Jobless Claims Continue To Trend Higher, But No Recession Signal Yet

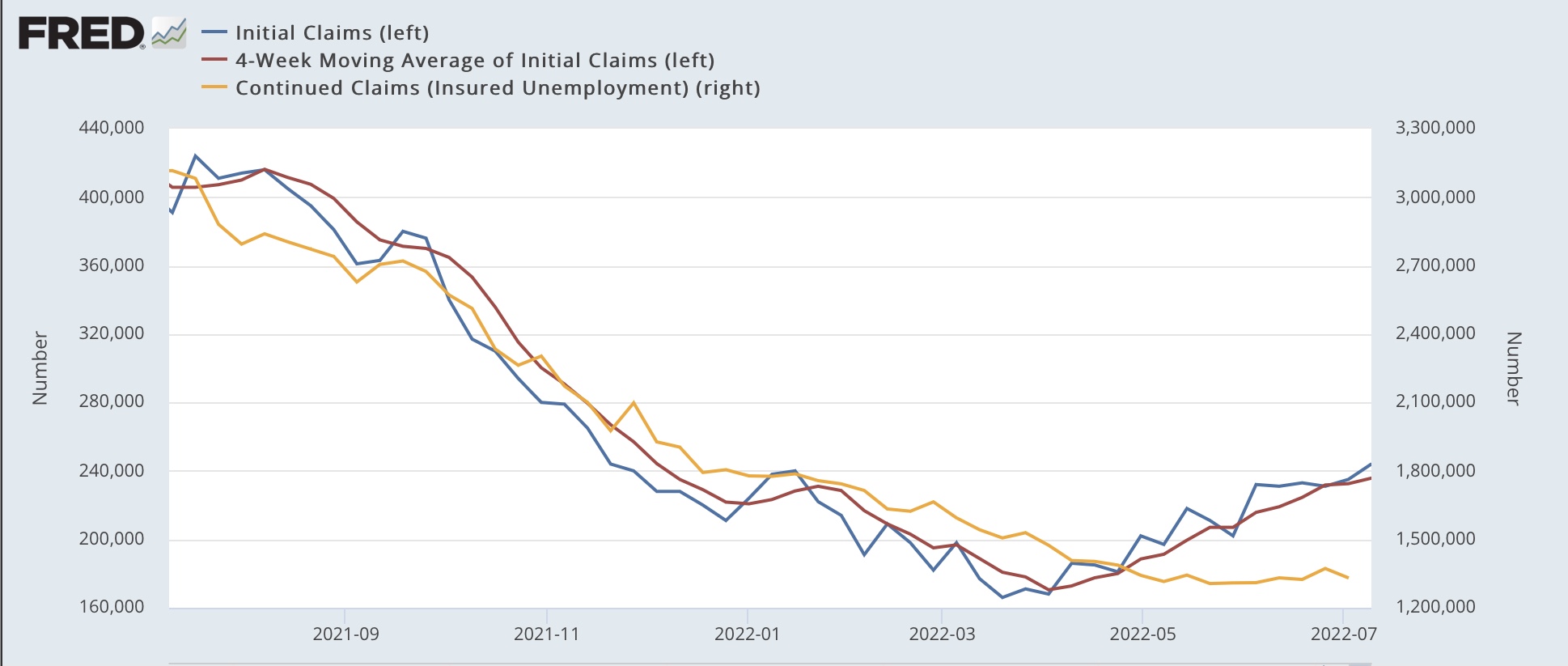

Initial jobless claims rose 9,000 to 244,000 last week, a 7.5-month high. The 4-week average rose 3,250 to 235,750, a 7-month high. But the news wasn’t all negative, as continuing claims declined 41,000 to 1,331,000, which is only 25,000 above their 50 year low set on May 21:

(Click on image to enlarge)

Two weeks ago I noted that, reviewing the entire 50+ year history of initial claims, “there are almost always one or two periods a year where the four week moving average of jobless claims rises between 5% and 10%. About once every other year for the past 50+ years, it rises over 10%. Typically (not always!) it has risen by 15% or more over its low before a recession has begun. And a longer term moving average of initial claims YoY has, with one exception, turned higher before a recession has begun.”

Both initial and, this week aside, continuing claims have been continuing to drift higher, and since that uptrend has lasted for more than 3 months, they are no longer a positive indicator. Indeed, initial claims are almost 50% higher than their low for the cycle, meaning they fulfill the first of the two above criteria to signal a recession is near. Further, if the present trend continues about 3 more months, initial claims will be higher than 1 year previous, which would fulfill the second criteria as well.

But we’re not there yet, so initial claims aren’t negative, signaling recession.

More By This Author:

June CPI Report: Bad, Bad, Bad

Aggregate Hours And Payrolls Of Nonsupervisory Workers And The Onset Of Recessions

June Jobs Report: Strong Headline Numbers, Betraying Numerous Signs Of Rougher Times Ahead

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.