FOMC Minutes Show "More Restrictive" Fed Worried About 'Entrenched' Inflation

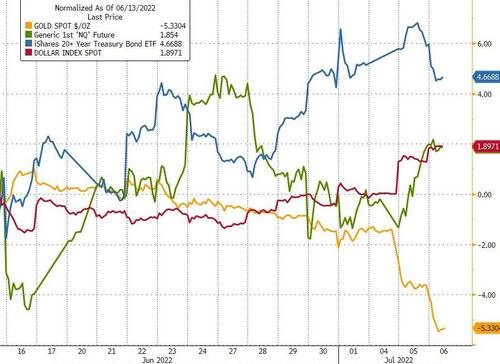

Since the last FOMC statement and press conference on June 15th where The Fed hikes 75bps - its largest hike since 1994 - and the WSJ leak on the 13th, bonds have been bid as recession fears dominate and gold has been dumped as inflation anxiety eases. The Dollar and stocks have managed modest gains...

Source: Bloomberg

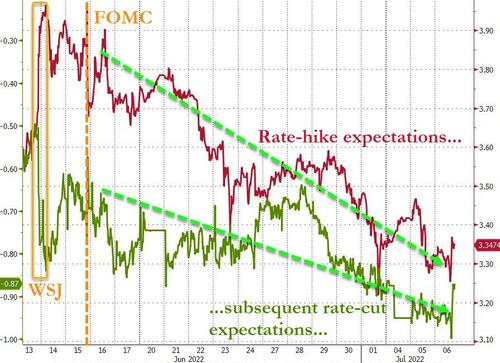

Most notably, Fed rate-trajectory expectations have dovishly plunged since the last FOMC

Source: Bloomberg

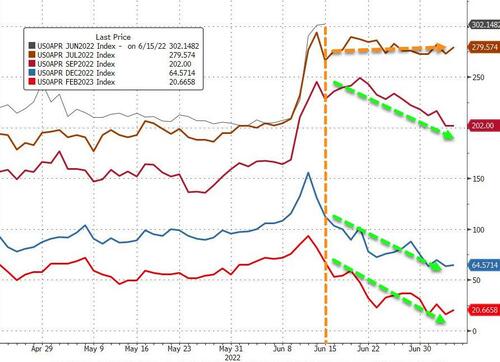

And while July remains an 80% lock for 75bps, the expectations for hikes in September have tumbled and for the rest of the year, almost gone...

Source: Bloomberg

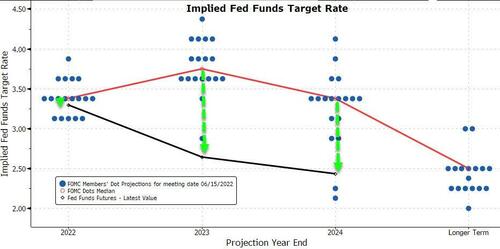

All of which is ironic since The Fed adjusted its 'DotPlot' UP to the market's hawkish view at the last FOMC and now the market has adjusted dramatically more dovish than Fed expectations...

Source: Bloomberg

One more thing before we get to the details, US Macro data has continued to disappoint since the FOMC meeting with 'soft' survey data really decelerating.

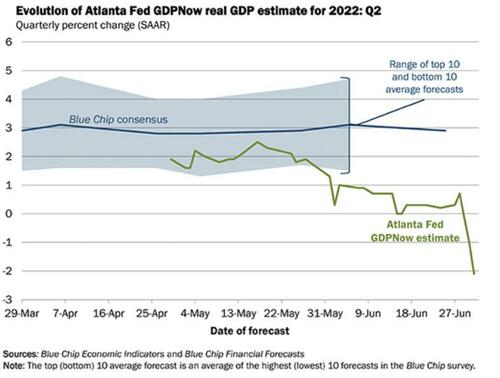

The odds of a US recession are 38% in the next 12 months, according to the latest forecast from Bloomberg Economics, after consumer sentiment hit a record low and interest rates surged, with The Atlanta Fed's GDPNow model crashing to -2.1%...

So the main focus of The Minutes will be whether The Fed uses them to suggest any 'less hawkish' bias than was projected at the press conference...

The highlights are as follows...

On continued tightening:

“Participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting.”

On entrenched inflation:

“Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.”

A potential pause?:

“Participants noted that, with the federal funds rate expected to be near or above estimates of its longer-run level later this year, the Committee would then be well positioned to determine the appropriate pace of further policy firming and the extent to which economic developments warranted policy adjustments.”

On financial market impacts:

“Downside risks included the possibility that a further tightening in financial conditions would have a larger negative effect on economic activity than anticipated.”

Read the full Minutes below:

More By This Author:

US, G7 Discuss "Capping" Russian Oil Price At $40-60, A Move Which Could Send Oil Soaring Up To $380US Services Surveys Signal "Bout Of Stagflation" Ahead, Employment Contracts Most Since COVID Collapse

Norwegian Strikes Could Sever NatGas Supplies To UK

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more