The Many Obvious Dots Of Keynes, Friedman, And Fisher

The obsession with inflation is grounded in historical fact. This is true both of our recent “conundrum” as well as broader circumstances surrounding slow burning structural changes. As to the former, last year the global economy was supposed to take off, concurrently signaled by accelerating inflation rates due to what are always claimed to be tight labor markets.

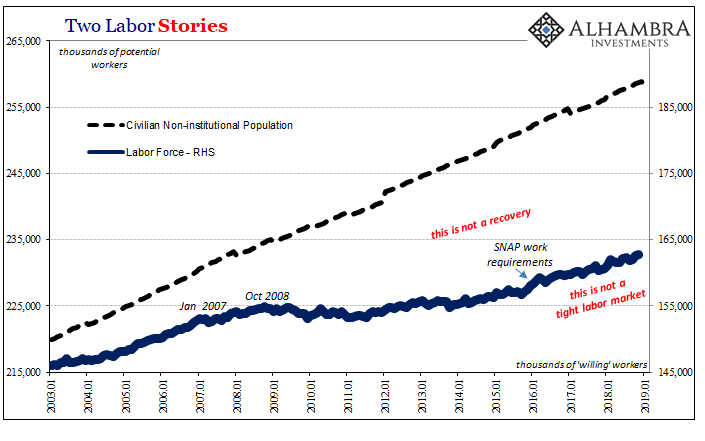

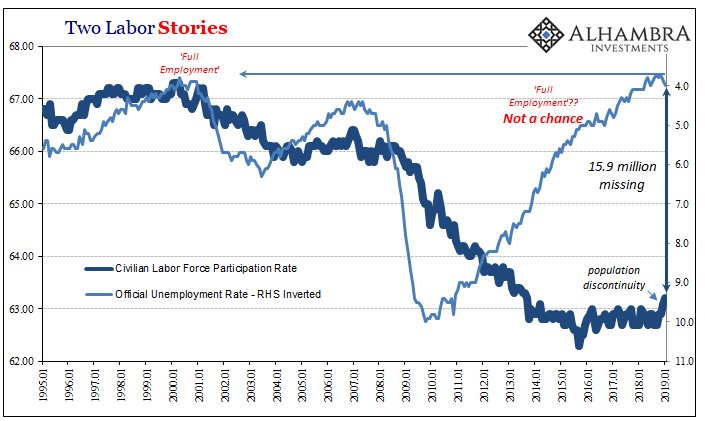

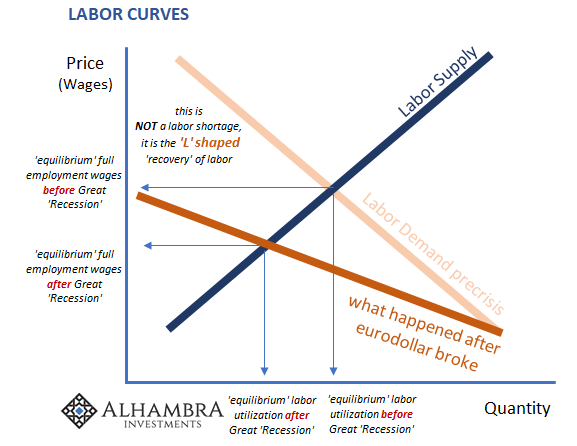

The worldwide LABOR SHORTAGE!!! was supposed to lead somewhere very good; an end to a decade of increasingly dangerous malaise.

This didn’t happen, a fact more and more central bankers are trying to come to terms with. As you would expect, they are having a lot of trouble doing so. The reason is that every answer is staring right back at them from the mirror.

Federal Reserve Chairman Jerome Powell was on Capitol Hill today for the semi-annual Humphrey Hawkins dance. The Full Employment and Balanced Growth Act of 1978 used to mean something. Among other things, it correctly required a minimal level of monetary competence from the US central bank. The year of its passage was no accident, the Great Inflation a case study in monetary incompetence.

Therefore, Economists find themselves stuck between what to them may seem competing goals. On the one hand, the awful seventies. On the other, the far worse thirties. Last Friday, FRBNY President John Williams underscored this tension. Confusion, more like it:

I concur that we must remain vigilant regarding a sustained takeoff in inflation… We must be equally vigilant that inflation expectations do not get anchored at too low a level. This persistent undershoot of the Feds target risks undermining the 2 percent inflation anchor.

Which is it? It is, after all, your specific job to pick one, the right one.

Monetary officials look at the unemployment rate and see risks of huge inflation. After the last eleven years, this would be an awesome problem for them to fuss over. Yet, as Chairman Powell told Senators today, “While we view current economic conditions as healthy and the economic outlook as favorable, over the past few months we have seen some crosscurrents and conflicting signals.”

In other words, the unemployment rate may be published at 4% or less, for all anyone might imagine, the lower it goes the less it seems to matter. Something else is going on (again, I will add), perhaps officials seeing only what they want from the BLS data.

People often have a visceral reaction to just his name, but John Maynard Keynes was right about a lot of things even if the agenda he was following abused those very observations. On the substance of inflation versus deflation, Keynes was never better. It was his views, more than anyone’s, which led to the very idea of inflation targeting. Though inflation was one evil, using Keynes’ words, it was very clearly the lesser of two.

We see, therefore, that rising prices and falling prices each have their characteristic disadvantage. The Inflation which causes the former means Injustice to individuals and to classes—particularly to rentiers; and is therefore unfavourable to saving. The Deflationwhich causes falling prices means Impoverishment to labour and to enterprise by leading entrepreneurs to restrict production, in their endeavour to avoid loss to themselves; and is therefore disastrous to employment. [emphasis added]

How can anyone look at the last part of Keynes statement and not see in it our current global predicament? Modern Economists uniformly agree with deflation as the worst evil, except, apparently, when it becomes the real thing on their watch. The answer to Powell, Williams, Draghi, Kuroda, Bernanke, etc., is right there in front of them. All good neo-Keynesians except where it really counts.

Williams’ “persistent undershoot” has been a topic of academic discussion, of course. Economists and policymakers haven’t reached any conclusions, merely noting a menu of possible factors which individually or in some combination contributes to their lament. Ultimately, that’s what the unemployment rate has been, along with globally synchronized growth, the very desperate, fervent hope that it would settle the unknown once and for all before any central banker has to answer for it.

Officials have been pleading with the labor market to provide an exit for the “persistent undershoot” before anyone started asking the relevant questions about it. How could that have happened with so much effective “stimulus”? Doesn’t matter now, the LABOR SHORTAGE!!! inflationary recovery renders the discussion moot history! Bullet dodged.

That was supposed to be 2018.

There are so many obvious dots waiting to be connected the fact they haven’t been almost has to be intentional. The St. Louis Fed, for example, in its First Quarter 2018 magazine, published a summary of the major theories on this disinflationary puzzle. The usual prospects you’ve already heard before, the authors cite technological factors, demographic shifts, globalization, and, oddly enough, central bank independence as the list of chief suspects. None of these account for why 2008 sticks out as the key inflection point and the authors draw no conclusions.

The last potential explanation included was something they called neo-Fisherism. Irving Fisher was among the first to seriously scrutinize interest rates as being related to money and economy. He deconstructed them into discrete pieces; a single rate contains a real interest rate plus inflation expectations (on top of which modern statisticians have added “term premiums”). The real rate is independent of anything but perceived conditions in the real economy – and is, therefore, the absolutely most crucial component (the flat curves of today demonstrating this with perfect clarity).

In this view, the answer is pretty simple – no need to depend upon drug addicts and Baby Boomers.

Thus, if the real rate is close to zero, it must be that, under this hypothesis, expected inflation is close to zero as well. The solution to low inflation in this context is to increase the nominal interest rate.

If the real rate is close to zero, pace Keynes, the economy must be awful. Therefore, the solution is to make the economy not awful – via inflationary policies. I know what you are thinking, the St. Louis Fed of all outfits bringing this up ten years after the crisis, then what the hell was QE?

It is at once the problem and the answer both defined in very simple terms; a deflationary drag results from tight money. As Keynes long ago observed, we know what the primary negative real economy symptoms of it are going to be: a persistently awful labor market. If the economy exhibits these very tendencies especially across a lengthy period of time, the solution is to do something about tight money. OK, really, then what the hell was QE!?

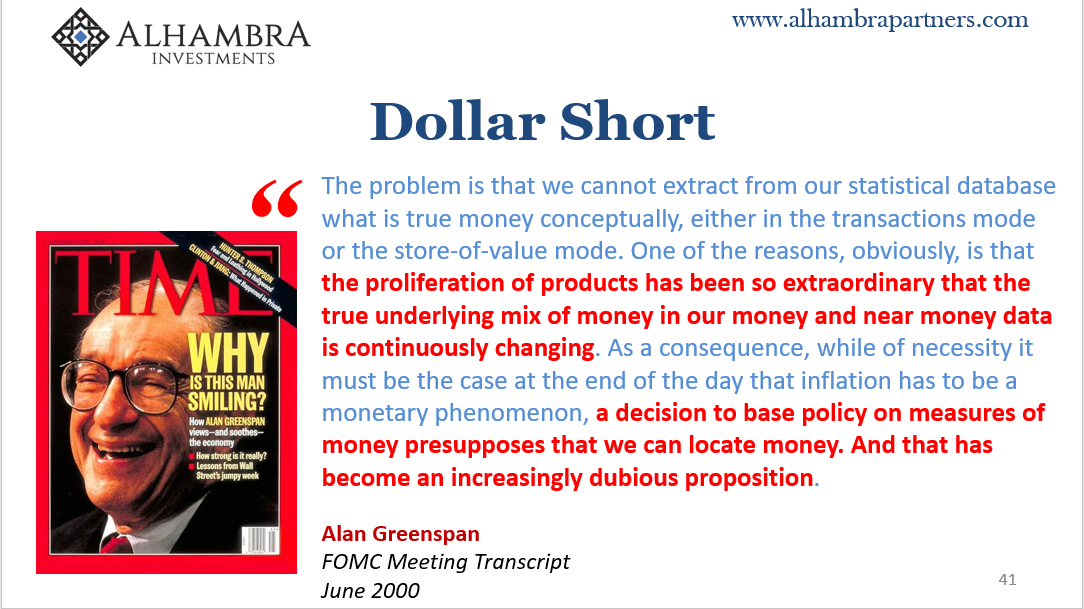

As many are now coming close to admitting, it was a gigantic, and ultimately self-defeating, monetary head fake. Some central bankers thought balance sheet expansion really was money printing, the emptier of the suits. Others realized it was nothing more than central bank accounting for an asset swap. Of the latter group, they were absolutely thrilled how QE was wrongly equated with money printing (or the term “ultra-loose”) over and over and over again.

Modern theory (neo-Keynesian, no less) posits that the only thing required to raise inflation expectations, to increase the nominal interest rate especially if the real rate is something like zero, is a monetary head fake. They don’t even have to know what money is, and they don’t, so long as you believe they printed it that should be more than enough to get the job done.

On that basis, they keep waiting. And waiting.

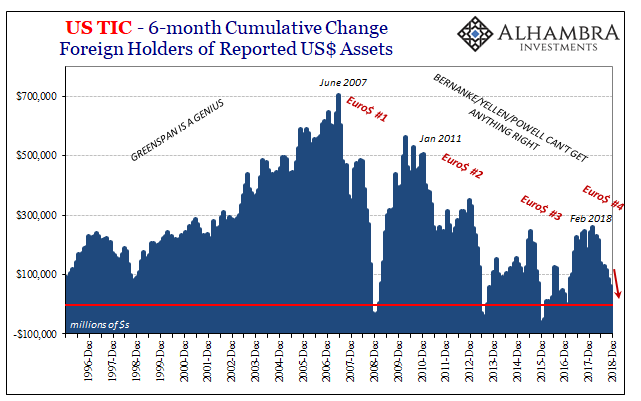

Unfortunately for the world and one lost decade moving further into a second, magic tricks are an insufficient answer for effectively tight money in the global economy. As even the empty suits recognize, this inflation problem is and has been worldwide. Global deflationary circumstances can only result from tight global money. Set aside 2008 as a lost cause, what the entire world required at least in its aftermath was basic monetary competence to get out of the deep trough.

Instead, we were given a puppet show.

I seriously doubt Powell or whoever might follow him years from now will be telling Congress that story. If they have even an ounce of conscience, they would say nothing else, certainly not “some crosscurrents and conflicting signals.” The only conflicting signals are all those very clear dots that once connected quite easily diagram the whole damning enterprise.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

But, now there is more collateral in the form of long treasury bonds to protect.

They are afraid of their own shadows and inflation even though there is deflation all around us. Except for assets.