Futures Resume Tumbling After Yields Spike To New 2 Year High

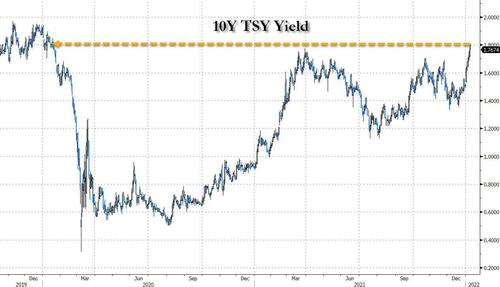

The new week has picked up where last week left off: with futures selling off and global markets lower as yields continued their relentless treck higher, hitting fresh two year highs (amid concerns of a faster Fed balance sheet drawdown coupled with a massive IG issuance slate forcing managers to put on rate locks in what remains an illiquid market).

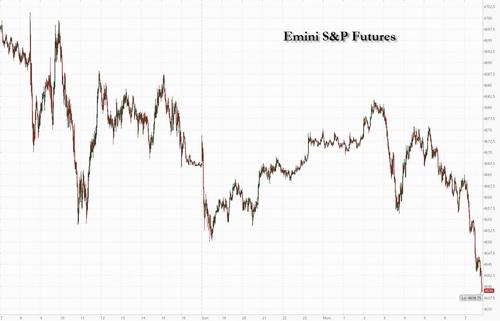

US index futures traded down to session lows as US traders sat at their desks after rising modestly earlier in the session, and were down 27 points or 0.6% at 730am...

.. while Treasury yields stabilized after reversing an earlier spike rising as high as 1.8064% before dropping to 1.7656% following a global bond selloff last week as investors awaited key inflation data later in the week. Tech stocks again led the decline with Nasdaq futs down 0.63%, while Dow futures were down 0.12% or 44 points. The dollar rose, bitcoin dropped and crude oil steadied around $79 a barrel.

“Market volatility continues to grow almost everywhere,” with lingering uncertainties keeping pressure on sentiment, said Pierre Veyret, technical analyst at ActivTrades. “Traders are likely to wait for new major market drivers before pushing stock prices in new directions. All eyes will remain on monetary policy this week with a new batch of comments from major Fed speakers alongside the crucial U.S. inflation report on Wednesday.”

As Bloomberg notes, markets face increasing volatility as investors grapple with how to reprice assets as the pandemic liquidity that helped drive equities to record highs is withdrawn. The latest U.S. consumer price index data due this week will be keenly watched as the Federal Reserve prepares to subdue price pressures with faster-than-expected rate increases. HSBC strategists raised their S&P 500 year-end target to 4,900 from 4,650, but say this year will be challenging for risk assets and consensus expectations are too sanguine. Watch Adidas and Nike shares after HSBC downgraded its ratings on both to hold from buy, citing a lack of short-term catalysts. Here are some of the biggest U.S. movers today:

- BioMarin (BMRN) shares jump 5.5% in U.S. premarket trading after the biotech firm announced positive results for its hemophilia treatment trial on Sunday.

- The bull and bear cases for Adidas (ADDYY) and Nike (NKE) are “quite balanced from here,” according to HSBC, which downgrades its ratings on both to hold from buy, citing a lack of short-term catalysts.

- Zscaler (ZS) has “plenty of growth levers to pull,” UBS writes in note upgrading the company to buy from neutral. The stock gains 2.5% in premarket trading.

- New Oriental’s (EDU) Chinese ADRs rose 2.2% in U.S. premarket trading, and peer TAL Education (TAL) gained 2.9% amid news that New Oriental dismissed 60,000 workers in 2021 after ending all K-9 tutoring services. Still, analysts foresee more regulations for the industry this year.

In Europe, the Stoxx 600 Index was slightly down, fading an initial dip through Friday’s lows. The Euro Stoxx 50 is flat, DAX off 0.1%; FTSE MIB and IBEX post small gains. Cyclical stocks in energy firms and banks tied to economic expansion were among the biggest gainers on the Stoxx Europe 600, offsetting declines in technology firms and real estate. Travel is the stand out best performer, the Stoxx 600 sector rising 2.5%, rebounding strongly after an early dip. Atos’s shares slumped as much as 19% to their lowest since June 2012, following a profit warning.

Earlier in the session, Asia’s stocks rose for a second day amid the overhang of rising interest rates, as investors awaited U.S. inflation data this week for further cues on where Treasury yields are headed. The MSCI Asia Pacific Index rallied as much as 0.4%, boosted by financial shares. Hong Kong stocks were among the best performers as technology giants including Tencent and Meituan continued to recoup some of their recent losses, while real estate shares extended a rally on state support. South Korea’s Kospi Index fell 1% to be among the region’s biggest decliners, dragged down by losses in the nation’s large chipmakers and internet stocks. Asia’s stock benchmark capped a loss of 0.5% last week. Omicron’s rapid spread in Asia is clouding the growth outlook for many economies, just as the Federal Reserve’s increasingly hawkish stance roils bond markets and hammers growth stocks including tech shares. “Some market participants may still view this pullback as another healthy correction and potentially an opportunity to buy more,” said Margaret Yang, a strategist at DailyFX, adding that the omicron variant may cause concerns about a delay in reopening among investors.

Japanese markets were closed for a holiday on Monday.

Australian stocks slipped as health-care, consumer shares hit index. The S&P/ASX 200 index fell 0.1% at 7,447.10 as of 4:15 p.m. on Monday in Sydney, after the S&P 500 capped its worst weekly start to a year since 2016. The Australian index was weighed down by consumer discretionary and health-care stocks, while shares in miners and energy firms rose. AGL Energy surged after Credit Suisse raised its recommendation on the stock to outperform from neutral. Reliance Worldwide was the biggest decliner after sliding the most in 14 months intraday. In New Zealand, the S&P/NZX 50 index fell 0.6% to 12,892.94.

In FX, the Bloomberg Dollar Spot Index was steady after earlier advancing and the greenback was mixed against its Group-of-10 peers. The Canadian and Australian dollars along with Norway’s krone were the best G-10 performers amid supportive economic data and commodity prices. Norway’s krone advanced after inflation accelerated more than estimated in December, adding pressure on the central bank to speed up interest-rate hikes. The Australian dollar reversed a drop as exporter demand and solid building data prompted leveraged funds to square short positions. The euro shed around half of Friday’s gains against the dollar and bunds mostly slipped, yet outperformed Treasuries.

In rates, treasury futures were off session lows amid gains for bunds and gilts, with cash yields across the curve still slightly cheaper on the day. Into the U.S. session, yields cheaper by up to 1.2bp across belly of the curve, spreads within 1bp of Friday session close; 10-year yields around 1.778%,lagging bunds and gilts by 1.5bp and 1bp in the sector. As we warned last night, Treasuries are hampered by expectations for another heavy IG credit issuance slate this week, but the market - dumb as always - sees today's rate locks as indication of more panicked outright selling in rates which it isn't.

Coupon auctions also resume this week, beginning with 3-year note sale Tuesday and including 10- and 30-year reopenings. Last week’s steep UST selloff resumed during European morning after a recommended market close during Asia session because of Japanese holiday; 10-year yields topped at 1.806% before buyers emerged

In commodities, crude futures are little changed with WTI trading either side of $79 and Brent near $82. Spot gold pushes ~$4 higher near $1,800/oz after a slow start in European hours. Base metals are in the green with LME aluminum outperforming slightly.

Market Snapshot

- S&P 500 futures down 0.6% to 4,639.25

- STOXX Europe 600 down 0.1% to 485.58

- MXAP up 0.4% to 192.99

- MXAPJ up 0.6% to 629.71

- Nikkei little changed at 28,478.56

- Topix little changed at 1,995.68

- Hang Seng Index up 1.1% to 23,746.54

- Shanghai Composite up 0.4% to 3,593.52

- Sensex up 1.1% to 60,402.57

- Australia S&P/ASX 200 little changed at 7,447.07

- Kospi down 1.0% to 2,926.72

- Brent Futures up 0.5% to $82.14/bbl

- Gold spot up 0.0% to $1,796.81

- U.S. Dollar Index up 0.17% to 95.88

- German 10Y yield little changed at -0.03%

- Euro down 0.2% to $1.1335

Top Overnight News from Bloomberg

- Bond yields are soaring globally in line with Treasuries as investors preparing for the first Federal Reserve interest-rate hike of the pandemic era set aside concern the outbreak will slow their already fragile economies

- Major emerging markets are set to report a slowdown in inflation this week, offering clues on when investors can finally shake off the burden of negative real yields

- U.K. Foreign Secretary Liz Truss said she’s prepared to unilaterally override parts of the post-Brexit agreement on Northern Ireland if talks with the EU fail

- President Vladimir Putin vowed to protect Russia and its ex-Soviet allies from what he called outside efforts to destabilize their governments with public protests, just days after Russian-led troops helped Kazakh authorities subdue nationwide demonstrations

- The Biden administration and U.S. allies are discussing possible export controls on Russia, including curbs on sensitive technology and electronics, to be imposed if President Vladimir Putin seizes more of Ukraine, a person familiar with the discussions said

- There’s growing evidence that China is encouraging state- owned property developers to take market share from stressed rivals to limit the spread of contagion from the debt-stricken industry

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more