Market Ka-Mauling

Image Source: Pixabay

This was the week when - like Biden's dementia - economic weakness became too much for the mainstream to ignore and while Powell hinted at cuts to come, the market demands more (again) and stocks won't be satisfied until they get them.

Source: Bloomberg

"Growth scares" now dominate the narrative (maybe growth's demise is not so 'transitory')...

Source: Bloomberg

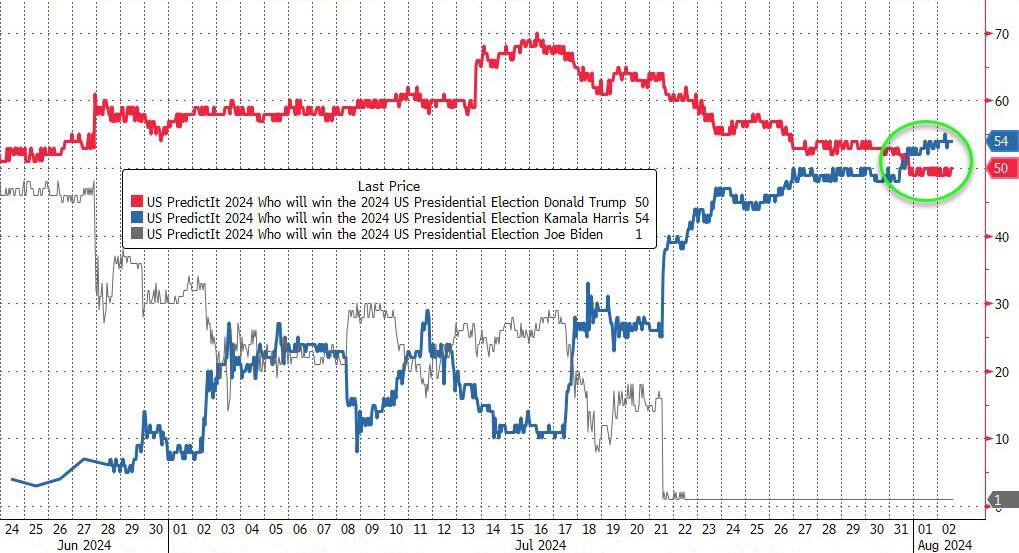

...as Kamala overtakes Trump in the prediction markets...

Source: Bloomberg

The economic weakness prompted the market to bet large on bigger (and sooner) rate-cuts - now pricing in 116bps of cuts in 2024 (and 100bps more in 2025)...

Source: Bloomberg

If you feel like you've heard this story before, you have... twice!

Source: Bloomberg

...and neither time did things work out as the market had hoped...

Source: Bloomberg

...and that smashed Treasury yields lower on the week, with 2Y yields crashing almost 30bps today alone and down a stunning 50bps on the week!

Source: Bloomberg

Today was the biggest drop in 2Y yield since Dec 2023 (Powell pivot) and the biggest weekly drop since March 2023 (SVB collapse).

The entire curve (ex-30Y) is now below 4.00%...

Source: Bloomberg

And the yield curve has disinverted (2s30s now at its steepest since July 2022)...

Source: Bloomberg

Stocks did not love the dovishness as the 'soft landing' narrative morphed into 'growth scare' and 'we are gonna need a bigger boat'-gull of rate-cuts. Small Caps (the most sensitive to the economy) collapsed this week, but while they were the worst of the bunch, all the US majors puked bigly...

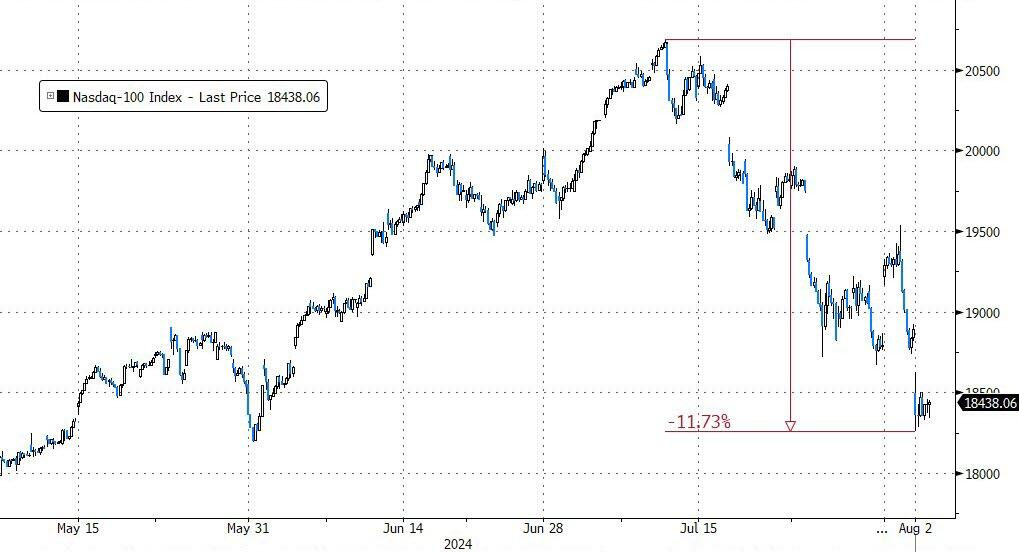

This was the Russell 2000's worst week since March 2023 (SVB collapse), and the fourth weekly drop for Nasdaq in a row.

The S&P 500 found support at its 100DMA today...

But Nasdaq broke below its 100DMA...

And The Nasdaq is now officially in correction...

Magnificent 7 stocks are now down an incredible $2.3 trillion market cap from their record highs...

Source: Bloomberg

"Most Shorted" stocks were clubbed like a baby seal this week, erasing all of early July's short-squeeze...

Source: Bloomberg

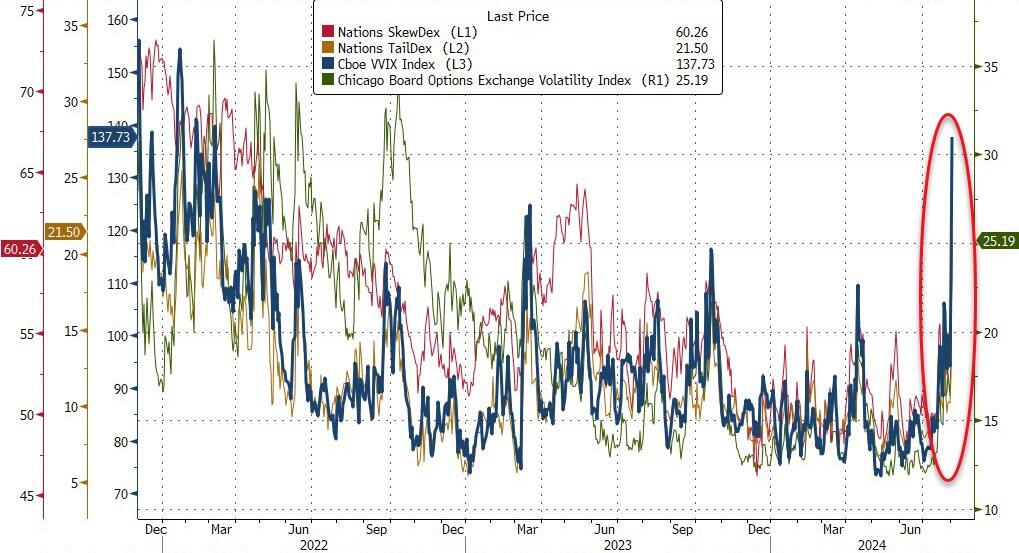

The options markets shit the bed with VIX exploding to almost 30 at its peak today (highest since Oct 2022) and VVIX smashing above the critical scare level of 100 (to its highest since March 2022)...

Source: Bloomberg

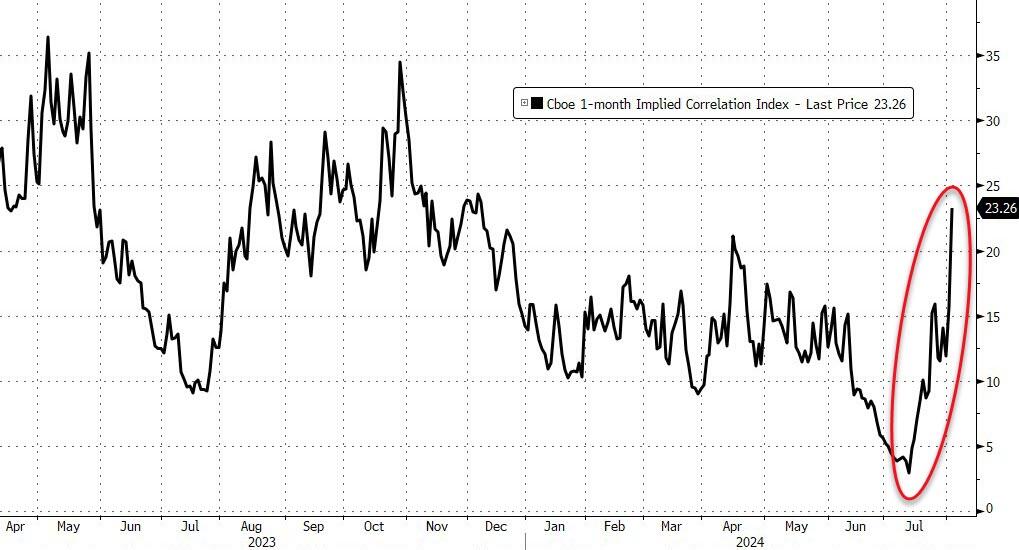

And the "correlation 1" move in markets this week sent implied correlation dramatically higher...

Source: Bloomberg

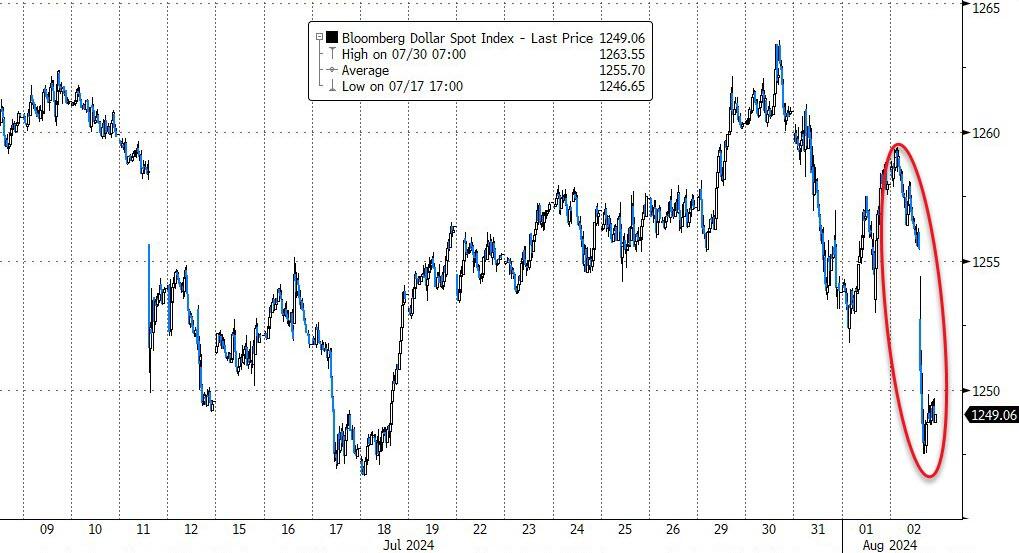

The dollar dovishly tanked this week, back to July's lows...

Source: Bloomberg

..as Yen soared (carry unwinds) to its strongest close against the greenback since January...

Source: Bloomberg

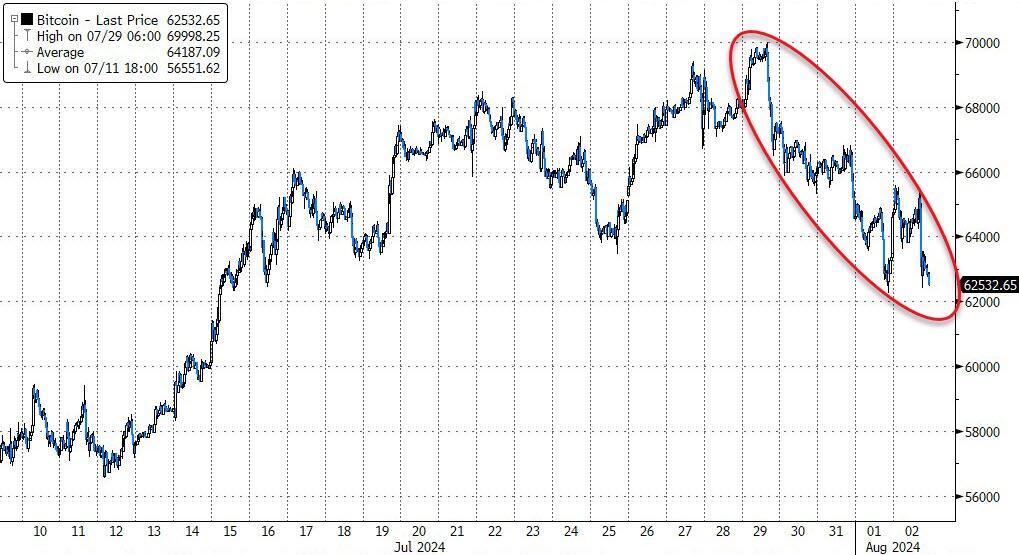

Bitcoin had a tough week, tumbling back from $70k to test down to $62k...

Source: Bloomberg

...but the entire crypto space was hit hard this week, with Solana the worst...

Source: Bloomberg

Gold tested up near record highs once again before being battered lower today (but was higher on the week)...

Source: Bloomberg

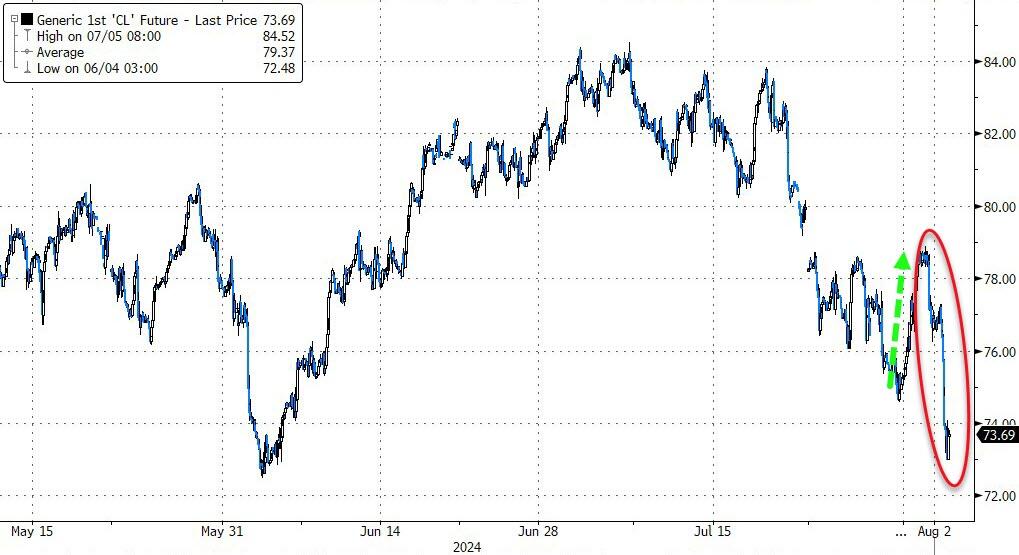

Crude oil prices plunged to two-month lows as the 'growth scare' weakness trumped the MidEast geopol risk premium...

Source: Bloomberg

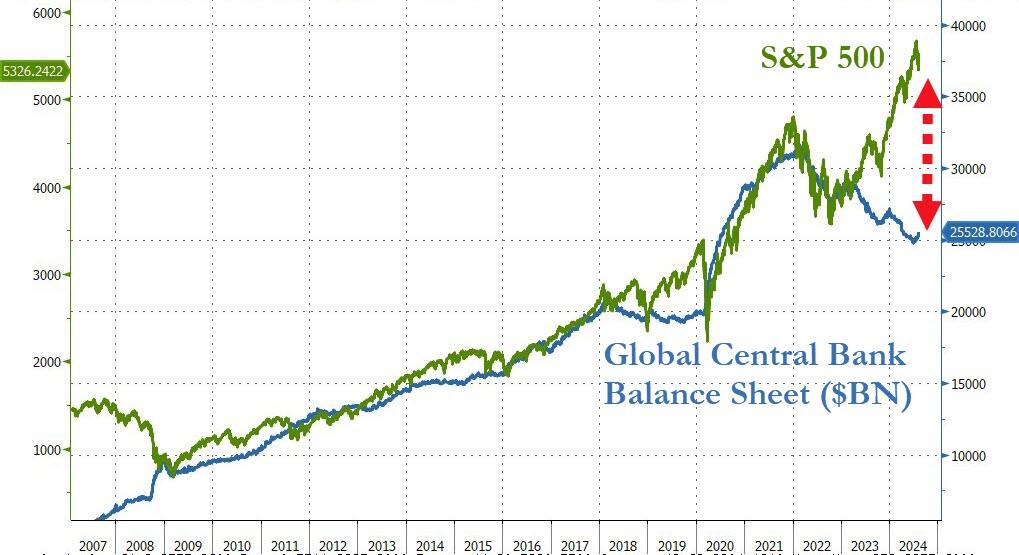

Finally, is it time for stocks to catch down to 'economic' reality?

Source: Bloomberg

How far will the world's central banks allow stocks to fall before the liquidity firehose is unleashed?

Source: Bloomberg

...well it is an election year (for Dems).

More By This Author:

Wall Street Begs Fed To Panic: Goldman Sees 3 Consecutive Rate Cuts, JPM Hopes Two For 50bps, Citi Even CrazierUranium Mining Stocks Sink After World's Largest Producer Boosts Production Guidance

Apple Pumps And Dumps As iPad Sales Help Topline Beat, But China Revenues Tumble

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more