Market Briefing For Monday, Aug. 29

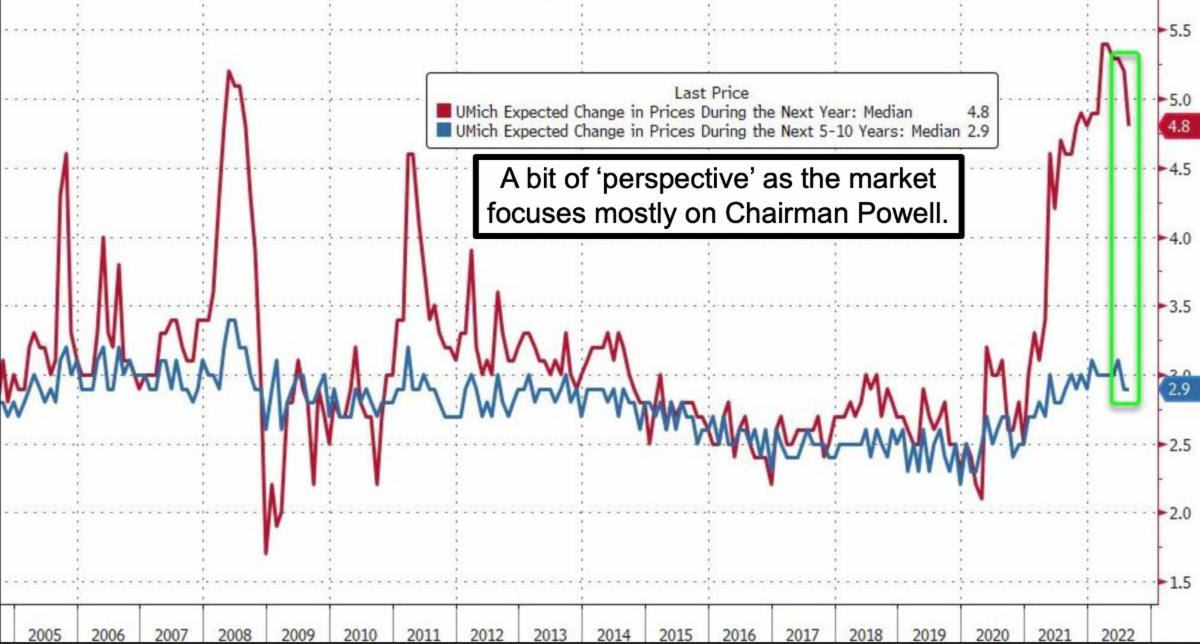

Prolonging the agony, with varying degrees of despair, is essentially where Chairman Powell left matters in his remarks that basically reiterated a majority of what regional Fed heads noted even before Friday. So, the Fed can crush demand; but they can't reverse the extreme climate shifts; claw back wages, or broker a peace-deal between Ukraine and Russia. Or fix the drought.

So yes I get his 'out of balance' remarks; but mostly it was a controlled predictable hit, until Politico tossed in the Apple story, which notably expanded the decline.

Powell's 'higher for longer' approach was expected; but isn't pro-growth or a stance focused on the economy; but primarily solely at inflation's pace. In the initial reaction, S&P eased down only a bit; actually tried to find footing; to only succumb minutes later and drift lower (on Apple). That's an S&P moving in direction of the initial reaction, after briefly trying to move in opposing ways.

So the takeaway was that the Fed will respond 'when' inflation is on a track of retreat, and its 'pace' can easily be controlled (they think) by the Fed. You are having deflation in some Durables already; but you also have inflation drivers not accelerating; but also not easing. Oil's stable after being repelled from the 120/bbl area; and lifting a bit from our goal of getting into the mid-high 80's.

At the same time much of Oil and especially Natural Gas is being influenced for sure by a mess that describes much of Europe presently; and nearly panic as to how they'll deal with the coming Winter demand. (Of course that's what keeps Russia believing they can prevail; by breaking the 'will' of those who did go for the multi-year bait of Russian Oil & Gas infusions.)

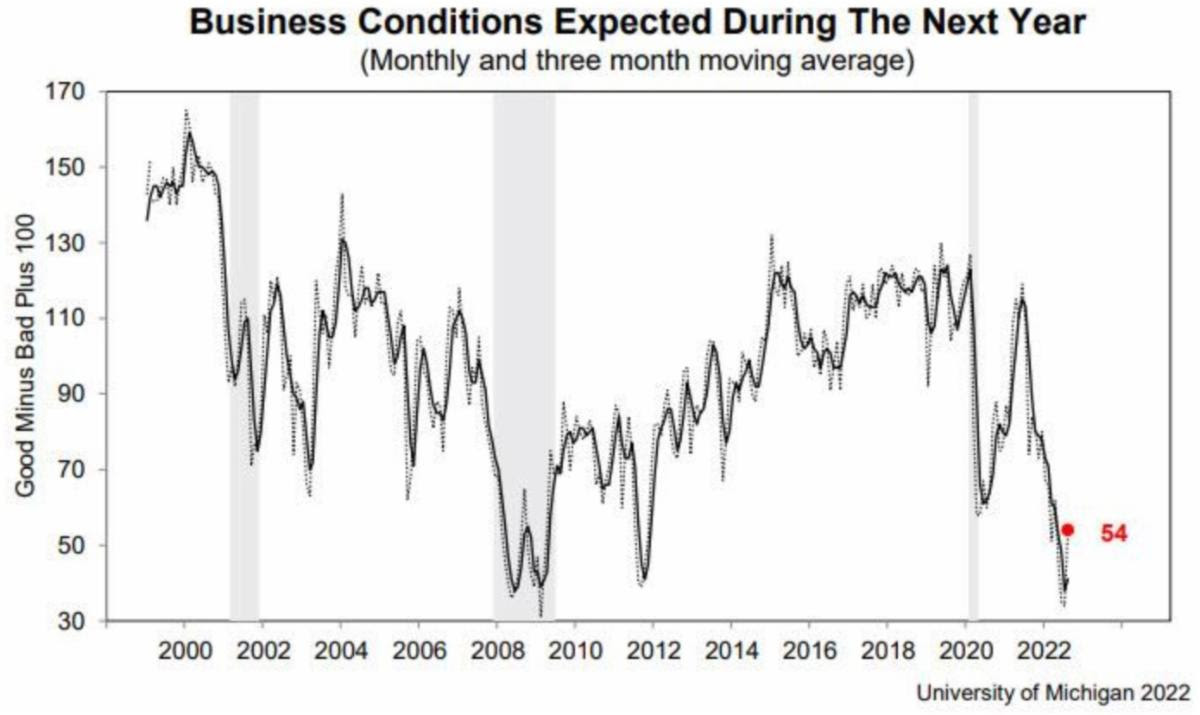

There is insufficient evidence to 'confirm' the recession as behind, and a 'soft landing'; but despite mixed data, the chances of it being 'softish' remain. Take the Jobs data down; and that would reduce inflation in the labor markets; but growth in wages does need to retreat, and who knows..if so maybe the Fed can claim 'victory'.

As to Apple vs. DOJ; if that progresses (some ponder what takes so long and others think Government should stay out of this); Apple could preemptively:

- Reduce the mandatory App Store fee to 15% flat.

- Allow developers to use external in-app-purchase and subscription through their API, further reducing their fee to 10% (or negotiable).

- Provide more analytics to developers, with support and refund options.

- Allow apps to be installed outside the App Store, with a process similar to Apple 's Developer Enterprise Program. If necessary, reduce restrictions to apps installed outside the App Store, via options in Privacy & Security settings (e.g., Photos, Health, HomeKit, Contacts, etc.).

What this might really be about is a potent effort by Meta (Facebook) to make it possible to have (data-stealing?) code in Apps, with Apple compelled to reverse their privacy changes (ahh..).

In sum: we had a Fed making up for lost time behind the curve; and they're in a Volcker-like mode that will continue for some time; presumably so inflation's not unhinged for longer; at least to the extent the Fed can actually influence it.

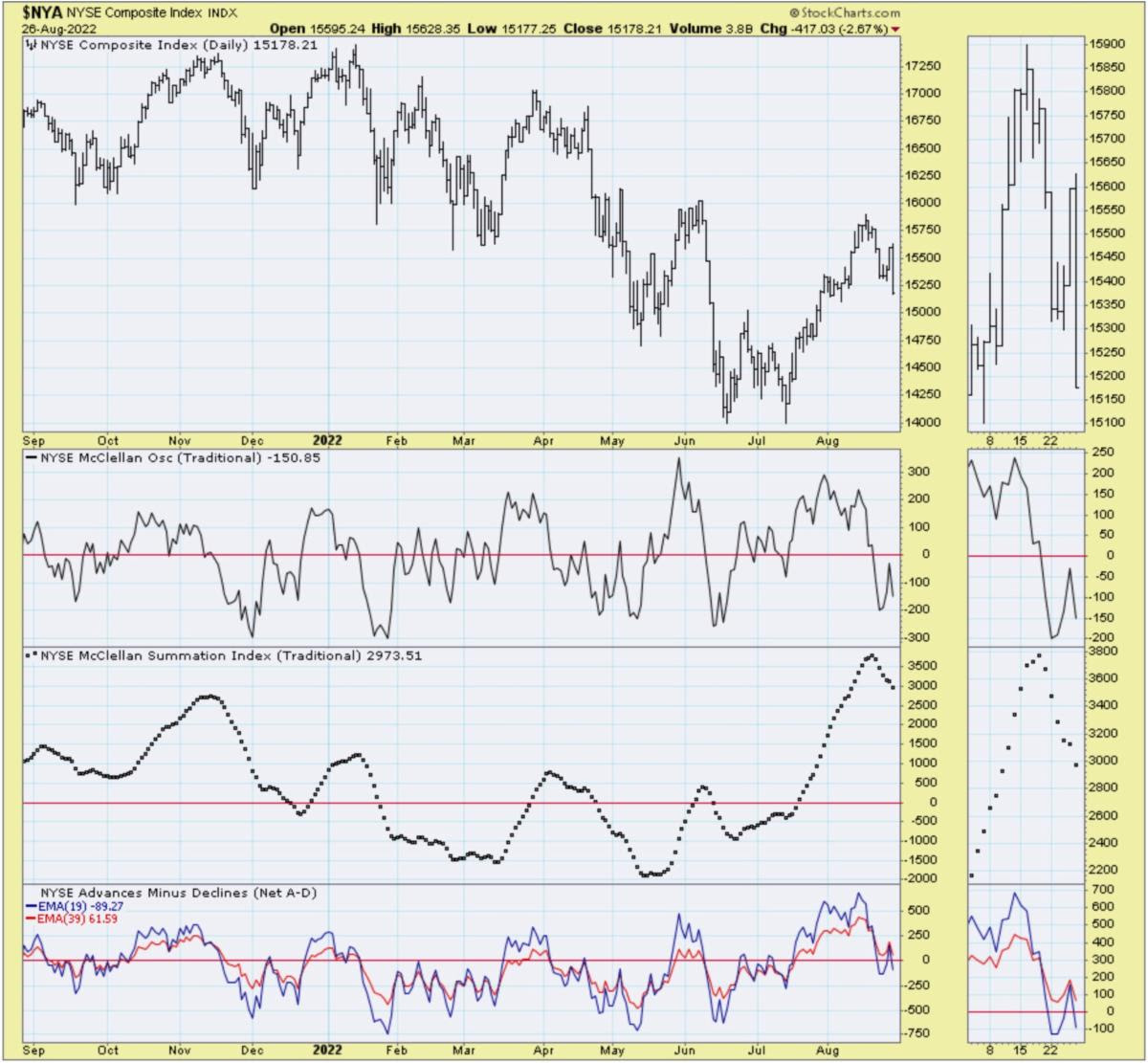

S&P has been (and remains) in a risky range; and neither the Fed nor attacks (or threats) against Apple helped of course. We may well get some washout early in the coming week; then a surprising (to some) pre-Labor Day rebound. But I'd not get excited as the post holiday shakeout progression is still likely.

'Pain now to avoid more pain later', is Powell's theme. There was not any talk of a 'path towards a soft landing' and that was a point not lost on markets.

With respect to Yogi Berra reminding fans of what can happen late in a game; in this case corrective behavior 'ain't over until it's over'. If this were an opera, where the expression actually started (before Kate Smith was born); what we have seen is a market catching its 'breadth' with a correction; that possibly will be followed by a washout and rebound; but the 'fat lady will be singing' again; and warming-up in the wings 'even if' we get stability ahead of Labor Day.

Constrained energy policies and overly tardy restrictive monetary policies are what risks prolonging the duration of inflation-stimulated duress Americans at this point continue coping with; although their ability to do so is limited.

We've already had a few rate hikes; inflation remains a problem; but maybe a majority of the pain is behind; even as the Fed (and knee-jerk reactions) tend to suggest otherwise. Powell has to be hawkish in his 'tone'; and that's what the market responded to on Friday. Certainly market 'belief' in the Fed, along of course with 'don't fight the Fed' mentality; limits upside; but as expected.

It is also what can take us... with their blunt instruments... into a softer Fall. In all candor, rebound or not ahead of Labor Day; and shakeout thereafter, it will all be tied to perceptions regarding Fed policies, even if it's really exogenous factors like inflation and climate extremes that are more seriously impacting.

That even ties to the staunch policies of the Fed minimizing inflation's triggers being wages, Oil, drought and war. Of course the Fed overstaying low rates in the late stages of the pandemic, allowed the wage-price spiral to get going. In a way the Fed approach now is a giant mea-culpa for being behind the curve.

Also, the world is 'not' de-Dollarizing; even as some proclaim; although China and Russia (indirectly a couple co-conspirators if you will) are pushing agenda policies in that direction. However the persistent strength in the U.S. Dollar as a result of an economic mess in Europe as they cope with climate and energy issues, only partially related to the war, makes it hard for Europe to trade with the U.S.. As a majority of multinationals derive over half their revenue abroad, this really matters to earnings for this year's 2nd half; more so than the Fed.

Friday Chairman Powell's claws indeed drew on memories of Paul Volcker; a reflection on policies I've shared for many weeks. So, I don't know why stocks are so 'pained' by this (or Apple); since both were already known. A 'resolute' stance on Powell's part was a given; although he could have moderated a bit on the pace of inflation (he stuck with his 2% target; absurd barring 'demand destruction', which is what he seems to be promising (even if not delivering).

Bottom line: Chairman Powell showed his (bearish in Jackson Hole) claws; by making it clear fighting what is significant inflation is not merely ongoing as a mission; his overwhelming priority almost regardless (for now anyway). So a soft-landing is less the goal than defeating inflation; and that's problematic.

Also problematic is his nearly-dismissal of global economic pressures which a monetary policy cannot significantly address like normal times; because of the war in Ukraine (hence impact on Europe in a broad way due to Energy crisis); and overriding all of this remains the 'extremes' of drought in Climate Change.

There's some bifurcation in markets, QT (Quantitative Tightening) is starting in the coming week or so; and basically the Fed is telling you that things will be tougher regardless. Hence, no change in our September risky outlook. So Wall Street goes back to what we never departed from; aside the interim rally largely based on short-covering and FOMO fund buying. All along expecting it to be exhausting; and even if we get another rebound, it too should be interim in nature; and fail way below the recent targeted high at the 200-Day Moving Average for the S&P.

More By This Author:

Market Briefing For Thursday, Aug.25

Market Briefing For Tuesday, Aug. 23

Market Briefing For Monday, Aug. 22

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.