Market Briefing For Tuesday, Dec. 7

Tora-tora-tora - was last week's deep-dive attack bombing the market. This time key S&P levels were defended, with squadrons of bears repelled.

Sorry for a World War 2 analogy, but I believe it always appropriate to honor those lost on that fateful day as the Japanese attacked Pearl Harbor. And never to forget an adequate defense is what it takes against authoritarian demagogues so that we never encounter another 'Day of Infamy' as we did on Dec. 7.

I am sickened to say on 9-11 as the World Trade Center and Pentagon were hit by Islamists (essentially funded by 'frienemy' Saudis) despite warnings out there for airline security risks (including from this writer in August that year based on an official warning seemingly ignored.. modern version of that radar operator perhaps as the FBI didn't even follow leads from its own agents as of course you know). Being personally acquainted with at least several victims of 9-11, it's a tendency to think about that every time I hear 'never again'.

Stress points in the market are reminiscent of the lone Army radar operator on a mountain near Honolulu that day, seeing a 'track' trending straight for Pearl, with 'command' assuming it must be just a flight of B-17's from the mainland. If he had been listened to it wouldn't have prevented war, but might be shorter as the Pacific Fleet and our Pacific Air Forces would have been intact. Japan would know the 'jig was up' and likely contemplated a revised military policy.

Executive summary:

- Multiple challenges are not yet 'definitive' crises, but evolving situations, these alternating swings will occur until we evolve thru tax-selling and of course accumulation on dips, and debates about the Fed and Omicron.

- Of these the hawkish Fed 'pivot' is perceived as most concerning for U.S. markets, while nobody believes Chairman Powell supports higher interest rates for the purpose of weakening Democrat mid-term prospects (?).

- Spin-talk about how 'good' inflation is for people is nonsense, as it truly does put more pressure on the lower economic segments and makes it even harder to achieve or maintain middle-class U.S. living standards.

- Of the other 'crisis', Omicron is front-and-center, as anecdotal reports of 'only' milder cases prevails, but may prove to be wishful thinking, during this New York is trying a 'business' COVID mandate, against opposition,

- In the meantime, bio-techs struggle to achieve solutions for COVID overall, with many of the big pharma stocks evolving in stages of correction.

- I mentioned Google (GOOGL) told workers to defer returning to offices after Jan., and that others would follow, today Ford (F) did just that (until March).

- While the market is focused on the 'major variable' issues and the Fed, it is important to notice our fairly bullish view on oil is supported by action (OIL).

- Today the Saudi's quietly increased their export price of oil to Asia and to the United States (but we believe the U.S. should buy zero oil from them, and that's because we championed 'energy independence' for decades).

- Oil bears are arguing for a benign winter tempering oil demand, and I'll say that's rationalizing their getting negative after-the-fact of overpriced WTI a couple weeks ago, when I thought oil in the 80's was 'enough'.

- Releasing oil from the SPR is a negative influence on oil, it hasn't really started and think it's a mistake, however it's a temporary weight on price.

- After bear crowds became negative for Oil into the 60's, I think back into the 70s, then higher after a full return of economic activity looms (believed by bears not coming back soon), and as relates to COVID we think one way or the other it comes back (having a 'Pill or two' for COVID will help).

- With regard to COVID pills, now 'Sorrento' (SRNE) put out a Press Release about the antiviral protease inhibitor, actually it seems like a 'fluff' piece but isn't, it references a completed 'paper' about the noted antiviral arrangement with Dr. Wenshe Ray Liu, professor at Texas A&M University.

- This was announced a few months ago, and now Dr. Liu prepared the pre-submission study, that seems similar to what he was commended for with 'Remdesivir' before it came into broad anti-COVID use last year.

- Investors are (understandably) so frustrated with Sorrento that they don't appreciate how important this 'could' be, along with others coming along from Pfizer, Merck, Gillead and Glaxo, or that Sorrento is nearing actual revenue-producing sales finally, just as global testing shortages increase.

- Sorrento also noted signing of the first distribution deal (including clinics) in Brazil, and that for the moment is very important for CoviStix revenue.

- I view the 'diagnostic laboratory' (additional aspect of Brazilian sales) as very important, as its 2000 testing sites might make CoviStix familiar as a 'go-to-test' in Brazil, just as it helped name recognition for Abbott's early (less accurate) test in the U.S. get name recognition.

- The PR probably is a 'token order' but I suspect purposely lacking lots of details, because they don't know demand 'as yet', however I suspect lots bigger than Mexico, although both are significant, so yes as usual there's more even to this story shareholders don't hear, but seems like Sorrento is putting-out whatever they can as it unfolds, which is appropriate.

- Yes many pharmas aim for effective antiviral pills, as mainstream media mysteriously never asks the 'experts', pharma guys know it will take a pill or cocktail to resolve this, one antiviral with a Gin & Tonic please (hardly).

- On the slightly selfish side of the CEO; the announcement of Scilex spun off via SPAC, probably reveals why Sorrento's CEO Dr. Ji wanted options for personal gain, which shareholder vote successfully defeated, seemed an effort to corral a position so he'd need nothing else ever (no wonder he was so pissed he cut-off the Annual Meeting on that vote tally, and didn't take it to Court for a recount / appeal haha), he was stunned.

- I have no idea of the structure of the SPAC and do not intend to delve into it other than knowing how I disdain that form of IPO as almost always the people in it sell after (in this case Cayman Island so Vicker's New York is probably a Hong Kong group no idea), how much equity Sorrento retains isn't at all clear, and I will share that once it becomes evident (expect any such SPAC to make it's high upon launch and then can revisit it far later).

- By the way the recent Canoo 'transfer' (like cross) appears to have been from DE capital (cutting their holdings in half) to a private fund controlled by Canoo's CEO, hence insider-buying in-size, about 35 million shares (GOEV).

- So directly/indirectly looks like CEO Tony Aquila controls about 47 million shares (238 mil. outstanding), he takes a 1 million annual salary (in North Dallas that's an annual mortgage payment), and perhaps Tony has sights on becoming another Texas Mark Cuban or similar (?).

- Speculation might spin around 'who' might be another partner or backer as things go forward, we all heard rumors about Apple and/or Walmart.

- Few are considering another domestic partner (Ford?) or that the soon to be re-negotiated (or cancelled) overall deal with VDL-Nedcar in Holland, might be aimed at a large EU market, but again U.S. made vehicles first.

- I believe Canoo grasps the importance of 'made in the USA', as locating plants and offices in Oklahoma and Arkansas attest too, by the way just recently Bloomberg mentioned 'Bentonville' (Walmart's HQ) as perhaps the new Austin, since unlike Austin it's still affordable and fairly relaxed.

- Won't it be interesting with controversy around Rivian (RIVN) and Lucid (SEC questions regarding how it came public), leaves Cacoon in the driver's seat a couple months from now?, no idea but quite a speculation if so.

- As far as the market I'm not relatively relaxed, simply continuing to nibble at a few speculative stocks in purges like last week (or one or two earlier today), but as usual will not chase the upside (idea is average entry for a few speculative issues will look good when viewed a few weeks hence).

- Prospects for expensive growth stocks are mediocre for 2022 so far, with the pending Fed policy initiatives and without a real resolution of COVID, no vaccine is or will be as confidence-building as simply a 'pill in your pocket (essentially prescription)' for something to knock it out if caught.

- The Norwegian ship returning to New Orleans with many COVID positives is a reminder this goes on, whether treated too casually or not, likewise a banker's party in Norway where 13 of 30 guests got COVID, emphasizes it, while I doubt many Americans are going to test every holiday party guest.

- The number of people testing positive in South Africa 'quadrupled' over the weekend, so 'probably' that's got everyone increasingly on-edge or at least wary, but a sizeable rise doesn't reflect in markets, at least not yet.

- NYC is going way beyond (in the minds of many) regarding a new indoor mandate for the private sector, this additional expedient is timed sort of to instill fear (justified or not) ahead of the big holidays, here in mandate-free Florida there is no change in relatively low positivity rates etc. seen lately.

(The above is absolutely uncertain, but could actually be a bullish alternative.)

For now the 'control line' remains the declining tops S&P, and even as/if that is taken-out to the upside, that doesn't prove it more than a 'B' wave in sort of an 'A-B-C' decline, though once we get past mid-month it could be more. The variable nature of that situation is why I felt it sensible to 'dip toes in the water' and not 'over-think' the short-term risks, with regard to small-cap value stocks.

Then, if S&P (SPX) gets hit again dip another toe, with a good overall entry average in any number of stocks (since ones we follow and others mostly got hit). The best (or lower risk) stocks for early 2022 may be the small-cap value techs (of course ones that actually have good ongoing or speculative promise).

In-sum:

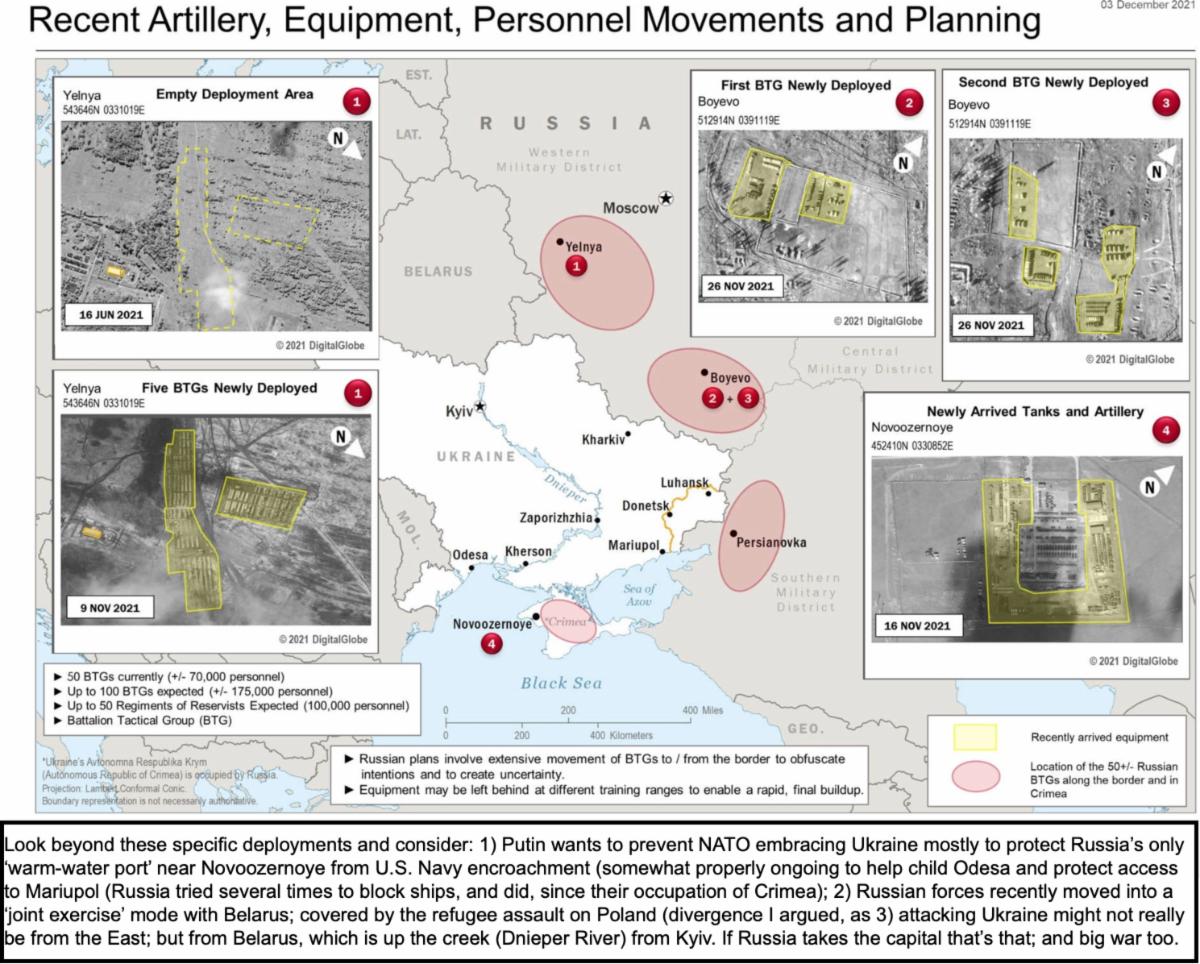

The COVID variables and monetary uncertainty, combine with new and existing (but aggravated) geopolitical challenges, to expand what's been rising fear or uncertainty for some time, which has been trying to hit a crescendo.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more