Market Briefing For Tuesday, July 20

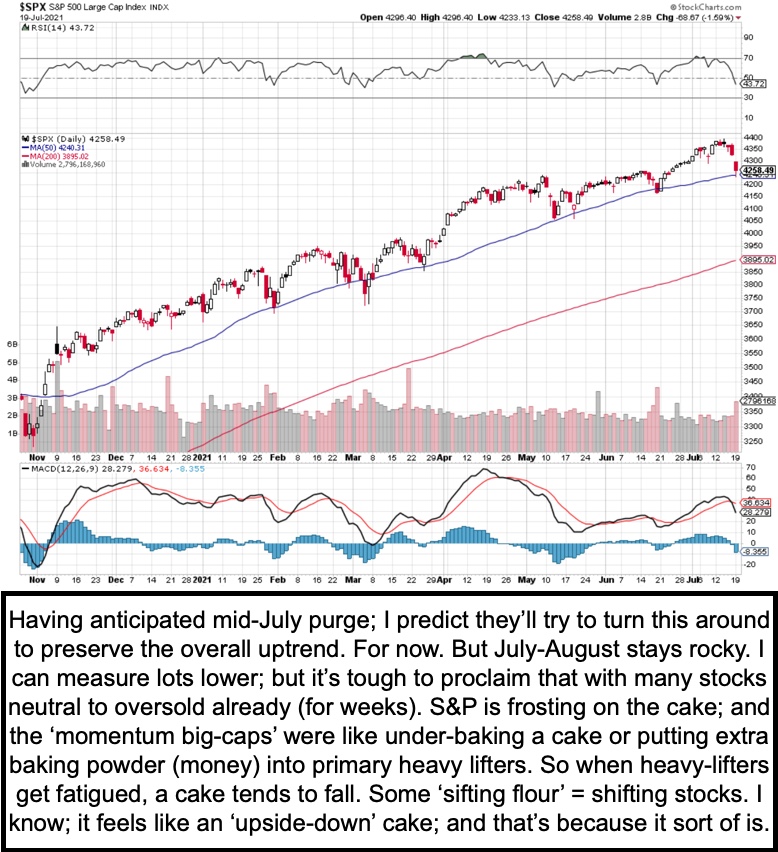

Sudden withdrawal, after weeks of struggle around record highs, isn't really what happened as the DJIA stretched to the downside Monday. Rather, finally the 'cat came out of the bag' and scratched at the surface of 'catching-down' where the broader market has been for some time (DIA).

This is just as projected for Senior Index behavior from mid-July forward, and of course there will be rebound efforts within the corrective process for what I call the 'uncorrected'. Now they've joined a process long after 'distribution under-cover of a strong S&P and DJIA' had already impacted the broad list (SPX).

(P.S. I'm not against the vaccines, just questioning if there's longer-term risk in the present ones, that are not discussed much with the public, lest people get even more reticent to take it, or totally panic the majority that already have. At this point I've talked to doctors about it.

This is not similar to the 'un-vaccinated' for COVID, but in a sense it makes the point that the impact of a market event, like viral onset in a way, is going to vary among groups. The big FANG / momentum types were (and still are) the 'uncorrected... and are thus un-vaccinated' against decline

Technically you had a combination of patterns, including an ascending wedge for the S&P and a lateral top for the New York Composite, and a blow-off for the Dow Industrials, while Dow Transports (as noted) warned of this over the past few weeks, not days or hours.

I mentioned the Transports and warnings, because now the super-bears tend to come out of the woodwork and I suppose market some economic collapse theory, typically based on technicals, extended along with debt impossibilities.

Incidentally, like plausible conspiracy theories (or advocates against vaccines) their core thought generally really is a concern, but being permanently bearish misses everything. Especially in a growth environment with a friendly Fed.

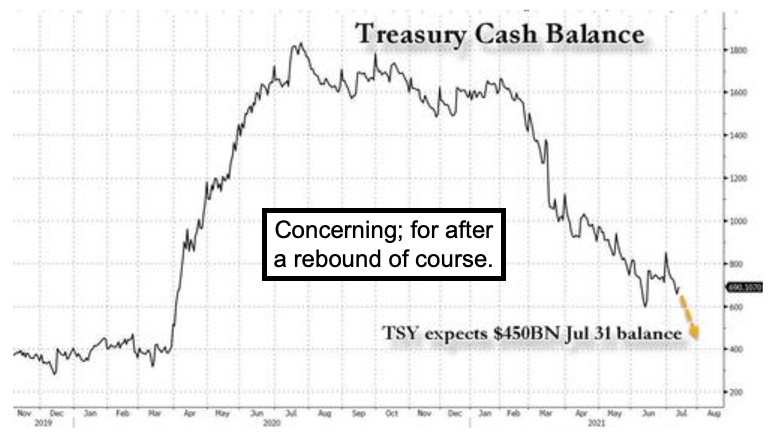

That Fed, by the way, won't dare get too hawkish now that COVID/Delta has its attention too. Much of what we're seeing now is precisely what I anticipated in the wake of the general market already declining, and starting about now. The 'severity' of the overall downward phase is what will vary, and that depends, I hate to say this, because it's not a cop-out to making projections on COVID.

'If' COVID/Delta is 'merely' (and that's bad enough) the global scare coincident with the Olympics (where you already see multiple cases, over 20 actually, in the Village as well), and 'if' mortality rates do not exponentially expand, we will get through this without the S&P repeating what it did in February & March of 2020 that - yes we identified both at the top and bottom - in terms of severity.

The drama cannot be as severe as 2020 because everyone (well except parts of the country and that's hard to grasp at this point) knows about this, and so there's no 'stunning surprise' like last year. Or there shouldn't be that much. It is one reason I suspect we'll washout a bit maybe, then higher on Tuesday.

In this case they will be trying to hold the approximate high level trend around a 4200 area I've noted, and there is a 'they' and a capacity to engineer that is there. However it's summer, the 'Dog Days' and so on, thus beware ensuing declines, which we'll try to identify. After a rebound, if the low now or coming in hours if not minutes, is penetrated to the downside, that will be treacherous.

In-sum:

Renewed virus fears (a so-called 'wild card' I've noted for weeks) has galvanized everyone's attention, proving I was not excessive in proclaiming 'it' (COVID / Delta) as the primary market influence for now, rather than 'yields'.

Low interest rates combined with higher prices and a bit of cautious or slightly sluggish economic prospects (we showed Consumer Sentiment now and their future plans being softer, a week or so ago) in the presence of unresolved and continuing spread of COVID 'globally' (we thought the Olympics would reveal a bit more unfortunately, as they have already), plus weakness from mid-July as the S&P catches-down with the broad market, well that's been our call.

Now we look for an S&P rebound, probably dramatic, and then risk returns 'if' things deteriorate globally, and I am primarily referring to COVID 19/ Delta (SPY).

Disclosure: This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analyses. You can subscribe ...

more