Gundlach Says "Classic Bear Market Rally" Reminds Him Of 1999

Jeffrey Gundlach, the billionaire chief investment officer of DoubleLine Capital, was quoted by Reuters on Friday as saying the stock market's parabolic move in the last couple of months reminds him of the days right before the Dot Com bust.

Gundlach, who oversees a $138 billion fund that is primarily invested in fixed income assets, was troubled by the rapid surge in government debt that has propped up the ailing economy.

He said the dollar would be pressured to the downside as deficits rise. Dollar weakness could boost equities in the short term, he said, adding that "ultimately it weakens as the debt situation is really remarkably bad for a developed country."

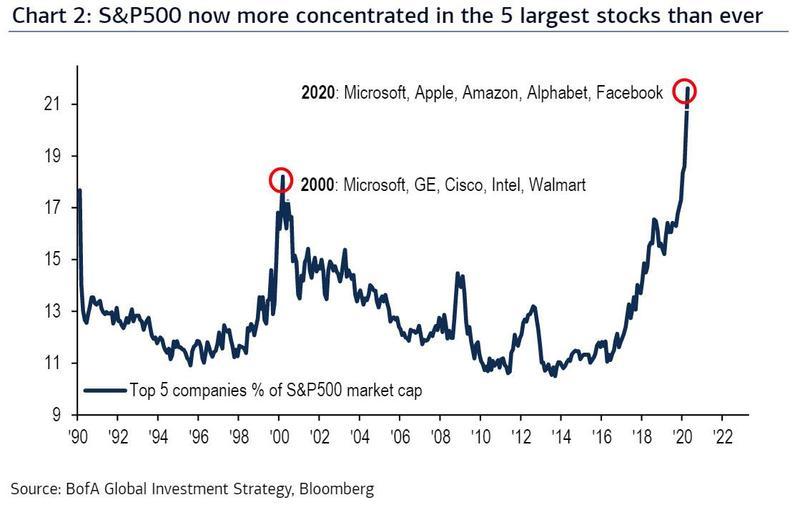

Gundlach voiced concerns about the V-shaped recovery in the S&P 500 from its March lows, along with how much of the gains are concentrated in a handful of technology stocks.

He said the concentration in equity market leadership is mainly in FANG stocks (that is Amazon, Apple, Microsoft, and Google) and retail investors panic buying stocks "is classic bear market rally activity," and a reminder of what he believes could be similar to the days right before the Dot Com implosion.

Gundlach warned today's situation is "way worse because we don't have the ability to cut interest rates" and have "used all the tools that are typically reserved for fighting economic problems."

Gundlach said there could be more opportunities in overseas markets. His latest warning is similar to the DoubleLine Total Return Bond Fund webcast on July 9, where he said stocks are likely to fall from its "lofty" perch.

For more color on why Gundlach is convinced today's move in stocks is a "bear market rally," the first chart below is the ratio of tech-heavy Nasdaq 100 over S&P500, hitting levels not seen since the Dot Com peak as investors panic buy FANG stocks.

In early July, the ratio breached the Dot Com peak, implying high-flying tech stocks were more overvalued today than right before the bust in late 1999/2000. Shown below, the ratio has since faded below the 2000 peak, due mainly to valuation concerns.

Nasdaq 100 remains disconnected from reality as treasury yields slide due to stalling recovery.

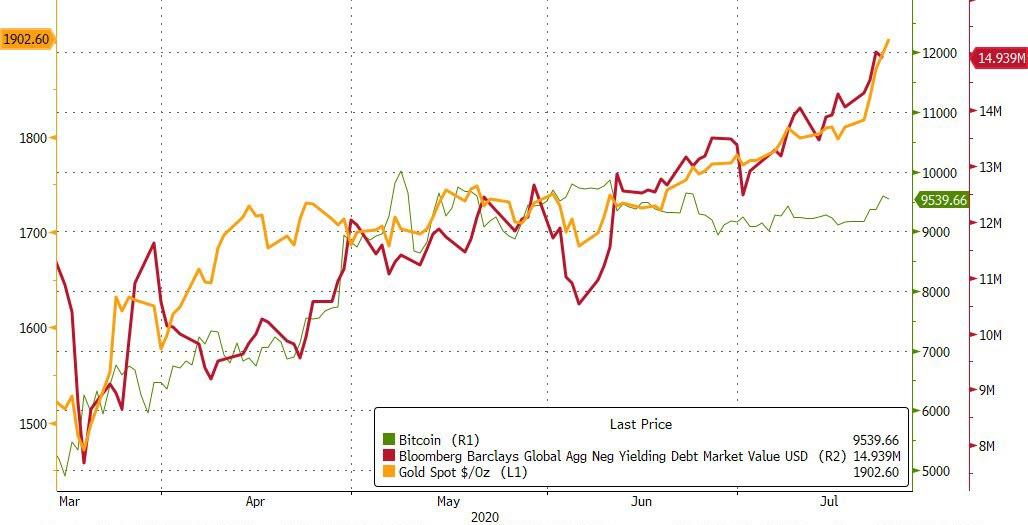

Gold soars to decade high. Gundlach mentioned in his July webcast that he was still bullish on precious metals.

Gold rises as negative-yielding debt market value increases.

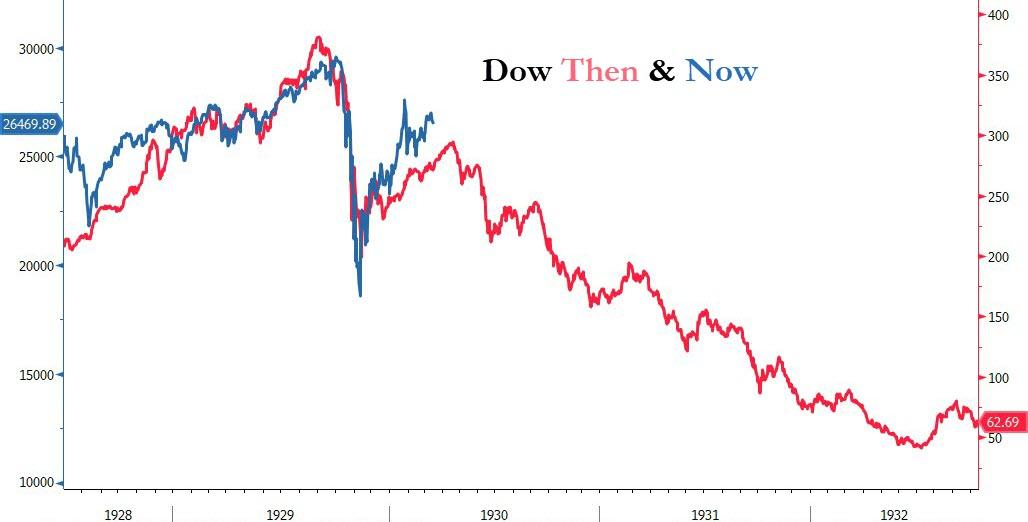

While Gundlach fears 1999, many are more concerned the current bear-market bounce is more akin to the 1930s collapse. Either way, this is far from over...

Gary Shilling believes a 1930s-style decline in the stock market is just ahead...

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

The nagging problem with debt is always that it must eventually be repaid. And the question always when assuming debt is "What is the value of what is being purchased?" Incurring debt without receiving adequate value is a poor choice, but it seems that is what is happening.

The fact that a few of the giants are swimming very well does not compensate for all of those who are drowning. A high average based on a very few is really a lie. I am used to being lied to, but that does not mean that I don't mind it. Likewise, I am used to seeing the fed do things to save their friends while damaging the rest of us.

At some point there needs to be a change in what is done and who does it, and whom it is done to. The best way will be for quite a bit more regulation, with my favorite part being reducing "leverage". Many things should be restricted to cash only, as a start.

(Whoa!, I seem to have gone off on a rant there, for a bit.)

The big point is that just because a few stars are doing quite well and holding up the average, the reality is that most are not doing so very well.

Means ATH's this week.