Market Briefing For Monday, Aug. 2

Whether 'stocks are overpriced' or not - seems to be a big question; aside clear concerns (which we've consistently voiced) about Covid's resurgence as the primary determinant of near-term market movements; Fed policy restraint; as well as people retrenching a bit from the recent spending extravaganzas.

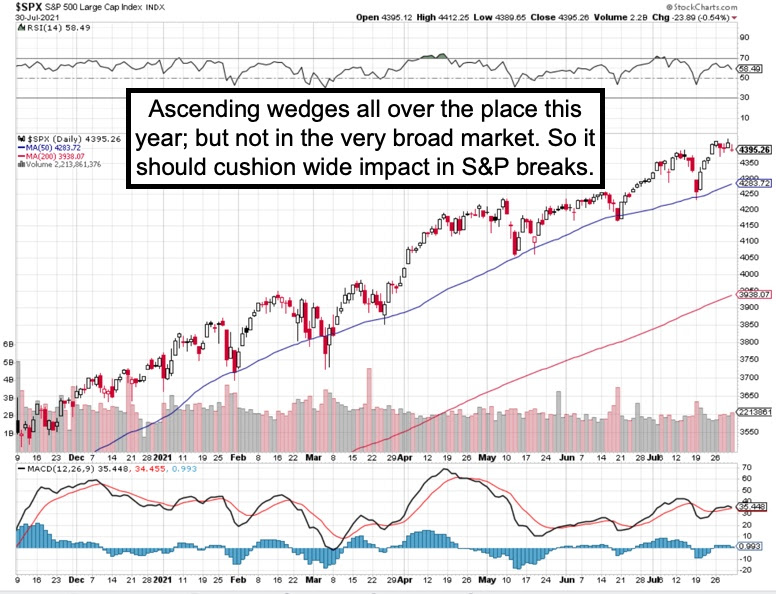

'Stocks' are not particularly overpriced; though the NDX and S&P are on their own right. Hence the core of our argument for shakeouts and perhaps now a much deserved correction in 'such' areas; while the already-downtrodden just snagnate, erode a bit, or even rally where they have unique fundamentals (or especially where they have applicability to resolving the Covid dilemma).

Executive summary:

- Moderation of consumer exuberance is already occurring; some of it just relates to the end of seasonal spending (like trips and housing which will peak in mid-Summer even without any crisis backdrop such as now);

- Hence Consumer Sentiment 'presently' was high most recently; while the data for 'forward' planned spending was declining notably for weeks now;

- Oil had a great month; more so than the stocks; which generally dropped but was responsible for leading the upside on a couple key rebounds;

- 'Dog Days of Summer' should base upon us; and have been for small and other stocks not just for weeks; but to an extent for months;

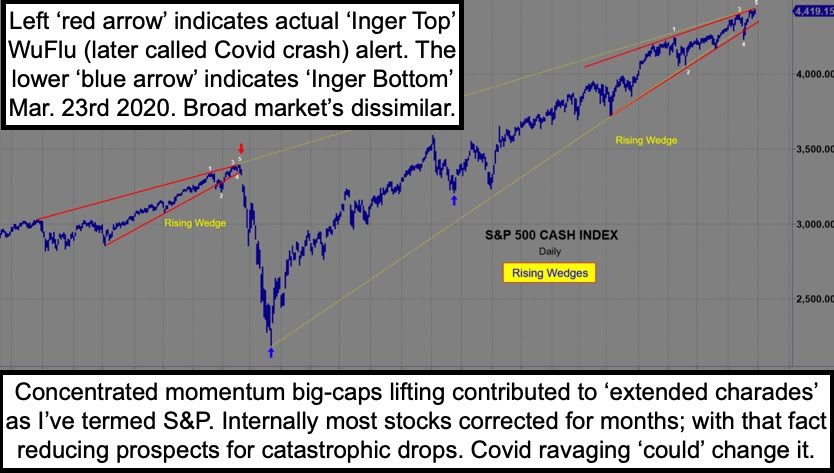

- That reinforces the view of how difficult it is to 'crash' markets overall; as it's S&P and NDX (FANG + momentum types) extended so far; hence if those tanks (some insanely expensive) little broad impact might result;

- Remember our call was for stabilization of S&P into or around early July, then by mid-month getting rocky; this defensive action (with potential to rise, and more risk of decline, but not catastrophe) persists into August;

- As to Chinese stocks, they rebounded when Beijing gave their 'blessing' to listing shares in New York; while the U.S. responded (sort of) saying it wasn't appropriate to do IPO's here when full accounting isn't available;

- We're 'not' in a global financial crisis; but we are failing the 'synchronized global recovery', due to the worldwide pandemic;

- The overriding recovery on a global basis was helpful as everyone saw during the 'eye' of what I'd called a 'hurricane'; so now the 'other side of the storm' could suppress the revival somewhat; and allow the Fed some luxury by making inflation 'appear' to be transitory (outside of wages);

- Most global players taking down forward guidance numbers based on where costs are, demand expected to contract; most relates to Covid;

- Many criticized Texas Instruments for great Q2 numbers and guidance very soft for Q3; however I argued they were first to be candid about it; since then most players have moderated their expectations;

- Among these, even Apple reduced their outlook; Amazon will do great if we are back into a 'retrenched' cocoon lifestyle (nobody wants that) and others like Facebook are pouting because of Apple's 'anti-ad-tracking' (a feature that happens to be core to Facebook's marketing);

- Incidentally this same 'security feature' in iPhones costs Apple money as well; since it might correlate to fewer sales in the App Store; although I'm thinking they had expected the opposite result (more buying from them);

- Disney is requiring workers (not worried about a Union issue) vaccinated fully; Orange County back to masks; Governor opposition or not so far;

- Notable big divergences in Covid outcomes: England, where masses of soccer (their football) fans 'failed' to contract Covid, suggests the U.K. is closer to 'herd immunity' than broadly thought; hence the travel opening (that's hard to pinpoint but seems to have been a contributing factor);

- Australia has had a hard lock-down and that did not result in reduction of cases, which is hard to understand; but sort of a mirror image contrasted to the Great Britain's apparent reversal;

- In the U.S.A. the FDA 'just' expanded Regeneron's 'monoclonal antibody' (it's about time) EUA to include prevention of disease; we've noted along the way that MaB's are good in early stages; as salvage recovery efforts; but also as prophylactic weapons against Covid /Delta;

- Regeneron's cocktail is a two-antibody variation (some rumors tied them to Sorrento at one time; though nothing more has been heard about that) and is still the large dose which President Trump received; but which was not generally distributed by hospitals even when it became available, due in-part to labor-intensive infusions and lack of patient education (which is still a factor with regard to monoclonal antibodies, shamefully on FDA);

- Broader use of MaB's is a good development and for those reluctant now to get vaccinated; or for whom breakthrough cases occur 'anyway'; this is likely to become a 'turn-to' treatment choice as it's better understood;

- Sorrento will benefit in a big way if 'their' monoclonal antibodies prove as efficacious as they have proclaimed (for too long it seems) in pending trial results; which interestingly should arrive at 'data revelation' almost at any time later in August, based on the time-line the Company outlined in their June 22nd Press Release (refer to their website if you'd like to review it; just click under 'investors' to see all their official releases);

- Presumably the once seemingly-outlandish 'cure' claims by Sorrento's Dr. Ji (CEO), have been put to the test (trials) and outcomes need to be clear pretty much now, given the wave of Covid / Delta upon the world; which it seems will 'blow over' in some countries while catastrophic in others;

- At this point 'nose drops' or pill approaches appear more urgent in a way than vaccines, given how MaB's work immediately without weeks needed to build immunity; again proper ones kill the virus essentially directly;

- Further controversy prevails about long-term risks of vaccines especially in children (endothelial cell and other issues); whereas monoclonal drugs can simply be available to give upon any symptoms; vaccinated or not;

- Bottom-line: Covid will be around for years in various forms; hence both vaccines (preferably better ones) and (better) monoclonal antibody drugs and straight antiviral drugs, as well as affordable rapid 'tests' are needed.

In sum: July was mixed; defensive in some areas; neutral in others; limited or not meaningful change in the grind of the S&P, which retreated from records.

Disclosure: This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analyses. You can subscribe ...

more

My guess is that the appearance and rapid spread of new variations of the virus is the result of more experiments by the Chinese army, or special defense group. Proving that they CAN rule the world should be an effective way to assure that all negotiations go in their favor. But do not panic until the truth is revealed, whatever it may be. Then say farewell to all your wealth, it will be tax time.