Market Briefing For Tuesday, Aug. 24

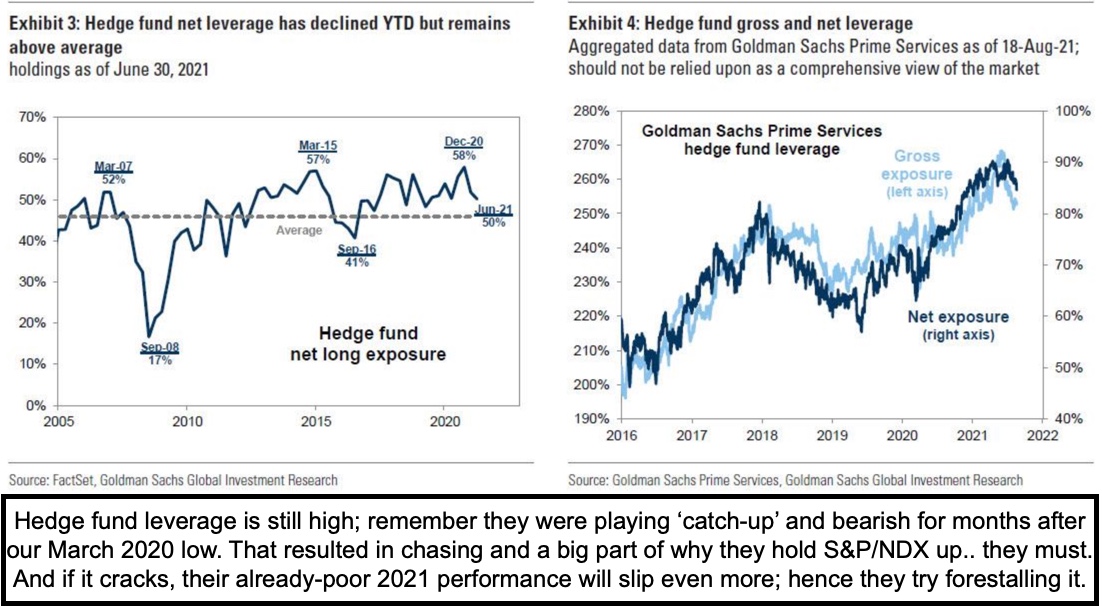

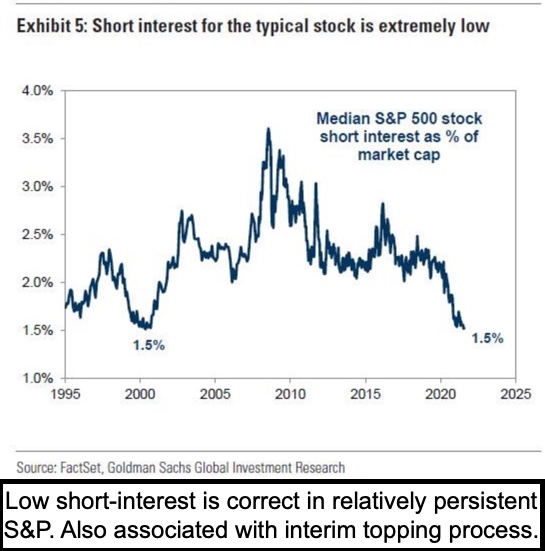

Suspended elevation of the S&P may be in-absence of any alternatives to do so, given what pretty much would be a 'snapping' of the short-term uptrend if that's broken. Not at all to say it won't be penetrated, just thinking managers do know what they got into by chasing strength well after our March 2020 low.

In-essence they can either continue supporting the heavy-lifting stocks, bring back Oil & Banks periodically to reinforce stability, trying to 'hold the line'. Of course that's already gone on, and as I've said it can longer than bears mostly would be able to hold-out (no limit to what you can lose with shorts, hence if a trader has to do it, at least with Puts there's a limit to what a trader will lose as most expire worthless, though I often noted 'option writers' have made money in these markets). Even the 'writers' better be careful as Fall volatility looms.

Executive summary:

- S&P continues holding traction, 'as if' it know what the alternative is.

- Pfizer (PFE) VAX got full FDA approval, which is sort of a joke considering that over 165 million Americans and millions abroad served as 'trial subjects' essentially, however given not much alternative, let's hope all will be fine.

- Moderna (MRNA) requires more science before it's approved (but it too had been tested now in millions who took it during the EUA and urged to do so).

- Sorrento (SRNE) has developed a 2nd generation vaccine which is yet to be in a 'trial', and it's hard to say how long a process that will be, however given it's also an mRna design, and lots is not known, perhaps it's expedited.

- Perhaps the market will grasp Sorrento being the major manufacturer of DYAI’s New generation, safer universal and affordable candidate, shown to elicit an extremely strong response to ALL known variants, and even to future mutations as it impact a common factor between all COVID strains.

- The total market for just mRna vaccines 'so far' has eclipsed revenues of a couple household name pharmaceutical companies, so that one of the reasons why Sorrento's effort is so important 'if' it's successful.

- Not to dwell on Sorrento, but today they were granted a 'trademark' for 'Covi-Mobile' from the U.S. Patent & Trademark Office, this is not FDA approval of Covi-Stix or anything else specially, but it is further evidence they're getting their ducks lined-up for marketing a 'package of solutions, for COVID 'testing, diagnostics and treatment' (one-stop medical shop?).

- Sorrento also announced impressive results for a rheumatoid arthritis drug, but it was just one patient so far, potentially huge market though.

- Danger 'of something wrong' in Kabul was demonstrated by a firefight at the airport, two Afghan guards were killed by terrorists (maybe Taliban of course), and Germans opened fire, then Americans reinforced them and finished-off the attackers, details are squelched as it doesn't fit models.

- Last week I noted the 3rd (and largest) shipping port closure in China, now the bottlenecks have thrust container shipping rates even higher, it can get worse for various reasons.

- One reason I suspect China restrains itself in the South China Sea might be fear of disrupting international shipping, and thus shooting itself in the foot if there was an insurance 'force majeure' imposed as a result, after all the largest beneficiary of global trade flowing smoothly is .. China.

- Aside that of course China is an expansionist power, and the U.S. really is the 'essential' Nation for the Western World, hobbled by the fiasco way the Afghan exit was executed, and way beyond Biden's 'legacy'.

- Stagflation continues, and more analysts are finally grasping that, so far has not impacted markets negatively, but stay tuned for Jackson Hole.

- We know the headwinds that exist technically, and the degree of gains attributable to momentum stocks and a handful of drug stocks, with Oils and Banks back in-gear at least today.

- Vulnerabilities to 'surprises' also are increasing, and that can relate to a Fed taper move despite ramifications, to another attack on our personnel in Afghanistan, or even (if push came to shove) the Army having to shoot its way out of Kabul airport at month's end (unlikely as Taliban wants a degree of legitimacy, and we are naive if granting it by the way).

- We aren't fighting the Fed or the tape, we are fighting complacency and for the first time since the 1970's we might say fighting incompetency.

- For sure the more-competent types made lots of policy errors made over the years, but usually supposedly had a handle on what's going on.

- There might be part of Kabul we don't know: a reason why years of Visa requests were deflected, a reason why Bagram closed before civilians of course were evacuated, and as I suspect 'lithium' more than opium right at the heart of the 'dealing'.

- Was there a quid-pro-quo, maybe, but we don't know yet.

- Chinese stocks are doing better but so far it's a bounce, nevertheless it may be that China slapped tech-wrists, installs more commies on boards of companies, but basically cares about businesses, not the executives, and that may actually find a balance the Communist Capitalist Party can live with (new definition of mine for the CCP, the commie capitalists).

In-sum:

The Fed has a puzzle they've created, and the emergency liquidity that in mid-March of 2020 was my basis of knowing we were going to have a bottom (and then did, proclaiming S&P would never be lower...full stop).

However they can't do this forever and really need to wean the nation off this kind of stimulus, with a bond market absurdly high. They might be setting-up a crash if they're not careful, and they do know that. Hence it's not just whether Chairman Powell wants to behave like Arthur Burns or Paul Volcker, but really once they taper and the market breaks, do they realize they'll have to reverse the tape to cushion the break?

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more