Major Asset Classes Performance Review - March 2024

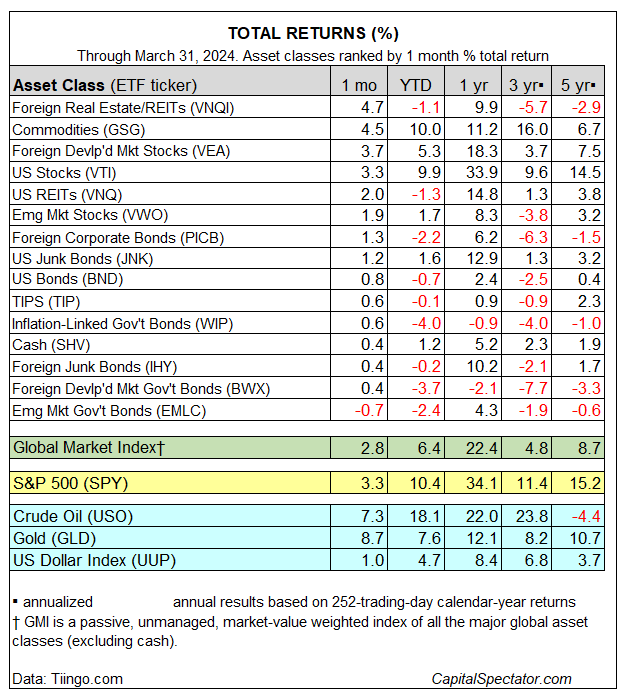

The rally in global assets broadened in March, lifting nearly every slice of the major asset classes. The downside outlier: bonds in emerging markets. Otherwise, last month delivered a clean sweep of gains, based on a set of ETFs.

Global real estate ex-US (VNQI) topped the long list of winners in March, rising 4.7%. The strong advance marks a rebound for the Vanguard ETF after two monthly declines.

Commodities (GSG) and stocks in developed markets ex-US (VEA) and America (VTI) enjoyed strong gains in March too. The lone loser: bonds issued by governments in emerging markets (EMLC), which shed 0.7%, the third straight monthly loss for the fund.

Year-to-date results, by contrast, reflect a mixed profile for global assets. Commodities (GSG) and US stocks (VTI) are reporting strong gains so far in 2024, but there’s plenty of red ink for the year, led by a 4.0% decline in inflation-linked government bonds ex-US (WIP).

The Global Market Index (GMI) extended its winning streak for a fifth straight month in March, rising 2.8%. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios. Year to date, GMI is proving to be a tough act to beat and is currently outperforming everything except commodities (GSG) and US stocks (VTI).

GMI’s one-year performance is also strong, topping 22% through the end of March. US stocks (VTI) are even hotter, rising nearly 34% over the past year. Meanwhile, the US bond market (BND) continues to hold on to a modest 2.4% rise over the past 12 months.

More By This Author:

Floating-Rate And Junk Bonds Lead Fixed Income So Far In 2024Negative Equity Risk Premium Estimates Persist For US Equities

Hope Springs Eternal, Again, For Small-Cap Equities

Disclosure: None.