June CPI Report: Bad, Bad, Bad

In case for some reason you haven’t already heard, the inflation news for June was uniformly bad.

Here is some of the carnage. For the month of June only:

- overall inflation was up 1.3%, the highest monthly increase since 2005

- energy inflation was up 7.5%

- inflation less energy was up 0.7%

- inflation in used cars and trucks was up 1.6%

- inflation in rents was up 0.8%, the highest since 1986

- owners’ equivalent rent, the CPI euphemism for house prices, was up 0.7%

Again, those were for the month of June *alone.* There was no respite anywhere.

YoY, overall inflation was up 9.0%, the highest since 1981:

(Click on image to enlarge)

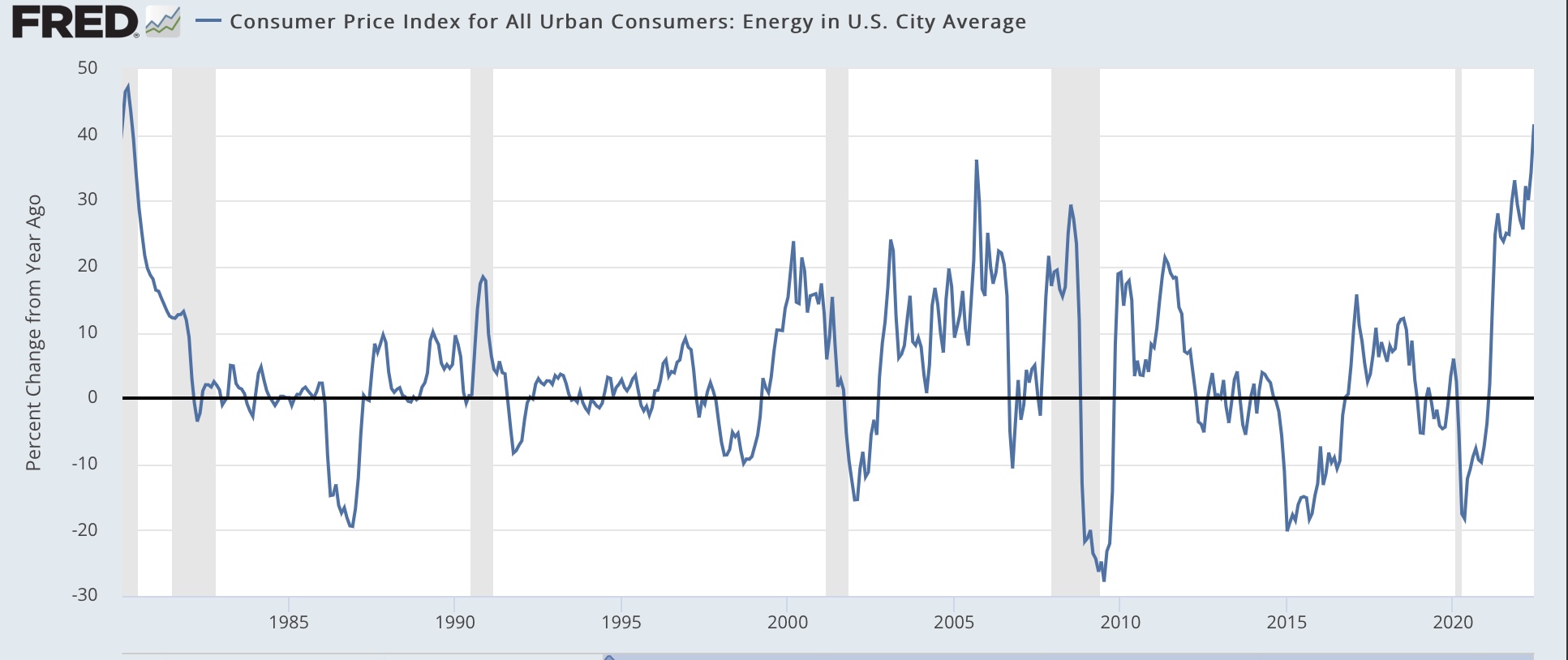

YoY energy prices were up 41.5%, the highest since 1980:

(Click on image to enlarge)

YoY prices less energy were up 6.6%, which is below the March peak of 6.8%, but still above any year previous since 1982:

(Click on image to enlarge)

The relatively bright spot is that YoY prices in used cars and trucks were “only” up 7.1%, compared with their June 2021 peak of +45.3%:

(Click on image to enlarge)

YoY rents increased 5.8%, the highest since 1986, and owner’s equivalent rent (red)(for houses) increased 5.5%, the highest since 1990. As I have been saying for 9 months, house prices (black) lead OER by 12-18 months, meaning we were likely to see the highest YoY% increases in OER ever. And we are well on our way:

(Click on image to enlarge)

I am sure everyone is expecting another 0.5% hike, if not a 0.75% hike, at the next Fed meeting.

Finally, this absolutely clobbered real wages in June. Average hourly earnings for nonsupervisory employees increased 0.5% in June, but with a 1.3% increase in consumer prices, real average hourly wages decreased 0.8% for the month. Real wages are down 2.9% from April 2021, and down 3.6% from December 2020:

(Click on image to enlarge)

It is going to take more than the recent 8% decline in gas prices to reverse this negative dynamic. Thus simply must be putting a real crimp in consumer spending, which raises the stakes for Friday’s retail sales report for June.

More By This Author:

Aggregate Hours And Payrolls Of Nonsupervisory Workers And The Onset Of Recessions

June Jobs Report: Strong Headline Numbers, Betraying Numerous Signs Of Rougher Times Ahead

Jobless Claims Continue To Drift Higher, Are No Longer A Positive; But No Recession Signaled

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.