Looking For Risk-On Signals

Mr. Market doesn’t explain himself, but he does drop clues about preferences. Interpretation is mostly art, but it can be worthwhile when there are clear signs of trend changes. One approach for monitoring such events is comparing ETF pairs.

Let’s start with the big picture via a set of aggressive (AOA) and conservative (AOK) asset allocation ETFs. Based on data through yesterday’s close (Jan. 10), this pair suggests that the risk-off bias rolls on, although there are hints that a consolidation phase is replacing a bear-market phase, which may be a set-up for a return to risk-on in the near future.

For the US bond market, however, the trend still looks conspicuously risk-off via medium- (IEF) vs. short-term (SHY) Treasuries.

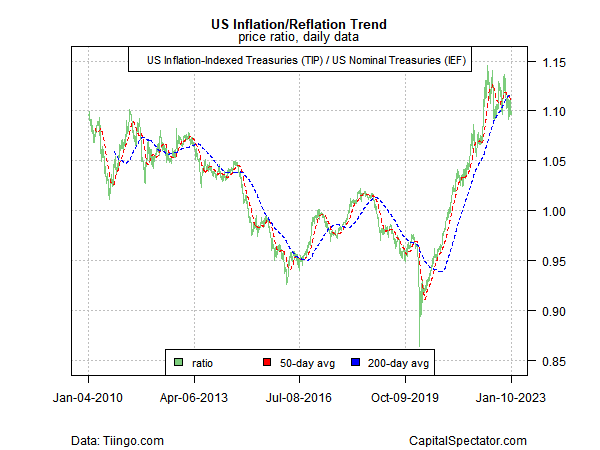

The reflation trend, on the other hand, appears to be peaking, based on the ratio for an inflation-indexed Treasuries ETF (TIP) vs. nominal Treasuries.

Meanwhile, there’s been a sharp change lately in favor of developed-world equities ex-US (VEA) vs. American shares (VTI). Is this an early sign that foreign equities are due to play catch-up to US stocks?

Within the US equities market, risk-off continues to show strong persistence in terms of the broad market (SPY) vs. low-volatility stocks (USMV).

Finally, US value stocks (IWD) continue to rebound relative to growth stocks (IWF), reversing a long-running dry patch for shares that trade a comparatively lower valuations.

More By This Author:

The US Dollar’s Influence On The Stock Market Isn’t TrivialGlobal Markets Rally In First Trading Week Of 2023

Book Bits: 4 Books For The Investor's Bookshelf

Disclosures: None.