Jobless Claims Continue To Warrant Yellow Caution Flag, While Continuing Claims Shade Closer To Crimson

Initial claims (blue in the graph below) continued their recent track into recession caution territory this week, as they rose 5,000 to 245,000, 12.9% higher YoY and the 5th time in the last 7 weeks that claims have been 240,000 or above. The last time they were at this level was in January 2022.

The more important 4 week moving average (red) declined -250 to 239,750, 10.6% higher than 1 year ago. This is the 4th week in a row that the YoY% change has been above 10%, but it has not yet crossed the 12.5% threshold that historically has been a recession warning. On an absolute basis, except for 2 of the 4 previous weeks, the highest it had been at this level was also January 2022.

Finally, continuing claims (gold) rose 61,000 to 1,865,000, 22.1% above their level one year ago, and the highest since November 2021:

(Click on image to enlarge)

Here is the YoY% change, which is more important at the moment:

(Click on image to enlarge)

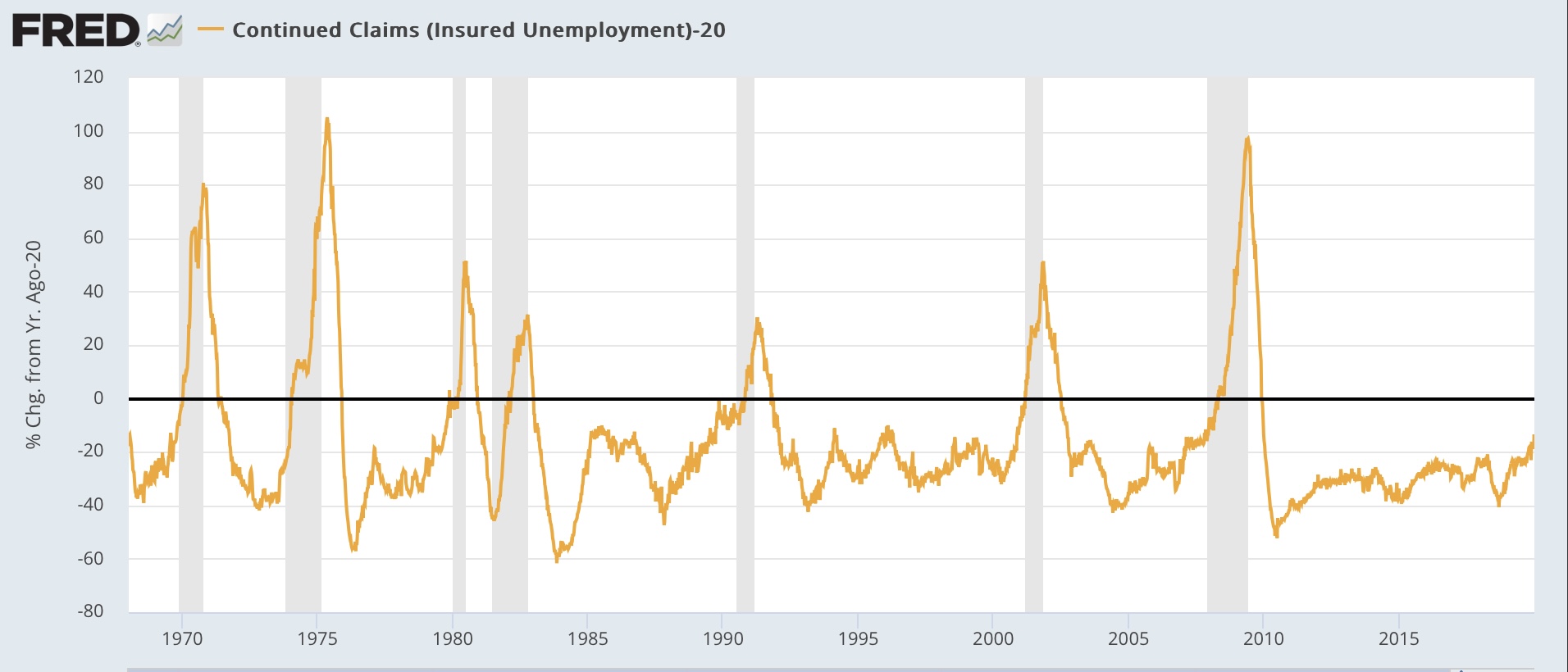

The increase in continuing claims appears especially significant. Historically, continuing claims have lagged, and have not been higher YoY by 20% or more until after a recession had already started (below graph subtracts 20% so that a YoY 20% increase shows at the zero line):

(Click on image to enlarge)

The only two exceptions prior to the pandemic were 2 weeks in November and December 1979, just before the January start of the 1980 recession, and 1 week in November 1989, 8 months before the onset of the July 1990 recession.

Parenthetically, it is important to note that the massive seasonal revisions which were announced 2 weeks ago did not significantly affect the YoY comparisons.

For forecasting purposes, this metric continues to warrant a yellow but not red flag. But if continuing claims are over 20% for even one more week, that yellow will shade closer to orange or even crimson.

More By This Author:

Coincident Indicators Hold On, Mainly Due To Improvement In Gas Prices YoY

New Housing Construction Appears To Have Bottomed; But Expect Further Declines In Construction Employment Ahead

Positive Revisions Make For A Good March Industrial Production Report

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.