Upbeat Q4 GDP Nowcasts For US Conflict With Recession Warnings

Image Source: Pexels

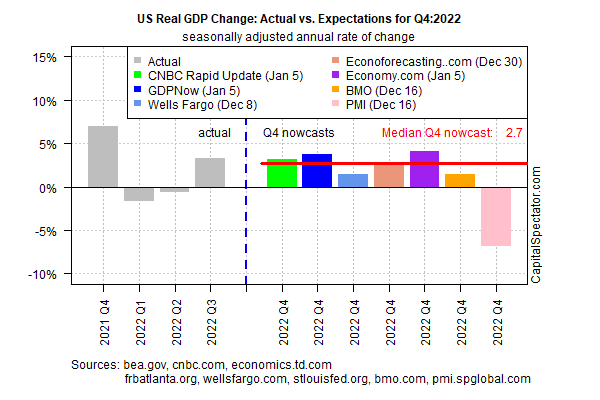

Several estimates of fourth-quarter economic activity for the US have turned higher recently. These improvements clash with ongoing recession forecasts, but for the upcoming Q4 report, the outlook remains positive, based on a set of estimates compiled by CapitalSpectator.

The US economy is expected to increase 2.7% in the final quarter of 2022 (seasonally adjusted annual rate) via the median nowcast for the release scheduled for Jan. 26 from the Bureau of Economic Analysis. If correct, output will slow modestly from Q3’s 3.2% reading.

The odds that a recession has started, however, remain low, according to the current nowcast. Yet many forecasters remain gloomy for the year ahead, even though recent nowcasts suggest that 2022 ended with a moderate tailwind blowing.

The main exception to the upbeat estimates in the chart above: US Composite PMI, a GDP proxy that continues to post a sharp decline in December.

“The latest data indicated a strong decline in private sector business activity, with output falling at quicker rates in the manufacturing and services sectors,” reports S&P Global in yesterday’s release. “Driving the fall in output was a sharper contraction in new business. The decrease was the fastest seen since May 2020 amid a broad-based downturn in client demand.”

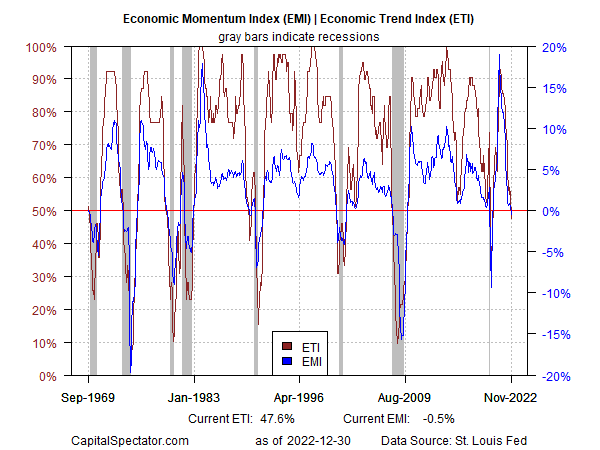

PMI’s weak profile of economic activity in Q4 aligns with a similar reading for the Economic Trend Index and Economic Momentum Index, a pair of business cycle benchmarks updated in The US Business Cycle Risk Report. The latest numbers for ETI and EMI indicate that economic output contracted slightly in November – a slide that’s projected to extend and deepen in December and January.

Even if Q4 turns out to be stronger than some nowcasts suggest, headwinds are still blowing for the near-term outlook.

“Under almost any scenario, the economy is set to have a difficult 2023,” predicts Moody’s Analytics chief economist Mark Zandi in a report published earlier this week. “But inflation is quickly moderating, and the economy’s fundamentals are sound. With a bit of luck and some reasonably deft policymaking by the Fed, the economy should avoid an outright downturn.”

More By This Author:

Total Return Forecasts: Major Asset ClassesFed Pivot Watch - Thursday, Jan. 5

Major Asset Classes December 2022 Performance Review

Disclosures: None.