Market Briefing For Tuesday, Feb. 8

Trading nearly halted due to an influx of apathy, might describe Monday's alternative shuffle. In reality there was more tension-on-the-tape, with little of substance for traders to embrace. (Slight cynicism, bit it was fairly quiet, and that's despite China trading resuming after a holiday week, and the meeting by the German Chancellor with President Biden, nothing notable reported.)

Perhaps the biggest stories of the day are Meta's (FB) problems with European regulators, and the fear of having to withdraw Facebook and their Instagram products, given that there are rules prohibiting export to countries outside of the EU. Late today Peter Thiel stated he won't stand for re-election to Meta's Board. Zuck showers him with praise, and he (notably) was behind the original funding that made Luminar (LAZR) possible.

I suppose one could 'guardedly' say the expected February COVID-case drops are news, but that was the projection. What might be surprising (controversial for the moment) were the mask requirements withdrawn on a schedule for the school kids in New Jersey and a couple other states (all Democrat and not in line with Washington health guidelines). Last time things opened-up it turned out to be premature, this time probably not so, though it's debatable for sure. In-essence the Country is opening-up whether regulators like it or not. Period. (Don't try that in Beijing, don't even think of going out, they might weld you in.)

And the other story being the Frontier-Spirit merger, with Frontier dominant in the surviving combination. Given limited route-overlap, it makes sense for these two non-IATA (so-called, but often not, discount) airlines to merge. The legacy major carriers which are IATA (which also means easy tick endorsing in-even of cancelled flights and so on which airlines won't do for discounters), these big airlines typically offer bare-bones economy fares to budget-hunters (ULCC, save).

Aside this more shuffling of stocks and tonight I'll not delve into areas already known, which remains an extended market but one that works-off daily stress in a sense (or daily overbought) by virtue of setbacks and/or quiet sessions.

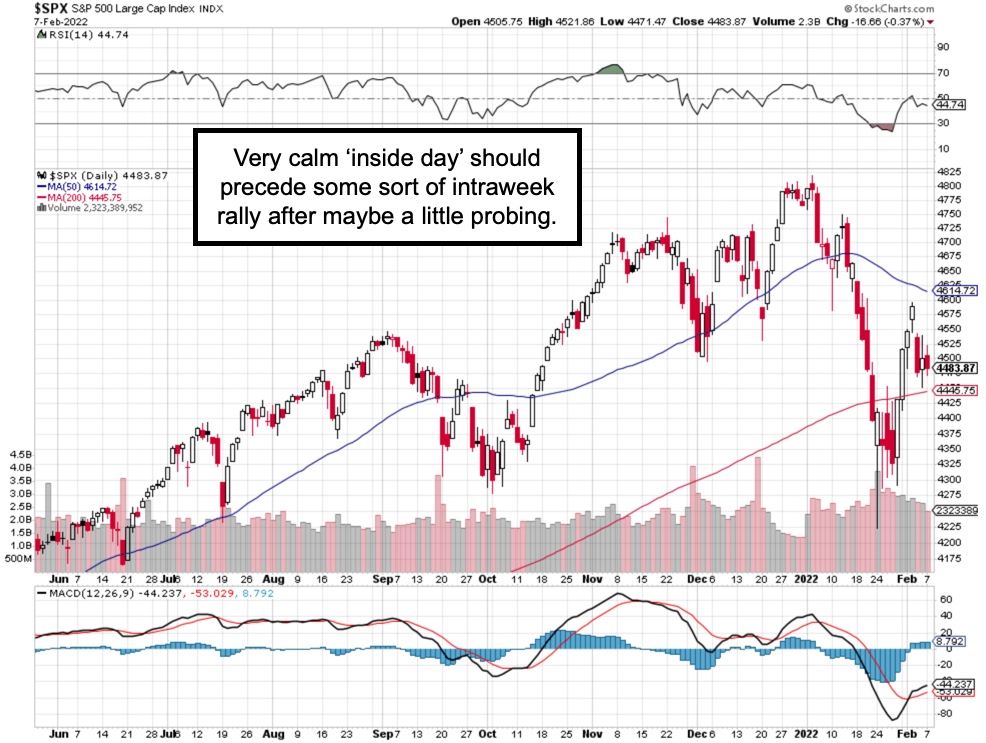

Nothing really has changed from our previous outlines and today's mild consolidation allows for a bit of downside probing and then an intraweek rally, provided of course that there's no major 'geopolitical' surprise.

There's no mystery to me that the market would have a shock if 'war' comes to Ukraine, at least initially. Perhaps that's reflected a bit in S&P hesitation, but it isn't discussed in media from market-impacting perspectives. Perhaps slightly with regard to Oil, but more seem to be focused on the Vienna talks resuming Tuesday with Iran, and the idea that the current Administration wants to show concrete results such as with Iran, or adroitly (is adroitly a word they know too well?) with Russia, to avoid war and have accomplishment claims this year.

Elsewhere... bonds traders might be braced for global rate increases, while it depends on factor that are in-flux with central bankers also reticent to jump. If you look at 'corporate credit risk' it's rising, but by no means concerning .. yet.

Also, I've opined that while some Banks are calling for 3-4-5 or more hikes in the Fed Funds rate, they want that (income) but may not get that. I suspect a market breakdown would cushion the Fed's ardor at hiking sooner, unless it's completely ignored (which the Index has mostly done so far but warily-so).

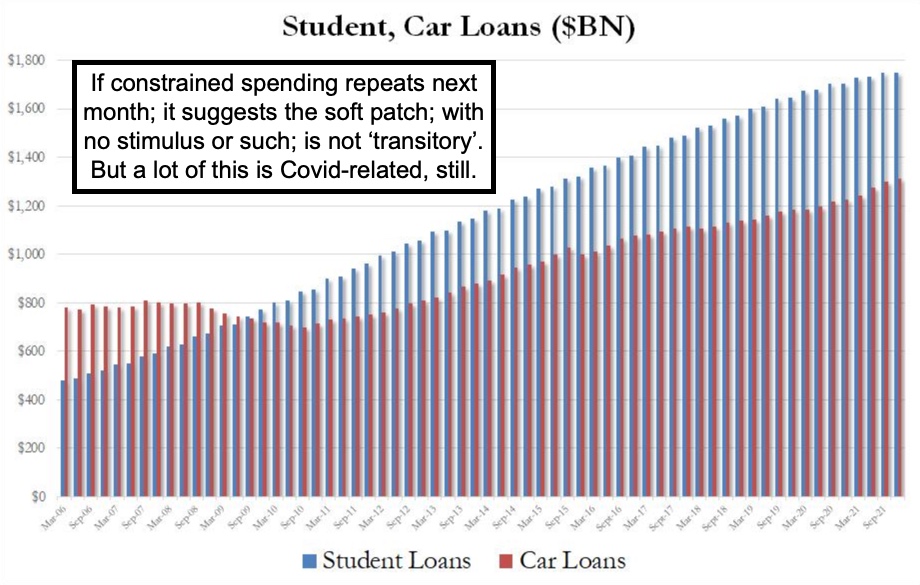

If there's one other thing: it's the share of our budget that must go to service the national debt basically. That's why you can thank Washington for inflation aside that portion caused by COVID, because .. well politicians basically go to Washington to spend money on projects, and often largely not much else. For sure that changes in times of political charades, health crisis, or war threats. It is notable we have all that now, ahead of the 2022 mid-terms.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more