Global Markets Rally In First Trading Week Of 2023

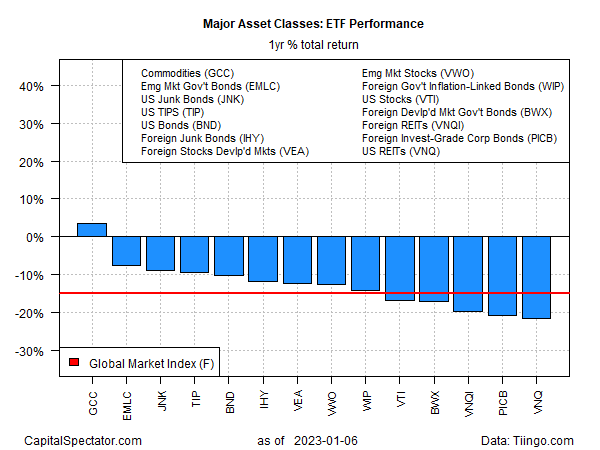

Nearly all the major asset classes posted solid gains in the kickoff to the new year, based on a set of proxy ETFs. The lone exception: commodities.

Image Source: Pixabay

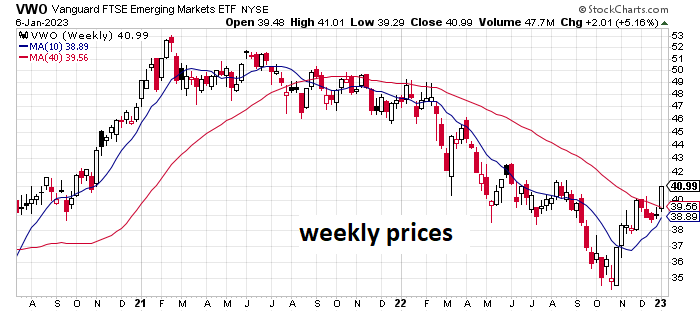

Stocks in emerging markets led the way higher for the trading week through Friday’s close (Jan. 6). Vanguard Emerging Markets Stock Index Fund (VWO) surged 5.2%, rising to its highest close since August.

“Valuations [in emerging markets] have been depressed for a long time and they were due for a correction but the real catalyst for the outperformance was the dollar weakening and China coming back online,” says Aneeka Gupta at Wisdomtree UK Ltd. in London.

The rest of the main buckets of the major asset classes rose last week – with the exception of commodities. WisdomTree Enhanced Commodity Strategy Fund (GCC), which holds a broad set of commodities, traded down 3.1%, falling to the low end of its narrow trading range of recent months.

The Global Market Index (GMI.F), an unmanaged benchmark maintained by CapitalSpectator.com, rebounded 2.1% in the opening week of 2023 – the first weekly gain in the past five. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

Despite last week’s broad-based rallies, most of the major asset classes continue to suffer losses for the trailing one-year window. The exception: commodities via GCC, which closed up 3.4% on Friday vs. its year-ago price.

GMI.F’s one-year performance is negative, posting a 15.0% slide.

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for most markets around the world. The softest drawdown at the end of last week: US junk bonds (JNK) with a 10.0% slide from its last peak.

GMI.F’s drawdown: -16% (green line in the chart below).

More By This Author:

Book Bits: 4 Books For The Investor's Bookshelf

Upbeat Q4 GDP Nowcasts For US Conflict With Recession Warnings

Total Return Forecasts: Major Asset Classes

Disclosures: None.