Market Briefing For Thursday, June 2, 2022

Perceptions of 'pivots' - on big-cap markets, monetary policy, even politics.. sort of dominate the debate about what comes next. The reality might simply be not just the oft-seen June swoon, but a time of general apprehension. So much apprehension, that it borders a sequel time of unanimity of negativity.

The market is paying the price for being behind the curve last year and failing to act when (including my view) they had time then, and boxed themselves in. We all know the variables, some of which 'may' be moving toward resolution, but none have firmly done so, and even China, has mixed reopening statuses.

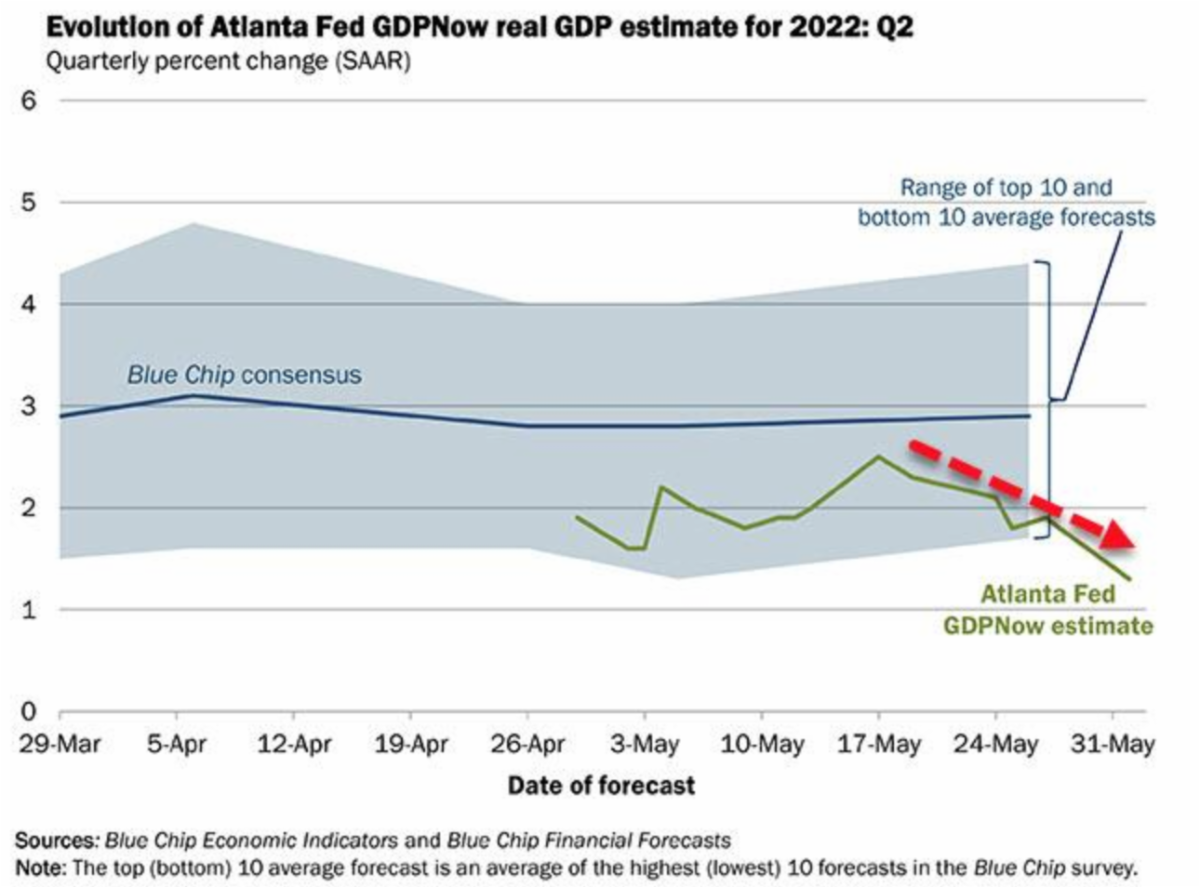

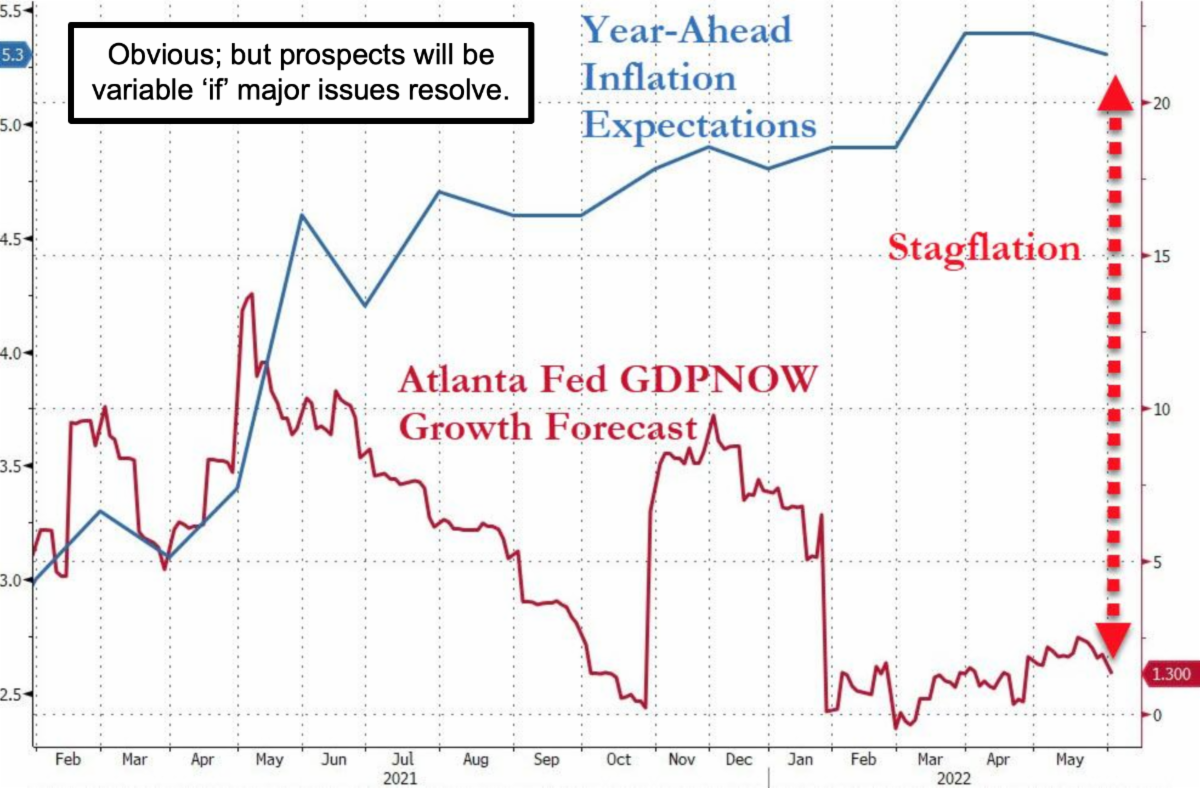

From a monetary standpoint, going into recession would likely be constructive as that would tame the Fed's restrictive zeal, so the political talk about having inflation drop while growth persists and the Fed takes a pause...well it's mere nonsense as it really can't work-out that way. We need inflation to stabilize but not decline, since the use of the word 'peaking' implies a rollover, which isn't a realistic expectation (whether wages, healthcare, and energy, changes will be minimal not maximal), given inflation normally advances in stair-step fashion.

Even JP Morgan came out and said 'Brace Yourself'. Meanwhile their analyst Lakos contrasted with Dimond, by saying we've adjusted to Fed tightening and is calling for S&P 4900 (which we don't see in any near-term time projection, sure in our lifetime perhaps that and higher but not at the moment). So right now it's probably difficult to be an analyst at JP Morgan and debate the boss, but that's essentially what they're doing. Or not. IF Dimond is right about the 'hurricane' not just storm clouds, then the Fed will back-off, that isn't noted in the discussions. Also today is the first day of 'hurricane season' incidentally (JPM).

If inflation and high National debt are indeed a match made in hell (they are), it is the Fed's love affair with printing money (creating debt) fueling spending and not sparking sustainable economic growth the way they've done it. Here I am speaking to the failure to allocate funds intelligently during the pandemic, at the same time they triggered a wage-price spiral, which war exacerbated of course. The discouragement of the U.S. Oil & Gas industry made it all worse.

I listened to Ed Bastian (CEO of Delta Airlines) talk about lower capacity, as well as lower fuel and ticket prices 'down the road', but staffing shortages are going to keep load-factors (and prices) relatively high. While Delta (and others of course) are happy to see higher fares (and rationalize staffing issues down to concern for passengers and fewer flight cancellations.. it's all related) ... the average family cannot afford to travel much with these kind of prices. Going to a discount bare-bones airline (which may actually rattle bones) like Spirit or a reviving Allegiant, is a bit tricky, low fares are 'bait' before extras kick-in, plus those airlines usually have no extra equipment if a flight is cancelled, and will not endorse a passenger over to a major (legacy) carrier whereas majors will (DAL).

I worry about the so-called neutral rate for Fed Funds. And I am somewhat of note concerned about Housing. I've called the top of Housing to be behind, as well as past the point for attractive investment by groups buying property with the intention of renting-out. (They're doing that but the rents are impossible so what looks like a good cash-on-cash return won't be over any longer time nor will most renters be able to sustain prices without doubling-up occupancy. It's a situation experienced for years in New York but incomes there are higher.)

Some assume inflationary environments aren't so problematic because wages also rise. That’s generally true, but the focus isn’t simply that incomes rise but rather the magnitude when compared to rising costs. In this current situation, costs of nearly everything are rising much faster than wages. Something must give, and we'd prefer it would be a break in prices due to peace of sobriety in Washington, but neither is at hand. Consumer spending for the bottom half or more of the Country cannot be maintained at the high level the Fed Beige (or Tan) Book contends, it simply won't happen if living-cost bell-curves persist.

Depending on one's degree of pessimism, the U.S. economy faces either: a) a serious challenge (already present) or b) devolves to a devastating calamity for which no acceptable answer exists, but of course would sort things out in a brutal way. Generally, the consensus not just that the country is suffering from an affordability crisis, but simply food and fuel which drive everything. So with soaring living costs as politically-and-war-driven energy costs having become the norm, 'normal' people don’t need much convincing something is wrong.

Lest this sound too bearish, consider that Shanghai is emerging from lengthy lock-downs right now, just small portions of life remain restricted. Opening up Chinese cities is one of the variables we'd like to have relieved and help more than just the supply-chains, even if it temporarily keeps Oil prices firm (rising demand in China). Next we need to see Ukraine's ports open one way or the other, and we wouldn't assume Kyiv has little leverage over Russia. Note the Oil to Hungary from Russia goes through Ukraine. If they lose that revenue to hurt Russia's Oil income, that matters to Moscow. Just one item that may well help push Putin to some sort of accommodation (mostly he wants to survive).

In-sum:

Even if most unknowns among the variables skew negative, including what happens next in Putin's war in Ukraine, you do have a market that for at least stocks outside of the less-than-a-dozen dominating 'grand dames', are in declines overall that seemingly don't measure far lower than already achieved (which means a bit of rotation and ultimately perhaps less focus on 'energy' to the benefit of 'tech', but again this might be some sort of mid-cycle shifting).

The Fed's 'inability' to control inflation (supply-push rather than demand-pull) in this situation, is something we've noted for months, and of course any push for peace in Europe would immediately reflect that change. We don't embrace the idea that the Administration actually wanted Oil prices high to push 'green' policies, or at least not this high. It's sort of like the Fed's 2% inflation goal, be careful what you wish for, as you might get more than you bargained for. But I do believe Washington misjudged how to handle the pipeline, oil leases and it was and remains important to buy Oil (including replenishing the raided SPR) from American producers, and not foreign sources that pocket US funds.

With the volatility we're seeing, there is little that's clarified, and that's about as it should be in the wake of the projected 2nd half of May relief rally. For the majority of smaller stocks, it's not fair weather, but neither new storm clouds. I realize the appetite for trading has vanished in this market, and that's possibly a positive in terms of frustration, disinterest, and often is pending a bottom. At the same time we look for trading lows (and got the last one), the macro story is largely dependent on progress in the several variables we've noted.

Construction initiatives to modernize building codes were proposed today and specifically in-response to climate change and stronger storms. While tardy by a few years, it's about time. This might be the focus for increased costs and/or retro-fitting of buildings and houses, almost reminiscent of San Francisco's big moves after the Loma Pietra earthquake. Perhaps recent storm destruction in states like Minnesota, that really don't experience tornadoes, got attention.

However, if there's anything to focus on near-term given dispersion of equities into variously-suppressed sectors for now (with exception of a few like Oils), it might be wise to note that QT starts to accelerate this month. The Fed might, depending on impact or events, limit the duration of Quantitative Tightening of course, but for now that amounts to further draining liquidity, so it matters.

Bottom-line:

as regards monetary policy, for too long the Federal Reserve was dead set on money creation (printing liquidity) to fuel spending to spark economic growth. Result: our nation’s debt grew at unprecedented levels.

We thought this irresponsibility would dilute every dollar, as the Fed clearly wanted to repay (or at least 'service') debt with depreciated Greenbacks. So despite the superficial inflation (which it contributes too beyond Oil's impact), or the higher Housing prices, that actually divides the societal demographics further. That in-turn leads to a lower standard of living that seems higher for a few segments of the population, who (as they're older) are likely debt-free.

At the same time there are no free-lunches, as the nation pays a price for old as well as new profligate spending by both the Fed and all sorts of politicians. Of course the risk is that the Fed 'now' has religion and overstays being tight, or tighter, since it's still actually an expansive strategy they're at pains to snug.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more