Market Briefing For Monday, March 14

Threats, lies and distortions dominate the market swings, even as relative aspects of Ukraine/Russia war remain very fluid; and entirely confounding. It's a reason that a) the war is no way over; b) Putin does acknowledge progress in discussions, which I suspected yesterday had to be in the background after they proclaimed 'nothing' done, and c) concurrently Russia fired missiles or hit the Western part of Ukraine (parts of which we noted historically were Poland and never Russia incidentally); and that prompted d) fears of war widening.

On Saturday I increased awareness of a couple things that might matter. One, President Zalensky continues inclined to 'compromise' on Russia's demands, even as he states they will not give in, not one inch, and so on. Meanwhile we learn that Israel played a vital role (Prime Minister Bennett's trips to Moscow & Berlin) in elevating the negotiations to the Ministerial level; and although they both proclaimed 'nothing none', we understand they are not so far apart.

That matters for the U.S. market, because Saturday Russia stated that all the NATO convoys of weapons flooding into Ukraine 'are' legitimate targets, in the same way that delivering the MiG 29's from Poland would have been. This is a big deal both ways; the first being that more negotiations would trigger yet another rally, since the majority are finally realizing we're in a year-long 'bear market' internally; and many months even for the Indexes at this point.

So I suppose the contingency is pretty obvious: the S&P downside 3700 +/- is very much still in-play (or lower); with the caveat that so many are bearish we could see an explosive rally 'if' some surprise negotiation occurs or a 'speech' by Zelensky that is unusual and based on what's not being revealed. There is an available opportunity for him to deliver that speech in Tel Aviv believe it or not, to a global audience. (And yes, El Al Airlines continues flights to both get refugees out of Ukraine and also to assist Russians departing Moscow.)

The other story impacting markets fundamentally on Friday wasn't reported in any broad sense; and that's a rampant explosion of Covid-Omicron in China that caused the draconian Beijing regime to lock-down a city of 9 million early today. However before the day's last hour we heard that over 1000 new cases were found today in Shanghai; the most Western and sophisticated of China's cities. They already closed the schools for the new week and more.

So Covid will also impact supply-chain issues more extensively as happens to coincide with the war; with chatter about China if they trade in certain ways as relates to Russia; and now you have the 'audit situation' effecting every China stock listed in the United States. This apparently has everything to do with the political influence on accounting rules in China (always a concern) and hits as Russia introduces another element; plus the tech-wreck on Chinese techs as is going on anyway. The shortage of Neon will impact semiconductors too; as half that supply comes from Russia; whether going to China, Taiwan or us.

In sum: lots of uncertainty existed in markets, and more has been injected by the confluence of concerns; regardless of China seeming conciliatory in some ways as regards their accounting issue (as there's a couple years to sort that, but it will further reduce interest in their securities, or result in listing shifts).

As much as there's a willingness to find a way to preserve trade with China; it definitely contributes to the reticence to have favorable market sentiment. For sure there's more, and no change in our backdrop overall assessment.

Certainly we hope the strategy of reticence to more actively support Ukraine, doesn't really escalate into a 'U.S. fighting Russia to the last Ukrainian citizen', but it is increasing appearing that way to some; including of course to Putin. If I call our approach sort of 'surreal', I think that's fair. Perhaps Sec'y. Austin will help define this better or for that matter do more than just say 'Ukraine trucks will carry the weapons from the border not ours no worries'. Tiptoeing into an overt engagement with Russia is the risk; while publicly repeatedly stating we are not going to engage them conveys yet again a sign of Western weakness.

Aside 'war or peace' next week, the expectation is a Fed rate hike; 'probably' with an attempt to soften impact by mentioning need for 'flexibility' in policies; even though we all know they plan sequential increases. What's unclear might be hesitation (delay) on 'quantitative tightening' too soon, given the backdrop.

Mostly it's 'consumer sentiment' soft due to inflation and war-fears; and in part of the country where rents have gone through the roof way beyond ability for a majority of average people to handle it. However that also shows many (as has been typical in New York, LA and Miami) living above their means or with very little margin for error even before the pandemic much less this inflation.

These factors are recognized by the Fed too; which realizes they were late by a long time in hiking rates; and that's why I called for it a year ago lest we get into a more complicated situation; which is where things are to say the least.

This also means the Fed 'might' say flexible but stick to their hubris too much; a prospect that would have them increasing rates until they do break inflation; which would mean via a severe recession. To avoid that you need Oil to break which can happen by 'urgently' making a deal with Canada (not Venezuela or Iran, which I suspected they would try and they did try; and now the Iran Deal seems dead, as Russia .. negotiating for us ?? ... walked out in Vienna). The Canadians reiterated that they are ready to deliver 400,000-900,000 bbl/daily to the United States, and this barely gets play in media. That would occur via rail and trucking and doesn't require reinstating the pipeline project (although if realization of how long Oil will be needed, that would also occur).

In essence big-cap optimists (I say it that way as most risk remains in the big stocks in tech or post-pandemic theme stocks that are cratering) continue to 'fight the Fed'; and I've not changed the prospects for S&P 3700-3800 +/-. For sure S&P can go lower than that; depending on entering the 'vacuum' below I tehnically noted, or whether flat-out war happens between NATO and Russia.

I am unwilling to get very bearish 'after' a year of rotating crashes; given both a preceding hammering in most stocks; a 'general' mega-caps catching-down to where the majority have already been, and if peace happens; reverse this.

As I've mentioned for a few weeks; 'shades of the 1930's' are present in more than one respect. You have Russian annexation of territories (or via proxies); you have the U.S. fighting Russia indirectly (sort of via proxies); and now the heavy sanctions on Russia's economy are warranted; but may succeed more than the desired effect; that could become problematic; as discussed earlier.

In the 1930's the U.S. and U.K. (and even the Dutch) sanctioned Japan after they invaded Manchuria, and U.S. 'volunteers' (like the Flying Tigers) flew the mountainous route over the hump from Burma to supply China's Nationalists; the predecessors to today's governance in Taiwan after pushed there by CCP forces post-War. I don't think Tojo differentiated trucking vs. flying-in supplies.

But the point is (though there's more) Japan interpreted the large sanctions as denying Oil, rubber, aluminum and so on; prompting the Emperor to listen to a deranged militarist (fringe?) that instigated ideas of attacking Pearl Harbor. So their idea was to break our Navy; presumed we'd make peace; trade wouldn't be impeded in 'their sphere of influence', and they'd dominate Asia. Tojo was a military cultist of that era; and the stock market didn't bottom until the 'Battle of Midway', marking reversal of Imperial Japan's Navy. Hitler miscalculated in different ways in Europe; at one point Poland thought they were going to fight 'with' Hitler against Soviet Russia; and they got sliced-up from both sides.

Perhaps these alternatives are why the Administration is hitting Moscow hard on the surface (sanctions); but is reticent to get more involved; confused from history that piecemeal approaches only allow the strife to spread wider. There is no certain outcome to how this goes; history may rhyme but not duplicate a past pattern; and then there's Zalensky, the Churchill of the era; who is caught between willingness to compromise but also knows what happens to leaders if their population thinks they betrayed them or the Russians capture him. I do hope he got his family to safety; and is spirited out himself if this goes awry.

It's hard to say if the market's going to get a 'classic washout' with this decline as it's more complex than usual; because so much of the market has been on the wane for a long time (a year or more in many cases). Keep that in mind.

Summary: we do know the S&P bottom in World War II was after the 'Battle of Midway' in 1942; as stocks gradually stabilized and firmed through the rest of the war. In this case much of the market (smaller stocks) crashed last year and are trying to grope for lows and low-level bases now. Technology is being impacted further in light of the China technology accounting issue.

And of course something like Apple breaking its 200 Day Moving Average might be the trigger for plunging to actually climax levels 'if' things get on with the process. We already had a crash, rebound and erode. They say they take the strongest stocks last; but it depends what you consider 'strong'. If Apple or Microsoft it applies; if Docusign, Zoom or Meta; those are disaster theme stocks. Something like Tesla could also crack; and there's competitive logic to that. Most EV's collapsed and little tiny Canoo is doing fairly well considering it was never considered a player (yet); so it's a possible surprise survivor (and if they deliver perhaps a really interesting play for late this year and 2023).

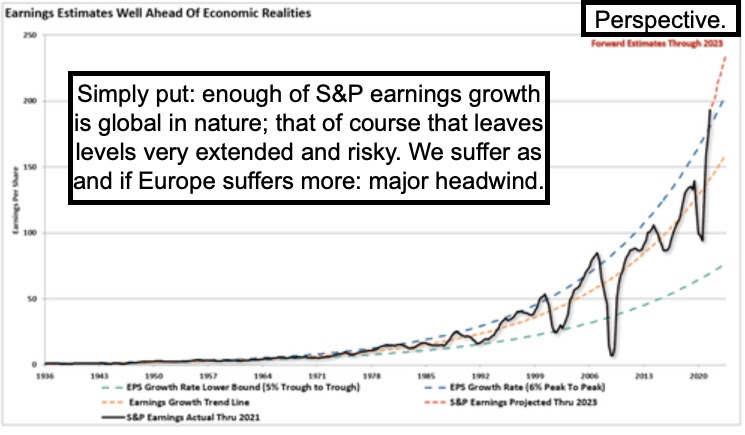

Downward earnings revisions are not entirely factored-in; they can't be, due to war. Negative revisions (even if 'peace breaks out') are in order. Input costs of materials, pass-through of costs to end-users; and so on face a challenged market. So it's not 'The Battle of Midway' yet; in fact, if this goes to the point of open war with Russia; it's not even 'Pearl Harbor' yet. And that must be for sure avoided in the nuclear age; but all that goes back to the hypothetical of 'is Putin still in office or not' as we contemplate ensuing economic structures.

If enough Russians agitate to remove him (or a real successful Palace Coup), before something more horrid than already seen, well; prospects for markets change immediately, due to the sensitivity of markets to run-shorts on any hint of positive developments. So you can get rallies; but you need him removed.

Meanwhile our supply-chains are insecure; Covid roars in Asia; we organize a lot of mobilization (just in case and not widely reported); so all of this is higher costs for consumers, regardless of what the Fed does next week and so on. I realize there's a view of less energy sensitivity than the 1970's; but not much, contrary to what some analysts suggest. Again watch Oil and the Dollar for a clue as to what traders really think a couple of months forward.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more