Market Briefing For Monday, April 22

This year is a technology transition time. I've regularly emphasized watching 5G become a reality starting next year. There's little reason to be a first adopter of the initial devices becoming available this year.

So we want to see the market coalesce a before dropping dollars both on stocks (or on devices) that may or may not be useful to you as yet. At the same time, by the time 2nd or 3rd generation 5G hardware and services (more efficient and reliable) are out, most stocks will already have advanced and discounted that (as investors sort-out 'winners').

Friday we heard that Apple is paying Qualcomm a high $9 royalty per iPhone (or at least more than the $7.50 they disputed originally). If in fact that's true, and especially if they paid a few Dollars per iPhone for other patent royalties; then you 'could' have a $5-6 Billion windfall for Qualcomm resulting from the global litigation settlement.

A subtext to this settlement might be how important (perhaps why they caved) Apple sees 5G technology to the future. 5G seems set to drive a second tidal wave of change; as you know; way beyond smartphone or other devices. Next-gen wearable computing; contextually-sensitive voice-interfaces; smart cars; connected health services.. all soon will be relying on 5G. And that's regardless of the controversial nature of microwave or RF interference or ramifications, which are out there (a correlation with crowd-suppression control by sounds on frequencies in that range is occasionally heard; because a US Army weapon used for crowd dispersion as far back as Iraq is cited). However, whether or not there is valid concern about 'big brother' with 5G on utility poles is not our focus for now; but rather the constructive broad applicability.

Speaking of AT&T, there is a big story not covered that I'm aware of. One key reasons DirecTV (conventional satellite) has continued to survive, is 'Sunday Ticket'; as AT&T has a lock on it. As I have said (remains the case); DirecTV Now (the streaming service), has at least a better chance for eventual success, 'if' they migrate the services together (essentially ending satellite delivery; or making it a pricier stepchild for rural or even foreign language customers).

Recent AT&T moves have been odd; reducing the channels offered by DirecTV Now (referred to as DTVN), while increasing prices to newer customers (even as they again offer a free Apple TV 4k with prepaying of 4 months service this time); and with poor channel lineup changes.

Now AT&T announces they're pulling the NFL Network from DirecTV Now and older basic U-verse TV. This comes as AT&T and the NFL are in talks over changes to NFL Sunday Ticket with a possibility that the NFL will pull back rights to NFL Sunday Ticket from AT&T. Now the Sports Business Daily reports AT&T never told the NFL they planned to drop the NFL Network. According to SBD this could be a last-ditch attempt by AT&T to keep the NFL Sunday Ticket bundled with AT&T's TV services (NFL Network is 'not' the same as Sunday Ticket).

So we will have to wait and see if this is a sign that NFL Sunday Ticket contract with AT&T is ending. We do know NFL Sunday Ticket will still be on DirecTV this year. Any changes will have to wait until the start of the 2020 football season. For now, what we see is NFL either serious about moving away from DirecTV as sole provider of Sunday Ticket or perhaps actually pressing for it to be on DirecTV Now (as opposed to a knee-jerk reaction the 'NFL Network' channel remove hinting just the opposite. I've been hinted at about AT&T new 'streaming' (thinking the combination package which makes DTVN and DTV one product with a streaming-delivery focus) announced as soon as next month.

If they'll do a deal with the NFL that covers all AT&T video distribution methods that could also tie-into this. Ultimately we think it's essential AT&T (with the widest distribution means of a single vendor) not only retain their 25-year NFL relationship; but offer Sunday Ticket, not only on the legacy (and fading) satellite service, but DirecTV Now (or what will possibly just be 'DirecTV' as hinted at by the loss of the 'Now' word on 'beta' boxes being distributed for those desiring conventional cable style interfaces (strictly Over-The-Top video streaming input). If AT&T offers 'Sunday Ticket' on DTVN as a 'premium' product (similar to the movie channels other than HBO, which is normally included) or even as an 'app', where your AT&T DTVN credentials create auto-sign-on if subscribed (similar to HBO GO, which accepts the DTVN credentials), they have a potentially golden product. My hunch is something like it; but as a generally-combined single service (DirecTV stream), with the low-end of distribution covered by advertiser-supported streaming in a 'AT&T TV' or 'Watch' service, such as low-end wireless customers can opt for now. (The higher-end get a discount on DTVN with free HBO.)

In-sum: As to Apple / Qualcomm.. Qualcomm has won a big victory. Not only will it see billions in incoming payments, but knocked-out competitors like Intel from the business. Eventually Apple may pursue a different (in-house or by acquisition or merger) 5G modem chip source, but for now will rely on Qualcomm; and might surprise later, with a 'premium' 5G-capable iPhone before waiting for late 2020. That's just a hunch. Of course Apple is also working to integrate its own ARMS-licensed MAC chip; aside iPhone processors; and has a history of disdaining any reliance on outside chip providers; as this saga just evidenced again (hearkening back to the old days of Motorola & IBM chips).

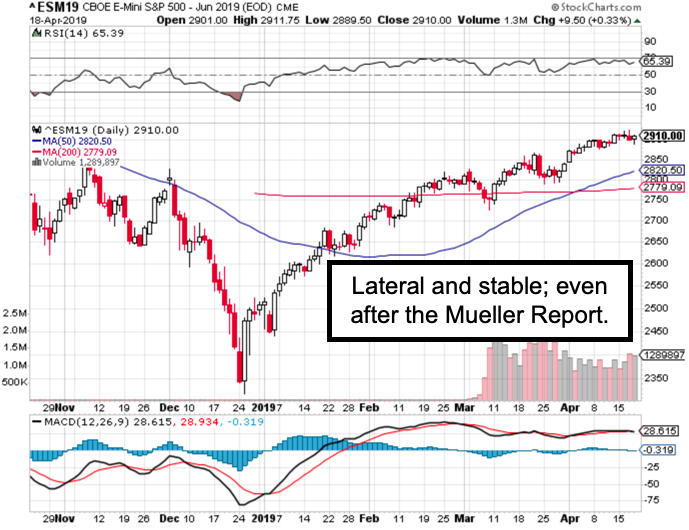

Conclusion: Not finding any American actually conspiring with Russia (meeting or not) is great; but leaves Congress with the oblique 'non-corrupt' intent debate, which of course is media fodder, but that's all it is.. for now.

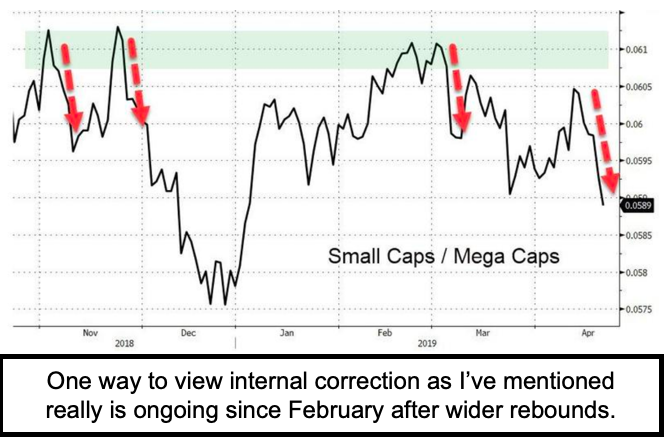

Market summary: while we certainly are open to 'corrections' and of course briefer 'pauses to refresh', we're not in the growing camp that's still pretending a slowdown didn't begin just over a year ago, rotating a lot through sectors (some of that still ongoing). So as they see a Cloud of poor earnings quarters looming; we see a struggling economy likely forming a trough this year; with a possible 'silver lining' next year.

Now of course there are risks; especially should a 'China trade deal' in the near-term not transpire. The political ramifications are still 'fluid' as you know how Nadler and others will be pushing-back against Barr's interpretation of the Mueller Report; and you don't know if that leads to anything 'heavier', although even Nancy Pelosi wisely knows better. In the meantime it's a stretched market with expensive leadership; and a generalized time of flux, given 'buyback quiescence' during earnings report time. Stocks are so high (the leaders) that 'profit-taking' isn't so unusual on good earnings; plunges on misses; and small companies that are already corrected, erode only a bit and then stabilize. News sensitive market in every way; especially regarding trade.

The Apple Qualcomm deal is a marriage of convenience more than anything long term or stable. They both didn't want the risk of a drawn out court battle and having to morph their business around each other at great cost. That said, they both will be looking for alternatives and they both are not fair players. Expect war to emerge again once one finds out the other doesn't need them.

Well said.