Goldman Says Mid-Atlantic Power Prices "Finally Caught Up To AI Data Center Load Growth Story"

Marylanders and residents in surrounding states should brace for rising power bills due to capacity constraints on the regional power grid and the increasing peak load from new AI data centers (read: here).

This combination creates a perfect storm of continued utility bill inflation, which will only pressure cash-strapped households in the years ahead.

On Friday, Goldman published a note about Tuesday's PJM Interconnection power capacity auction for the 2025-26 planning year (June 1st, 2025, to May 31st, 2026). The note revealed a massive surge in capacity prices:

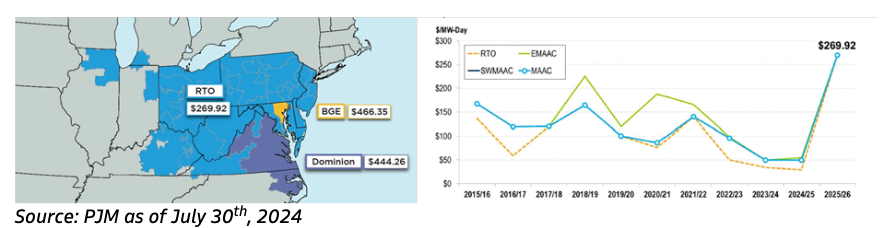

"The price across the RTO (see map below) was $269.92/MW- day. This is more than an 800 percent increase from the most recent auction (which cleared at $28.92/MW-day), and also a new record (the previous high was $174.11/MW-day for the 2010- 2011 planning year)."

"In addition to procuring the required capacity across the PJM RTO region, PJM's auction also sets targets for specific zones or LDAs (Locational Deliverability Areas) based on transmission limitations. The auction failed to procure the required level of capacity in two zones (Dominion or "DOM" and Baltimore Gas and Electric or "BGE ") which cleared at the applicable caps of $444.26/MW-day (DOM) and $466.35/MW-day (BGE). PJM has not yet published the extent of the shortfall in the two zones."

The critical point from the report:

"After a series of auction delays and relatively low clears (see chart below), PJM capacity prices appear to have finally caught up with the generative AI data center load growth story that has been central to parts of PJM."

Goldman warned that more power capacity would be needed for grid stability. However, any new capacity could take years to come online, which essentially means, as the analysts point out, "higher prices are here to stay."

"All else equal, the market expects the next few auctions to all clear at more robust prices, especially since the signal is clear – PJM needs more reliable capacity to manage the potential demand growth. Given the lead time for new-build capacity (4-5 years given current market dynamics and supply chain issues) the expectation is that generally higher capacity prices are here to stay."

Goldman noted:

"The higher prices are expected to delay retirements, potentially spur more focus on coal-to-gas conversion for units that were at risk of retirement due to carbon related costs, and to also incentivize new construction."

Meanwhile, as we've previously noted, "Maryland "Can't Import Itself Out Of Energy Crisis" Amid Urgent Need To Boost In-State Power Generation ..."

Let's remember Maryland's power crisis stems from 'green' policies pushed by progressive lawmakers in Annapolis who have banned any new fossil fuel power generation in the state. With AI data centers coming online, the result in the next 3-5 years will be crushing power bill costs to everyday voters.

Maryland voters need to make leftist lawmakers in Annapolis accountable for failed green policies that sends power costs higher.

More By This Author:

Cattle Market Rattled By Recession Risks As Cash-Strapped Consumers Pull Back

Cocoa Prices Slide To Five-Month Low On Demand Destruction Fears From Hershey

Market Ka-Mauling

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more