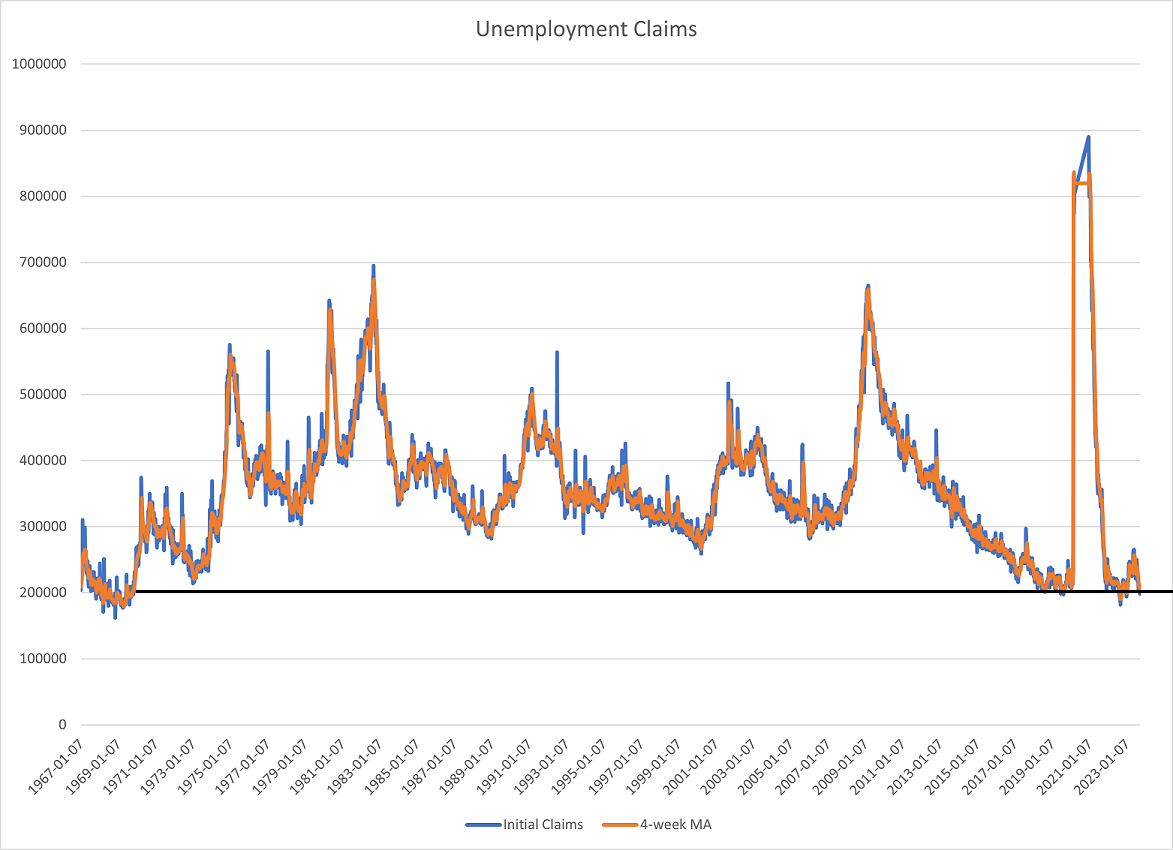

Macro - Initial Unemployment Claims

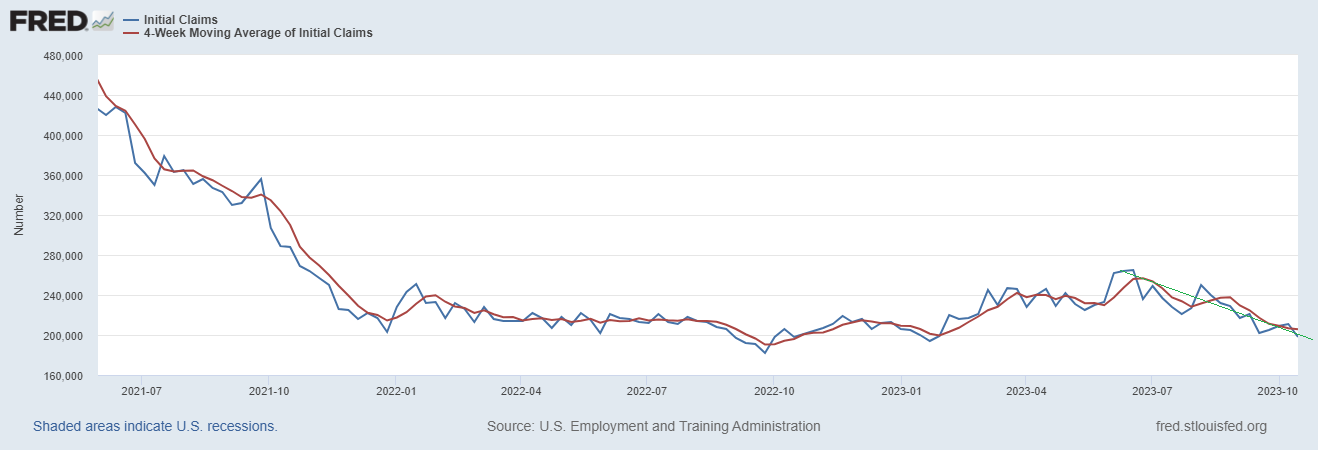

As a weekly number, this is your leading indicator for employment and it just broke below 200,000 again after a recent peak of 265,000 in early June. It continues to be historically fantastic, better than about 95% of history going back to 1967. Btw, I did remove some of the data from 2020, the unprecedented jump in claims to close to 6,000,000 messes up the chart too much.

(Click on image to enlarge)

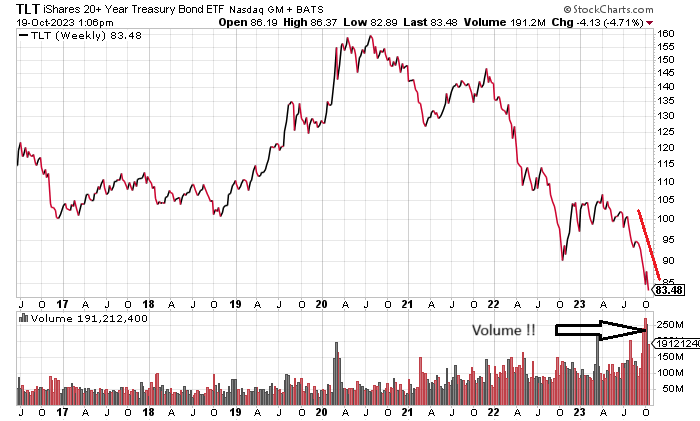

It’ll be interesting to see what the Fed does with interest rates on November 1. Fed Funds are currently giving a rate hike only a 4% chance. It may be more interesting to hear what they say if they keep rates steady despite their dual mandate data indicating there’s still work to be done. Wage growth is currently 5.2% (trending lower), employment continues to expand, inflation is well above 2% and oil remains in an uptrend. The Fed may feel they don’t need to raise the short end anymore because longer dated interest rates have risen over 150 basis points since April 3.3% to 4.9%. I did hear an interesting quote yesterday from Economist and former Dallas Fed Advisor Danielle DiMartino Booth. She was commenting on the Fed pausing hikes, what that signals about their vigilance in fighting inflation given recent data and the recent rise in longer term interest rates (drop in bond prices). “If you’re not going to fight inflation, then we don’t want your bonds.”

![]()

More By This Author:

Macro: Housing Starts

Macro: Sept Industrial Production

The Happiest Workers Are 65 And Older

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more