Market Briefing For Thursday, Oct. 7

A current 'blackout period' exists where vulnerability for S&P is retained, pending companies being past the quiet period in which they can't speak to at least most prospects. That doesn't mean we have to 'fold', but it leaves stocks more sensitive to the nuances surrounding the Washington chaos, or energy issues in Europe and here (where Oil price fuels the inflation debate), that we might see otherwise, or once we get forward guidance from the big leaders.

The so-called 'soothing' remarks about Natural Gas coming from Putin, clearly resonated with my thoughts about Putin and Russia this week, high prices but available as he becomes 'benevolent' with supply, but at a price. Nonsense is all I have to say about the 'supply' of Natural Gas (UNG), there's no shortage.

Executive summary:

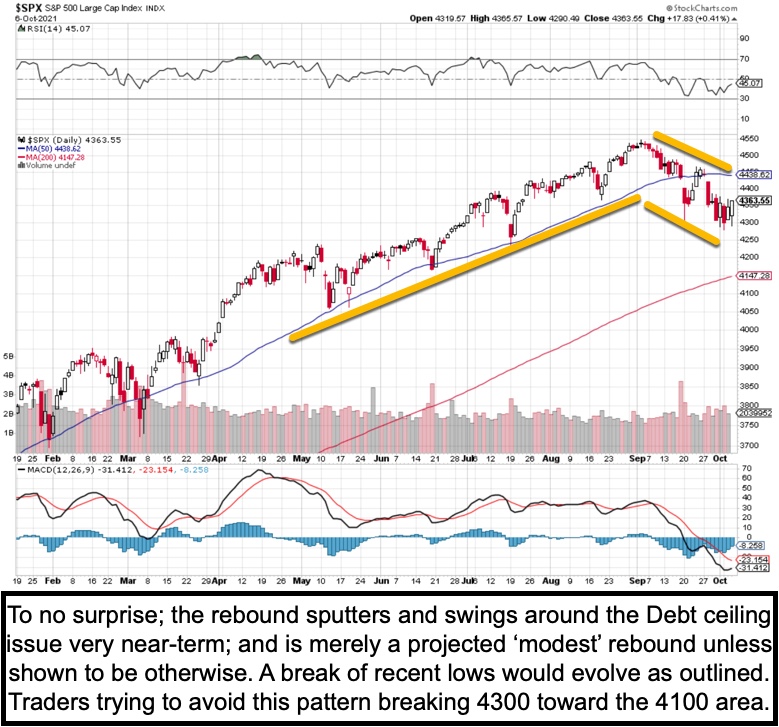

- S&P's projected rebound from the vicinity of twin recent lows, became for sure essential to hold any hope for stability and earlier (contrarian upside) prospects, given money managers know risks of algo-driven lower-lows.

- While generally sensitive to fundamental / fiscal developments more so than technical considerations, the S&P is carefully focused on action with commodities (even iron ore bounced back after recent plunges), and hard to compute the relationship with broader prospects (SPY).

- For the moment S&P resistance remains around 4400, and similar initial support around the prior lows of 4300 +/-, with no change of our measure of 4100, or even 3800 'if' an actual Default were to occur (unlikely).

- While approaches to initial (hourly basis really) supports were actually today, the session recovered lots, to be more sort of a consolidation after the modest bounce yesterday, hence it's indecisive from any big macro perspective, aside being a normally heavy or rough seasonal time,

- If not for the continuance of relatively low interest rates (mortgages said to be tougher to get as lenders realize rates will be higher fairly soon), the housing market would be under more pressure, so far it's fairly normal as interest in family homes almost always wanes once school years starts.

- JP Morgan's analyst comment about Oil able to go to 150/bbl is simply ludicrous in an economic sense, and JPM says it wouldn't be troubling to the stock market (hardly!).

- Needless to say I think if that's the case the Fed needs to 'taper' faster vs. all the speculation about that, and no way will a super-high Oil price be a bullish factor, absolute nonsense perhaps to hold clients, or they're wrong simply-put, my point being high Oil as I called for was 'bullish to a point'.

- Also the 'energy crisis' in Europe (not just China) is somewhat artificial, as Putin's Russian 'benevolence' (willingness to provide what's needed, but at extremely advanced price levels, there is no real Natural Gas shortage.

- France & the U.K. continuing 'fishing rights' dispute has related to cross-channel energy transfer (hence insane coal price rise, not just Oil & Gas).

- All this plays into Putin's hands just as I commented months ago, Russia trying to get more 'sway' over how Europe (especially Germany) views it, and that is why selling 'our' LNG to Germany was indeed the way to go (LNG).

- Domestically, I don't believe it's wise for President Biden to open the U.S. Strategic Oil Reserves, since there's no real supply shortage, just ease a few restrictions (they won't reinstate the pipeline) and wait for 'shale fields' to perk-up as the price now is high enough to make them viable again.

- As to what investors can do to combat inflation, the answer usually is real estate and Oil stocks, however both areas are extended, inflation (or any ease of that) will depend on COVID too, but for now we have 'stagflation', which was my expectation for several months, even as earnings outlooks will like have a mixed character when they start emerging, it's evolving.

- The Dollar meanwhile remains our preference, but I know the dynamics of this impact commodities, foreign trade, and as U.S. goods get pricier, this also implies the Fed will likely take some liquidity out of the market (USD).

- Crude Oil has probably been our most important call for 2021, aside the 'distribution under-cover of a strong S&P and NDX', and WTI Oil will likely remain firm, even consolidating a bit if Pres. Biden does open 'reserves' (BNO).

- Oil is unlikely to explode to $130 / bbl as JP Morgan suggested today, besides being nuts (unless there was war), we would be cynical at this point and ponder who owns or leases the largest offshore Oil storage tankers, still moored in the Gulf of Mexico (Goldman has involvement).

- There's no logical realistic reason for extreme Oil pricing unless the U.S. suddenly is going to supply Oil & LNG to the U.K. or Europe aggressively and as much as some would welcome that the price level would be very destabilizing, and probably 'as it is' risks social disruption in the EU now.

- Speaking of, all this validates one aspect of my defensiveness this year, which was that 'inflation would NOT likely be 'transitory', but enduring' in most key areas where wages come into play, Oil was bullish for growth and a good sign 'to a point', but beyond this seems to be crazy or just a way to get investors to chase the higher ends of energy trends in-force.

- Incidentally that doesn't mean 2022 will be a poor year for growth stocks, a lot will depend on the U.S. / China relationship (virtual summit coming between Biden & Xi, and they need that), on comfort living with COVID or affordable mass testing, and we will tend to focus on tech stocks after the overdue projected rollovers, as it made plenty of sense for big-cap drops.

- One final note: now the 'Havana Syndrome' has surfaced at the White House and today we heard about the Pentagon, this hasn't been taken as a serious enough threat yet, and it is (whether Russian or not), why it's so difficult to isolate nobody yet knows, it's sort of like 'directed energy' used as crowd control during the Iraqi campaign, inexplicable why unknown.

In-sum:

Once again the market is mired in a 'process', which is evolving very close to our outline patterns, with limited upside potential (if there's a fast Debt Ceiling deal even for the very short term), and lots of risk if S&P breaks 4300, and then moves on down toward the next measured level of 4100, with 3800 in the distance, and to which it doesn't have to reach 'if' things go well. So far they are not going particularly well, and indeed this is October after all.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more

Thee concept of "transitory Inflation" is aLIE from the begining. It does not ever stop, it only slows for a while, and inflation never ever backs off. Gasoline prices did drop quite a bit a while back, but the rise was not due to inflation, but rather to speculation, no action by the federal reserve that time.

And if the actual mechanism of that "Hananna Sydrom" were ever disclosed t would become a tool for so many bad actors that it would be a serious problem for all. So the best we can hope for is unexplained explosions terminating it's occurrance. Which is probably OK by me.