Make Copper Expensive Again: The Trump Tariff Effect

Image Source: Pexels

In our analyses, we regularly examine current movements, identify possible influencing factors, and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

What was the hottest topic in the financial markets this week? Trump's tariffs. And what about next week? You guessed right, it will be Trump's tariffs again in all likelihood.

The market is now pretty certain that copper will also be affected by the import tariffs -- and sooner than expected. Is this a clever idea? Well, yes, this would make the brown metal more expensive, but that seems to be the lesser evil for the Trump government. It's better to have an expensive copper than no copper at all.

The real problem, however, lies deeper: the approval procedures for the US mining industry now resemble a jungle of regulations and requirements. It now takes an average of 29 years from discovery to production of a new mine. According to S&P Global, this is the second longest lead time in the world after the African country of Zambia.

Without a secure copper supply, Silicon Valley and Co. can bury their ambitious tech projects - be it for AI or data centers - right away. Even the green energy transition will remain a distant dream if the crucial metal is missing. Grand visions are pointless if the raw materials are missing.

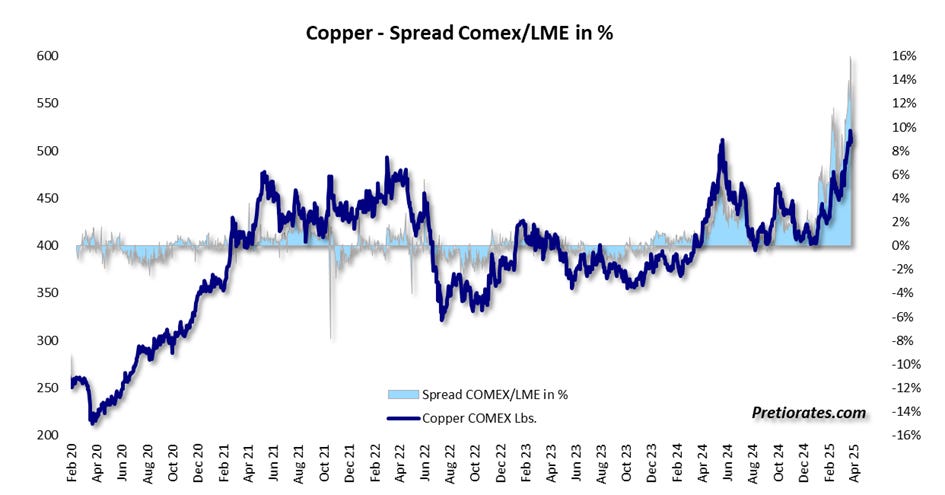

We can already see how quickly markets adapt: Copper is rapidly moving from London to the US. If Trump actually implements the threatened 25% import tariff - and this is very likely - copper will soon be exactly 25% more expensive in the US. The market has long since reacted to this: On the New York Stock Exchange, copper is already trading over 15% higher than on the London LME.

(Click on image to enlarge)

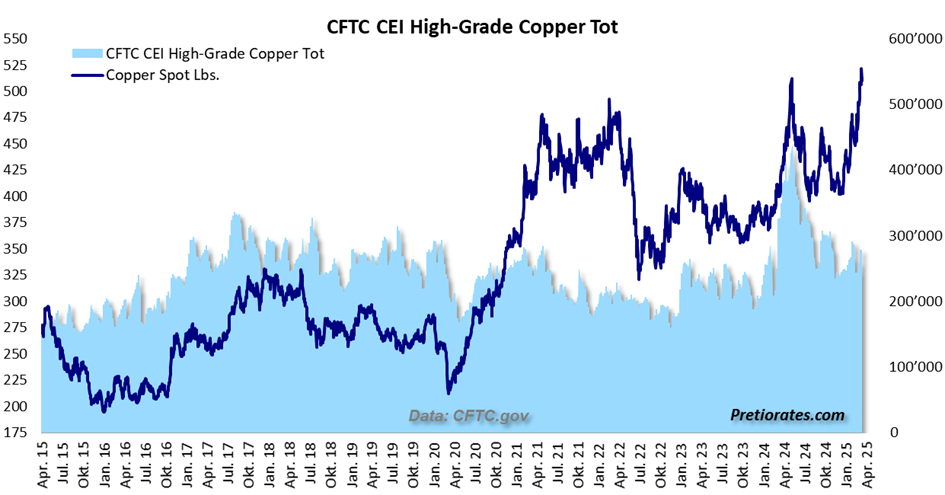

We already experienced a massive price rally a year ago. At that time, the rally was due to supply bottlenecks. But while investors (non-commercial) made a lot of money back then, their influence appears to be largely absent this time. The recent price increase is happening without their involvement, which is an unusual phenomenon.

(Click on image to enlarge)

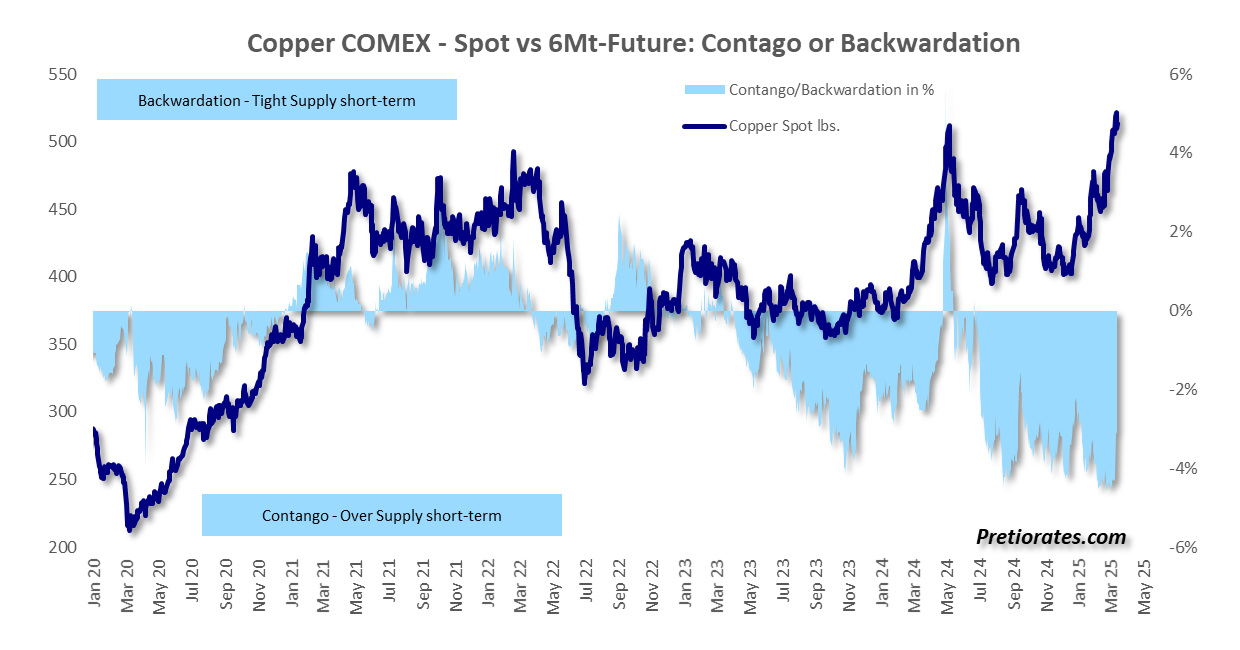

Normally, price spikes like this occur when a product becomes scarce. Then the spot market prices exceed the longer-term futures -- a situation known as “backwardation.” And, historically, this has been the case every time copper prices have risen. But what about now? That's not the case this time.

(Click on image to enlarge)

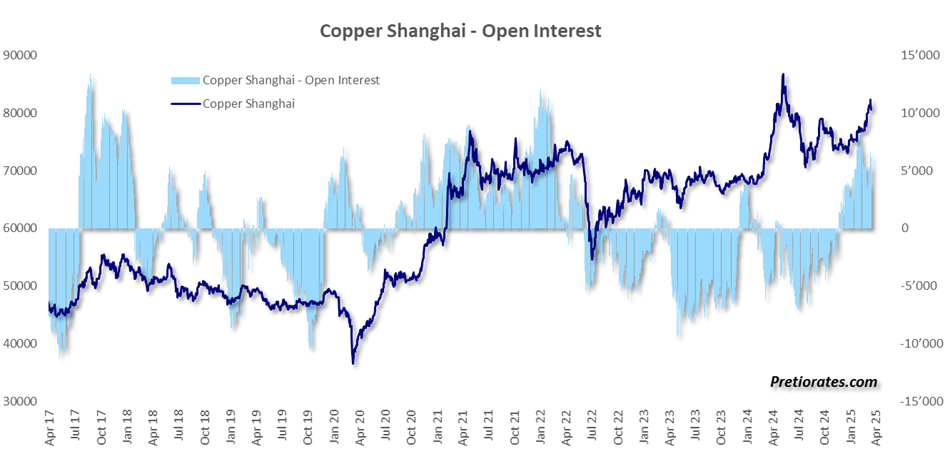

For years, China has been responsible for more than half of global copper demand. Recently, however, the economy there has been rather weak, and demand has been correspondingly lower. But, since the beginning of the year, there has been a turnaround. The number of open copper contracts on the Shanghai Metal Exchange has suddenly risen massively.

(Click on image to enlarge)

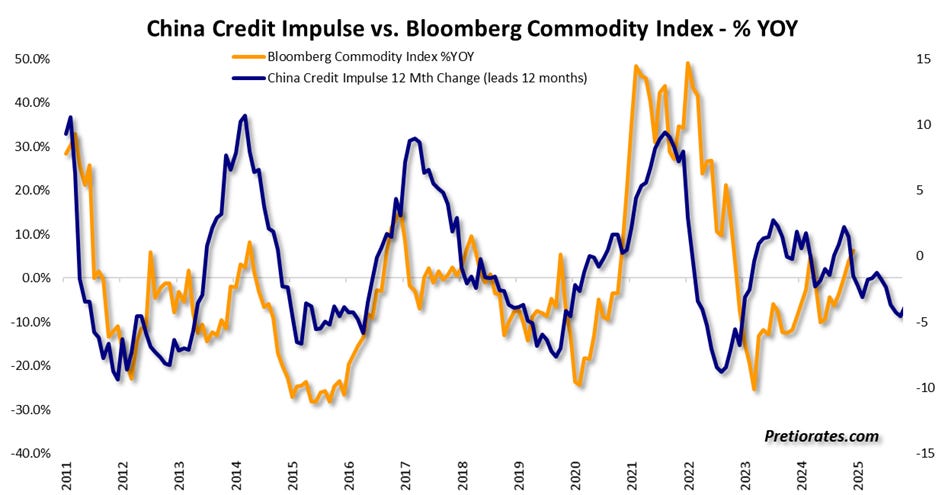

This is particularly exciting because China's credit impulses - an indicator of future industrial activity - do not actually point to increased demand. Past experience shows that if the number of loans increases, industrial demand picks up in around 12 months. And as industrial demand increases, the price of copper also rises.

(Click on image to enlarge)

Conclusion

The US mining industry is struggling with massive regulatory hurdles. In less than two months, the import tariffs imposed by US President Trump have already led to companies making commitments worth almost $2 trillion for new production sites in the US.

However, the mining industry needs less bureaucracy. If nothing changes, the US will have to continue importing large quantities of copper. If China also gains more economic momentum, the copper market will likely become even more exciting.

Remember, we are not making any recommendations for investments. We are just giving you ideas for your own analysis and decisions. Do your own due diligence. We wish you success in your investments.

More By This Author:

Gold Is King, But Silver Could Now Become The ChampionHow Sharp Are The Bears' Claws?

Are The Bears Waking Up From Their Hibernation?

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more