Market Briefing For Monday, Feb. 7

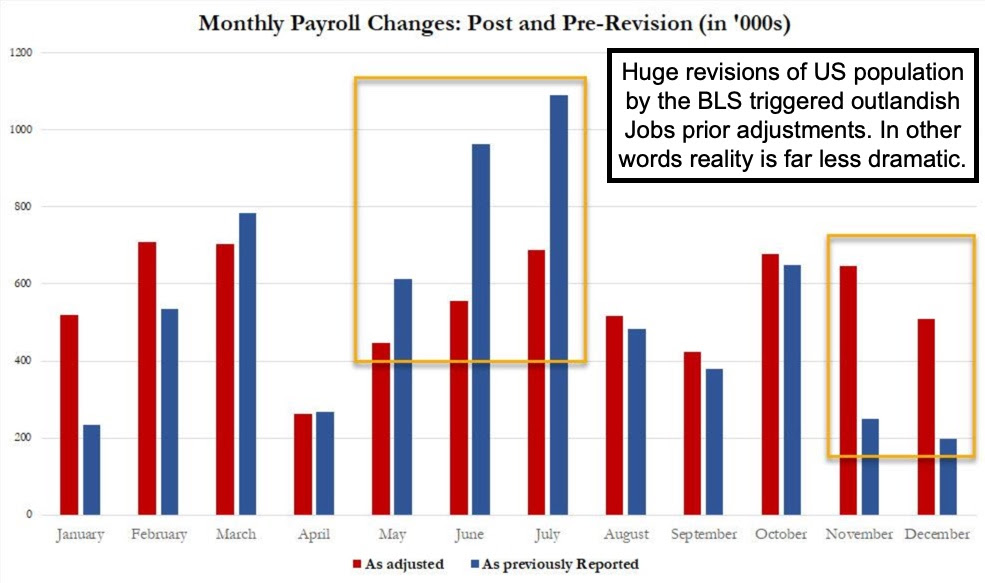

Delusional interpretations of the January Jobs report sent yields higher as stocks dropped initially; aborting what might have been a favorable start. Ha.. however, as the data -especially the upward revisions for preceding months- was incredibly and unbelievably favorable, the market started questioning it a bit. That would justify Fed tightening, or so the market pundits initially reacted. Not so fast; there was distortion.

Surprise; a legitimate dissecting of the reports reveals they were adjusted for population changes (not sure if that relates to previously unaccounted people that are citizens, or non-citizens that work); hence absurdly ballooning reports looking too optimistic for jobs, or pessimistic for containing Fed aggression.

You see the table posted. However, at the same time we want growth and more jobs, there's too much nonsense by any pundit taking today's report at face value. We want sustainable growth.

We also watch Oil being stronger than we would like for global economics, at the same time the move over 90/bbl is fine for those of us 'in' Oil or oil stocks.

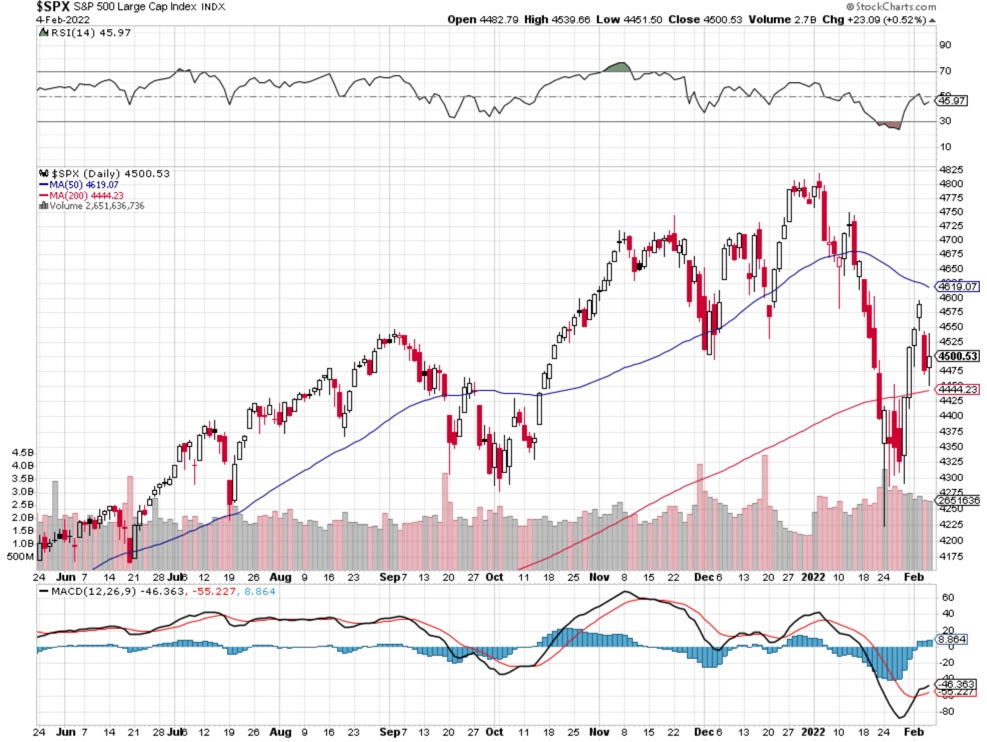

Struggles persist, amid roller-coaster market action; which is not so violent at the moment as it was just days ago. Such 'chaotic behavior' in alternating day swings have been seen both at an expected S&P 'trough' just a couple weeks ago; and again as S&P fought around the ~4600 area'; now right ~ 4500.

The affair has been an odd mix, with Oils & Banks thriving; while mega-caps caught the headlines with dramatic moves in both directions. Social media is essentially a segment of technology that needs to be broken-out of the pack. However there's not enough 'Faceplants' (Mega's new nickname) to do that.

Even late Friday, analysts continued to view the market's performance after this Jobs number as impressive; because stocks generally absorbed the news. So they ignore the BLS adjustments, which means a Fed watcher should realize the market recovered because the revisions mean the raw numbers aren't so important to the Fed, and do not reinforce their hawkishness as some say.

The Fed was already in tightening mode; so better to have booming economic growth; which is what most pundits are assuming. The reality is slow; and that might be what Jim Bullard (Pres. St. Louis Fed) intimated with his Tuesday comment: that there was no reason for a 50 basis point increase at the next Meeting. To wit: if they're going to hike anyway let the economy rip; but that's not actually the case, as you must consider the adjustments and revisions to the Jobs data; or taps on the shoulders by some to give a strong impression.

Binary outcome prospects persist in a number of big stocks and Oil, as well as Gold. Most technicians expect Oil to break down from this run; and Gold to break down too. How about Oil defies that and breaks-out more temporarily; while Gold moves up from a symmetrical pattern; maybe only if Bitcoin fades from this rebound, at least as a test of recent lows at our downside target.

Rebounds were led by Oil (and a bit Banks); which matters. Oil is expensive; a few are urging buying and a couple notice the rising tops over a decade. So my view is the 90's is more than enough; but I'm not selling Crude (unless you wish to actually buy some and have a tank-truck.. just kidding) not chasing as fortunately 'we' are the ones they speculate about that were 'bullish on Oil' at the lows under 40; called for the 60's, then the 70's; then '80's were enough or so on. Well we sold nothing in WTI actual production nor stocks like Chevron, which has performed as well as anything for a considerable period of time. It's not good for inflation if it spikes higher from here; while still fine for us holders.

I hear analysts trying to sort out what happens next in 'stocks' like the S&P and NDX, which have been influenced by the major movers (up or down). So for a clue about what happens next, keep watching Oil. Odds favor a setback, but as technicians see that it probably wouldn't last long or get far. They try hard to correlate it with 'raw materials' or regular commodities; and that's incorrect analysis in my view. Normal 'commodity' factors are not the influence here; for that matter even 'demand' is somewhat limited. Geopolitical factors impinge.

Mostly geopolitical. Yes, Biden wants Oil lower to reduce horrible prospects the Democrats face in the mid-terms with high inflation (Oil a major factor just to make workers who did get a raise feel a little better if he can tame it). That might make him a soft and make a deal with Iran in Vienna. That, or Putin will get a weapons-based concession in Ukraine; and in either case Oil would for sure (most likely) drop quickly 10 or 15 / bbl on such developments. But then would rebound based on real demand if the general concerns get abated. So; I see the charts; understand it's overbought; realize what could trim the gains; but I wouldn't get too negative. Not to mention the alternative: war and 120 Oil (hah... probably not, but there's always the possibility diplomacy blows up.)

Bottom line: the week's eye-popping roller-coaster e-ticket rides in various stocks are characteristic of 'chaos theory' I've labeled; and often occur within Bear Markets, which by the way are notorious for sharp unsustainable rallies.

The new week continues the chaos and maybe more eye-popping moves.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more