Liquidity Tightens Just As The World Needs More Dollars

U.S. economic policy is moving in contradicting ways as the Fed tapers off from its bond-buying program at a time when the United States and the world in general needs more USD liquidity. These opposing conditions are now being felt globally, especially in the emerging markets.

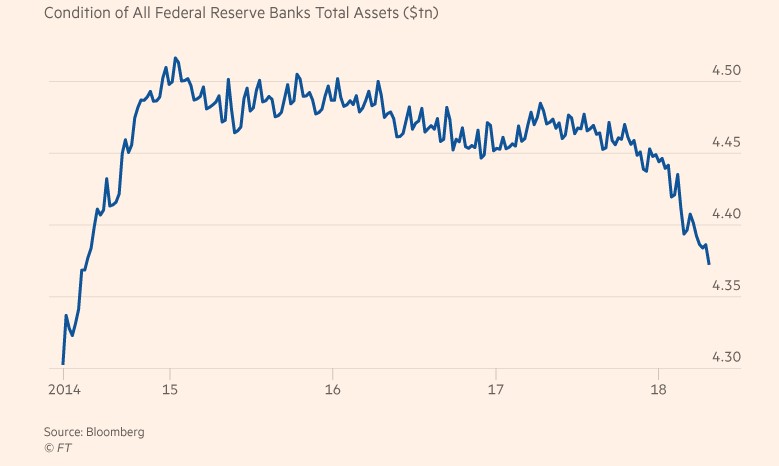

Readers will recall that the Bernanke Fed argued for quantitative easing as a means to lower long-term yields, thereby pushing investors into riskier assets. As a by-product, QE also resulted in increased commercial bank reserves/deposits. The financial system was flush with liquidity and this spilled into the equity and debt markets at home and abroad. Quantitative easing increases the money supply in the banking system for lenders and lowers interest rates for borrowers, spurring growth in business and consumer spending. At the height of the bond-buying program, the Fed’s balance sheet exceeded $4.5 trillion, up from around $800 billion at the start of the program (Figure 1).

Figure 1: Fed Balance Sheet

Although the Federal Reserve maintains a large balance sheet, it has now shifted towards buying a lot fewer Treasuries. Balance sheet reduction has now begun in earnest. The Fed is withdrawing liquidity at the same time as it is raising the cost of borrowing.

While this unwinding program continues, the U.S. Treasury has increased its issuances of new debt in response to the rising deficit level of the federal government. This coincides with the US Treasury projecting the sale of an extra $1.3tn of debt this year to help finance the addition to the nation’s debt load. The passage of the tax reform bill in January has widened the federal deficit; however, domestic savings is too low to finance the growing deficit. Americans must turn to their international trading partners who have USD reserves to buy Treasuries. China and Japan, for example, run current account surpluses with the United States and are the primary purchases of US Treasuries internationally. The connection between the trade surpluses and U.S. capital inflows seems not to be understood by many Trump advisors.

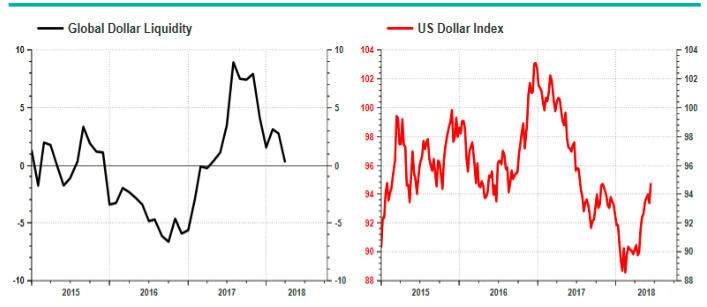

The upward movement in the USD index (Figure 2) since March is now taking its toll on emerging markets. Turkey, Brazil, South Africa, India and Argentina, for example, have had to counter double-digit currency depreciation by raising domestic short-term interest rates. More importantly, these countries are heavy borrowers of dollar-dominated debt which now becomes more expensive to service. At the same time, as trade protectionist policies spread, these nations must generate current account surpluses to provide dollars to support debt levels. All in, this is an unhealthy situation and could lead to serious deflationary conditions in many emerging markets.

Figure 2: Global Dollar Liquidity and the USD Index

Source: Nedbank CIB

As William Chin of Caldwell Securities, writes:

“A Fed that is determined (for now) to raise the Fed funds rate is driving up the US dollar and inflicting hardship on Emerging Markets…. Historically, Fed Chairs liked to consider the Fed being just the central bank for the US, until things blew up globally. Powell is no exception.”We could be witnessing a slow-moving train wreck.

Thanks for your information

This is not all bad given the current administration is running a massive deficit again. The dollar strengthened which is good because the opposite would be terrible. The Federal Reserve is right to tighten liquidity to insure it can float all those new Treasury bonds at a reasonable price which is their primary job.

Two point of clarification. First,The US domestically saves too little to fund the Federal deficit. Thus the deficit can only be fully financed with dollars that are held in reserve by US trade partners who run trade surpluses with US, such as China, Japan, EU and many emerging markets. Second, The Fed takes cash out of the markets when the bonds it currently hold mature. Thus there is a demand for USD to fund deficits but at the same the supply shrinks. A stronger dollar only makes matters worse since encourages more imports and hence a higher trade deficit.( ironically, should the USD increase by, say 20%, it would negative most of the tariffs recently imposed ). It is the twin deficits--- trade and govt budget deficits--- that puts the US in a bind, a bind that will get only worse under a protectionist. If you want to see how this plays out, read the history of the Plaza Accord of the mid-1980s, and substitute China for Japan.

Agreed, however there is a concern the US dollar will erode and thus the attractiveness of US treasuries wanes making it harder to finance the deficit overseas. The US is balancing a lot of eggs here.