GDP And Ten Year Yield Forecasts: Messages From The Survey Of Professional Forecasters

A remarkable downgrade in expected growth shows up in a large implied negative — and widening — output gap, even as forecasted long yields rise, according to the Survey of Professional Forecasters (released 8/12).

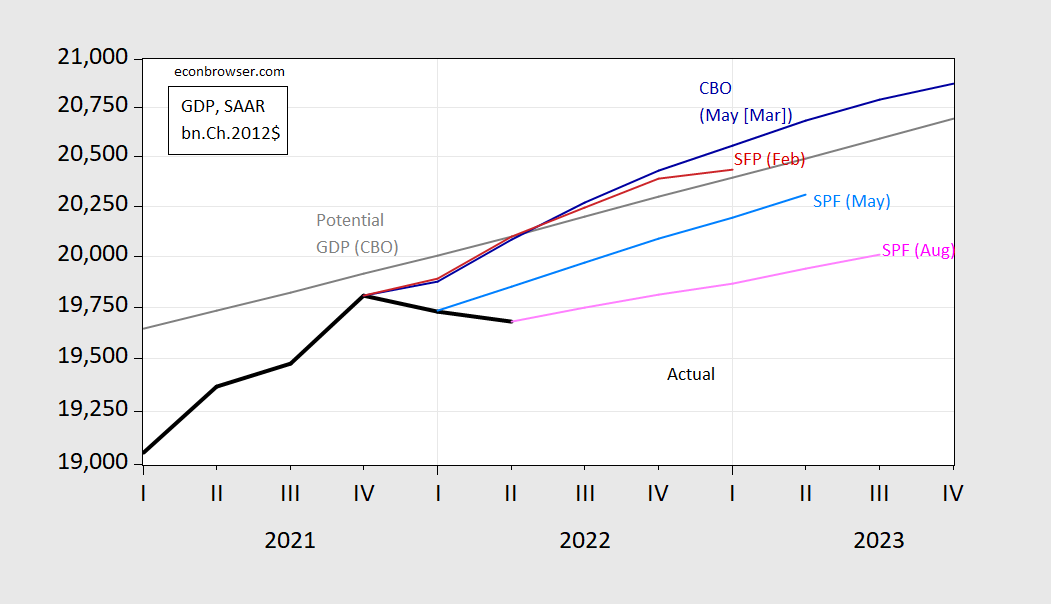

While the release is already almost a couple of weeks old, it occurred after the advance Q2 release. With tracking indicating a slight upward revision to -0.3% from advance -0.9%, it’s not clear that respondents’ views would’ve changed much. So here is the picture for GDP.

Figure 1: GDP as reported (bold black), CBO potential GDP (gray), CBO May 2022 projection (blue), SPF February median forecast (red), SPF May forecast (light blue), and SPF August forecast (pink), all in billions Ch.2012$, SAAR, on a log scale. Source: BEA advance 2022Q2, CBO (May 2022), Philadelphia Fed Survey of Professional Forecasters (various).

The output gap, using CBO’s May estimate of potential, is -2.1% in Q2, rising to an implied -2.8% in 2023Q3. Taking this estimate of potential literally, one should expect substantial downward pressure on prices. In addition, the -2.1% gap in 2022Q1 suggests that cost-push shocks (and whatever expected inflation is in the system) are driving inflation, not demand push. Of course, potential GDP is notoriously difficult to estimate, so one has to be wary of making strong conclusions.

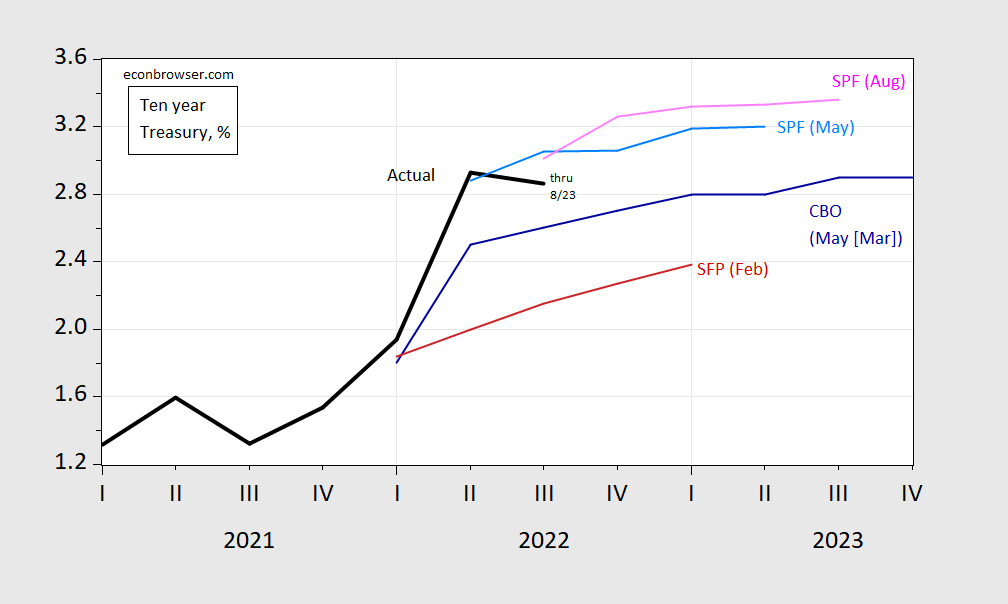

In terms of expectations regarding long term yields, these have consistently risen over the past three quarters.

Figure 2: Ten year Treasury yields as reported (bold black), CBO May 2022 projection (blue), SPF February median forecast (red), SPF May forecast (light blue), and SPF August forecast (pink), all in %. 2022Q3 observation is thru 8/23. Source: BEA advance 2022Q2, CBO (May 2022), Philadelphia Fed Survey of Professional Forecasters (various releases).

Note that the big upward shift is from February to May. Doubtless, there’ll be some movement after the Jackson Hole speech, but probably not enough to change the material substance of the projection for long yields.

More By This Author:

The “…Recession…Of H1 2022”

So You Think We’re In A Recession As Of July?

Bank Loan Growth