Jay Powell Is In The Way (Literally, For The UST Curve)

Early in May 2013, the word “taper” exploded into the mainstream. It was everywhere, scarcely an article was written or news story pieced together which hadn’t included the term (even though Ben Bernanke never actually said it). The so-called tantrum spread like wildfire simply because of what it represented, the very thing everyone had been waiting for. Confirmation, at last, the long economic nightmare, about half a decade to that point, was over.

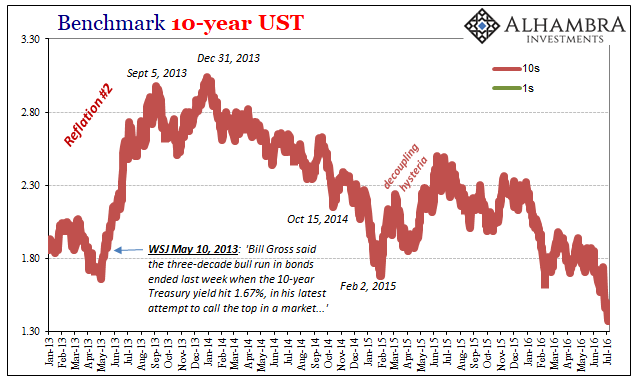

For much of the rest of 2013, there were various calls for an end to the “30-year bond bull.” Setting aside the inappropriate use of the characterization, these were obliged by a growing selloff in that market. The usual suspects were given blanket coverage in the usual places:

Bill Gross said the three-decade bull run in bonds ended last week when the 10-year Treasury yield hit 1.67%, in his latest attempt to call the top in a market whose buoyancy has been aided by central-bank policy and long questioned by skeptical investors.

That was the first paragraph written for the self-described bond king by the Wall Street Journal on May 10, 2013. The second was actually the one that has mattered:

The manager of the world’s largest bond fund stressed that a bear market in bonds won’t start until economic growth and inflation pick up — an arrangement that he doesn’t expect to see immediately. [emphasis added]

Coming up on six years later, we are still waiting. To Mr. Gross’s credit, he was right about what will kill the bond market. There is a massacre waiting for it at the end of the line. But it doesn’t happen until sustained, meaningful economic recovery is a realistic shot. It sounds like time is a factor here, quite easy to fall into the trap since we’ve waited long enough for a reversion back to the growth mean.

There is a new economic mean, a bad one, the kind of underlying condition that keeps liquidity hedging right at the top.

What failed Bill Gross and the others like him was in mistaking minor changes within the same no-growth paradigm for a categorical change. Central bankers have been committing the same error always in parallel. The two groups are very much the same, beginning with their shared infatuation for econometric models that no matter how many times they come up with the wrong forecast are given another chance. And another.

It’s always recovery for ferbus, no matter how many times (four now) recovery is interrupted by reality.

Within seven months, the BOND ROUT!!! was over and what followed over the subsequent two and a half years was even lower bond yields still. There were, as always, numerous warnings throughout 2013 suggesting that was the more likely intermediate-term scenario. These were ignored until early on in 2014 they couldn’t be any longer.

Reflation #2 died and there was little stop Euro$ #3 in safety yields, German, Japanese, as well as UST’s.

We are witnessing the same reversal in the same places following much the same pattern; with one important exception.

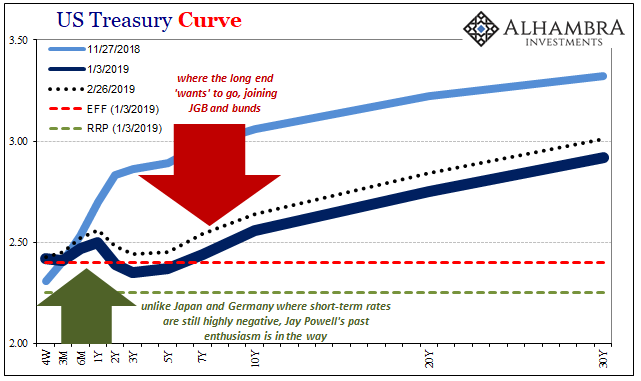

Like they did throughout 2014, in two out of those three, JGB’s and bunds, yields have been falling pretty relentlessly especially since last October. Five years ago, UST’s acted the same way but that’s not how the Treasury market has performed this time around. Obviously, there is something different in this one compared to those others.

UST yields had reversed sharply at first like interest rates in Japan and Germany. On January 3, however, the process was interrupted. Many are now suggesting the market is less pessimistic given the shift in monetary policy stance(s) in the US (and elsewhere). There is a renewed “dovishness”, a change was driven home by Federal Reserve officials who were once stapled to “strong” but are now firmly gripped by “pause.”

The US central bank has been joined by the Bank of Japan and ECB in its rethinking of the economic situation. The latter was scheduled for “rate hikes” this year but those have been taken completely off the table. In Japan, in the middle of last year, Haruhiko Kuroda was openly discussing an exit from QQE. To begin this year, BoJ officials publicly whisper about ramping it back up all over again.

In short, many have come to believe central banks broke it and now they will fix it. They might even use the Treasury market and the fact that yields haven’t gone lower as if to see evidence for the claim, a more optimistic tone after December’s global rout. It should be pointed out that the people who are saying this are those same end-of-the-30-year-bond-bull commenters from 2011, 2013, and 2017. They simply cannot conceive how central banks are not central.

We already see there is a problem with this theory. Japanese and German government bonds are not buying it. They are instead being bought heavily by financial institutions and other investors as if a dovish ECB or BoJ wasn’t a solution (a hawkish ECB or BoJ wasn’t the problem).

That leaves the US Treasury market alone to distinguish something. But what? Is it the Fed?

Longer end bond yields in UST’s are certainly being interrupted by the Fed if only as a technical matter. The bond rally slammed right into the short end. It became so jumbled, around January 3, some shorter rates dropped below monetary equivalents (see: distorted UST curve below).

In 2014, UST’s wouldn’t encounter the same resistance because back then short rates were still at and near zero. There was unobstructed room for yields to fall as much as the market required in all these other places in both timeframes, the common theme uniting UST’s in 2014 with JGB’s and German bunds in both 2014 as well as late 2018.

UST yields, I believe, would follow their German and Japanese counterparts lower if Jay Powell’s unbacked past enthusiasm wasn’t now in their way.

This isn’t a trivial thing. There is enormous power (arbitrage) policing even the flattest of curves, natural settings that will complicate even the most straightforward flight to safety. The Fed, for all its incompetence, as a technical matter offers equivalent monetary instruments at the short-end (repo for RRP, or a 4-week T-bill compared to IOER). This is what makes the short end a boundary for the more independent long end should they ever meet (they aren’t ever supposed to).

Inversion is unnatural, meaning that it takes an enormous effort by the entire market to overcome these inherent qualities. And yet, there are still parts of the UST curve that are inverted right at this moment – meaning, the UST market though (for now) flirting with the short end boundary isn’t fully ready for the whole back end to overwhelm it and join its Japanese and German counterparts in their more straight-line pessimism.

In fact, that’s just what the small inversion in the UST curve is all about. This distortion echoes the unobstructed path for lower yields in JGB’s and bunds transposed to a situation where short-term rates here are no longer zero. The Fed’s policies are the distortion in UST’s, and that’s all they are.

Therefore, the inverted UST curve is actually saying the same thing as uninterrupted long end JGB’s and German Bunds.

Unless economic conditions actually, meaningfully pick up and soon, the short-term policy alternative boundary won’t stay much of one. At some point, like an avalanche, the whole curve might just sink under it as Jay Powell watches on the sidelines in amazement. As Alan Greenspan, the current Fed Chairman is no doubt flabbergasted by the bond market not acting like a series of one-year forwards as he has been trained to expect.

Bill Gross was right to peg bond rates to real economic factors. He just got it backward. Everything you want to know, really know about the world is in these bond “bull” markets.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more