Tuesday, February 1, 2022 3:30 AM EST

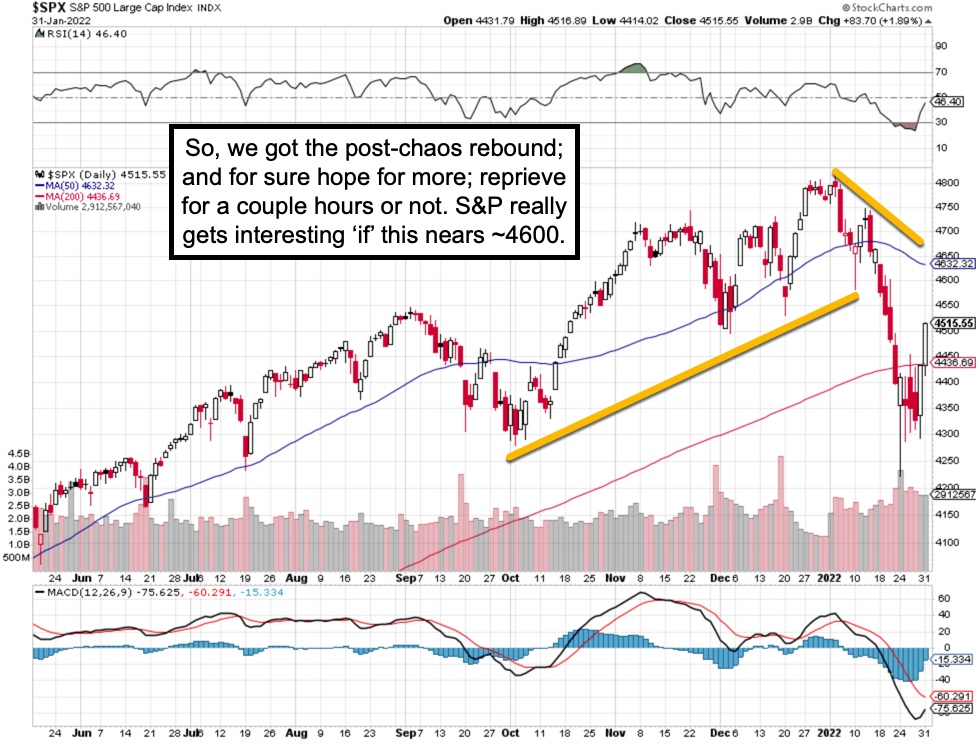

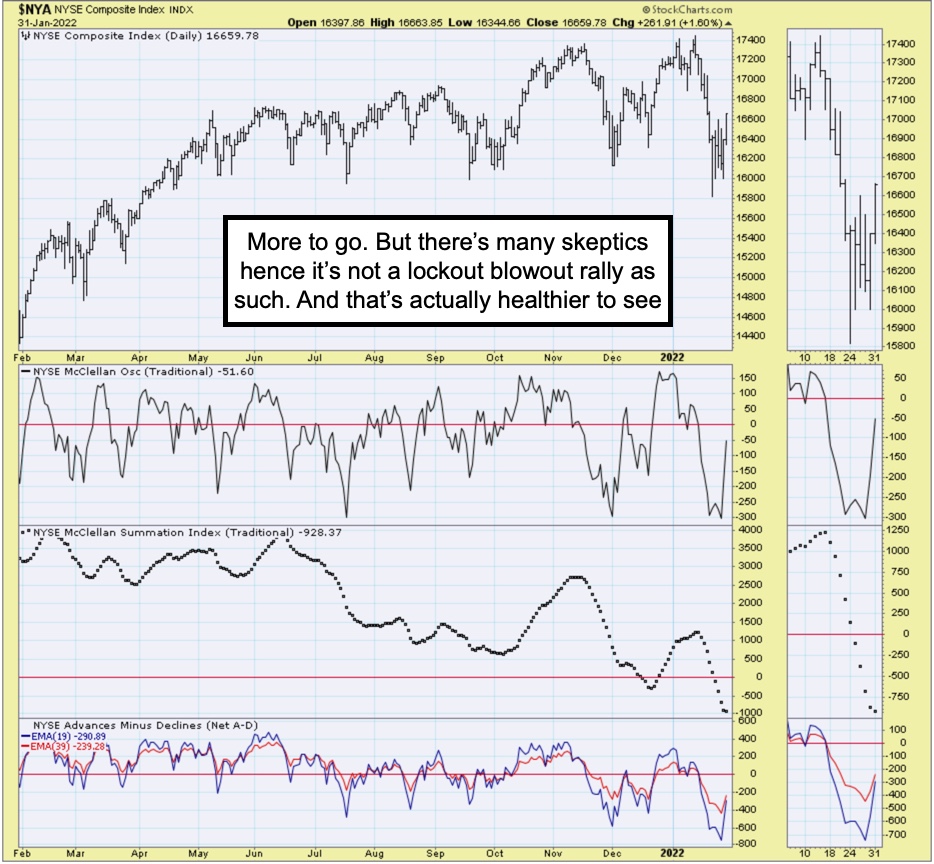

'Burden of proof' remains for the broad market (this time working in-sync), while the elements for this move were in-place based on last week's chaotic swings that I thought were setting-up a rebound, regardless of Fed or Russia. I am glad plenty of skepticism prevails, that should allow further S&P gains for the moment, allowing for some early defensive probing helping pave the way.

Unsplash

|

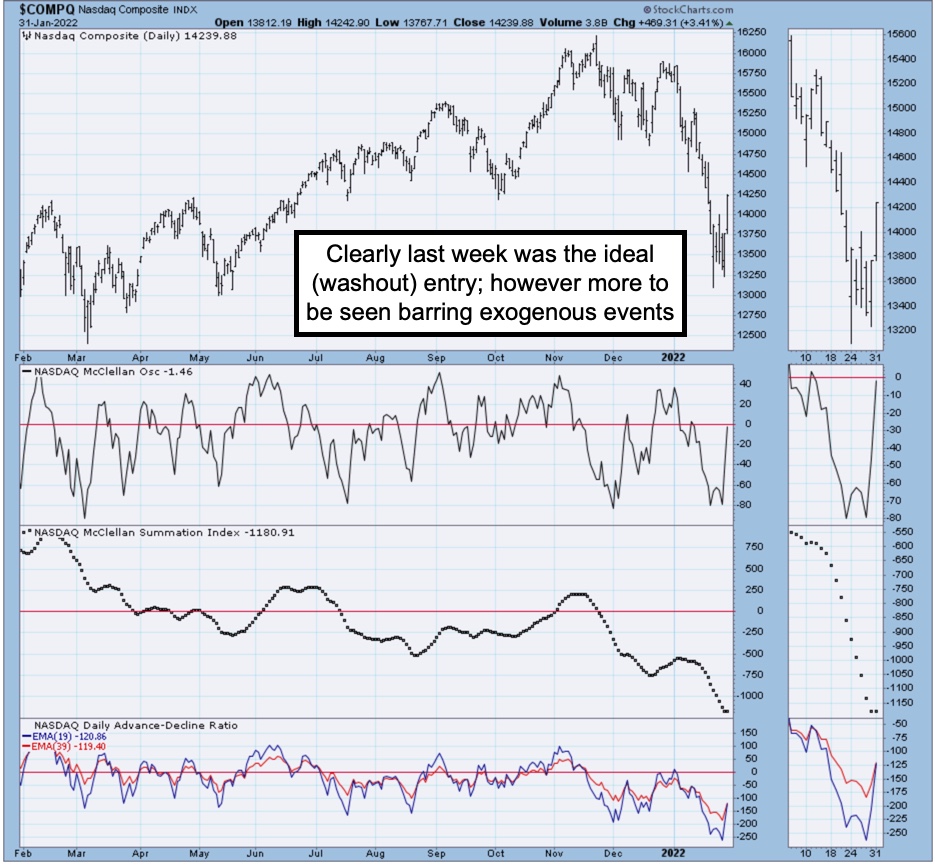

This is not about earnings, which will generally be better for Q4 than for Q1 as far as that goes, but really over-reaction bordering on panic in small-caps last week and before, as the unanimity of negativity early last week was sufficient for me to call it 'climactic' even at relatively high S&P levels (SPX), and totally what's seen in washouts for small-cap stocks which were extraordinarily suppressed.

And obviously, with Russian troops not only being backed-up with medical or other teams (and 'blood supplies' as mentioned Friday), plus now encircling a still radioactive Chernobyl (the closest route for a blitzkrieg-type attack on the Capital of Kiev), all bets are off if Putin recklessly moves forward with that.

|

|

|

These moves off the recent lows are not as dramatic as some historically, and that's likely (and logically) because of the high Index levels and skepticism so predominant, and especially as regards the Fed. That's why we suggest that it most likely would be a key 'B' wave rebound, but might be a more significant trough for certain small-caps, while others will remain choppy for months (that mostly refers to those for-which fundamentals won't be clear for some time).

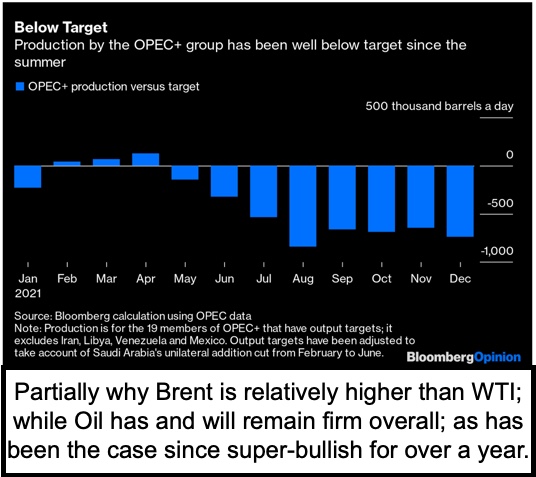

The indexes are clearer as the chaotic chop came from around and below the key moving averages, and that was where a battle had to be fought. Oil rising also helped, and today Goldman is suggesting 'boosting' exposure in Oil (OIL) now, which is fine for those of us in and bullish for .. over a year now. So sure they can buy all they want, but I'd be a lot more comfortably hold from the 30's and 40's and not requiring to get to 100/bbl higher to achieve gains for their 'folks'. (Sure, if war starts, 100/bbl will be support on a pullback, hopefully none of it.)

|

|

In-sum:

Today was a 'rebalancing' month-end session, and maybe we'll get a brief pause Tuesday morning, but nothing to get carried away with, before we likely see more advancing, even if it's a temporary phenomenon.

|

|

|

It's hard to keep it up all day long, hence the S&P did a beautiful job, as did a host of small-cap issues, many of which were up 10-15% early-on, with later pullbacks very sub-minor, as they tended to firm-up later in the day. (Evening is seeing minor contraction in overnight futures, with various interpretations.)

Now candidly I don't deny this is part of a process, but the stage-was-set last week, and that was the idea of a 'firm Friday finish' being helpful for rebound. I realize it might try pausing tomorrow morning, but barring new pestilence, war or famine, I suggest there is more upside to be seen, even if this is merely the kind of speculative 'B' wave rebound, with a 'C' wave decline 'down the road'.

|

|

|

I should qualify that while for the S&P that might be the case, for small-stocks it will depend on their individual fundamentals and supply-chain issues. That's going to vary, and companies that are domestic-centric and not reliant on any or many supplies from China, will be in better-shape regardless of relations as relate to trade, but simply because COVID may cripple their output for longer.

Of course that was my point last week about the Fed 'not' being able to effect inflation as much as some of them 'think' they can, because COVID is central to the inflation case, when you step-aside wages and domestic food costs etc. China is not well-protected, their quarantine policies are incredibly bizarre and ineffective in the long-run, and their Sinovax vaccine is worse than a mediocre U.S. or EU vaccine. (The Russian vaccine is somewhere in the middle.)

|

|

Bottom-line:

The market washed-out, things were classically set for this and it seems we have more upside remaining until contending with another rough or rougher spot. The strongest rallies do occur in bear markets, but so many are convinced everything is negative, that it sort of seems slightly encouraging.

The market excessively priced-in the concerns about the Fed (or Ukraine just possibly), and now we get the expected breathing-space without larger clarity. We thought some of the speculative stocks were screaming buys last week, it seems almost all are rebounding to varying degrees, and what one does with them probably depends on how this rebound extends and what news occurs, but also whether one has added to or initiated new pilot positions in a stock.

|

|

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for

more

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more.

less

How did you like this article? Let us know so we can better customize your reading experience.