Market Briefing For Thursday, June 16, 2022

Liquidity deterioration tends to be an after-the-fact concern awakening lots of analysts, and correctly so. However, it's not new, and has been suspected as an issue for awhile now, as I attributed the wild S&P and bond swings in both directions, primarily as a result of limited funding availability, and some of the flight-capital factors from abroad.

Just this week I observed the situation in Italy (at least they have Draghi now, so there are few more qualified people who could handle the financial crisis), at the same time I've suspect the Dollar was going up (we're multiyear bulls on the Greenback) for a number of reasons as global conditions got chaotic, and then interest rates firmed in the USA, which propelled the Dollar more.

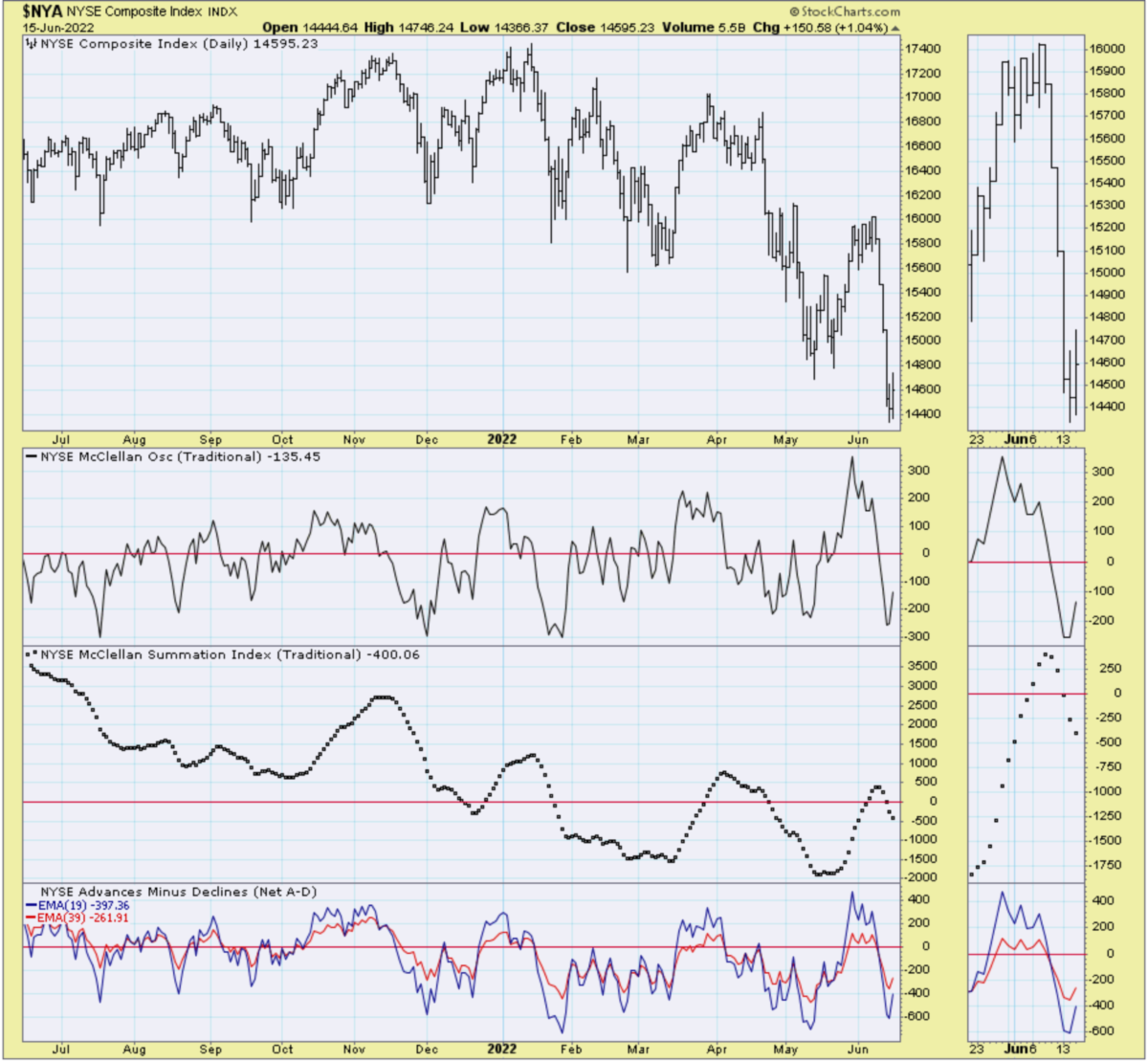

Today's rate hike was indeed the 'leaked' 75 basis points of the other day, so now the gap between were the Fed Funds were relative to the market. As you know I had thought the set-up was there to scamper the short-sellers and run the S&P (and NDX) higher again temporarily, while not out of the woods from an overall longer-term standpoint (SPY, QQQ).

In his 'news conference', Chairman Powell intimated another 75 basis points, although data dependent flexibility was mentioned too, as likely at the FOMC meeting next time. Credibility is still dubious, but Powell went a ways towards getting it back. I don't think they lost more credibility today as some do, rather his expression of data-dependency is logical. To give the market what some of course wanted, would also give the nation a deeper recession.

In-sum:

Nothing the Fed does blends headline with core inflation, which has been my view of the nonsense of 'core' (ex Food & Energy) CPI data etc. So profits will come down, guidance will remain conservative, things ailing stocks did not go away, but they could not fully do so based solely on Fed actions.

Yes, I suggested (including in the early comments) that if they hiked and S&P rallied in-response, it would then sell off, but move in the direction of the initial move, which would be up. In this case the market conformed to that, and just is starting to price-in recession fears, although I believe we're already well in it in a sense, and of course when (probably not 'if') it's official pronounced, we'll already be in the next equity uptrend of significance. That's in the future.

We were set-up for the kind of response we got, and again it's not merely just chart views, though they are handy to contemplate as they do have influence. But just because we can always create higher or lower measures doesn't for sure mean those are reached or exceeded, so in this case the temporary low was just below the ~3800 level but not quite to extended measures below it.

Those extended measures will loom after this relief move, which probably will see essentially a consolidation tomorrow, and then try to extend a bit more (or just the inverse hourly). Recession is 'not' better for the market, although you will always have some analysts who want to have a 'beautiful operation, even if the patient doesn't make it' (to use a medical analogy).

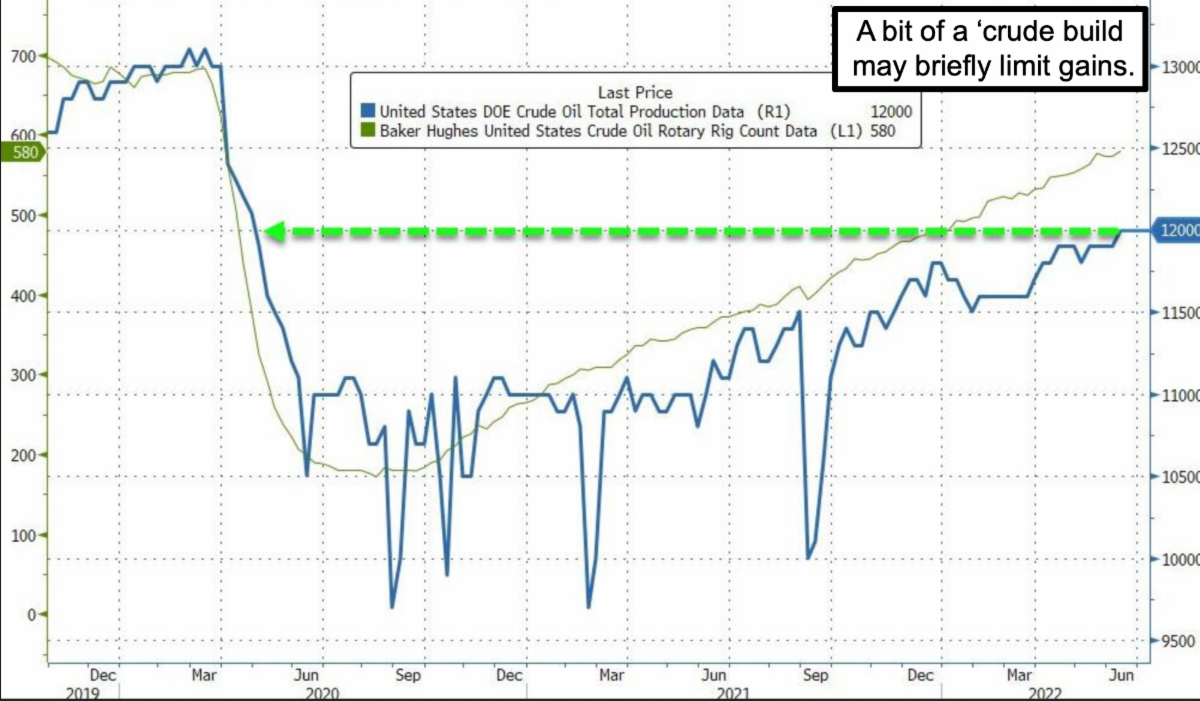

In this case it depends more on food supplies, Oil and Russia being defeated (or at least denied) in Ukraine, than on politically questionable efforts (stunts?) like trying to get more Oil from OPEC countries or even Russia, whereas both political parties spent decades helping the US achieve 'energy independence' (OIL).

So I'm sorry, but no way do I prefer sending hard-earning money for pricey Oil to any other country, much less officially discouraging domestic exploration or production. Want the stock market to see persistent higher levels? Be realistic with regard to Oil & Gas policies, not merely retreating from excess expansion and flip-flopping monetary policies.

Oil and the drought (which is only indirectly addressable in the political realm) essentially had price impacts that metastasized into every inflationary aspect of the Country, and largely had similar impacts on a global scale. One thing I would like to see is the Administration stop trying to pin inflation responsibility on 'big Oil' alone, just as they did on 'Putin alone', when it's a combination of a few influences, with Russia and suppression the pipeline and exploration sort of clearly looking like elephants in the room on that issue.

Increased global Oil production isn't going to cut it significantly, the war began with Oil already oh about 80/bbl (double our get in not out indication 2 years ago), and the issue has been politicized absurdly and is counterproductive because demonizing energy makes no sense. Even the SPR releases didn't make sense. Now let me add that we'll likely be looking at even higher Oil this Summer, with a big hurricane season just having started. However, if the war ends that changes the global picture, if not the domestic 'event' concerns.

Inflation is thus correct that inflation is deeper and will last long than thought in the halls of Washington. We have forewarned of tentacles of inflation going into every area for more than a year, the core of our 'they're behind the curve' argument for over a year. So sure they should have moved sooner. Yes it is correct Chairman Powell recognized the impact of food and war on this now, better late than never I suppose. However something might just blow up, and I mean financially not just militarily.

It's hard to speculate about 'what can break' or a 'systemic crisis', and just the way things look at the moment, the forthcoming 'black swan(s)' could likely be foreign more than domestic, and (as noted with Italy and my Japan comments the other day) may be telegraphed also by some of the recent Dollar strength.

I'd like to suggest after consolidating, we work higher in S&P and we may well do so. However everyone will gradually contract their optimism and recognize what's clearly evident (and was forecast) in both commercial and residential real estate, and a perception that gives property owners about overall wealth (for most folks who own their homes outright or have low-interest mortgages, it is less relevant). That's because unless downsizing the impact is of minor consideration, since we all have to live somewhere, so Dollars get swapped, and the tax and other considerations usually don't make such trades wise.

In this regard of course renters are impacted more, and you might have some uptick in foreclosures over time, which can also become somewhat of a risk in terms of systemic issues, but hopefully not that rough. Again, will the Fed get a softish landing out of this? Perhaps not. However that's their goal and stock markets are giving them the benefit of the doubt for the moment, stay tuned. I am concerned that along the way there's an 'event' that rocks markets, and of course then the Fed would likely 'pivot' back to an expansive policy.

Bottom-line:

Almost 'all' sectors lost their luster on recent days, and that set-up the potential we noted for another 'relief' rally if the Fed 'went big'. It is clearly reminiscent of last time, at least in terms of the kickoff action.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more

If you like my work; since we captured the upside and downside; please visit www.ingerletter.com and join our Daily Briefing. If you mention TalkMarkets in feedback to me; I'll rebate half the first Quarter's subscription; that offer is for this weekend only... call it a 'Juneteenth special' :).