Market Briefing For Thursday, Aug. 19

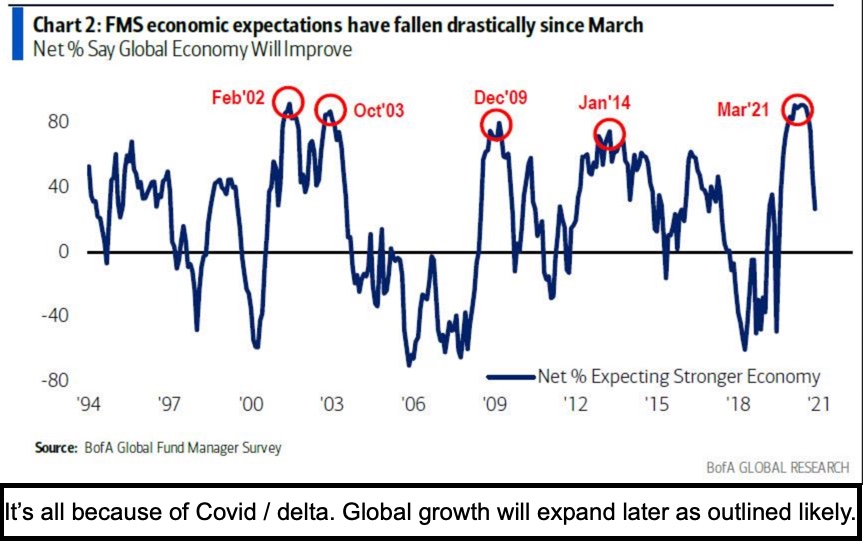

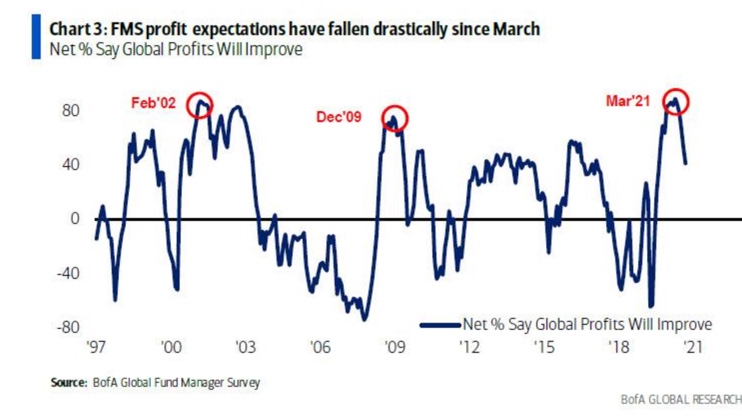

Paradox sort of describes the market's posturing at the moment. Whether it is going to be 'peak COVID' (unfortunately that's not very likely though we wish) immediately ahead, with rapid growth unfolding following a fast slide of 'delta', impacting nations (also unlikely), or not.

But regardless knowledge that after all this we envision a better time post-pandemic persists, helps, as it should.

In the short run the vision of a rosier future can be disarming, and there lies the risk, especially if the virus runs rampant again as the WuHan lab designed it too most likely. As for today, meanwhile, the Fed Minutes reflected what we already suspected, with some references to Repos and of course tapering. So we're going to see that but in no aggressive immediate way, while preparation of the backdrop persists. Soon we'll hear more from Jackson Hole, and aside that, it was a 'given' that the market would be defensive about now. And it is.

Technically, the S&P was hanging on a big-cap momentum darling bulge that was not the case for the rest of the market, and that hasn't changed but clear slippage is observed. I've been warning of a shakeout and even last weekend suggested this timing was a good week for failing rebound attempts, including defensive Tuesday and down-up-down Wednesday.

In the last minutes Wednesday, S&P essentially 'melted away', and it's really a past-due scenario. Yesterday I thought one shouldn't fade / short weakness on a Tuesday morning and that was correct given the strong late recovery. On Wednesday we had suspected no rally would gain traction, so no surprise. No admonition against fading either. More downside coming, Hail Mary's or not. And yes, Thursday will probably start down and be grabbed by managers with a desperate 'Hail Mary' recoil-rebound, so tread lightly if trading around that.

CDC Director Walensky said today: 'Examining numerous cohorts through the end of July and early August, three points are now very clear'. (Maybe more.) Anyway, she said: 'First, vaccine-induced protection against SARS-CoV-2 infection begins to decrease over time. Second, vaccine effectiveness against severe disease, hospitalization and death remains relatively high. And third, vaccine effectiveness is generally decreased against the delta variant.'

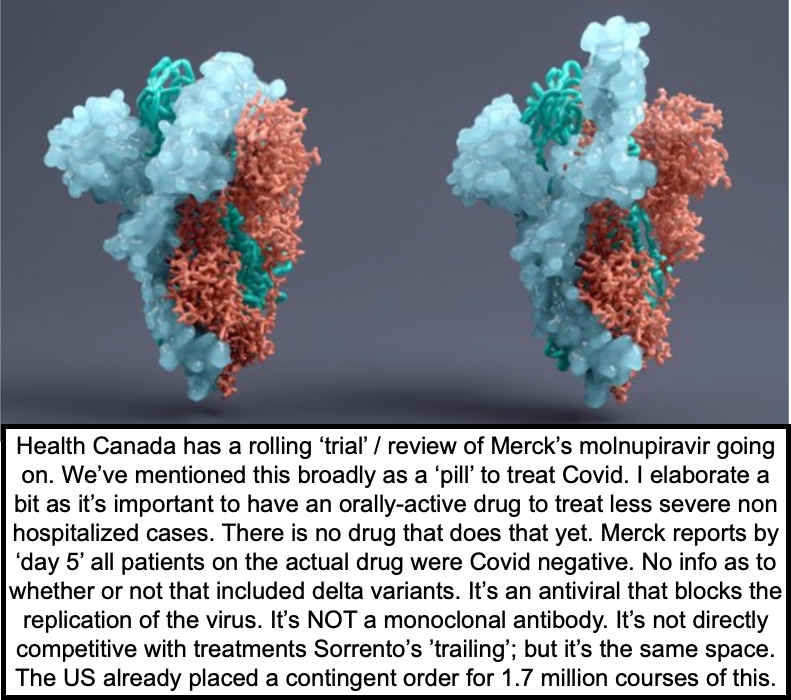

Well I think we all know all that. However the placing of the 3rd sentence has a slightly suspicious ring to it: meaning is the risk of hospitalization lower but not so much if infected with the delta variant? I don't think she meant to sort of prioritize it that way, or at least hope not. What I do hope for is antiviral and a few other treatments, particularly low dose monoclonal antibody cocktails. No words on that from CDC or FDA today.

One other thought about this: epidemics are not solely 'biological events', but relate to social, cultural and geopolitical conditions. So, while some like Israel or Taiwan, might see the rate of infection decline or nearly disappear, as they both experienced in the late spring, other countries may continue to be plagued by the virus, especially if vaccination took on political more than science overtones.

This whole year (and last as well) related to COVID in our view more than any other influence, like the Fed. In fact the Fed and other policies were controlled by the pace or retreat of COVID virtually at every turn. That's still the case now. Although so much money got concentrated into so few stocks that risk rose as I've outlined, and hence late day meltdowns like Wednesday's give clues with regard to what can happen if a quick trap-door opens and algo's kick-in.

In-sum:

Rising risk has persisted for weeks now. August is where most tricky markets get their start, although the charade of distribution under-cover of a strong S&P (SPY) and Nasdaq 100 (NDX) has prevailed for many months. As often discussed.

Recently I mentioned the 'Lambda' variant of COVID, of course hoping it does not spread in the USA, although I said it has been detected here in Florida. It seems that officials are denying that, so I will deny their denial, while praying they're correct. Not because it is supportive of what I said, but today, Israel's Director of Int'l. Health Relations, a Dr. Salmon, said he has reports of 'South American variant Lambda' having made its way to the United States.

Dr. Salmon said: if it came to Israel, “we will reach the lock-down that we so desperately want to avoid.” Certainly, and we want to avoid that here as well. What's disappointing while hearing all the clarion calls for booster shots and so on, not a word being said by CDC today. If Lambda spreads widely, and if it resists vaccines (we did our own updated search and find over 40 cases not cities that have encountered Lambda, including in Houston and Jacksonville), all the Fed and growth rationales in the world won't prevent an S&P dive and postponement of the preferred 'peak COVID' achievement presumptions. Just the opposite is what I'm hearing, hospitals jammed and influx worsening.

The world is in a storm, and I don't mean a hurricane of spin encircling some of the spin coming out of Washington to divert acknowledging how mediocre -if not totally uncoordinated- the final phases of Afghan pullout has been. And by the way mainstream media is sorely neglecting covering the housing crisis that exists with respect to how tens of thousands of refugees will be cared for, whether here or abroad.

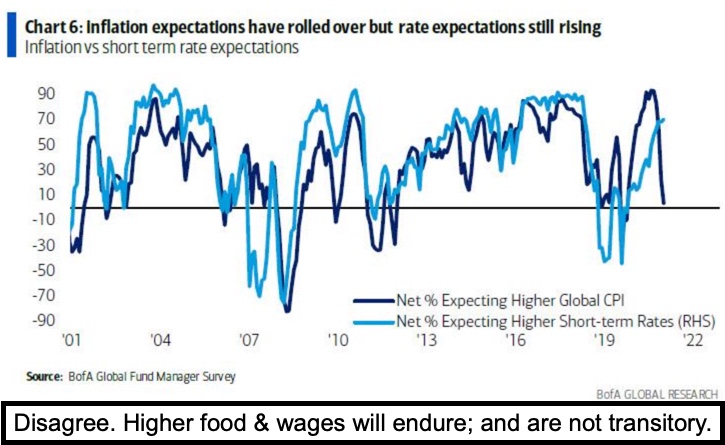

Assessing supply-chain interruptions because globally COVID / delta is again shutting down the world, the Fed is talking tapering, the world is 'possibly' destabilized a bit given the American pullout even though it was planned (it was the execution of departure that was inept / embarrassing and more), plus you have a specter of 'stagflation' we've outlined developing.

And the S&P fell out of bed late in the day. So we'll see if they can bounce it a bit, probably a false start bounce, then a lower low, then a 'Hail Mary' rally. It's just one pattern possibility for Thursday's pattern. Friday is August Expiration.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as charts and analyses. You can subscribe for more

Indeed the times are changing and it is not an improvement, and as each new version of this plague is released it is shownto be a very effective weapon indeed. What other explanation works for the different versions appearing in distantseparated regions? So it is a weapon that got out prematurely and now the testing is being done to seejust which version is most effective. Certainly not a sunshine announcement.