Market Briefing For Thursday, Aug. 4

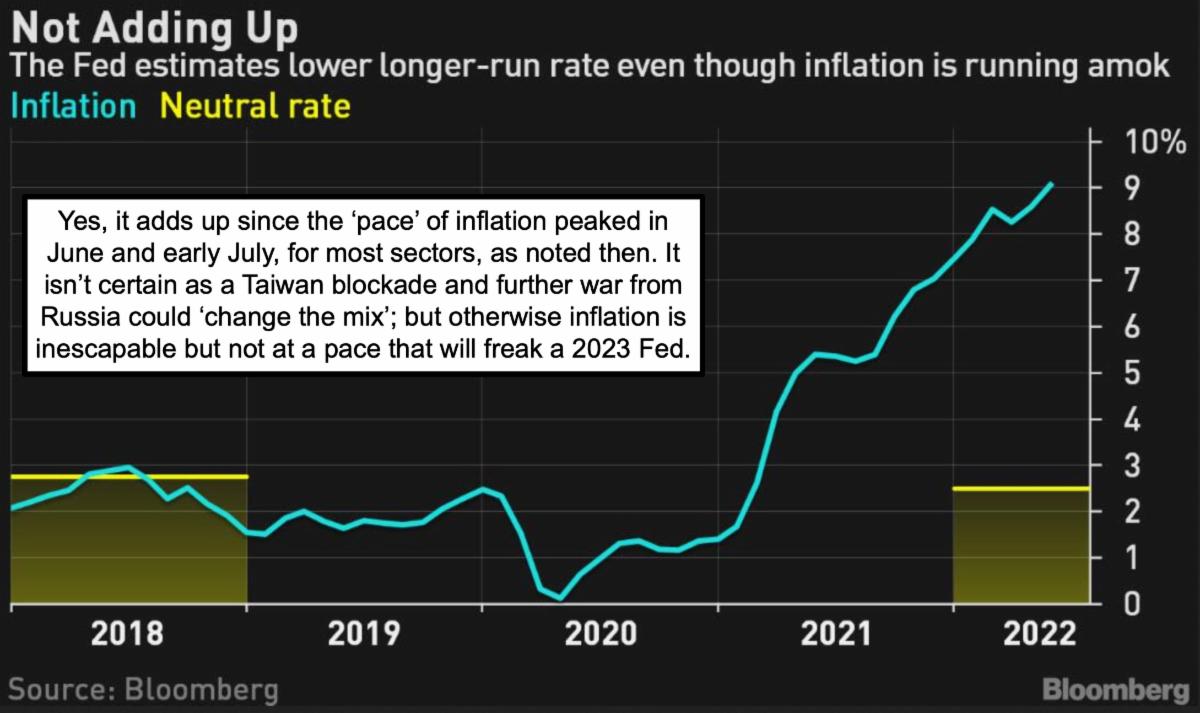

Fed fears falter probably because of the lag effect of rate moves vs. stock shuffles. So as the economy slows down because of pandemic-related funds and stimulus, is a different premise than blaming inflation solely on the Fed or for that matter Oil prices, although Oil has been more of an impact overall.

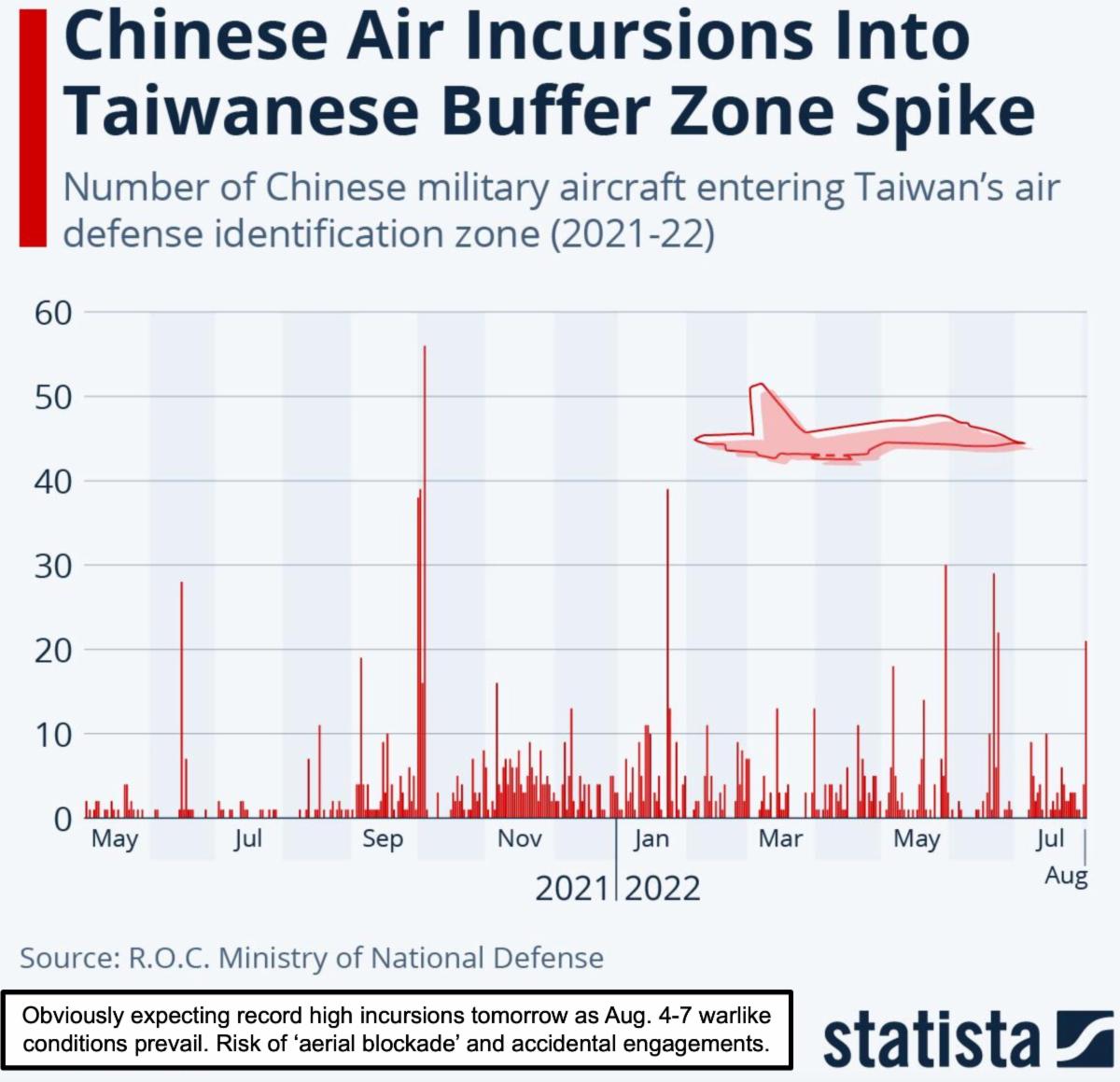

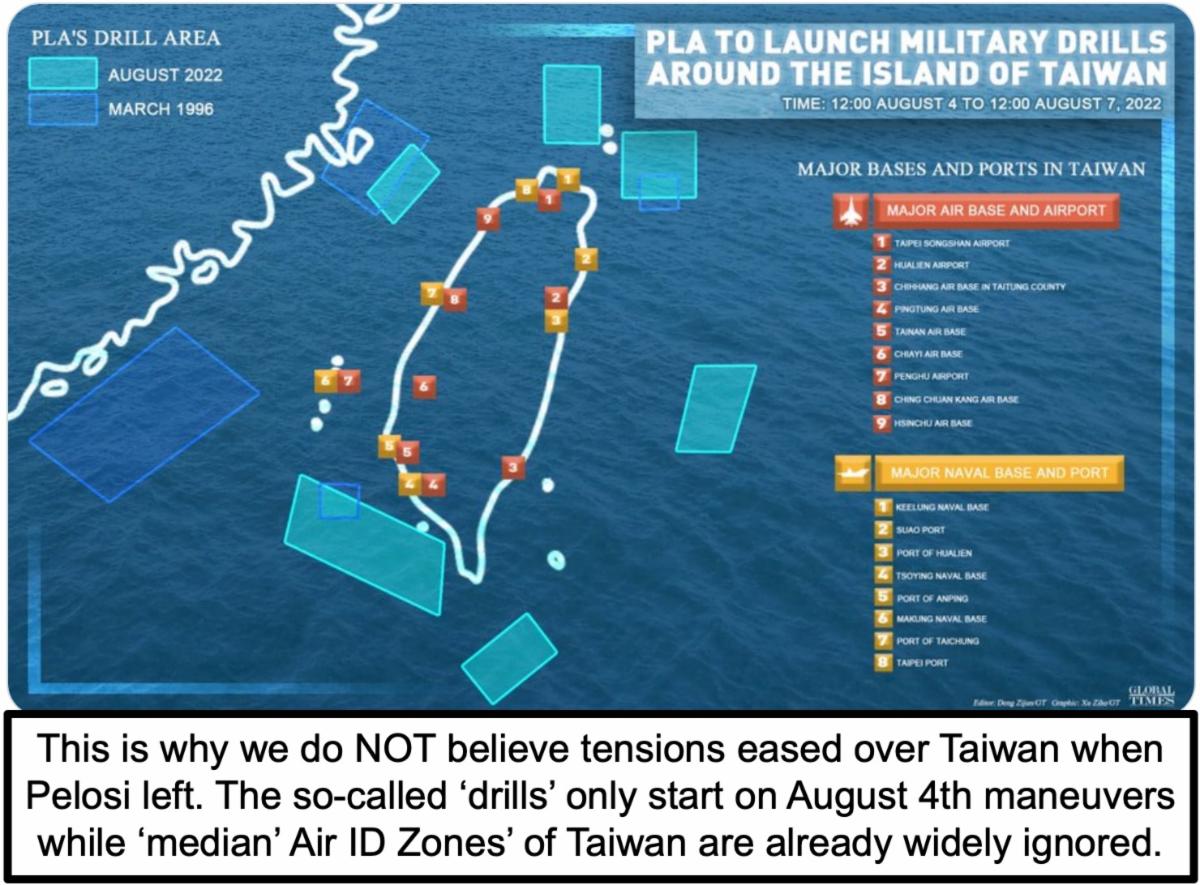

I don't envision the Fed doubling rates from here to equal the inflationary pace in-part because we don't need to have that with the 'pace' of inflation ebbing, although not to the extent the Fed would like to achieve. Much now depends on China too, and whether or not they actually impose supply-chain limitations by virtue of a 'blockade' of China and/or restricting shipments to us. But we're their key customer and they know they have hyped the Taiwan issue to their populace excessively, but there is the risk of trying to distract people with that rather than focusing on the economic revival post-pandemic. It's variable but a constructive stance has to envision avoidance of a hot war or trading conflict.

Nevertheless we'll likely see the debate continue, but S&P is pretty high now, as it achieves and/or surpasses our measured moves up from June's low. We have had literally a half dozen Fed-heads trotted-out to tell us how determined they are to fight inflation, and then today Neil Kashkari comes forth to tell us it is possible that inflation is....'transitory'.

That fabled word isn't correct either as much of the inflation is institutionalized at this point, especially as relates to 'wages' and firmer oil regardless of pause or dip from excessive price levels, pretty much as we outlined over months. If people are counting on 'deficit reduction' for reducing inflation, well don't hold one's breath, as that part of the Legislation wouldn't have impact for 5 years it seems, so that's political more than physical reality. We have inflation, just not at the pace it was a few months ago, pace having peaked as noted.

We're about to establish a higher trading range for S&P, while many technicians continue to call for legs down, and what we get is a leg higher. It is extended and can be vulnerable, especially to an encircling 'CCP' blockade.

This is worry-wall climbing and welcomed. I don't have much confidence in all the arguments of extreme downside as I've mentioned before, or too much on the upside, with the exception of domestic-centric stocks that don't require the supplies or marketing from or in China. Of course if China settles down, all the better. If China ratchets matters up, such as an air-and-sea 'trading blockade', well that's more bearish for the big multinationals or certain major techs than it is for the domestic players whose signs of life lately actually reflect just that.

Meanwhile Oil prices are soft partially based on low gasoline refining capacity as well as the economy 'in' China being crushed. But reports of slowing flows of Oil from Russia through the Caspian Sea pipeline, could firm Oil yet again.

OPEC+ added only 100 bbl/daily to forward production, and that argues for a rebound in Oil probably 'soon', based on chronic under-investment in new oil production, and much however depending on China coming back-up. China's need to export and not lose revenue from their major customer (us) is probably reason enough for President Xi not to follow-through on his own threats in Asia, that have the nationalist fervor in his country all perked-up, and that itself is risky.

A recession in Europe impacts oil demand, as it could in the US. But demand is not all that low, and can easily perk up again 'if' the Fed presumed flexibility can navigate / thread-the-needle to recovery without much more pressure. So many variables in the recession we believe ongoing (definitely in the EU, here too in a lighter sense), with geopolitical risk present regardless of economics.

The world needs more supplies of energy, and de-carbonizing the world sort of is impossible, but exporting rather than flaring Natural Gas (which USA has a surplus of) will help. Not much one can do about the bovine gas aspect ..or be vegan I guess.

Bottom-line:

Everyone seems to be concerned about the S&P extension, and with logical reasons incidentally. However it's merely elongated from our low in June, and fortunately we were anticipating upside, not meaningful declines like so many looked for (which is part of what helped the upside).

Now you have lots of anticipations for setbacks and then more upside, and in a sense there's gradually too much complacency about what is at this point an 'old' short-term rally. So we won't retreat from 'Dog Days of Summer' concern, at the same time I suspect 'if' we get a fading CPI number next week, odds of a lift on that would be feasible. But there again, everyone now recognizes that CPI prospect. What they don't recognize fully is that the Chinese Communists might not retreat from encircling Taiwan and causing problems and 'clash risk' (though they should as Pelosi asserted American policy better than her boss), and that makes the days just ahead dangerous (higher Oil rebounding too?).

More By This Author:

Market Briefing For Wednesday, Aug. 3

Market Briefing For Tuesday, Aug. 2

Market Briefing For Monday, Aug. 1

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe more