Goolsbee Grounds Bond-Bulls But Bitcoin, Black Gold, And Big-Tech Bounce

Image Source: Unsplash

Having had the weekend to soak up the good-cop (Powell), bad-cop (Williams et al.) routine of last week, futures pushed higher overnight extending the exuberance and giving the benefit of the doubt during this quiet (post-OpEx) week to Powell (don't fight him, remember). Rate-cut expectations have (hawkishly) pulled back from Wednesday's euphoria but not enough to change the "the peak is in" narrative...

Source: Bloomberg

Chicago Fed's Goolsbee was wheeled out again to uncomfortably walk back the market's enthusiasm... without admitting that was what he was doing.

"It's not what you say or what the (Fed) Chair says, it's what do they hear and what do they want to hear?" Goolsbee said in an interview with CNBC, in reference to the response of financial markets to Powell's comments last week:

"I was confused by what the market was imputing...

...I was surprised that the market reacted" that way...

...the markets are a little bit ahead... they jumped to the end part, which is 'We're going to normalize quickly', and I don't see that."

He also seemed to confirm what Fed's Williams said, that they did not discuss future rate-cuts at the meeting.

"We don't debate specific policies speculatively about the future"

Late in the day, SF Fed's Daly was less dovish too, suggesting that "rate-cuts could be needed in 2024." Not exactly a "we're gonna cut 6 times no matter what" that the market 'heard'.

That spooked the bond market, with yields rising...

Source: Bloomberg

...but still well below pre-Powell levels. Yields were up around 3-5bps today (long-end lagging)...

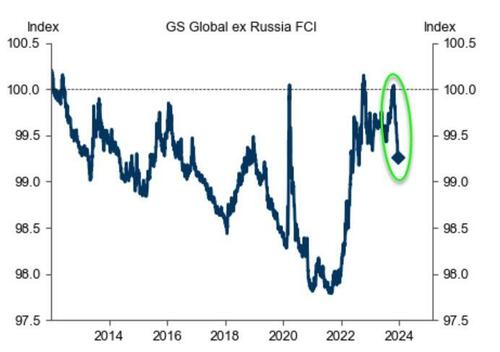

Source: Bloomberg

No major macro to speak of today (weak NYFRB Services and rebound in NAHB sentiment), but global financial conditions continue to loosen dramatically...

Source: Goldman Sachs

And those 'easy' financial conditions helped (long duration) tech stocks shrug off higher rates and lead the Nasdaq and S&P to gains on the day as Small Caps lagged. The Dow ended unch...

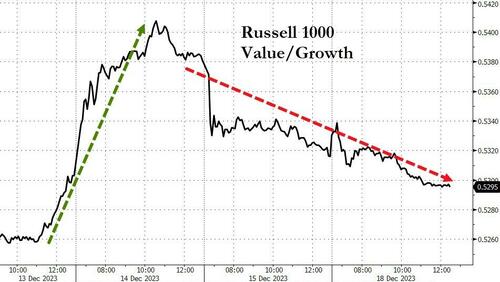

Growth stocks are recovering their post-Fed relative underperformance to Value...

Source: Bloomberg

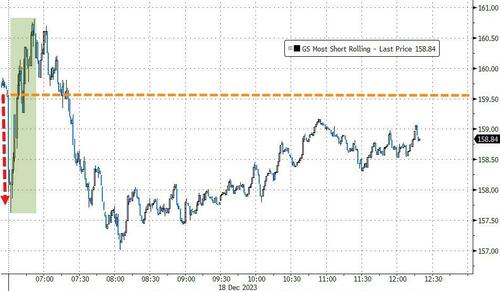

"Most Shorted" stocks opened down, tried the ubiquitous squeeze higher, failed and ended lower...

Source: Bloomberg

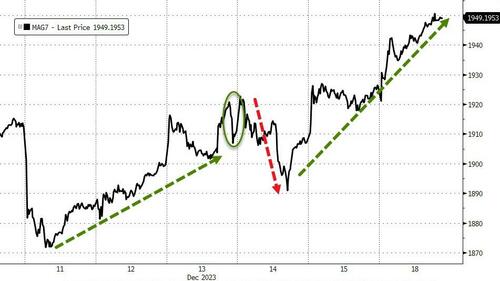

But MAG7 stocks rallied strongly for the 4th day in the last 5 to a new high...

Source: Bloomberg

AAPL did not participate in the MAG7 melt-up after China iPhone bans and US iWatch bans... 'Cook'ed?

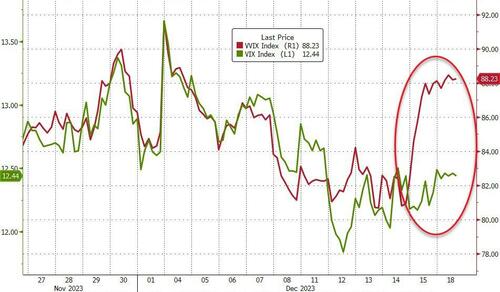

VIX was marginally higher on the day (still with a 12 handle) but VVIX is flashing an amber warning signal that some are getting anxious about a mini-Minsky...

Source: Bloomberg

But hey, why worry - look what Santa's got in store...

Source: Bloomberg

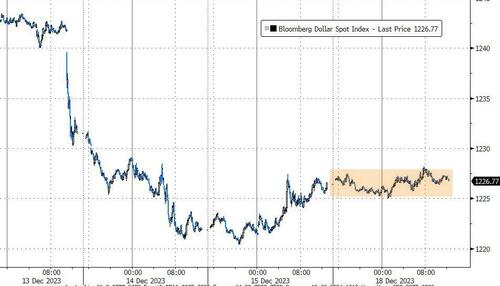

The dollar was broadly speaking flat against its fiat peers today

Source: Bloomberg

Bitcoin ended marginally lower after roundtripping the ubiquitous Asian-selling-programs, finding support at the pre-Fed lows...

Source: Bloomberg

Gold managed small gains today after Friday's tumble...

Source: Bloomberg

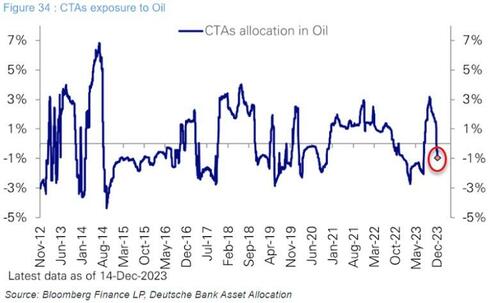

Oil prices surged intraday amid more headlines of attacks, and re-routings of tankers in the MidEast with WTI psuhing up near $75 before fading back...

WTI once again found support at around the $70 level (having traded roughly between $70 and $90 for the last 18 months), and is pushing up against the 21-day moving-average

Source: Bloomberg

...and with positioning so short, there could be more room to run...

Finally, it's deja vu all over again...

Source: Bloomberg

So what happens next? Premature ease-ification could be a problem for you Mr.Powell (or the next Fed Chair).

More By This Author:

A Shocking 40% Of Student Loan Borrowers Missed First Payment After Pandemic-Era Freeze Expired

BP, Evergreen, Euronav Halt Sailings Through Chaotic Red Sea As Insurers Demand War Risk Coverage

A Record Number Of American 40-Year-Olds Have Never Been Married

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more