Market Briefing For Thursday, March 3

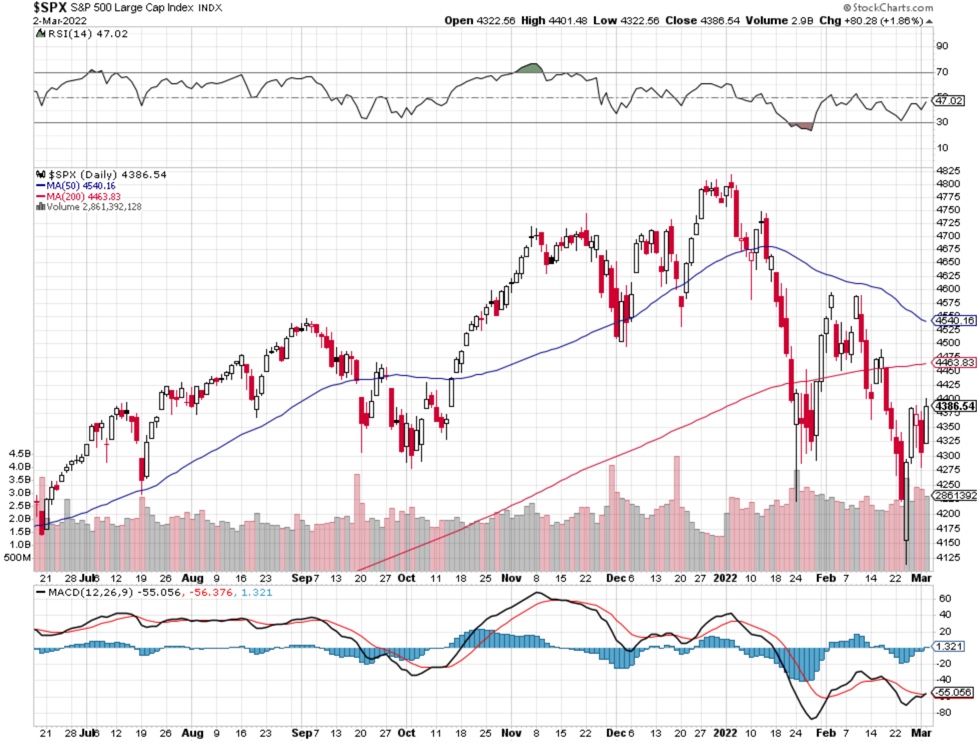

Stocks staged a rally after the SOTU Address, which we thought likely. For that matter I was inclined to do a little nibbling virtually at the prior day's lows.

Now we have most analysts crediting the Fed for 'calming' the market today, which actually isn't what happened, other than getting off negative real rates is a laudable goal, but easier said than done in this inflationary phase.

Encouraging people to spend is a little ridiculous, supplies are limited and you won't get an economic cooling by bolstering spending here, although clearly I get where a Fed believes they can hike rates and avoid a recession by having that combination which is not historically how such things evolve.

So sure, it was a 'pick your poison' choice for Chairman Powell, since history suggests there's no easy solution. However I still opt for post-COVID / post-war prosperity, although that's not necessarily coming with the kind of dynamics or simple formula as outlined by the Chairman, and not even intelligently noted in the President's remarks, as he talked about more 'lowering costs', which is not really possible in the short-term, but the Nation's long-term goal for sure.

The high prices in commodities and even Oil can see slippage (and must for that matter), but not immediately. And that's why I objected repeatedly to most analysts and pundits calling for people to sell Oil or Oil stocks, believing (if we think about it for well over a year now) that it was the best sector to be 'in'.

And if you want the super-bullish alternative right now: the Fed does little and Putin capitulates, not Ukraine. We too can have our own laundry 'wish' list.

Incredibly little changed today as far as strategic aspects in Ukraine, although the human suffering persisted. Behind the scenes more oligarchs turn against Putin's war policy, and recognize he made an enormous miscalculation doing this to their near-breathren in Ukraine. I've suspected the avoidance of Russia occupying Ukraine meant he would try to retain the border areas and Crimea of course, and it may come to that. But it's premature to conclude anything. I think evidence of captured (or surrendered) young Russian soldiers, clueless it seems about what the objective is (everyone is, including generals I'll bet), calling home on borrowed cellphones is a sign that helps awaken Russians to what is being done in their name that they don't even want.

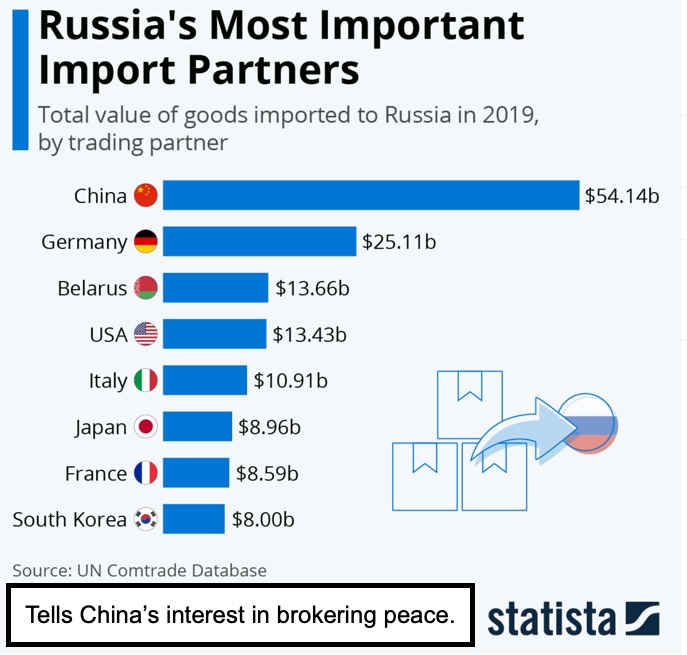

Negotiations loom we suspect, and China is behind pushing for that. While of course China may talk about aspirations of a separate financial system, they are smart and know its not the time for anything like that now. Plus they trade with all the parties in this conflict, plus the entire Western World, so there's a self-interest in calming Russia down.

I really should say calming Putin down, as almost from the start, it was clear a lack of support 'within' his own hierarchy existed, no enthusiasm for a flat-out war. Plus how they likely scammed money from defense procurement's came to the fore, as nobody can understand how their equipment is so mediocre on the ground. (That's a contrast to the high-end aircraft, which are top-notch for most purposes -unfortunately- as are their intermediate missiles, which seem 'too' accurate). Let's hope we never get to evaluate long-range effectiveness.

I'll not say much about the laundry list in last night's SOTU, as everyone has their view and heard it. Strong about a US standing with (but not fighting in) Ukraine, and pointing out regional realities at the same time any failings (like the exit from Afghanistan) were ignored. The idea of opening up the pipeline or new drilling wasn't even mentioned.

And an interesting protest from Elon Musk, believing not mentioning the truly pioneering or major EV role of Tesla (TSLA), is being viewed as a personal slight. As to Ukraine parts, I do think Biden might have given Putin a hint of an off-ramp for face-saving in the speech, but that may be implied, intentionally avoided, or something to withhold for negotiations as this unfolds.

The prospect of a soft-landing for the non-acknowledged recession, chatter of negotiations regarding Ukraine, or even the Ford double-down on EV's and a split of operations.. regardless of reason (even the President's speech but not much in it that made sense for a market rally), we get the market's advance.

I'd think it's the squeezed Russian oligarchs that might come into play, in any event I thought the market was likely to get a rebound post State of the Union, and sure we got that. Also it was fairly broad, although most small caps didn't change. I was not displeased with Powell's comments, which sort of took the anxiety as relates to current Fed meeting off the table a bit.

Also that doesn't means inflation is off the table as a risk, by any means. And the flow-through of higher Oil may take some time to pass-through into prices. A bit may depend on whether Ukraine gets solved (without total devastation, a strategy that is unclear although Russia has pummeled some areas) or slowly deteriorates into a quagmire, which is sort of what we had in Iraq (although by no means is a comparison a fair one politically, since Russia basically struck in some views 'itself', whereas Putin tried to make it seem more like civil war).

So I'm not shocked at this rally, expected it (hence yesterday's light buying for the most part in options in-case it didn't workout), but won't express duration's confidence. What I suspect is traders again took the S&P back from the edge, really of an abyss, when you consider the 'vacuum' that underlies this market.

And if they want to characterize it as taking Fed Funds (theoretically) perhaps up to a 2.5-3% rate by the middle of next year that's fine. Or 2-2.5% this year which seems like the level Jerome Powell views as generally neutral territory. That works, and seemed to work to the S&P today. Whether it can become an important 'launching pad' for the market is yet to be determined, and probably hinges more on Oil (spiking and retreating 'if' we don't get to the feared level of what I talked of last night, 'demand destruction') and peace than the Fed.

Consolidation and grinding higher prices unless war news prevents that.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more