Market Briefing For Tuesday, May 3

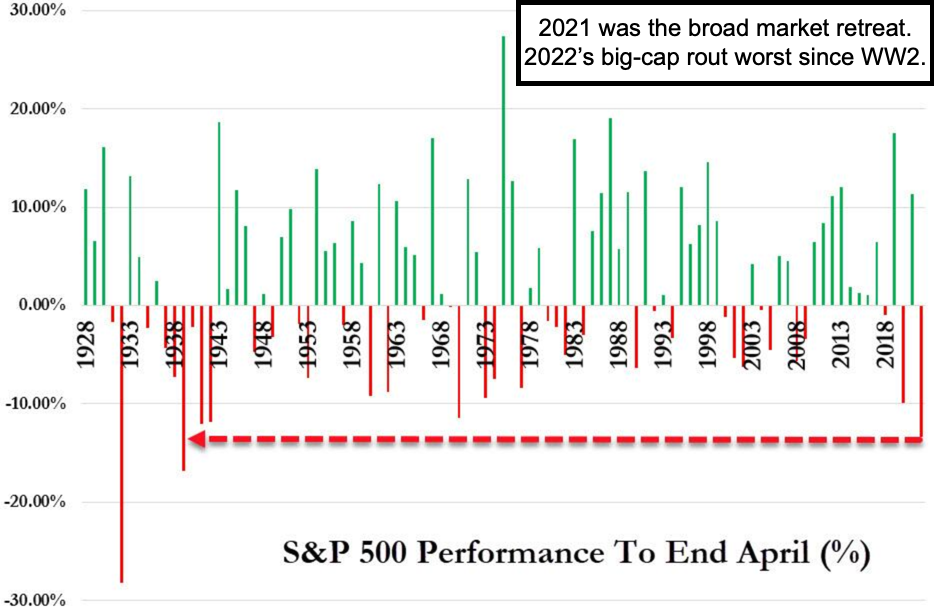

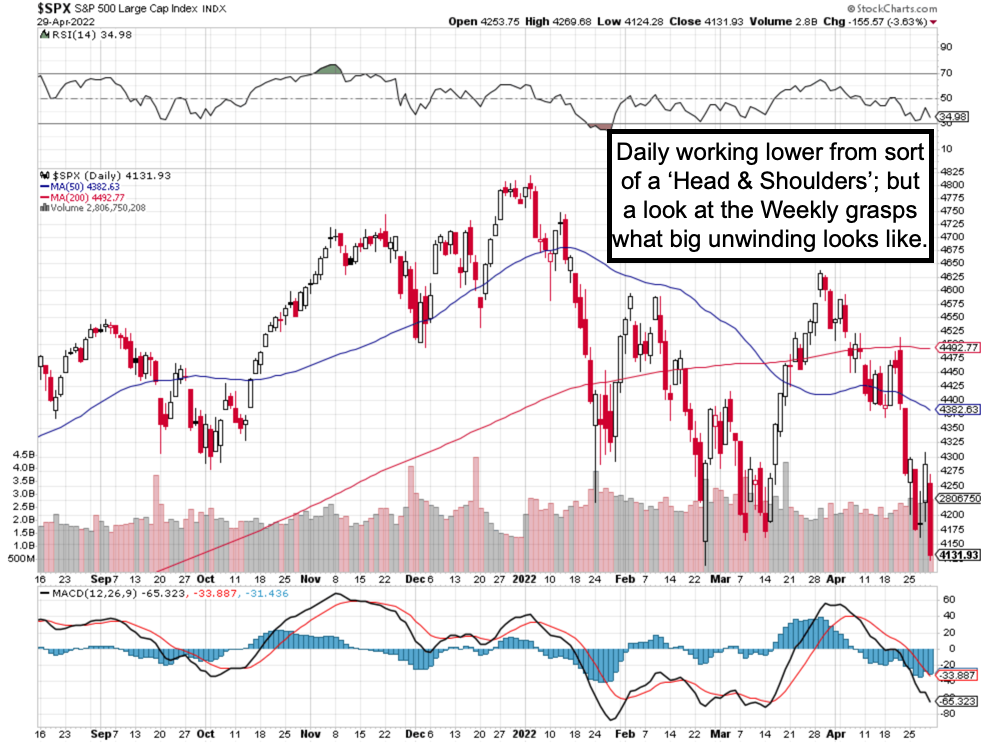

Insufficient 'price discovery' was basically my view going into this week. In essence that meant many stocks were getting relatively attractive, and some sort of short-squeeze rebound could be envisioned, but mega-cap levels for the most part suggested additional continued decline was probable first. That is why we got, although it was after the London 'flash crash' that traction was finally generated in the S&P, after EU and London markets closed.

Basically as prices get lower, risk is reduced, not increased. However hedgers are typically leveraged, and insufficiently 'actually' hedged, hence they get hit with compelled liquidation. Those guys (and a few gals) typically leverage the client's money, reckless as that may be, but because their fee is a percentage of profits and they're working with OPM (other people's money), they also do use leverage way in-excess of the 50% typically seen for individuals, thus the increased tendency to (algo or human) panic when 'trap doors' pop open. So that was the weekend call (for downside) with some sort of turn-up to follow.

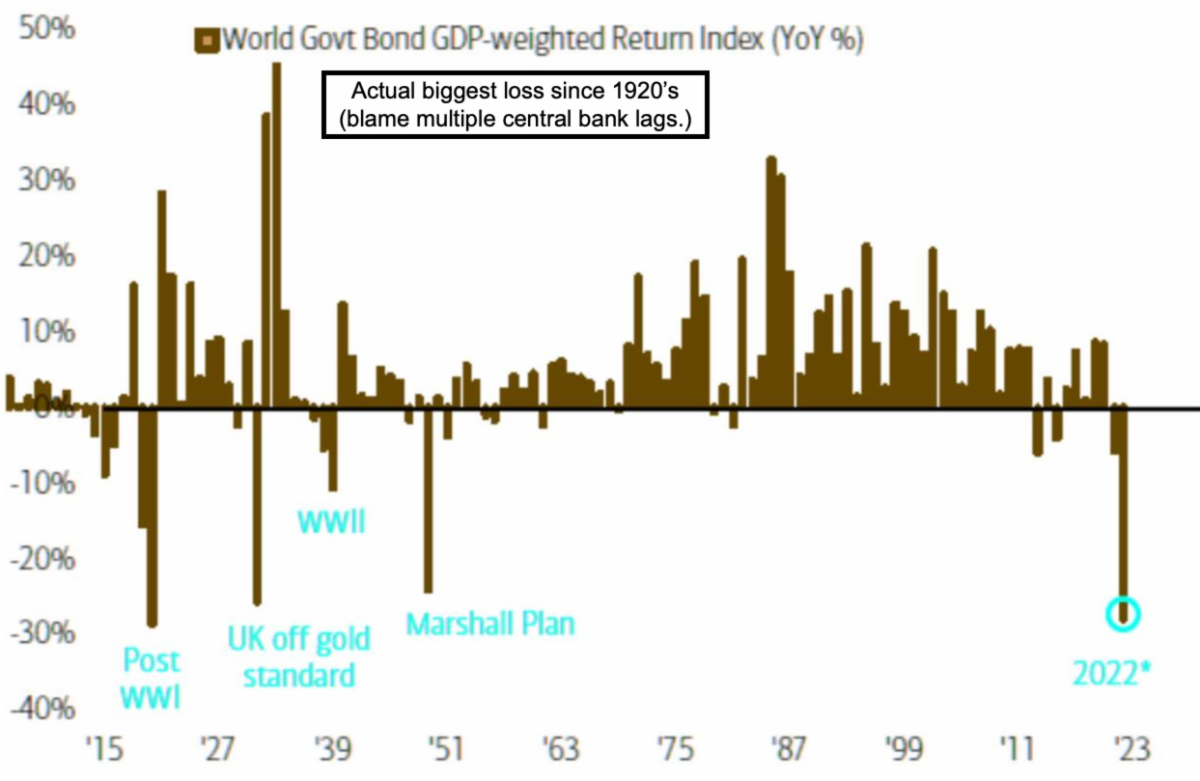

The stock market was suspected to not merely be 'on-hold' pending FOMC, as it was easier to trap shorts by springing a turnaround ahead of that. So, if things really weaken in the economy, the Fed probably won't in the long-run be able to do as much as they 'say' they plan. It's because inflation's origin may have been excess stimulus and wages, but it pressed higher with Putin's war too, and the Fed won't end that. Obviously if Putin stops, stocks go higher fast, before inflation comes down, but is that a real possibility for him?

I won't be surprised to see the USA do better later in the year, but it depends on so many variables, with Oil prices a primary key to all, but lower Chinese demand for energy can inhibit Oil going up much more even without an end of the war. These variables created a murky scenario, and thus most stay out of the fray.

My saying was: 'when the going gets like a circus, stay out of the center ring', but that was mostly last year, when we thought they would take down the 'big top' of the circus tent. What happened (largely due to buybacks and fund concentration in a handful of issues) was 'distribution under the big top'.

That's part of why it's so dangerous to short stocks already broken, and also a premature time to go long big stocks, given nobody really knows if economic orders of the post-war era get restored or not. Actually 'some' reinforcement is seen in terms of 'unity' of the Western Alliance, and Putin failed at dividing the EU or NATO, even if some mavericks like Hungary's Orban betrayed the body of Europe, by paying for Russian energy in Rubles, just as Putin demanded.

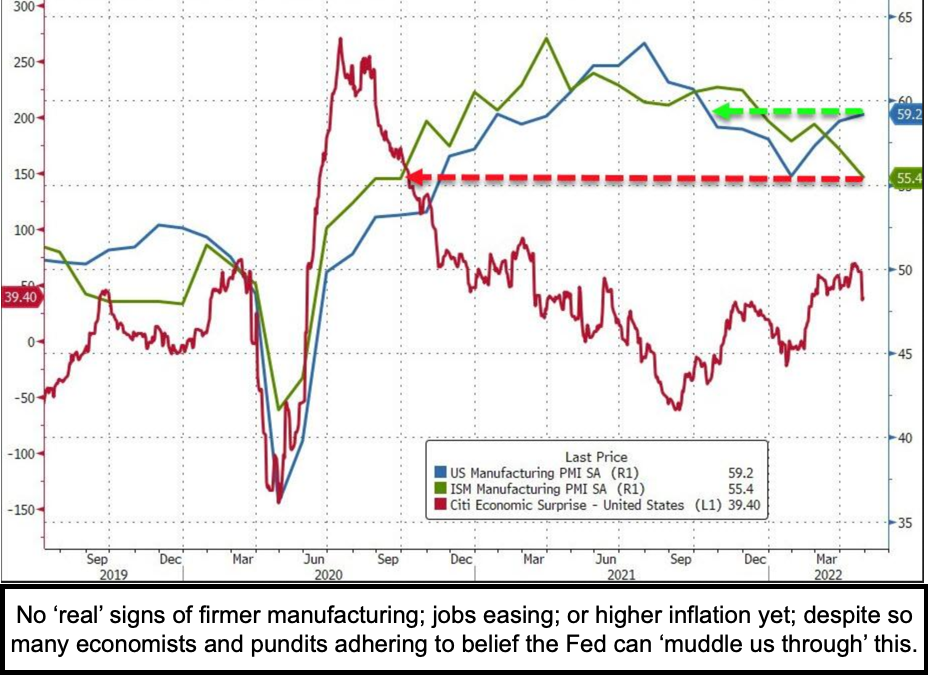

The Fed is engaged in a tricky effort to execute a soft-landing with an imposition of higher rates, while Japan (huge customer) is selling Treasuries, and while China is still stuck in various stages of COVID-related lock-down.

While the market was exhausting compelled liquidation, preparing for what we got (a counter-trend rebound), odds for any sort of sustainability might be a bit better 'if' the Fed on Wednesday would 'admit' they can't control what mostly is a 'supply-related' inflationary trigger, more so than related to U.S. demand.

Many areas are flirting with or below 52-week lows now, except our Oil/energy favorites, and that reflects (especially Housing related sectors) prospects for a difficult time ongoing, despite marketing pitches to shoppers to feel otherwise.

As we're going into the Fed presumably raising interest rates again, we might see a 'sell the rumor / buy the news' scenario, but again bear markets are rife with violent but unsustainable rebounds. We are interested not only given our S&P trading focus (still thinking ~ 3800 is a reasonable measure) but because this is a time when already-beaten-down smaller stocks psychologically tend to be coupled to the behavior of the Senior Index, so even though the 'troops' are hunkered down for months, they have low chances of advance until those 'generals' are revived after making it back to the trenches. Likely takes time. I will be thrilled if this expected rebound holds traction, but tame enthusiasm.

Bottom-line:

S&P probed technical no-man's land briefly, staggered around a bit especially as Citi's London desk was attributed with handling a 'flash crash' of European stocks, and then S&P found traction (after London closed) as we got a comeback.

This wasn't unsurprising ahead of FOMC and heavy negativity, although that's not to say any sort of sustainable move is indicated, although a lot of small or inexpensive tech stocks (not the Grand Dames) seem sort of exhausted with regard to downside, although that will vary between stocks and sectors.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more