Market Briefing For Monday, Nov. 20th

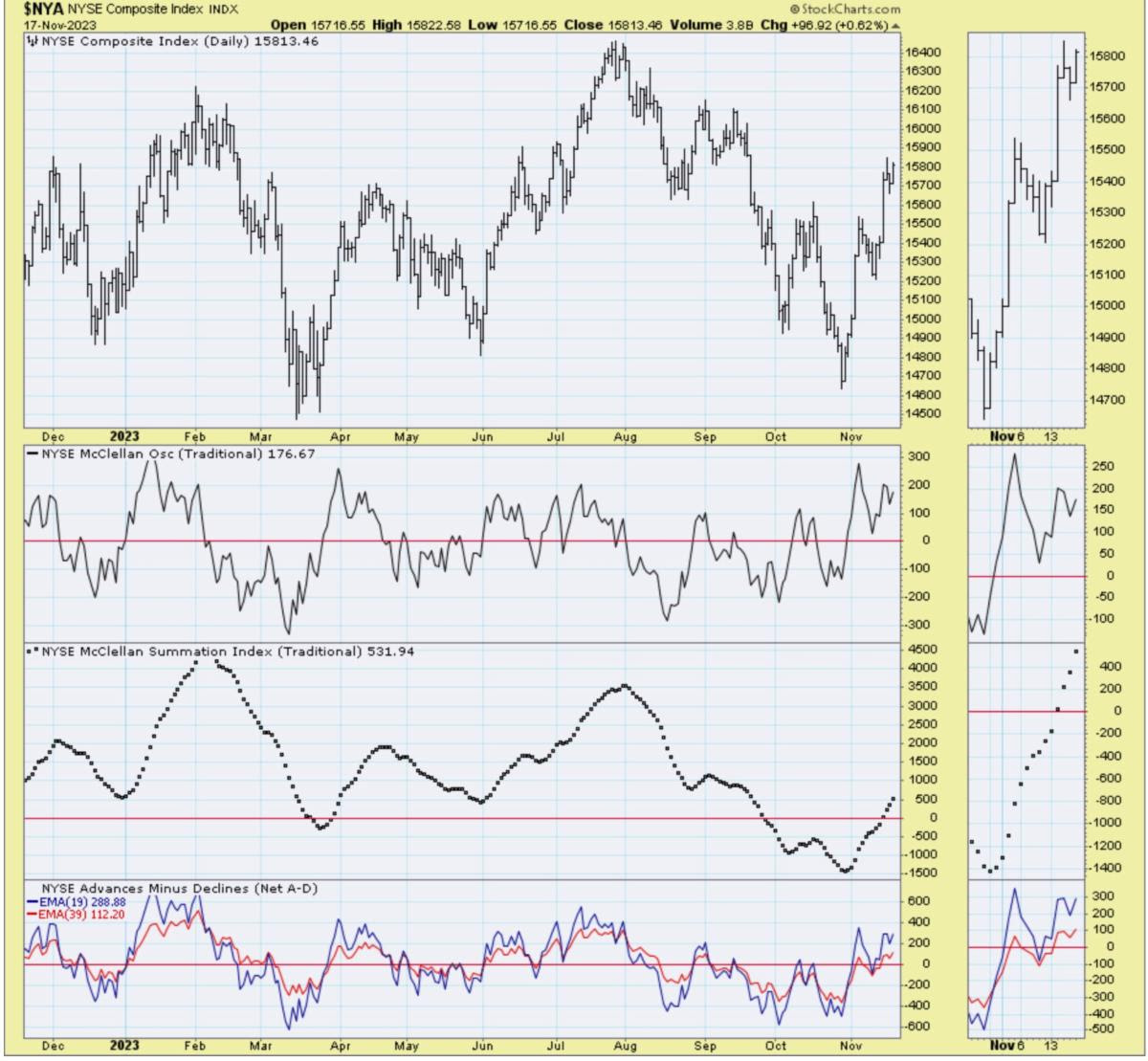

Late-year rejiggering is generally what's afoot; hence the S&P is very quiet, which is actually pretty constructive as far as nominal consolidation after what was a barn-burner of a rebound coming off our washout lows of late October.

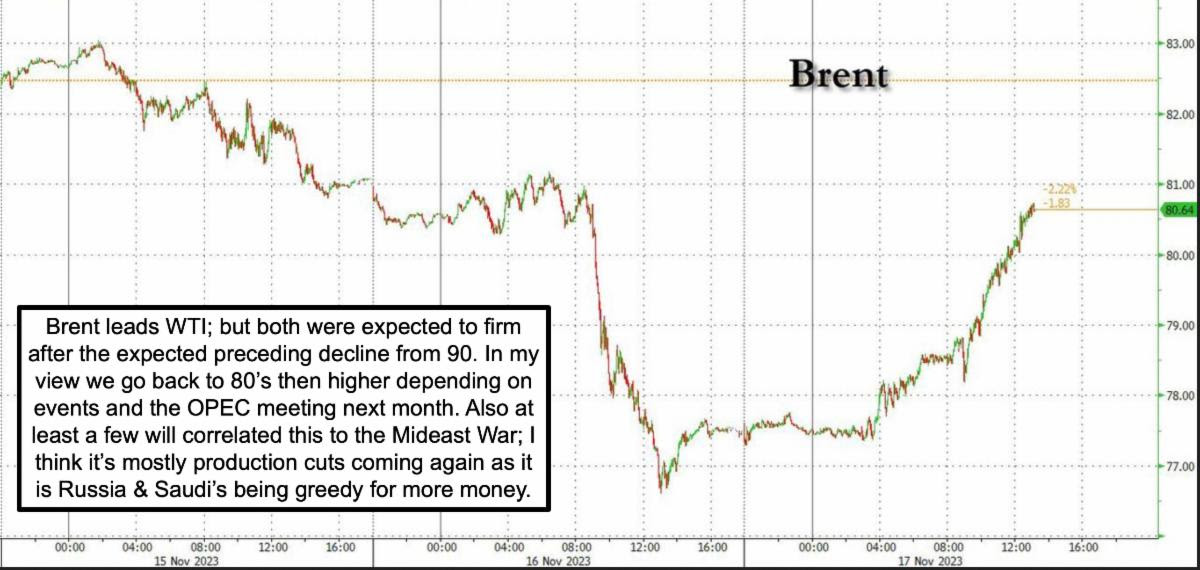

A few variables could hinder the market holding together; but so far so good. I am not bothered by interest rate, Oil or Dollar behavior for just now. That's liable to change; but barring drastic over-weekend news, not for the moment.

Whether the Israeli/Gaza war 'so far' is drawing toward victorious conclusion as far as near-term victory by Israel (and by inference surviving Palestinians if they can govern reasonably after Hamas is eviscerated) is key in one way.

That way is: it must not be prologue to what comes next. So far both Israel as well as United States (and France by extension in Lebanon) have absorbed a number of relatively minor series of (not trivial if you were in the area) attacks by Iranian proxies; or by Iran itself which is being somewhat squashed by the media. We mentioned the latest Houthi/Yemen drone attack on a US warship a couple days ago; and you hear almost nothing. So yes, retaliation could be in the wings; or not, and that's why there's a bit of trepidation.

Market X-ray - very satisfied with S&P consolidation after the big lunge higher earlier in the week. S&P 4400 resistance is now weekly support, while a zone around 4500 is trying to become hourly support for the moment.

This is a military weekend, so we pay attention to that; and notably little else has changed, plus there's no serious vitriol coming from Communist China yet. Also we got a low for Oil, and though it was a buy in the low 70's; and likely it was (so far anyway). I suspect Saudis want Oil higher (if not sooner then via the upcoming OPEC meeting next month).

The consumer has been resilient only in some ways; the market outside of the mega-caps was clobbered going into our projected S&P washout low; and I'm not going to call small-caps 'resilient' because they're generally lateral more or less in the vicinity of recent lows. However later in the Season may do better.

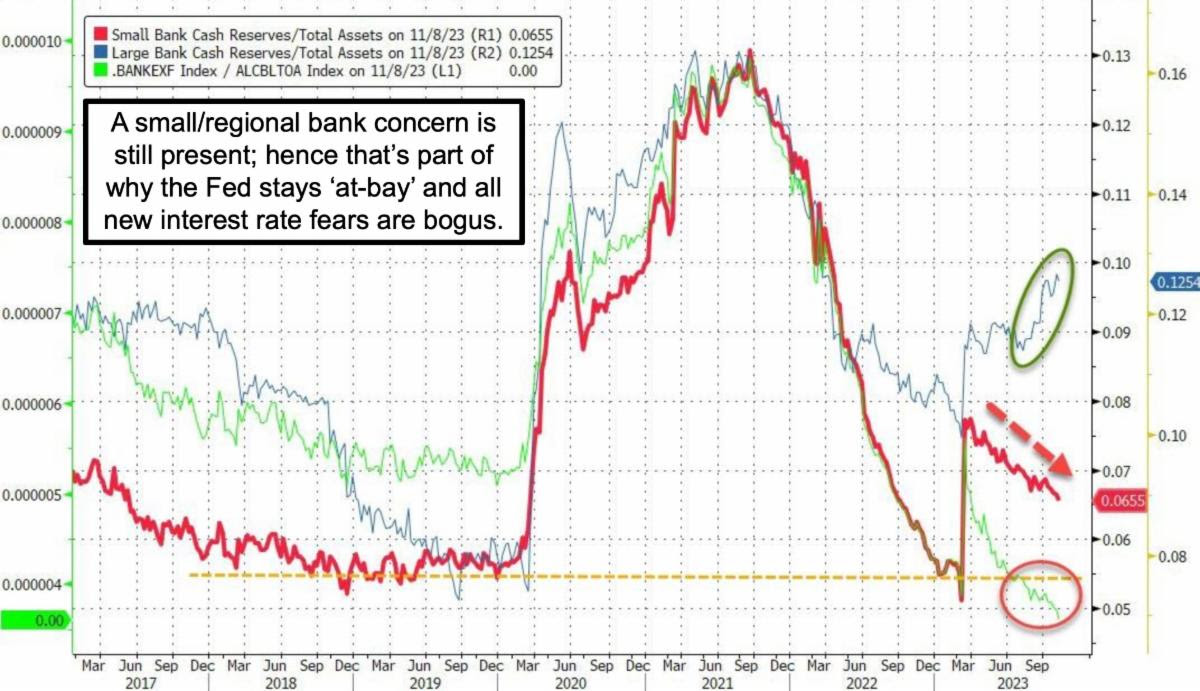

I'm aware of a few pundits and Fed-heads that keep talking of inflation or yet a need for more firming by the Fed. Balderdash. The market won't take that; at the same time hearing that keeps many bearish and that helps the upside just when there are thrusts that run-in short-sellers. What's notable about the past week or two is that even 'if' you viewed our rally as a short-squeeze, the action thereafter has been an excellent consolidation (so far); as a favorable sign.

We are absolutely open to this all part of an A-B-C rally off the trough October low; and a normal pullback would look similar to a decline or rally failure; so it is a matter of faith to remain optimistic through a forthcoming retreat if that is on the menu. And that may depend on the war progress (and non-expansion into a regional affair beyond what we've seen); as stocks otherwise should be holding together ahead of Thanksgiving. You have the pattern and seasonals.

The massive under-performance of small-caps is struggling to improve; but it still contends with seasonal tax pressures; so sideways is acceptable for now. It's not so much for the S&P, which needs to hold together to be reassuring.

At the same time we've allowed for a retracement, even a 'B' wave correction; but seasonals argue that could come a little later; barring a war expansion. In a sense the market reflects shuffling and not consumer retail stocks; although it is a contributor but not very important. What this is about is planning for '24.

Bottom line: the face of 'generative Ai' lost his job and that ruffled feathers a bit late Friday; otherwise not much. Similarly the Applied Materials drop on failure to conform to U.S. restrictions on exports to China, didn't impact others much (we're not in AMAT, and haven't been; maybe they'll focus more domestically going forward).

As to the Open Ai controversy; again we're not directly in that. Microsoft got hit a bit as a result; and surely the regulatory pressure might play a role here. As to small-caps like SoundHound; that's 'conversational Ai' so is different. So is BigBear.ai, which is 'battle-space' management (and commercial too).

Thus the massive shakeup in OpenAi doesn't impact the speculative group we follow; unless you wish to include the little shake it gave to Microsoft. In the general market it remains more of the same; and appropriate seasonally.

More By This Author:

Market Briefing For Thursday, Nov. 16th

Market Briefing For Wednesday, Nov. 15th

Market Briefing For Tuesday, Nov. 14th

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can follow Gene on Twitter more