Market Briefing For Monday, May 10

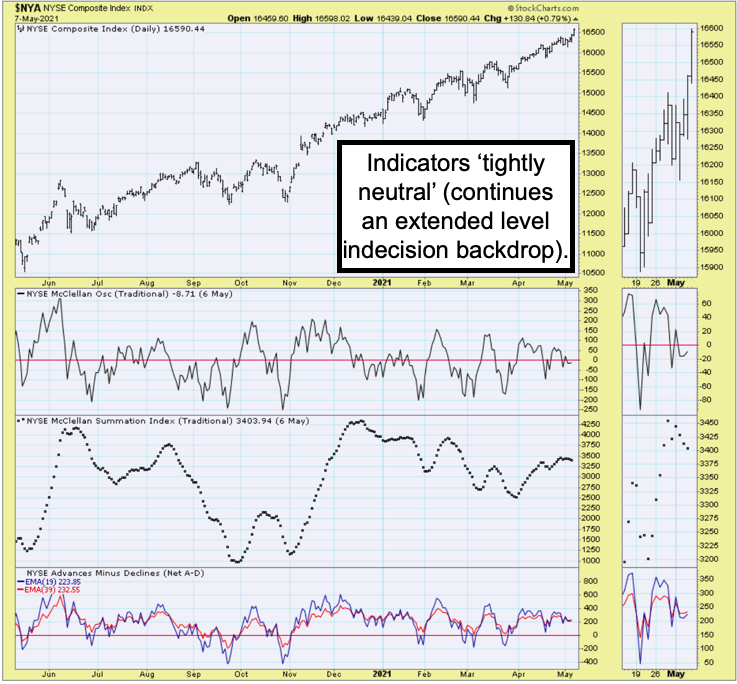

Tight correlations - with preceding distributional highs, aren't comparable to the extent so many historic tops exhibited technically or fundamentally; and of course not to the frothiest bubbles, regardless of any claiming that condition. I am not saying many valuations are stretched; of course they are. I am saying that the backdrop of this liquidity-driven more both defies those fighting it, and has been rotatationally correcting and bouncing, rather than any sort of broad topping formation that actually preceded months ago near an internal high.

I should note there is no prospect of an ultimate high now; barring exogenous influence; but there already is an internal 'calm' prevailing; which isn't labeled as such, but to me is a form of an 'indecision pattern' by most managers (they are nervous and trying to hedge; but also unwillling to surrender positions).

At the same time there has been algorithmic trading (leveraged) dominating this market; and it is sort of fractured (I call it bifurcated); that supports somewhat, what the biggest money managers already own, rather than value based upon logical statistical data or fundamental assessments.

The closest this comes to logic relates not just to growth or momentum; but to the Fed-backed liquidity injections, which perpetuates TINA (for anyone new it means 'there is not alternative' to equities) in this ongoing environment. Also it isn't really a broadly extended market; those very stocks (even as they've had a dip more recently) are 'buttressed' by Oils and Industrials to sustain the S&P image of being right at the highs. Some are more influential in the Dow Jones Industrial Average; hence helping it be essentially at record highs right now.

Executive summary:

- Structurally the S&P high-level pattern persists as does May risk as well;

- This time may not be different; but it is special; with no sign of abating on the part of fiscal and monetary policies that -while experimental to be sure we emphasize- have not ended; not pillars presuming underpinning really the core primary trend, while not denying our April-May corrective actions;

- If anything it's fiscal policy that's too loose; and that may be reflected in a comment (at least) from the FOMC in June; probably not the 're-pricing' or similar event; which means ripples in the market not catastrophic plunges;

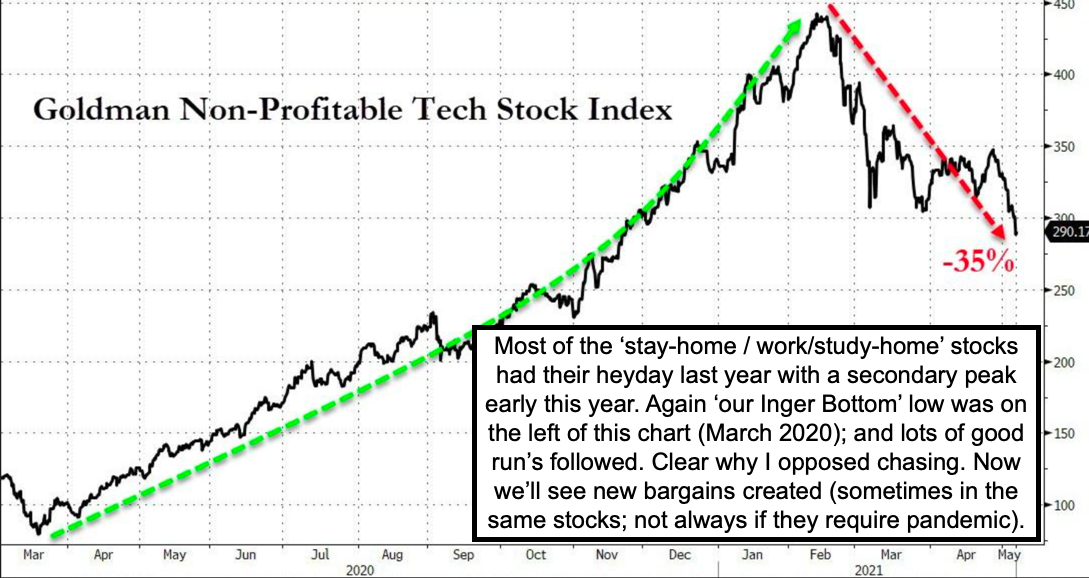

- So yes you get bouncebacks in techs periodically (most games behind for now); while those that benefit from pandemic-emergence hold up better;

- At some point (early next year perhaps) cyclicals will have rebounded so much and for so long; that it will be hard to extract much more gains; for sure 'if' the overall structure lasts that long; and that is also debatable;

- The idea that officials would say monetary policy would stay expansive if until a 're-pricing event'; speaks volumes about 'bureaucrat speak', and it sort of warns that the Fed doesn't want to rock the boat; unless it leaks or worse, gets torpedoed by an 'event' that can blame as 'unanticipated';

- So for now the 'bifurcated rotation play' (if you will) continues; with duress anticipated as we move into mid-May; again erratic corrections mixed for now with those names that have great fundamentals so outperform;

- On the Covid front, the WHO today approved China's SinoPharm vaccine, for emergency use, so that's a way to help poorer nations without forcing the Intellectual Property 'crown jewels' from major Western pharmas;

- Little reported; but this matters: just yesterday Oregon reported 611 'fully vaccinated' people are now infected with COVID-19, 8 already died;

- Market caution remains appropriate; as I'll continue to discuss below.

Yes I know I've quipped that I disdain too many jumping on the 'correction bandwagon' and that 'my indicators are almost even for instead an upside breakout'. I of course don't rely on indicators in a vacuum, but I've noted for a period of time that markets (much of it) were correcting internally.

Hence much general technical commentary out there about 'plunging' equities remained just as wrong recently as it mostly has since March (Inger Bottom) of 2020's low. So sure we will get more Index shakeouts, but some managers are so hedged they're in a mode to 'think' they bought serious protection; but others are so leveraged that it remains worrisome (and is one of the catalysts of concern if more 'blow up').

So the dynamics are mixed and there remains plenty of tension on the tape, beyond the superficial advances you're seeing. For sure 'limited' engagement in trading, and great care if any shorting, has been generally right. There are particular stocks (almost all in tech or the overdone post-pandemic rebound travel stocks for-instance) that really got ridiculous on valuation (maybe I'm thinking of AirBnB as I know I'd like to take a trip to visit friends but can't yet as the recovery saga evolves). Basically I'd let such stocks all settle down.

In-sum: analysts continue the ongoing (although valid) debate as to forward growth, earnings; bond jitters; Dollar prospects; or of course equity rotation.

The problem with the future is that its history is not known yet. With that said the big jobs miss meant nothing; we thought higher anyway. It's not merely 'bad news is good news'; but a reflection of almost anything fueling rebounds.

This has persisted for some time, it may be frustrating to many (except for the commodity sector and the increasingly risky crypto gambling sector). This isn't a 'deeper the problem the higher the market goes' scenario; just seems like it.

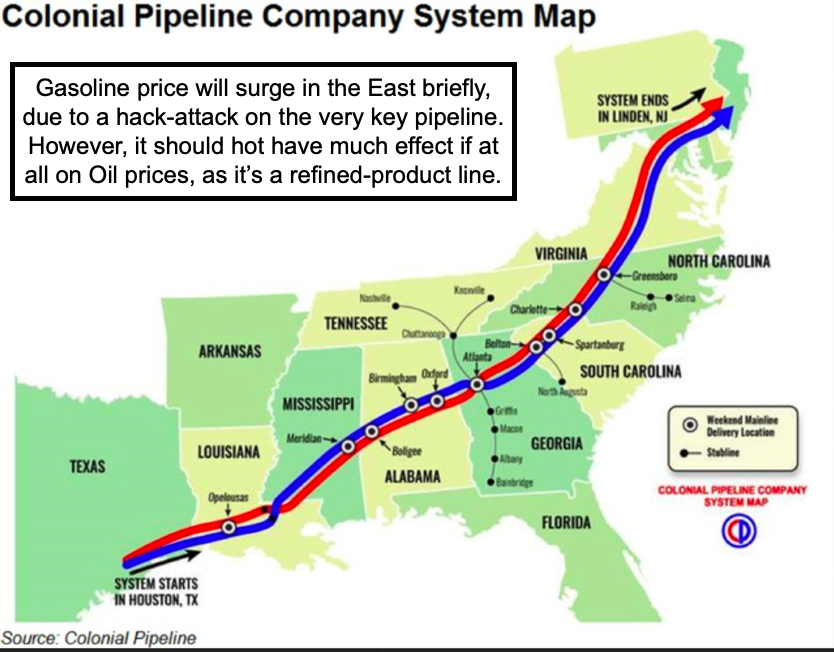

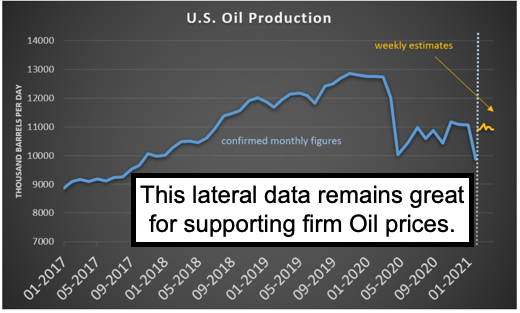

While many wait for 'shifts in sentiment'; the internal rally of even the S&P has abated, some weeks ago. Pressure came into sectors that were overdone as you know; and rotation helped stabilize the Index for some time. Oil stood out as strong; and even some software stocks are relatively ok. Oil 'might' bounce a bit more; but isn't directly related to the pipeline interruption; which might be corrected before the new week trading starts (it's software); impossible to say.

What was flat? FANG type stocks; and most semiconductors that already got a bid (rebound) after being crushed briefly a few days ago. Oscillating is what I see; and yes the 'calm' that prevails could precede a nastier period; but that is not assured. Why? Because so many stocks already reflect adjustments.

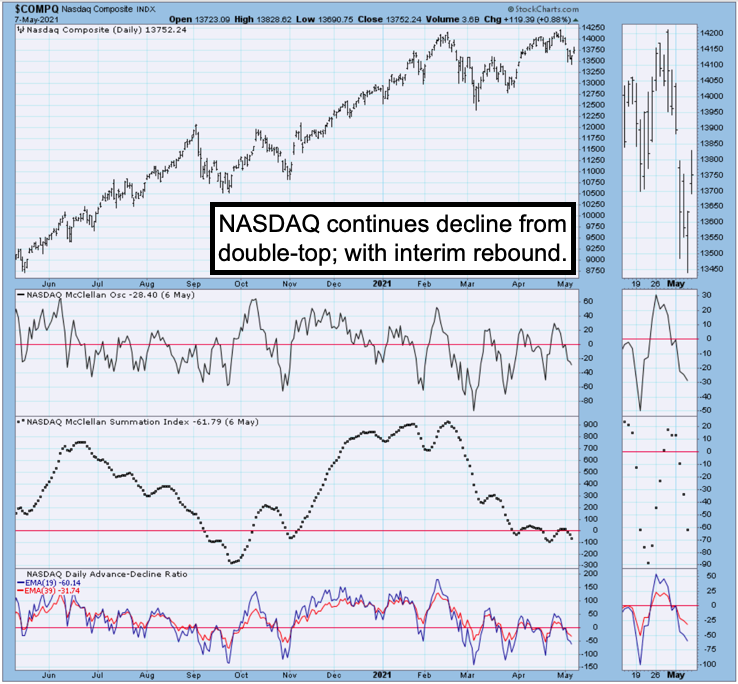

So, energy and industrials are the leaders, and while not exciting that's what I called for to be at the helm of stabilization efforts. Now, if tech was truly weak, and I mean plunging (which it's not), then of course Oil and Industrials alone, typically would not be able to prevent what we call a 'mean reversion' for S&P and if one takes a gander, you already see such action in the NASDAQ and in NDX, in-part because they reflect the 'grand dames' even clearer than S&P.

I've talked of a 'double top' prospect for NASDAQ before it developed; just as a potential; especially because I thought the 'super-cap' (FANG type etc.) just very stretched and in need of retrenching.

I'm focused less on the ongoing yield compression that many think must end; I agree that it will end; just now at this moment. If it does end now, then so be it, because as my expectation was for late April and (parts of) May behavior to be either a correction or at least shuffling in a sometimes bizarre manner.