June ISM Manufacturing Index: Lowest In Two Years

Image Source: Pexels

On Friday, the Institute for Supply Management published its monthly Manufacturing Report for June. The latest headline Purchasing Managers Index (PMI) was 53.0, a decrease of 3.1 from 56.1 the previous month and a reading that lies in expansion territory. Friday's headline number was below the Investing.com forecast of 54.9.

Here is an exerpt from the report:

"The U.S. manufacturing sector continues to be powered — though less so in June — by demand while held back by supply chain constraints. Despite the Employment Index contracting in May and June, companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain, according to Business Survey Committee respondents’ comments.

"Panelists reported lower rates of quits compared to May. Prices expansion slightly eased for a third straight month in June, but instability in global energy markets continues. Sentiment remained optimistic regarding demand, with three positive growth comments for every cautious comment. Panelists continue to note supply chain and pricing issues as their biggest concerns.

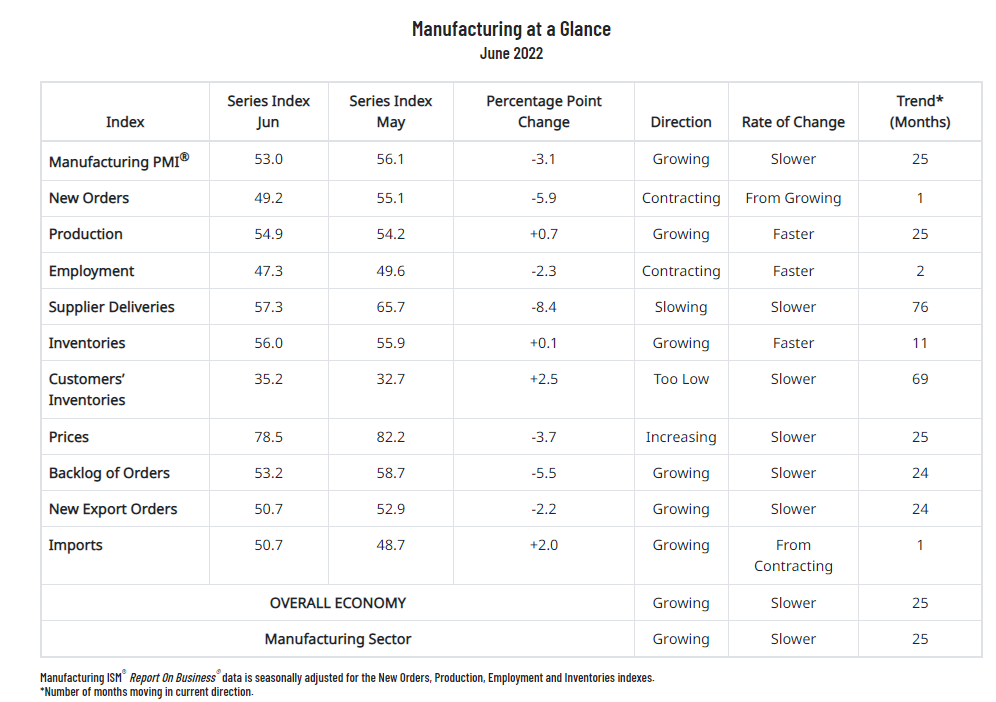

"Demand dropped, with the (1) New Orders Index contracting, (2) Customers’ Inventories Index remaining at a very low level, though it increased and (3) Backlog of Orders Index decreasing but still in growth territory. Consumption (measured by the Production and Employment indexes) was mixed during the period, with a combined minus-1.6-percentage point change to the Manufacturing PMI® calculation.

"The Employment Index contracted for the second month in a row after expanding for eight straight months (September through April), but panelists again indicated month-over-month improvement in ability to hire in June. Challenges with turnover (quits and retirements) and resulting backfilling continue to plague efforts to adequately staff organizations, but to a lesser degree compared to the previous month.

"Inputs — expressed as supplier deliveries, inventories and imports — continued to constrain production expansion but to a lesser extent compared to May. The Supplier Deliveries Index indicated deliveries slowed at a slower rate in June, which was supported by a slight increase in the Inventories Index. The Imports Index expanded in June after one month of contraction preceded by six consecutive months of expansion. The Prices Index increased for the 25th consecutive month, at a slower rate compared to May."

Here is the table of PMI components.

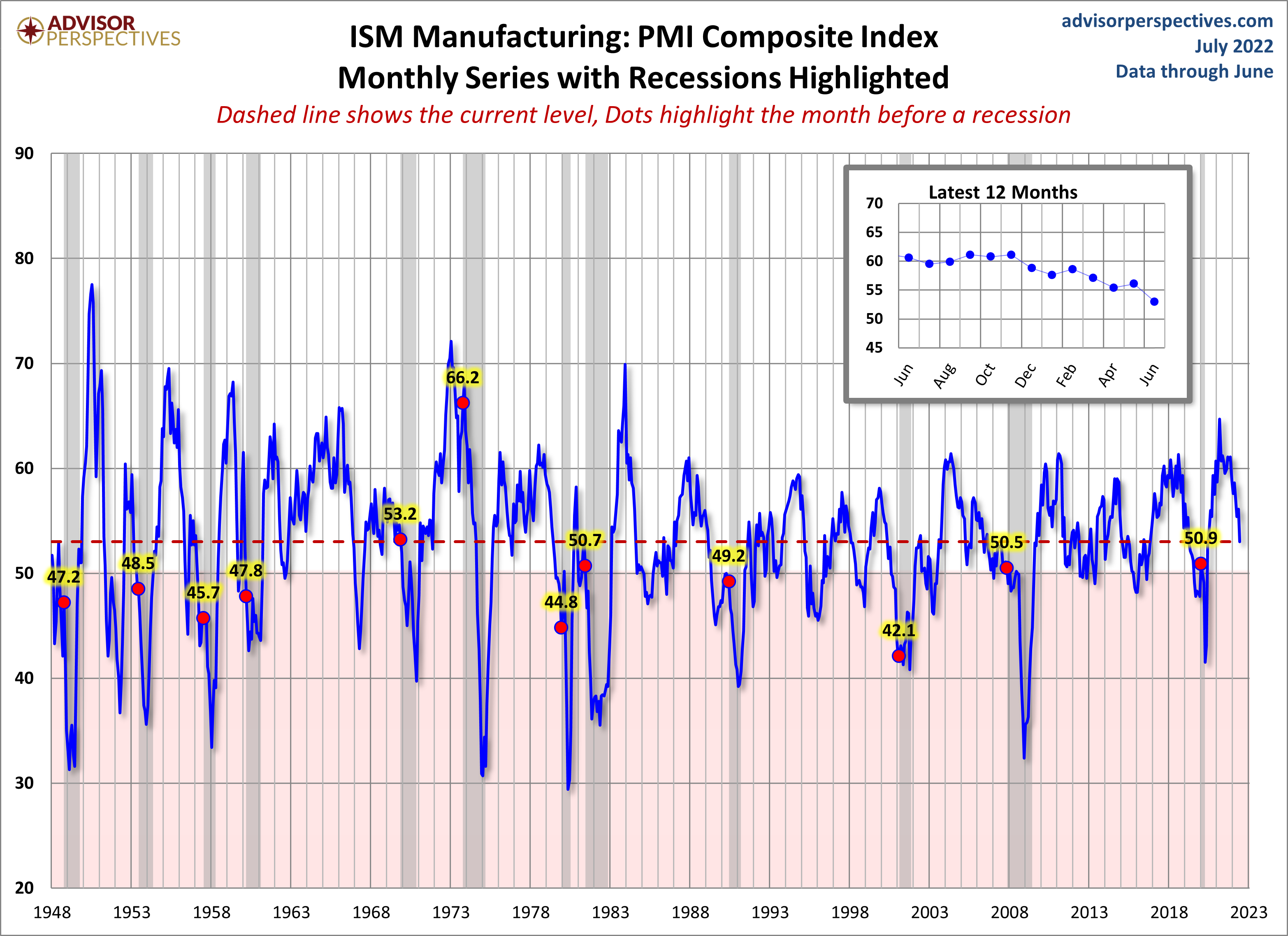

The chart below shows the Manufacturing Composite series, which stretches back to 1948. The eleven recessions during this time frame are indicated along with the index value the month before the recession starts.

For a diffusion index, the latest reading is 53.1, and it indicates expansion. What sort of correlation does that have with the months before the start of recessions? Check out the red dots in the chart above.

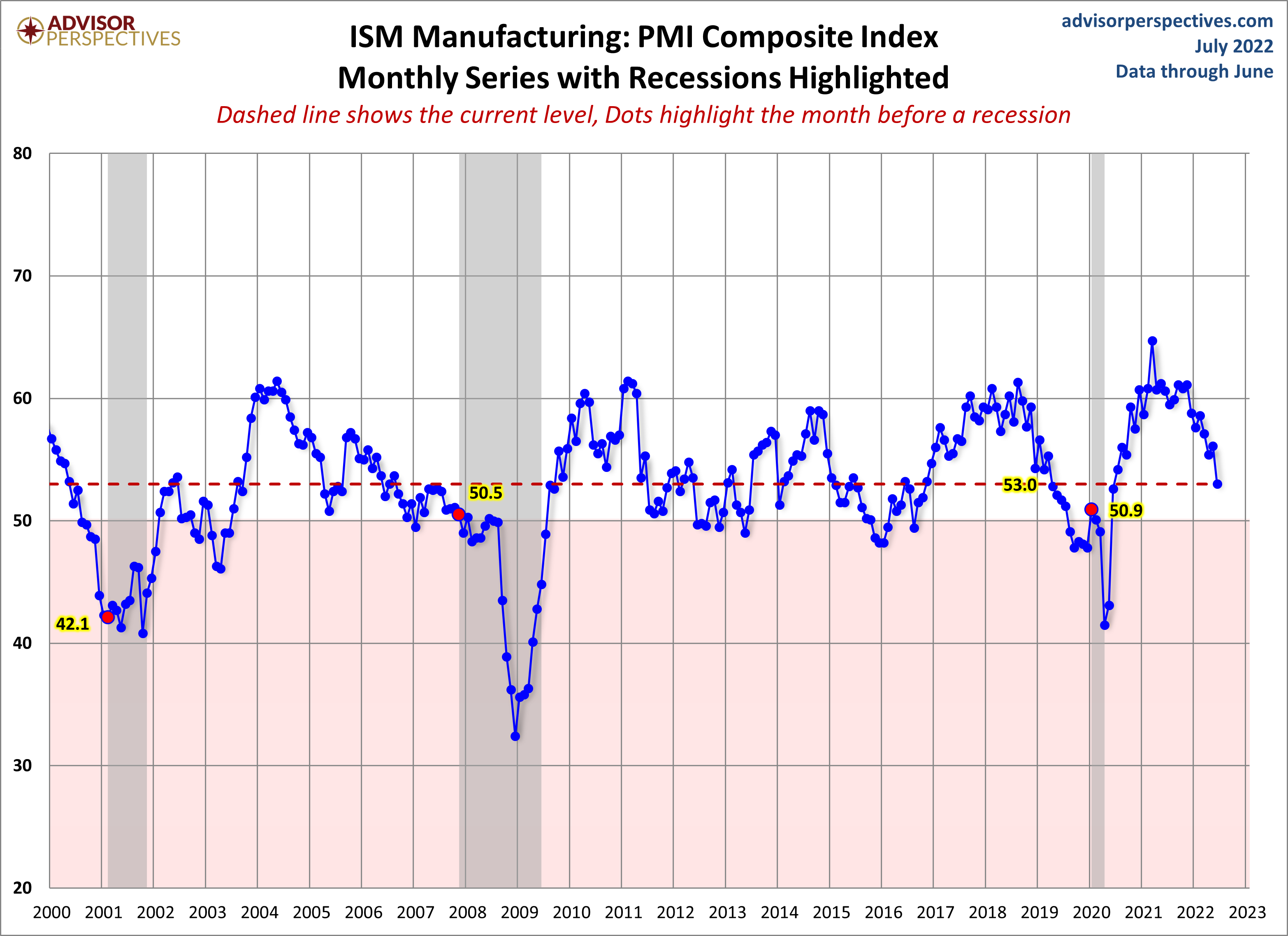

Here is a closer look at the series beginning at the turn of the century.

Note: This commentary used the FRED USRECP series (Peak through the Period preceding the Trough) to highlight the recessions in the charts above. For example, the NBER dates the last cycle peak as December 2007, the trough as June 2009 and the duration as 18 months.

The USRECP series thus flags December 2007 as the start of the recession and May 2009 as the last month of the recession, giving us the 18-month duration. The dot for the last recession in the charts above is thus for November 2007. The "Peak through the Period preceding the Trough" series is the one FRED uses in its monthly charts, as illustrated here.