Market Briefing For Tuesday, May 28, 2022

Reasonable consolidation is how I'd describe the week's start, considering the S&P is coming-off a fairly impressive rally from Quarter Expiration about 10 days ago, and finished the past week solidly, to our satisfaction.

Now we're going into end-of-Quarter re-balancing, and that's structural market shifting, which typically see increased volume and small-cap changes galore, at times. This may seem 'dull' but it's not, considering S&P and DJIA at least didn't surrender a big chuck of the gains we had looked for last week. What the market is saying is that there's a potential recession on-tap, as I'm saying much of the puff in overpriced stocks is out, but that doesn't make many quite the bargains some think (because they were grossly overpriced last year with the buyback mania). And all of this is impacted by the debate over whether or not we're 'in' recession, which I generally have thought, but realize that much like the country, it's segmented and divided in a few ways.

This is not a time for 'speculative fever' nor the kind of 'downtrodden despair' I have warned was seeping-into numerous assessments 'after' the former drop. In this case there's not a lot to be said other than this rebound towards a prior resistance (say around S&P 4100) was the expectation, and we prefer not for too many to recognize that as the extent of the upside move, because then it might increase the tendency to 'front-sell' ahead of the next shakeout.

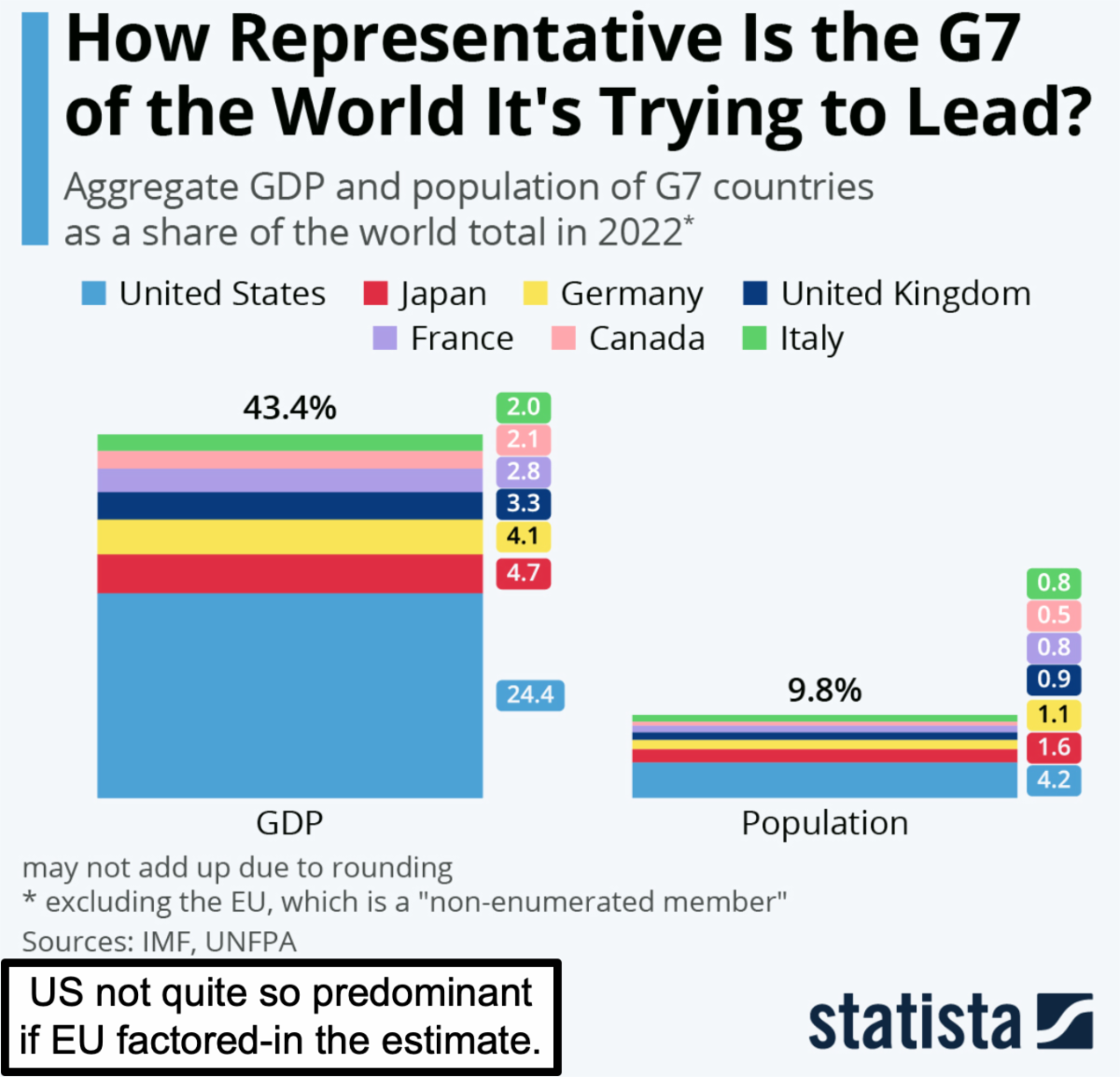

If all goes well (and the overseas news is very mixed in that regard, so harder to assess especially as China increasingly comes off COVID-lockdowns and of course the tensions with Russia have expanded not contracted during the G7 gathering)...if all goes well we will see this ebb-and-flow into early-mid July. I think in the meanwhile the increases in 'revolving credit' utilization and travel expenditures beyond what average families can typically afford, this is going to result in a 'shoulder-season' contraction as schools resume, regardless of the bigger picture implications. (I had dinner last night with a friend just back from Cabo and a separate trip to Michigan, telling me of chaos and crowds in ways he'd never seen, whether Customs or TSA Security or delayed flights.)

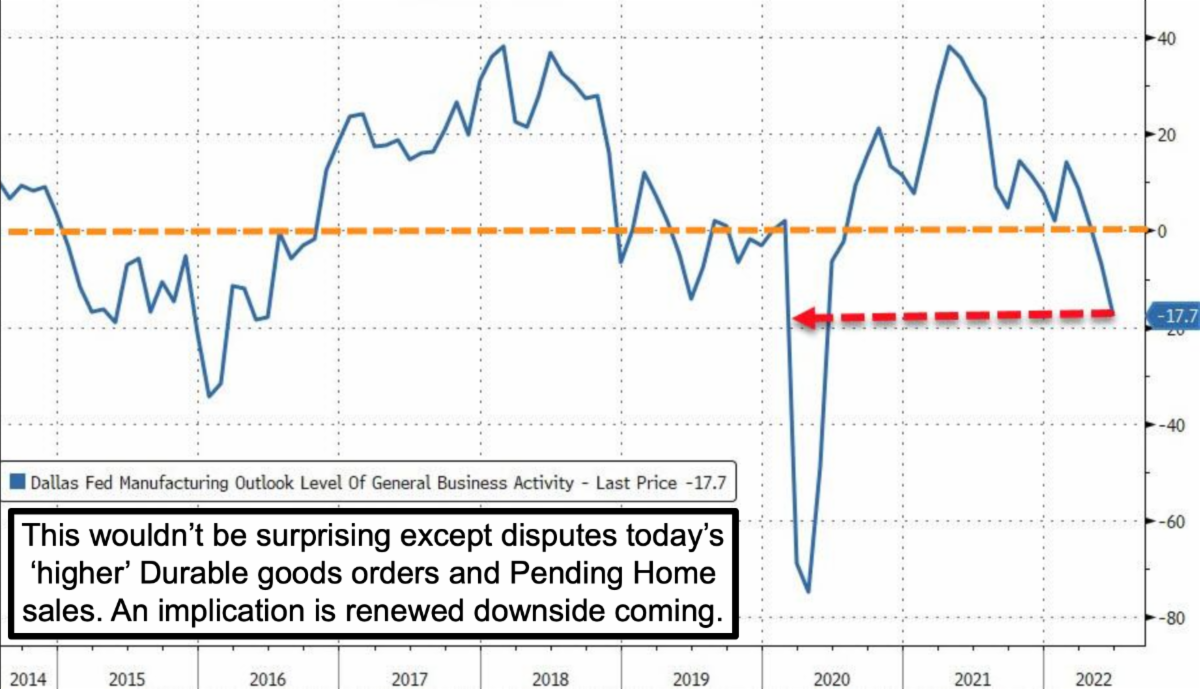

(The reference above is the Dallas Fed expectation of resumed economic not stock market downside, but both may be pending later 'next' month, not now.)

Cyclical late-cycle stocks dominated the market, and of course healthcare, as it has long-term continued focus, but certainly is not cheap (a couple ancillary areas are acceptable), and the same applies to Energy.

Oil prices staying high supports these stocks, however that was our favored sector for last year (and even just before), so holding is not the same as the chasing (as reflected by the absurd higher Oil forecasts by a couple firms).

Stocks like Nike and Starbucks can and are rebounding as China reopens a bit, but remember that's variable as Beijing can reverse again without warning as they have done more than once. I hear reports from G7 suggesting 'solely EV's will be sold and in 40 years there won't be one internal combustion car' in the world (they mean sold, as I suspect mine will be a classic by then..ha). I have heard no more about Tesla's not being allowed in certain Chinese areas but do have some skepticism about how they'll do over time, and competition in Europe and the USA from almost every automaker as time evolves. At the moment, some say that Hyundai / Kia have the broadest EV lineup for now.

By the way:

Iran's Foreign Minister is meeting with Turkey's Erdogan today, in the face of countries seemingly lining-up to press Iran to make the nuke deal. I understand that later-on, Erdogan is actually going to meet with the leaders of Sweden and Finland during the NATO Madrid meeting, presumably to sort out Turkey's objection to the two prospect new members of the Alliance. (The 'indirect' nuclear talks with Iran and the U.S. resume in Doha this week.)

In-sum:

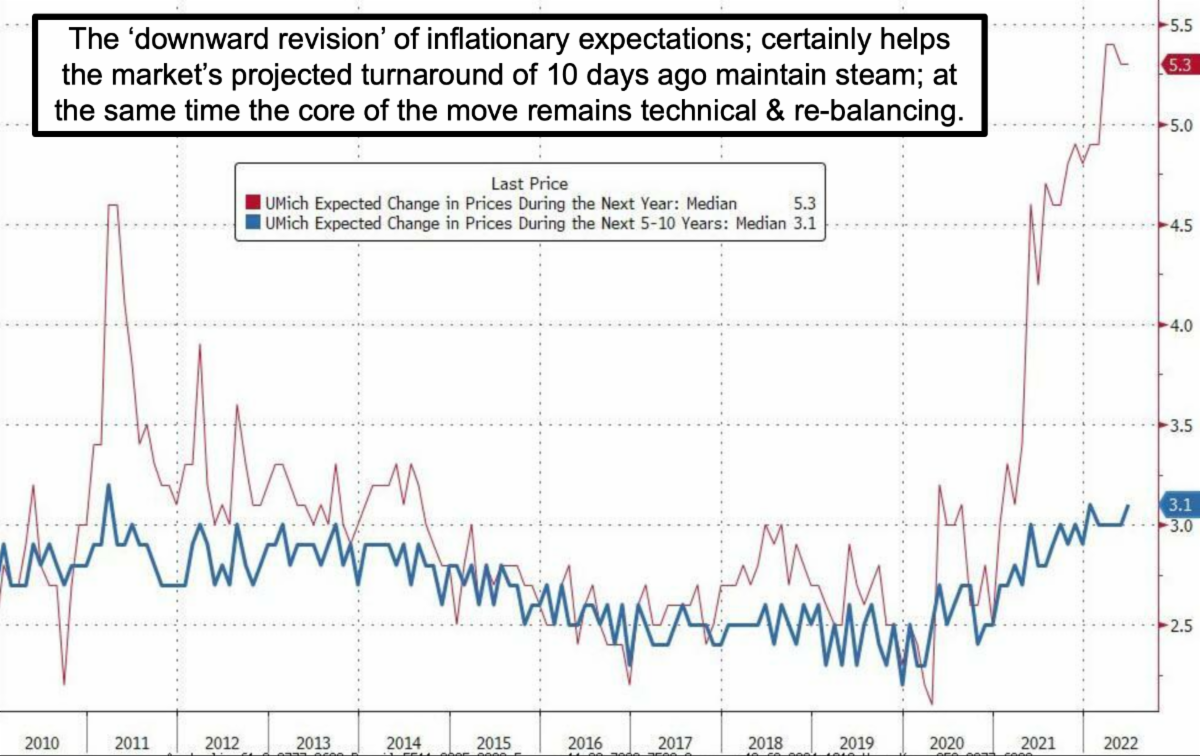

Commodities are easing a bit, the Fed is not looking through inflation easing a bit in that area, since prices will remain robust for a couple months I suspect (at least), since inflation might plateau but not really rollover yet.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more