It‘s Not Over Yet

S&P 500 indeed didn‘t reverse on Friday in earnest, and both tech and value sold off hard. Not much reason to be bullish thanks to credit markets performance either – the posture is very risk-off, and the rush to commodities goes on. With a little check yesterday on the high opening prices in crude oil and copper, but still. My favorite agrifoods picks of late, wheat and corn, are doing great, and the pressure within select base metals, is building up – such as (for understandable reasons) in nickel and aluminum. Look for more to come, especially there where supply is getting messed with (this doesn‘t concern copper to such a degree, explaining its tepid price gains).

And I‘m not talking even the brightest spot, where I at the onset of 2022 announced that precious metals would be the great bullish surprise this year. Those who listened, are rocking and rolling – we‘re nowhere near the end of the profitable run! Crude oil is likely to consolidate prior steep gains, and could definitely continue spiking higher. Should it stay comfortably above $125 for months, that would lead to quite some demand destruction. Given that black gold acts as a „shadow Fed funds rate“, let‘s bring up yesterday‘s rate-raising thoughts and other relevant snippets:

(,,,) If TLT has a message to drive home after the latest Powell pronouncements, it‘s that the odds of a 50bp rate hike in Mar (virtual certainty less than two weeks ago, went down considerably) – it‘s almost a coin toss now, and as the FOMC time approaches, the Fed would probably grow more cautious (read dovish and not hawkish) in its assessments, no matter the commodities appreciation or supply chains status. Yes, neither of these, nor inflation is going away before the year‘s end – they are here to stay for a long time to come.

Looking at the events of late, I have to dial back the stock market outlook when it comes to the degree of appreciation till 2022 is over – I wouldn‘t be surprised to see the S&P 500 retreat slightly vs. Jan 2022 open. Yes, not even the better 2H 2022 prospects would erase the preceding setback.

Which stocks would do best then? Here are my key 4 tips – energy, materials, in general value, and small caps. But the true winners of the stagflationary period are of course going to be commodities and precious metals. And that‘s where the bulk of recent gains that I brought you, were concentrated in. More is to come, and it‘s gold and silver that are catching real fire here.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 didn‘t do at all well yesterday, and signs of a short-term bottom are absent. It‘s entirely possible that the brief upswing that I was looking to be selling into to start the week, has been not merely postponed.

Credit Markets

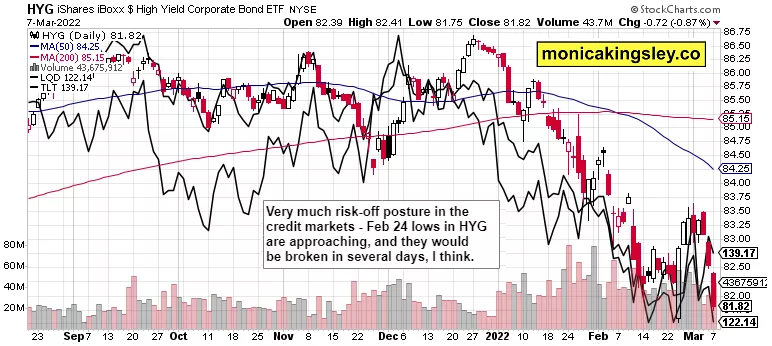

HYG is clearly on the defensive, and TLT reassessing rate hike prospects – yet, long-dated Treasuries still declined. There is no appetite to buy bonds, and that confirms my thesis of lower lows to be made still in Mar.

Gold, Silver, and Miners

Precious metals keep doing great, and will likely continue rising no matter what the dollar does – the last three days‘ experience confirms that. This is more than a mere flight to safety – I‘m looking for further price gains as the upleg has been measured and orderly so far.

Crude Oil

Crude oil‘s opening gap had been sold into, but we haven‘t seen a reversal yesterday. The upswing can continue, and it would happen on high volatility. I don‘t think we have seen the real spike just yet.

Copper

For all the above reasons, copper isn‘t rising as fast as other base metals (one of the key engines of commodities appreciation). The run is respectable, and not overheated. $5.00 would remain quite a tough nut to crack – for the time being.

Bitcoin and Ethereum

Cryptos haven‘t made up their mind yet, but one thing is sure – they aren‘t acting as a safe haven. Given the extent of retreat from Mar highs, it means I‘m looking for not too spectacular performance in the days ahead.

Summary

S&P 500 missed an opportunity to rise (even if just to open the week on a positive note), and its prospects for today aren‘t way too much brighter. It‘s that practically nothing is giving bullish signals for paper assets, and the market breadth has understandably deteriorated. The rush into precious metals, dollars, and commodities remain on – these are the pockets of strength, lifting to a very modest and hidden degree Treasuries as well (these are however reassessing the hawkish Fed prospects) at a time when global growth downgrades are starting to arrive. Pretty serious figures, let me tell you.

As I wrote yesterday, stocks may even undershoot prior to Thursday‘s lows, but I‘m not looking for that to happen. The sentiment is very negative already, the yield curve keeps compressing, commodities are rising relentlessly, and all we got is a great inflation excuse/smokescreen. Inflation is always a monetary phenomenon, and supply chain disruptions and other geopolitical events can and do exacerbate that. Just having a look at the rising dollar when rate hike prospects are getting dialed back, tells the full risk-off story of the moment, further highlighted by the powder keg that precious metals are. And silver isn‘t yet outperforming copper, which is something I am looking for to change as we go by.

Subscriber to Monica‘s Insider Club for trade calls and intraday updates. more