Gold Is King, But Silver Could Now Become The Champion

Gold has easily broken through the 3000 mark and has been consolidating just above it for a few days now. The fact that the price did not fall back below it can be interpreted as a sign of strength.

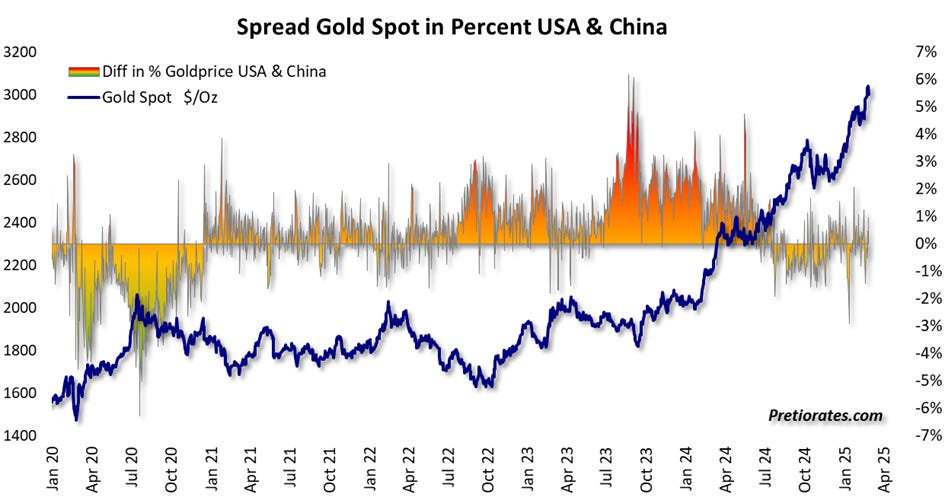

As always, however, we distinguish between trading in the western hemisphere, which is strongly dominated by paper Gold. This includes futures, ETFs and all structural financial products. In eastern trading, especially in India and China, the focus is more on the physical metal. Accordingly, buyers and sellers behave differently.

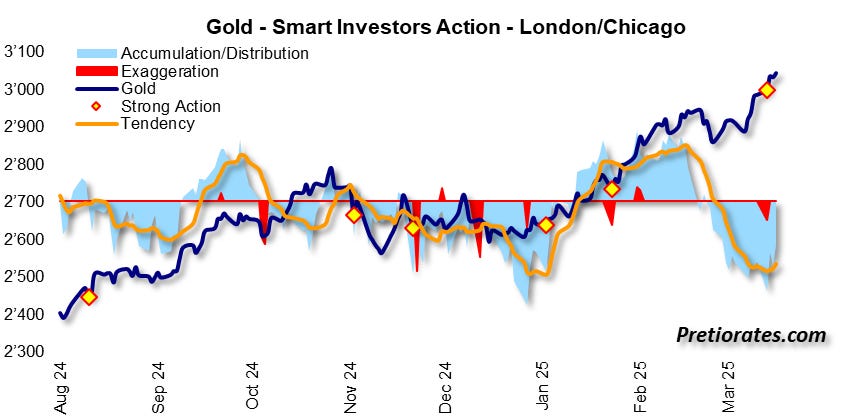

If we observe the smart investors action in London and the US, they have recently distributed massively in the rising market...

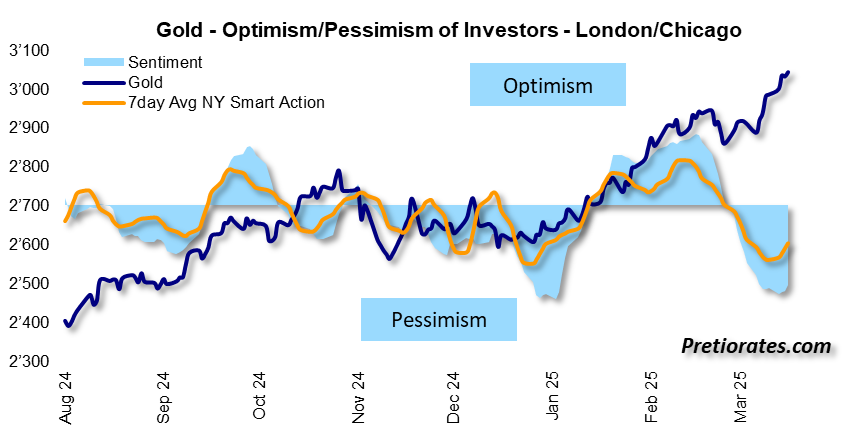

Surprisingly, the market showed not optimism but deep pessimism. Western investors do not believe in a further rising Gold price...

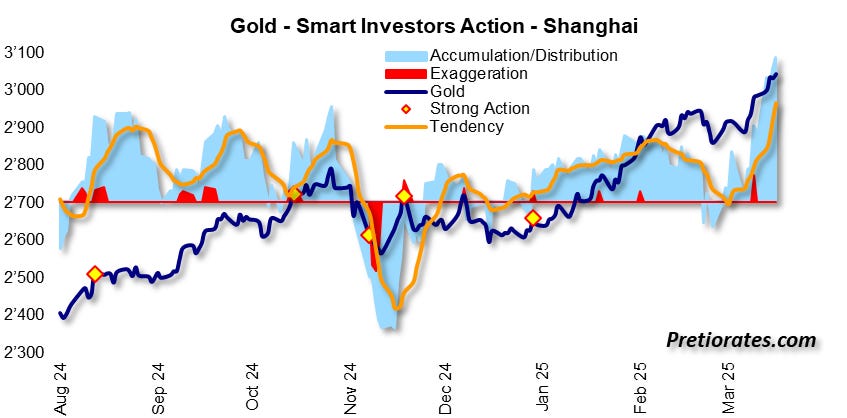

In contrast, smart investors in the eastern markets have accumulated massively. And this to an extent that we have not seen in the last 10 months...

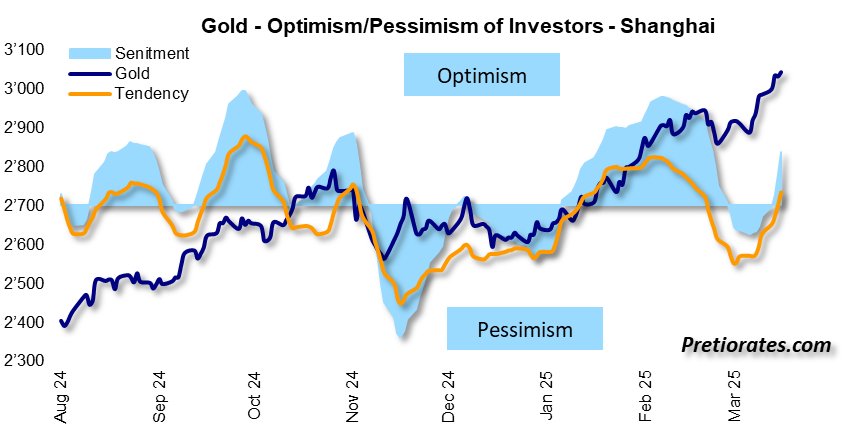

During the consolidation of the last few weeks below the 3000 mark, sentiment also showed a slight reluctance, but this has since turned into optimism again...

However, the market price still does not reflect a premium to trading in the West. Purchases in India and China are therefore being made cautiously and patiently...

The premium in Silver trading has also fallen sharply recently. Currently, a premium of around 5% is still being paid for physical Silver in China – in contrast to over 15% a year ago...

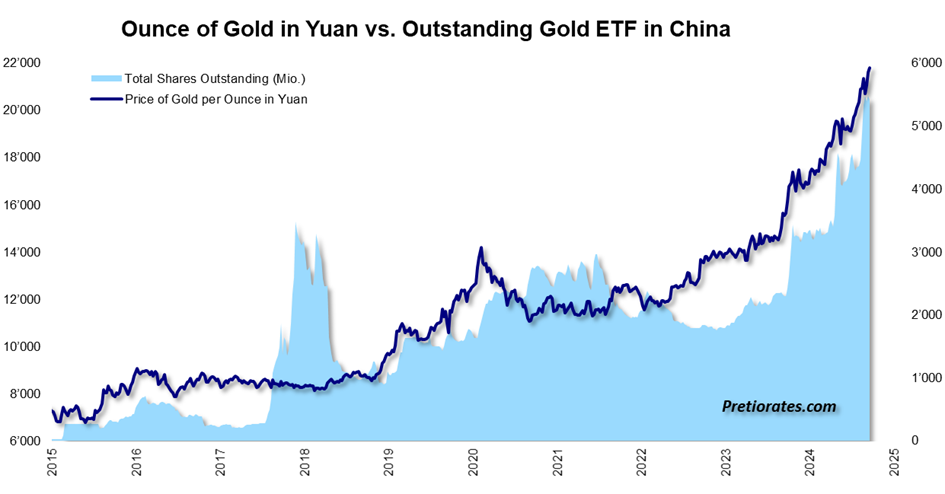

In China, too, it is now possible to invest in Gold via ETFs. Interest continues to skyrocket.

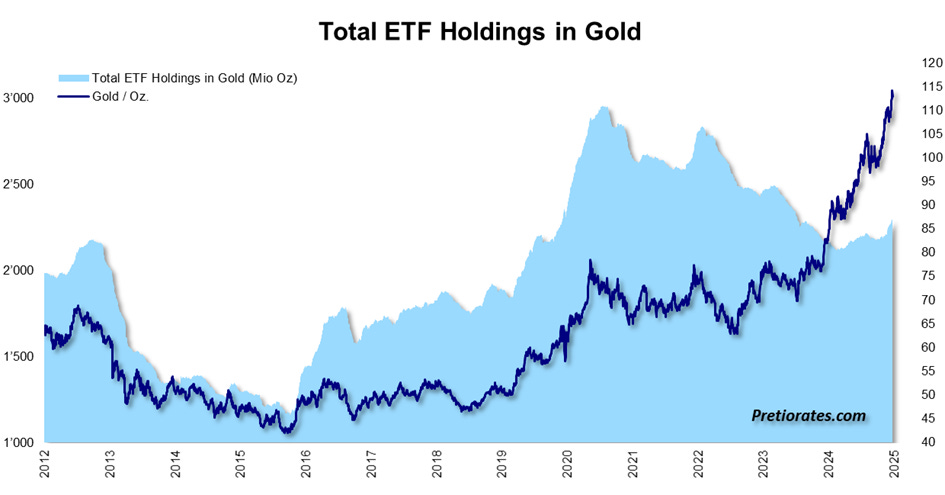

By contrast, the number of outstanding ETF certificates in the West is only just beginning to recover. There is still a lot of catching up to do!

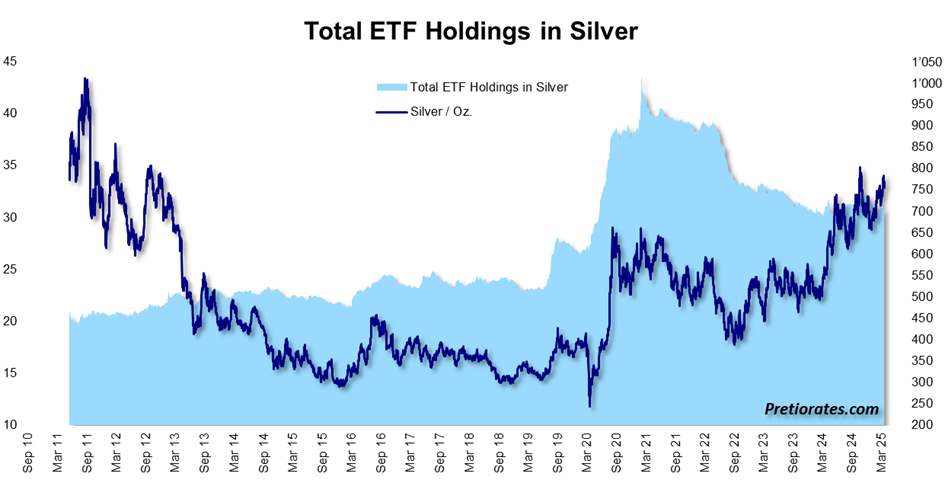

By contrast, the Silver ETFs are still totally sluggish and there is no new interest...

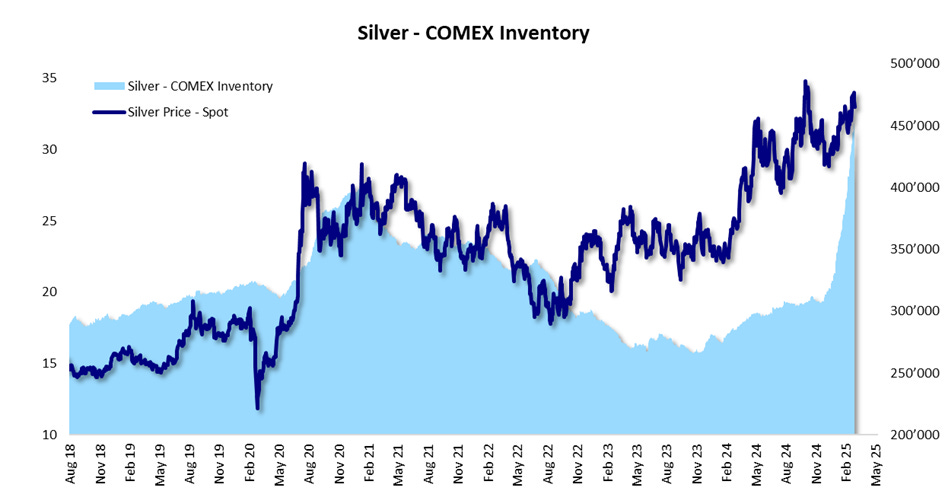

And as you have probably already noticed: COMEX imports all available Gold and Silver from the LBMA-Vaults in London. While Gold imports continue to rise, albeit at a slightly slower pace, the pace of Silver imports appears to be accelerating...

This is also reflected in the lease rate that investment professionals pay for leased Gold. This recently fell to a more usual level of 0.16%... In Silver trading, the lease rate is still more than 5%. The scarcity of available physical Silver is thus accentuated...

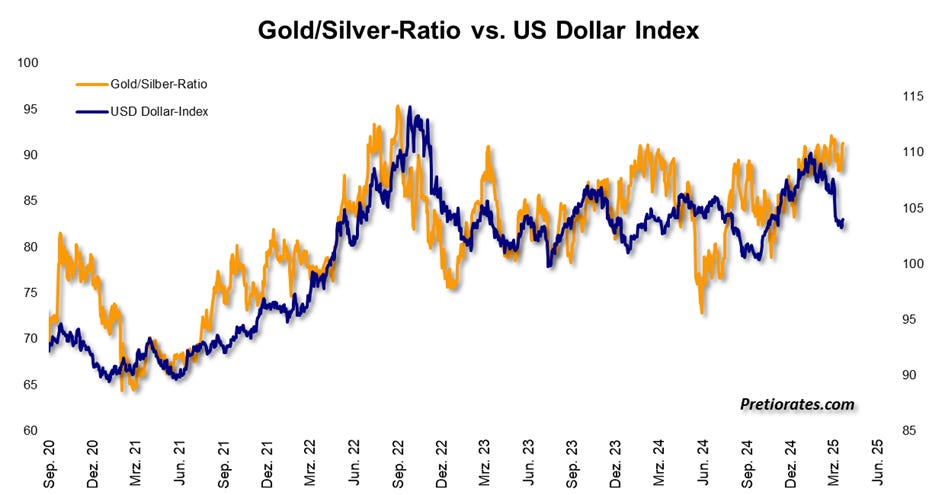

There is a very high correlation between the US Dollar and the Gold/Silver ratio, as Silver is also classified as an industrial metal. A stronger economy brings a stronger US Dollar with it – but also a better performance by Silver than by Gold due to the higher demand... The current comparison suggests that the Gold/Silver ratio should fall. This would mean that Silver would outperform Gold...

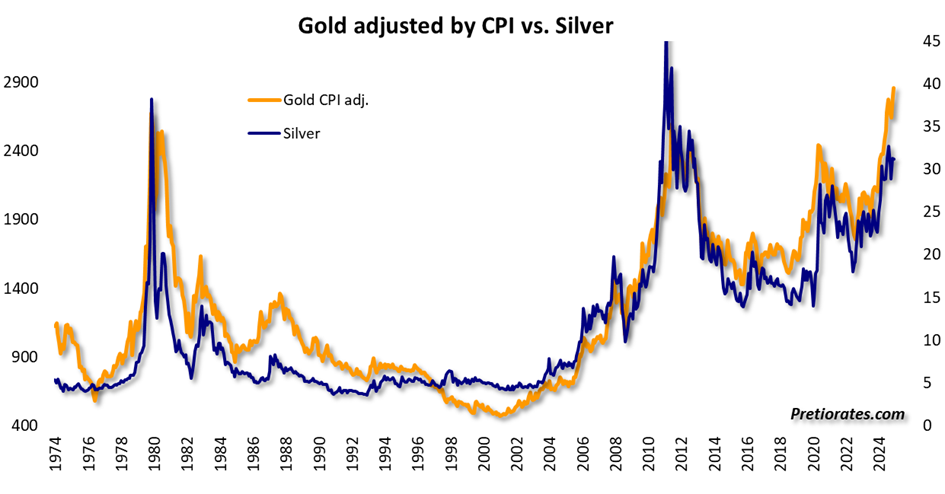

Tavi Costa (https://x.com/TaviCosta) also showed that there is a high correlation between the Gold price adjusted for the consumer price index and the Silver price. According to this comparison, the Silver price should rise towards USD 40.

Conclusion:

Even though Gold has broken through the 3000 Dollar mark, investors in Asia continue to be big buyers in the market, although interest has shifted from professionals to private investors. In the West, investors are only waking up and there seems to be a lot of catching up to do. But while Gold is clearly the king, Silver could become the champion in the coming weeks.

More By This Author:

How Sharp Are The Bears' Claws?Are The Bears Waking Up From Their Hibernation?

No Love For The Gold Miners

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more