GBP/USD Weekly Forecast: Expecting A Dovish BoE Path Ahead

- Investors are fully expecting two rate cuts from the BoE by December.

- Data on US and UK business activity showed further expansion in June.

- Investors will pay close attention to monetary policy meetings in the US and the UK.

The GBP/USD weekly forecast is trending south as markets shift towards a more dovish outlook for the Bank of England.

Ups and downs of GBP/USD

The GBP/USD price fell last week as Bank of England rate cut expectations increased. At the same time, the dollar firmed as data showed economic resilience and easing inflation. Investors are fully expecting two rate cuts from the BoE by December. However, the timing remains unclear. Rate cut bets went up as bets for a September Fed cut rose.

Meanwhile, data on business activity from the US and the UK showed further expansion in June. Therefore, both economies are doing well despite high rates. Additional US data revealed bigger-than-expected economic growth in Q2 and a drop in unemployment claims. The week ended with inflation figures coming in as expected at 0.2%.

Next week’s key events for GBP/USD

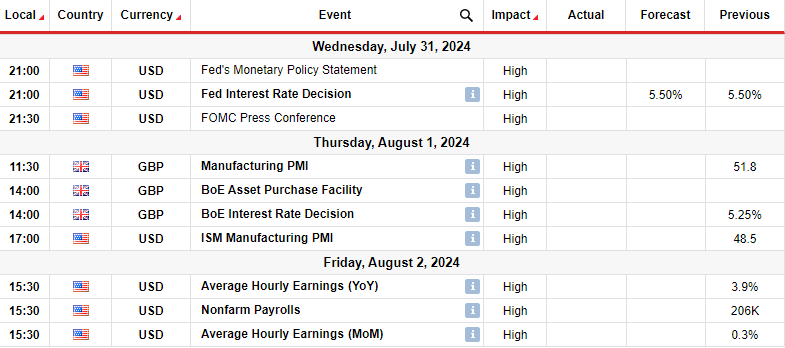

Next week, investors will pay close attention to monetary policy meetings in the US and the UK. The Fed will meet on Wednesday and likely keep interest rates unchanged at 5.50%. Meanwhile, the Bank of England will meet on Thursday, and there is a 50% chance, policymakers will vote to lower borrowing costs.

Additionally, markets will focus on the all-important US monthly employment report. The last report showed slower job growth and an increase in the unemployment rate. If this trend continues, policymakers might assume a more dovish tone. At the same time, the dollar would fall, allowing GBP/USD to rally.

GBP/USD weekly technical forecast: Bears challenge bullish trend at the 22-SMA

GBP/USD daily chart

On the technical side, the GBP/USD price has fallen back to the 22-SMA after reaching new highs. However, the bullish bias remains intact, with the price above the SMA and the RSI slightly above 50. The bullish trend continued when the price broke above the 1.2800 key resistance level.

Bears prompted a pullback before the price reached the 1.3050 key level. If the bullish trend remains in play, the price will bounce off the 22-SMA to revisit the 1.3050 resistance. However, if bears take over, it might break below the SMA and the 1.2800 support.

More By This Author:

USD/JPY Outlook: Yen Retreats From 2-Month Top After US GDP

EUR/USD Forecast: Bears Intensify After Downbeat EU PMI

USD/CAD Outlook: Posts 3-Month Top Following 2nd BoC Rate Cut

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more