Thursday, January 27, 2022 3:12 AM EST

Investment narratives are not exactly like Shakespeare plays, though of course a 'to be or not to be' nature of whether love will be provided markets in the presence of a stricter parent (the Fed), is very much a story in-process.

Unsplash

|

Unrequited love can be problematic in the market, as people are increasingly afraid to get involved, as 'don't fight the Fed' (the purported parent) prevails. I hasten to remind everyone of that, as during the Q&A with Chairman Powell, he said basically the Fed will hike rates at every meeting starting with March.

|

|

|

Formally the Fed 'did' nothing, avoiding mentioning Balance Sheets. However they emphasized maintenance by using the means of the Funds rate to adjust Fed policy to the economy. And... to my point about 'hiking at every meeting': I doubt that's feasible as the stock market is not being ignored (despite plaudits claiming all they watch is the economy), and would be dramatically lower with calls to reinstate a 'Fed Put' before such a sequence of rate-hikes gets far. If the market miraculously didn't plunge, then JP Morgan's view of having 5 or 6 or more hikes (if only the economy in their dreams was so firm).

More importantly, they emphasized using 'all their tools' to maintain economic strength, and they sort of relieved tension about their moves, for the moment. I don't think they're taking the route that would build more confidence (that's a move sooner and get it done), while not moving suggests they know 'more' to worry about than is discussed in its statement.

|

|

|

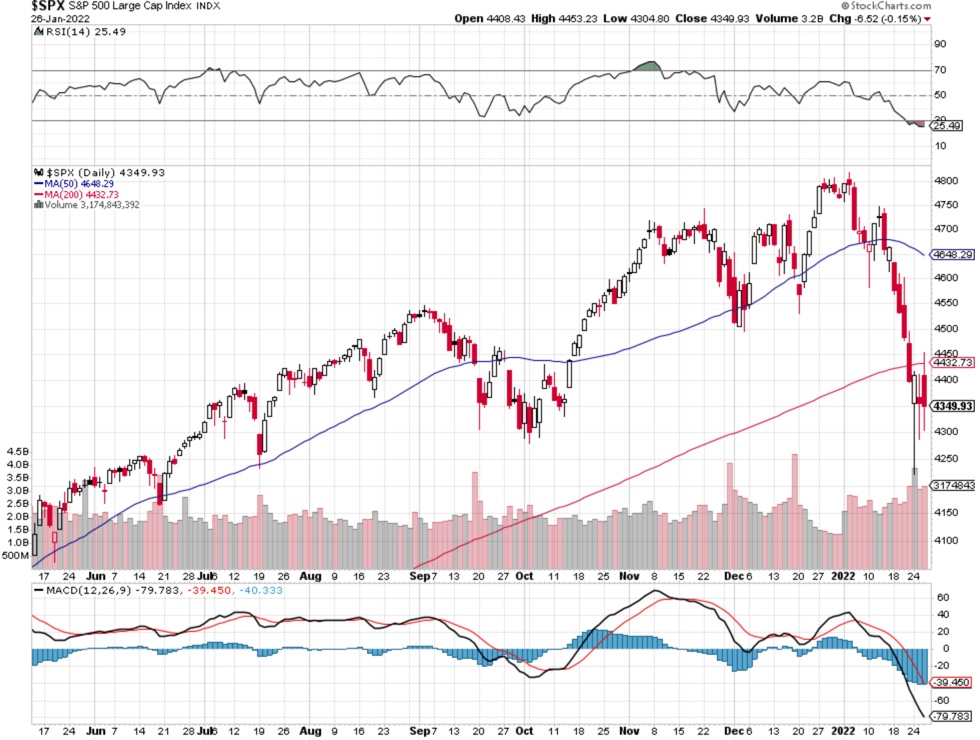

Top-of-mind for the market probably is 'balance sheet shrinkage', and using a limited interest rate policy alone doesn't compute really well. Need to lean on the Fed balance sheet to achieve what they want, though the lack of mention of the balance sheet is part of what helped the S&P respond favorably. Then the 'hike every meeting' comment squirreled the comeback and kaboom.

|

|

|

This was the more boring early 2022 Fed Meeting, with justification of their hawkish stance essential down-the-line. Hence the market was pleased initially, quite the opposite during the Q&A. The market reversed as soon as Chairman Powell talked about multiple hikes coming at every FOMC meeting, and that soured matters from the statement, which notably had not directly mentioned the balance sheet.

|

|

|

There was not much speculation about the 'balance sheet' being mentioned, or not, with the idea of the Fed getting one or two rate hikes under their belt in preparation for trimming the balance sheet, which happens to be their plan as far as we know. It's pretty clear this is not about the economy standing mostly on its own, this is about changing the liquidity paradigm as rapid inflation will not allow a particularly friendly Fed, although the Fed really can't stop inflation in the traditional way, not with wages and goods prices unique to this era.

The Fed also focused on 'guidance' from the path of the virus, acknowledging they don't know how COVID is going to go. Hence they left open most options, and are treading very carefully here, as frankly they should.

The press conference was problematic: inflation longer-lasting above goals, and the idea of 'more' rate increases. The market wanted Powell to be a good bit more dovish, or more likely greater clarity which Chairman Powell usually is pretty good at. So now will there be a 'clarification' coming from Powell?

|

|

|

Waves of the virus have contributed briskly to rising prices and inflation. They (the Fed) expect it to decline over the year, while we're not so confident about that, especially wages, and also the shortage of supply from China, which far more than us, is by no means finished with the virus (even as they pretend to be in better shape ahead of the Olympics).

The Fed planned to end high-levels of monetary support, with 'humility' and a recognition that outcomes cover a wider range and have to adjust responses as appropriate. Thank goodness he said so, although I expected nothing less.

Reducing the balance sheet occurs after the process of hiking rates begins, a plan he has also stated before. Price stability and maximum employment are their mandates, part of why I thought the 'goal of inflation' was more a mission to eventually repay Debt with depreciated greenbacks than anything.

|

|

|

The Chairman acknowledged 'it's not possible' to predict the exact path their policy must follow, hence two-sided risk analysis. Good! Led by data not their politics. The Fed believes 'both sides' of the mandate call for firming policy.

Powell mentioned the majority of the Committee believe doing so becomes an appropriate path. Especially if the Labor Market situation improves.

In-sum:

The Fed 'could' have shown more backbone and hiked today, but did not, and I think that's acceptable too. The reference to COVID impacting how well the economy does was realistic, and things are a bit subdued pending it resolving. Further improvements and reverting to tradition are tied to COVID.

|

|

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for

more

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more.

less

How did you like this article? Let us know so we can better customize your reading experience.