GameStocks - Fun While It Lasted...

So how about GameStop (GME) and AMC (AMC)? That Silver short-squeeze? Fighting the man? That was fun while it lasted.

I don't want to lecture anyone or say that I told you so. During one of my newsletters last week, I even said that I tip my hat to anyone who profited from this—all the respect in the world.

Me personally, though, I would never trade like this. Monday (Feb. 1) and Tuesday's market (Feb. 2) was nothing more than a reality check. GameStop's stock has lost nearly half of its value, and other Reddit darlings like AMC, Blackberry (BB), Koss (KOSS), and Silver (SLV) tanked.

Stocks don't go up forever.

Stonks especially don’t.

Who knows, maybe the party's not over. But I think the plummet in the Reddit stocks was bound to happen. Bubbles always eventually pop.

The market seems happy that the earth is back on its axis in stockland. The indices have recovered nearly all of last week's losses already.

I didn't call the GameStop short-squeeze, but I had called last week's downturn for a while. The recovery so far this week wasn't entirely surprising either.

Be that as it may, I remain concerned about complacency in the markets and overstretched valuations, plus the potential return of inflation. But the breather last week was needed and brought the indices to less overbought levels.

Generally, investors and analysts are bullish these days. According to a recent Bank of America survey of 194 money managers, bullishness on stocks is at a three-year high, and the average share of cash in portfolios, which is usually a sign of protection from market turmoil, is at the lowest level since May 2013.

We have still not declined 10% from the record highs- the minimum needed for a correction. Although the market needed last week's downturn, we're once again mostly right where we were several days ago.

I know what you’re thinking. Amazon (AMZN) and Alphabet (GOOGL) are the latest companies to crush their earnings estimates, how could we possibly have a correction?

For one, there are still things to be concerned about from a public health and economic perspective.

We are also long overdue for one. We haven't seen one since last March. Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

We're no longer as close to those same BUY levels as we were after market close on Friday. But we're not quite at SELL again, and I still think we're a few pullbacks away from making more BUY calls with conviction. In other words, welcome to no man's land.

In my last newsletter, I cautioned against making manic moves and trading with emotions. We saw our worst week since October last week and declined in two of the previous three. Much of that was due to the GameStops and AMCs freaking out Wall Streeters. But I reminded you then, and I'll remind you again. Shares of Eastman Kodak surged by 1,481% in three days last July, and the broader market seems to have done just fine since then.

Do not let the noise deter you from your goals. My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

We're all in this together!

Is It Safe to Buy Tech Again?

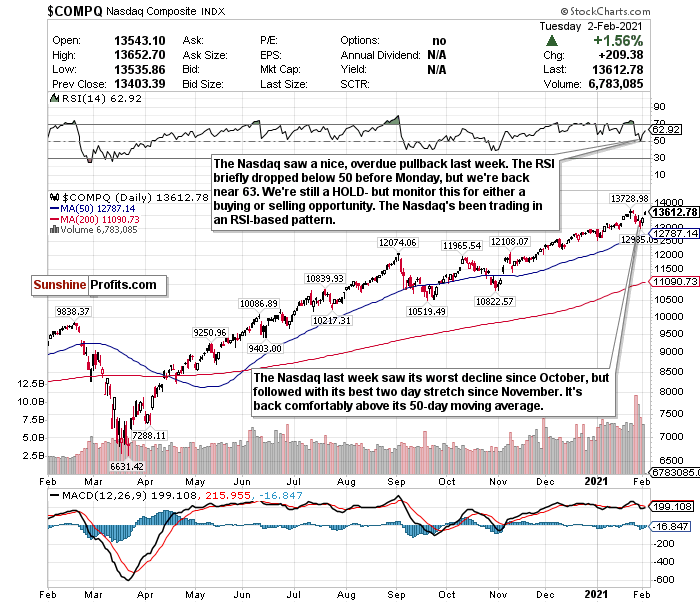

Figure 1- Nasdaq Composite Index $COMP

Earnings season for tech stocks hit record numbers last week and is set to continue this week with Amazon and Alphabet clobbering estimates. Usually, when investors get what they expect, it’s more of a reason to sell rather than buy.

But the Nasdaq so far this week has already recovered almost all of last week’s losses, and then some.

I’m not ready to call this a BUY though or recommend buying into momentum. There are still concerns. Tech valuations, especially the tech IPO market, terrify me. SPACs don’t help either. The Nasdaq last week declined to a more "normal" level, and in the span of two days, hit an RSI approaching 63 again.

Last week's decline was needed, but there are still echoes of the dot-com bubble 20-years ago. I remain bullish on earnings and tech sectors such as cloud computing, e-commerce, and fintech for 2021, but please monitor the RSI.

The RSI is how I have called the Nasdaq since December. While an overbought or oversold RSI does not automatically mean a trend reversal, it has with the Nasdaq.

The Nasdaq pulled back on December 9 after exceeding an RSI of 70 and briefly pulled back again after passing 70 again around Christmas time. We also exceeded a 70 RSI just before the new year, and what happened on the first trading day of 2021? A decline of 1.47%.

When I changed my Nasdaq call from a HOLD to a SELL on January 11 after the RSI exceeded 70, the Nasdaq declined again by 1.45%.

Before the Nasdaq exceeded an RSI over 73 prior to January 25th, I switched my call back to SELL, and the QQQ promptly declined 4.13% for the week.

The Nasdaq is trading in a precise pattern.

I still like tech and am bullish for 2021. But for now, I'm going to stay conservative and say HOLD.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more

I had thought that share VALUE, as opposed to share PRICE, would be more closely related to the cost to earning ratio. Of course "cost" is a somewhat nebulous term as far as what it includes. But I am new to the stocks game, being a semi-retired engineer and a writer now. So a lack of insight into the stocks and Wall street is my handicap, also not being greedy. Probably I will never truly fit in. Oh Well.

If you were to take a long-term view, then what about being invested in an asset class that has better prospects than paper asset such as stocks? I like copper, precious metals, also oil - what about commodities then?

I wouldn't be comfortable recommending only commodities to an investor myself @Monica Kingsley. @William K. You set yourself up for failure when you do not diversify properly for the long term. You might luck out and get in for an upswing (which seems possible here with a reflation trade), but I would not dismiss all stocks as an investment. Allocate some of your portfolio to stocks for the long term, and buy ETFs to get the diversification you need at minuscule prices. I personally have about 70-80% of my holdings in stocks that are not correlated to commodities or commodity assets themselves.

First, there has been no mention of percentage net worth available for investing. Second, no mention of investment horizon and willingness to tolerate drawdowns of specified size. Third, I am very far from writing off stocks, me the raging stock bull who sees great gains ahead. Fourth, we don't know about other investments of said gentleman. Fifth, commodities are still likely to outperform stocks in the current environment - that is worth posing the question I posed (no recommendation). What is long-term to the gentleman exactly anyway? Unless he tells, only he knows...

In your case, it may be better to take a longer term approach and invest more passively? There's a reason passive ETFs have outperformed the vast majority of hedge funds in the last 10 years...

Evidently a "correction" is when prices fall down to what somebody feels is the correct value. Certainly each organization has some number that represents the actual value of a share. That bears little relationship to the current share price, except in some strange exceptions.

I agree with the author on emotions, and just today said publicly that trading should ideally be really a boring activity, no adrenaline rush. Professionals lay down their plans well in advance, and adjust them for incoming (price and other) information - but more than the contours of each trade's parameters (risk, reward) are specified before entering the trade. Not overleveraged (risk per trade), just a reasonably small percentage of account being risked on a single trade (varies upon trading strategy: e.g. for breakouts much lower than for position swing trading) - so as to have always enough firepower left for many subsequent ones given your historical win ratio. In other words, you gotta be able to survive a series of bad luck. That's my surefire way of making money in bull, bear or sideways markets, whatever the instrument. Take care!

Hi @[William K.](user:30001)! Yes, most companies would have an idea of their intrinsic values on shares, but you would be surprised at the amount of newsletters / stock traders / institutional investors that get into stock markets without any plan for an exit - what do you do if the price runs (to the moon)? What do you do if the price drops? Generally, a correction is defined as a 10% loss, with a bear market being 20%, but I think to put a hard number is not the best way to go overall - there are certainly markets that pulled back 19.5% that you could call a bear market, and 9.5% that you could call a correction, for example. So it is dependent on more than just a pure number, in my opinion. Of course, I went into more detail about these calls in the full paid version on Sunshine Profits, but if you didn't know already, I would highly recommend checking out Bob Farrel's 10 rules of investing - I look at them often in bull and bear markets to try to take my emotions out of investing, which is no easy task! www.cnbc.com/.../...cable-to-this-bull-market.html Thanks for your comment, let me know if you have any questions about the piece. -Matthew

Well, in the prior author's post, a number of 10%+ was thrown around, taking down the risk level called justified - I argued that it has run quite far with 4% already - and we're some 30 points from prior top three sessions later. I comment on so many articles that discuss stock indices, precious metals, currencies, commodities or just oil - talking market actions' whys and whats, and own trading perspectives - because I write daily too.