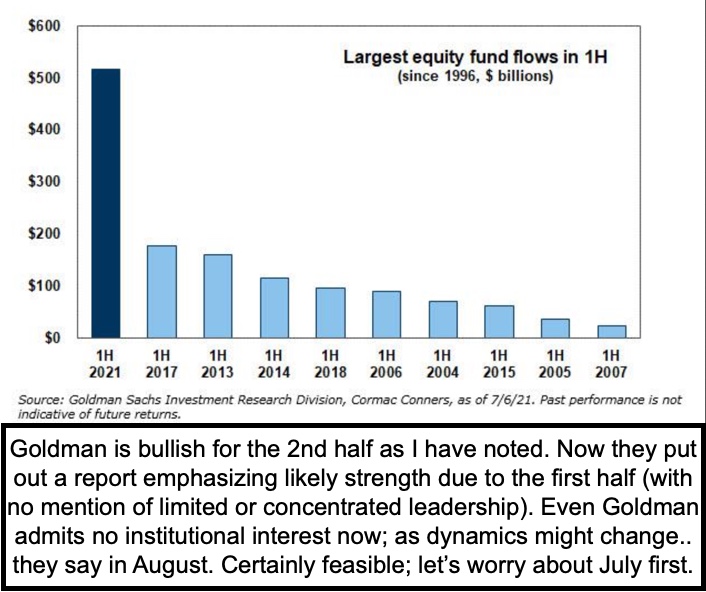

The market rebound from late June into early July is on a short leash. I have little doubt that an intraweek rally (Tuesday turnaround perhaps) will be attempted, and remember some firms are encouraging clients to expect these to be the best weeks of the year .. which I think is ludicrously optimistic, even if they're lucky enough to have the S&P hold together that long. It's doubtful.

Disclosure: This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analyses. You can subscribe ...

more

The suppressive moves by China probably contributed towards the downward movement in Asia,and that may have been the intention. Unlike our federal reserve banks, in China moves are carefully calculated and results considered. So it is not likely that any of the moves were of a random kind. Just because we do not yet see the plan does not mean that it is not moving along.

But the whole thing is not done yet, so we need to hang on tight for a while yet.