The Global Reach Of Kuroda’s Premature Celebrations

The unemployment rate isn’t just misleading in the US, though the gap between what it suggests here and what isn’t happening is now enormous. This idea of a labor shortage, or LABOR SHORTAGE!!!! as each case may be, was itself as global as synchronized growth when it showed up in later 2017. There were stories about Chinese factories unable to source workers. European service providers had grown concerned over staffing levels.

Powerful, powerful stimulus.

In March 2018, it was reported that Japan’s unemployment rate had fallen to just 2.4%. Inflation was on the rise, too, so you can guess what they were saying about the Japanese economy and specifically its employment situation:

Monetary stimulus has succeeded in boosting Japan’s economy and driving the jobs market to its tightest state in decades, with labour shortages spreading across the country.

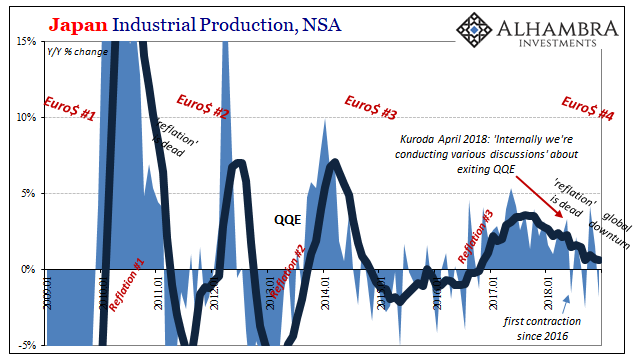

It was at this point Haruhiko Kuroda decided to take a victory lap. On March 2nd of last year, the Bank of Japan’s Governor quite purposefully let it be known that policymakers were considering an end to QQE. After just about five years of it by then, there was growing confidence it was nearing its goals.

The following month, on April 3rd, Kuroda went further. Clearly adoring the positively glowing stories written about his bold efforts and stubborn persistence, BoJ’s top official specifically stated that they were talking about the exit. “Internally we’re conducting various discussions,” he said, having been formally re-appointed to another term just weeks before.

Was it politics? Or, more likely, was Kuroda embarrassingly premature in claiming success?

Either way, depending upon the unemployment rate in Japan as a measure of economic progress is dangerous business. As has become usual, something else was going on behind the ratio.

Whereas in the United States the problem is labor force participation, the unemployment rate’s denominator, over on the other side of the Pacific it’s quite different. Japanese firms are employing more workers and more Japanese workers are joining the labor force. But in the aggregate, the totality of Japan’s workforce is working less.

I’d write that this is unusual, however, this is Japan where nothing really is anymore. Not after just about thirty years of the worst combination imaginable: an overactive central bank running out of magic tricks and the zero-growth paradigm which painfully extends the show.

What’s more, Japanese workers appear to have a much firmer grasp on the real economic situation. Unlike Kuroda and the fawning media, household income more accurately reflects the diminishing individual prospects of labor as more workers share fewer hours. As such, being paid less in real terms they spend much less.

This isn’t the recipe for an inflationary breakout due to a labor shortage, it is very clear redistribution that in the long run is self-defeating. Any positive effects due to gains in employment are at least canceled out by uncertainty over individual incomes resulting in less spending per household or worker.

If you only look at the unemployment rate, you don’t see what’s missing from it.

It meant that Kuroda actually had two big problems early last year as he approached his personal zenith. The first was his reliance upon the LABOR SHORTAGE!!! narrative, leaving him and his colleagues susceptible to confirmation bias with slightly higher inflation numbers. The second was what you see most clearly on the first chart above; the labor market entering 2018 was already slowing (note the timing, January 2018, consistent with almost every other global indication including Japan IP at the bottom).

What the BoJ projected as successful QQE was nothing more than worldwide Reflation #3 handing them the benefit of the doubt – which they immediately abused. This is also pretty common to the point of being universal; the more central bankers fail, the more time wasted by their ineffective methods, the greater the desperation. In this position, the smallest molehills are made into the most majestic mountains humans have ever laid eyes upon.

Sure enough, as Reflation #3 was quietly strangled to death by the noose of Euro$ #4 circumstances have reversed. In December, Japan’s statistics bureau estimated the country’s CPI had increased by just 0.3% year-over-year. Today, they report consumer inflation in January 2019 of 0.2%.

The unemployment rate remains steady at 2.4%.

As late as July 2018, the BoJ’s models were still predicting Japan’s economy finally reaching the 2% price stability goal. They aren’t now, obviously, with official predictions for this year made in January merely hoping that the CPI might be able to reach half that. Expect more downgrades after beginning 2019 at near zero again.

In the absence of meaningful labor market tightness, Western inflation is pushed by oil and energy, Eastern inflation is governed by food prices. Both times last year Japan’s CPI managed to climb above 1% neither was because the unemployment rate was at a record low.

Japanese officials fooled themselves because they wanted to be fooled since they are fools. With the entire global economy poised for another downturn, the only surprise is why anyone still talks about central banks and “stimulus.” Japanification used to refer to just Japan. It still applies in that one country, only now it has been spread all over the world on word of fools.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more