Market Briefing For Tuesday, July 19

Engineering a 'soft landing' is a rare achievement, but hope for this Fed in a sense performing a miracle by threading the needle accordingly as needed, is a factor in the market's push higher, or at least the explanation most heard.

Suggesting a 'softish' but not 'soft' landing, was probably close enough for my own take, probably because I believed we were 'already' in shallow recession to a degree, so the credit markets were already pricing-that-in to a degree.

That's not to say we won't continue to exercise care, but it's also why quite in a regular way, I've mentioned how the big-cap decline was the 'Generals' sort of 'catching-down' with the 'troops', that were hunkered down in the trenches, at least for months, and often for a year or more. And I thought 'if' the Fed did pull this off, or get fearful of doing too much damage, S&P might stabilize.

The economy has signaled a 'growth scare' and looked for a CHIPS deal from our Congress (perhaps tomorrow?) which would help set a tone for optimism that we thought was already developing over the last 3 weeks or so in tech. I'd noted before that nearly half of tech revenue comes from abroad, so it's tricky economics and heaviness in Europe that matters a lot for U.S. companies too.

Thus, with ECB about to hike rates, and guidance likely cautious in-part due a good bit to the European worries, you can (and likely will) have more volatility and turbulence during the remainder of this Summer. However those dips are for buying, not liquidating (as I noted some were incredibly doing last week) in an era environment that discounts cycles quickly and even the Fed's speedier.

We are not 'fighting the Fed' (warned about that and their tardiness more than a year ago, including warning about the nonsense of inflation being 'transitory' as they of course regret saying), we are and did accumulate a bit more over a few weeks on dips in a sprinkling of speculative (and sometimes innovative or disruptive) stocks believed likely surviving the current maize in this world.

In-sum:

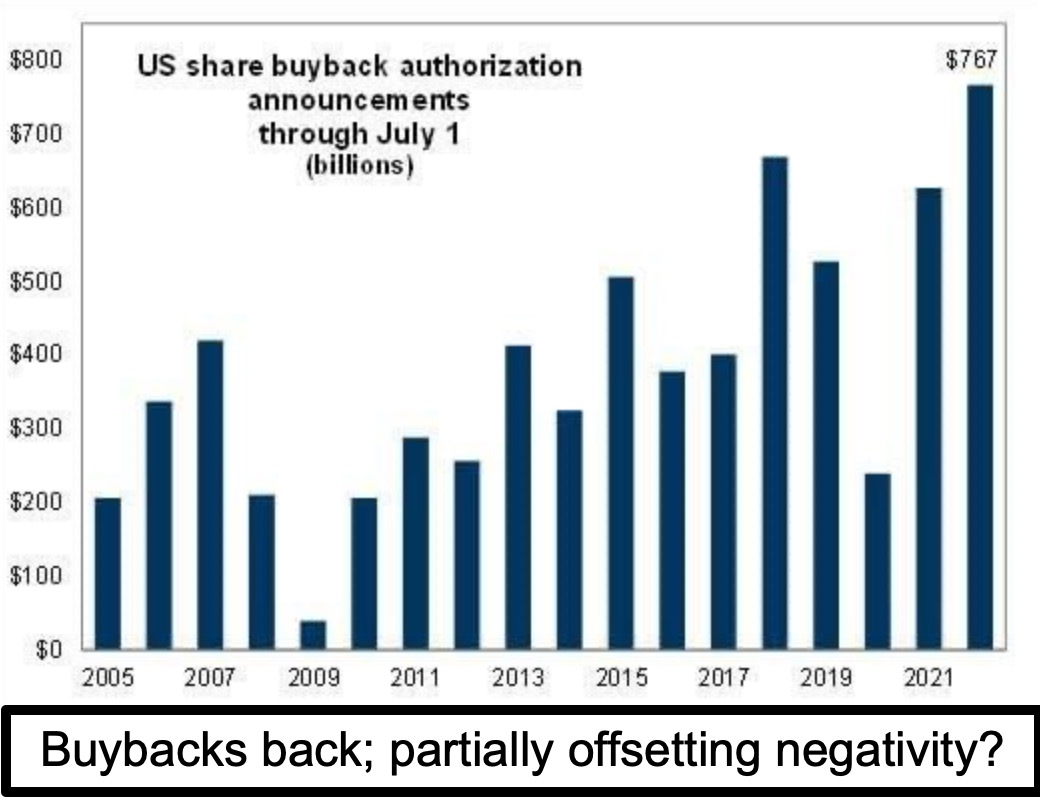

We've actually had a multi-year (2 years) malaise in the majority, after our forecast 'Inger Bottom' of March 23rd 2020 ran its course, got chased high by late-entering money managers, and also aided by big-cap-buybacks that to a degree 'masked' the distribution that was concurrently occurring. And as for sure it set-the-stage for historically high insider selling, as we noted.

Now the process evolves, and for many that will remain solvent and viable, it's time to be less pessimistic even though this will be a multi-month process. For sure nothing is changed in that regard, or for that matter the tight-Oil markets, that definitely affect demand and inflation. Furthermore there's the war. And if last week's quiet talks in Turkey bring the protagonists to some accord that for the first time in months, finally allow the Port(s) of Odesa to be opened and to save parts of the world from famine, well that would be a favorable outcome of course, and might be a precursor to overall ceasefire talks, we can hope.

As for the general market, it's trying to look past the inflationary numbers and contradictory sentiment, but again society is almost as economically bifurcated as the politics were. A moderation of inflation certainly would be part of better times ahead (or resuming), but again it can take months for things to unfold.

More By This Author:

Market Briefing For Monday, July 18

Market Briefing For Thursday, July 14, 2022

Market Briefing For Wednesday, July 13, 2022

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more