Gold: Prepare For A 20% Rally From The Annual Lows Into Q1 2022

Fundamentals

On October 7th, the government announced that unemployment claims finally fell after a month, but 4.2 million Americans are still receiving benefits. The labor market appears to be struggling less than expected. About 326,000 people filed for unemployment benefits this week, down about 38,000 from the previous week. Economists expected about 345,000 claims. About twice as many Americans remain on unemployment benefits compared to before the pandemic.

Image Source: Pixabay

Gold

The CEO of the Equity Management Academy, Patrick MontesDeOca, said this news, "Led to a bit of a selloff in precious metals."

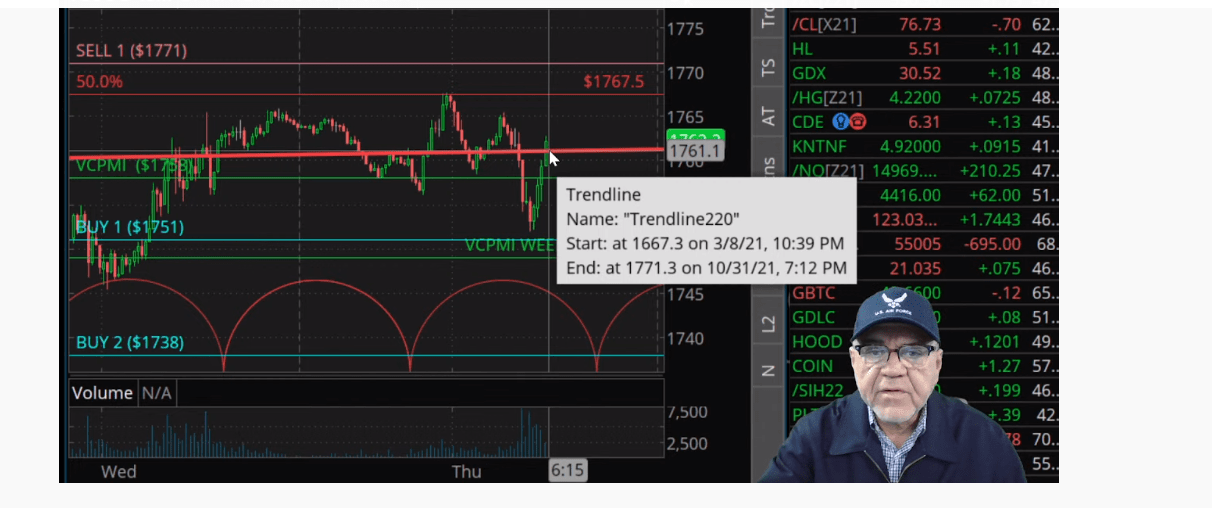

Gold came down to almost the daily Buy 1 level of $1751, but then it reverted, activating a bullish price momentum. According to the artificial intelligence embodied in the Variable Changing Price Momentum Indicator (VC PMI), the target is $1771. The market is showing a lot of buying action. The market reversion back up means that, MontesDeOca said, "the market basically discounted the fundamental news." He argued that raising interest rates will be bullish for precious metals. Raising rates is bearish for most instruments that are leveraged, but there will be less of that type of buying as rates rise, since there will be less borrowing and less leveraging in various markets.

Source: ema2trade.com

Inverted Market

"Precious metals have been in an inverted market since last year," he said. Gold hit $2089, discounting the damage that the pandemic had caused. The market then declined back down to test the levels of support around $1480. Then it reverted back up again. The market is matching the Fibonacci wave model. We are in the beginning of a third wave. The market is ready to move up again, but it may move down to test $1765 again. However, the VC PMI predicts that the market is far more likely to go up again. When gold came down to the weekly average of $1733, it found a lot of buyers. It is also an area of support based on the daily data.

(Click on image to enlarge)

Source: TDAmeritrade

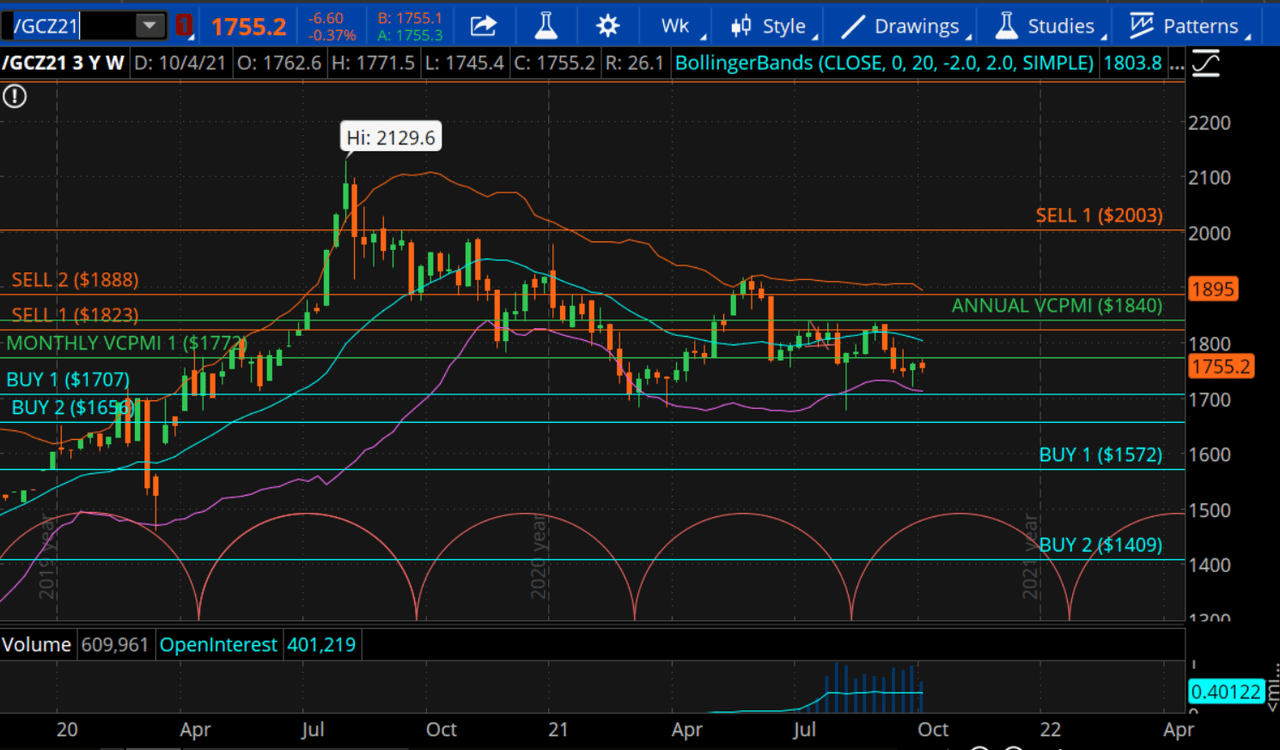

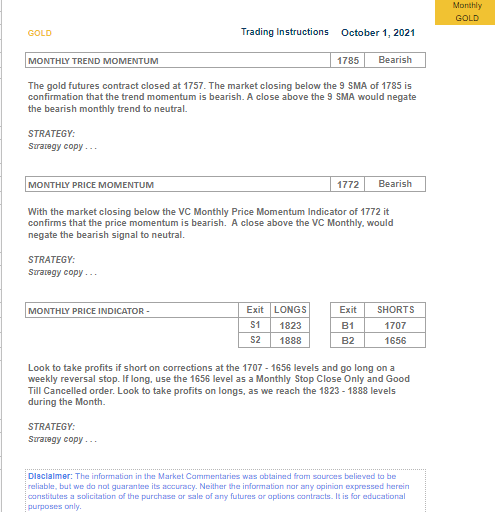

Monthly Gold Report

For the monthly gold report, with gold closing below $1785, the trend momentum was bearish. A close above $1785 will negate this bearish momentum to neutral. The monthly price momentum of $1772 was also bearish. A close above $1772 stop, will negate this bearishness to neutral. On the downside, the monthly targets are the Buy levels of $1707 and $1756 for the rest of the month. If we trade through $1772, we have targets of the Sell levels at $1823 and $1888.

Source: Marketplace

Weekly Gold Report

For the weekly gold report, the weekly trend momentum of $1783 is bearish, while the weekly price momentum of $1749 is bullish. So we had a bullish price momentum within the larger bearish trend last week. So $1777 and $1793 are the weekly targets for this week, which is where you want to lock-in your profits weekly.

"The fact that the market reverted based on the economic news that came out," MontesDeOca said, "is just icing on the cake on top of the technical indicators." The fundamentals appear to be moving toward aligning with the technicals as we move into the fourth quarter of this year. We are probably going to make the annual low over the next few weeks. "Any opportunity when the market comes down, add to your positions. We are about to complete a cycle and start a new 360 day cycle with great promise. The VC PMI is looking for a 20% to 25% rally over the next two quarters."

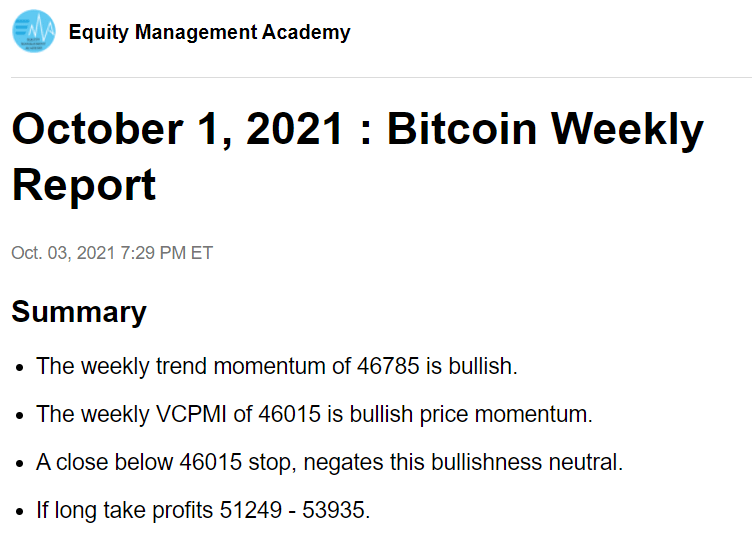

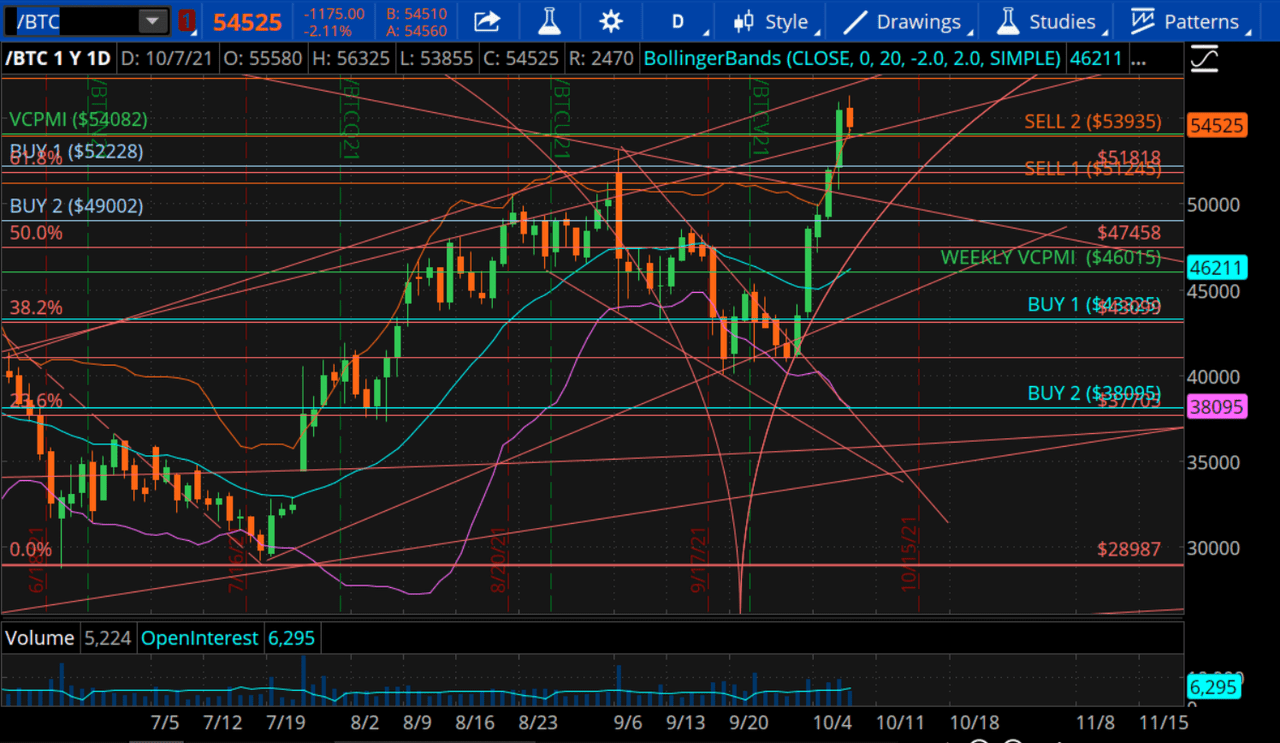

Bitcoin

Bitcoin is at 55,160. On October 1, we recommended to go long from the Buy 1 level of 43,325, which is the first level of support using conventional technical analysis. This was an area where the VC PMI says you want to buy and go long.

(Click on image to enlarge)

Source: ema2trade.com

The market then came back up and reached the weekly Sell levels, which were the targets of 51,245 and 53,935 completed.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on Ticker ...

more